Page 141 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 141

Profile’s Stock Exchange Handbook: 2022 – Issue 1 JSE – HUL

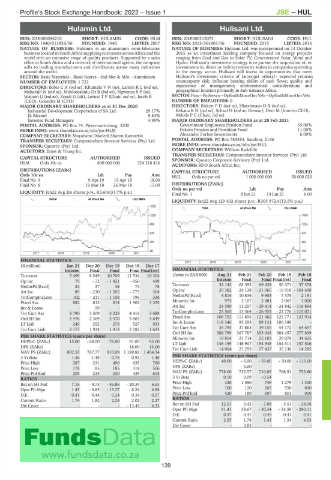

Hulamin Ltd. Hulisani Ltd.

HUL HUL

ISIN: ZAE000096210 SHORT: HULAMIN CODE: HLM ISIN: ZAE000212072 SHORT: HULISANI CODE: HUL

REG NO: 1940/013924/06 FOUNDED: 1940 LISTED: 2007 REG NO: 2015/363903/06 FOUNDED: 2015 LISTED: 2016

NATURE OF BUSINESS: Hulamin is an aluminium semi-fabricator NATURE OF BUSINESS: Hulisani Ltd. was incorporated on 13 October

business located in South Africa supplying customers across Africa and the 2015 as an investment holding company focused on energy projects

world with an extensive range of quality products. Supported by a sales ranging from Coal and Gas to Solar PV, Concentrated Solar, Wind and

office in South Africa and a network of international agents, the company Hydro. Hulisani’s investment strategy is to pursue the acquisition of, or

sells to leading manufacturers and distributors across many industries investments in, direct or indirect minority stakes in companies operating

around the world. in the energy sector. Hulisani will invest in opportunities that meet

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Aluminium Hulisani’s investment criteria of (amongst others)– expected returns;

NUMBER OF EMPLOYEES: 1 722 counterparty risk; inflation beating ability of cash flows; quality and

DIRECTORS: BolesCA(ind ne), KhumaloVN(ne), LarsonRL(ind ne), experience of management; environmental considerations and

Maharajh N (ind ne), Mehlomakulu Dr B (ind ne), NgwenyaSP(ne), geographical location primarily in Sub-Saharan Africa.

Watson G (ind ne), Zondi G (alt), Leeuw T P (Chair, ind ne), Jacob R SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

(CEO), Gounder M (CFO) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 DIRECTORS: BirkettPD(ind ne), HlatshwayoDR(ind ne),

Industrial Development Corporation of SA Ltd. 29.17% KekanaKN(ind ne), Schaaf H (ind ne, German), Dem M (Interim CEO),

JL Biccard 9.83% Mdoda P C (Chair, ind ne)

Investec Fund Managers 4.99% MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

POSTAL ADDRESS: PO Box 74, Pietermaritzburg, 3200 Government Employees Pension Fund 35.00%

MORE INFO: www.sharedata.co.za/sdo/jse/HLM Eskom Pension and Provident Fund 11.00%

COMPANY SECRETARY: Moyahabo Dikeledi Sharon Ramoetlo Alexander Forbes Investments 6.00%

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. POSTAL ADDRESS: PO Box 784583, Sandton, 2146

SPONSOR: Questco (Pty) Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/HUL

AUDITORS: Ernst & Young Inc. COMPANY SECRETARY: William Radcliffe

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED SPONSOR: Questco Corporate Advisory (Pty) Ltd.

HLM Ords 10c ea 800 000 000 324 318 436

AUDITORS: BDO South Africa Inc.

DISTRIBUTIONS [ZARc] CAPITAL STRUCTURE AUTHORISED ISSUED

Ords 10c ea Ldt Pay Amt HUL Ords no par val 1 000 000 000 50 000 020

Final No 9 9 Apr 19 15 Apr 19 18.00

Final No 8 19 Mar 18 26 Mar 18 15.00 DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

LIQUIDITY: Jan22 Avg 2m shares p.w., R5.6m(31.7% p.a.)

Final No 1 8 Jun 21 14 Jun 21 6.00

INDM 40 Week MA HULAMIN

LIQUIDITY: Jan22 Avg 129 402 shares p.w., R305 972.4(13.5% p.a.)

1552

FINA 40 Week MA HULISANI

1259 1505

966 1224

674 943

381 663

88 382

2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS 101

2017 | 2018 | 2019 | 2020 | 2021

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Interim Final Final Final Final(rst) FINANCIAL STATISTICS

Turnover 5 499 8 549 10 709 11 534 10 304 (Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18

Op Inc 79 - 72 - 1 421 - 950 498 Interim Final Final Final(rst) Final

NetIntPd(Rcvd) 24 37 48 74 78 Turnover 32 142 62 392 69 438 50 371 37 378

Att Inc 89 - 230 - 1 205 - 773 304 Op Inc 29 382 24 128 - 21 065 - 16 918 - 104 698

TotCompIncLoss 102 - 211 - 1 158 - 796 336 NetIntPd(Rcvd) 4 814 10 834 9 953 7 378 2 191

Fixed Ass 882 813 814 1 902 3 325 Minority Int 975 2 107 2 481 2 067 1 020

Inv & Loans - 59 - - - Att Inc 24 590 11 257 - 29 414 - 24 842 - 116 864

TotCompIncLoss 25 565 13 364 - 26 933 - 22 776 - 115 071

Tot Curr Ass 3 790 3 509 3 228 4 416 3 688

Ord SH Int 2 476 2 369 2 570 3 803 4 649 Fixed Ass 106 753 111 695 121 462 125 771 133 914

LT Liab 249 252 276 527 953 Inv & Loans 118 346 95 293 89 131 106 189 -

Tot Curr Liab 2 173 1 924 1 413 2 182 1 623 Tot Curr Ass 35 795 37 863 39 155 54 172 64 657

Ord SH Int 388 799 367 787 355 043 384 457 377 899

PER SHARE STATISTICS (cents per share)

Minority Int 19 854 21 714 25 103 29 078 34 625

HEPS-C (ZARc) 15.00 - 68.00 - 76.00 91.00 95.00 LT Liab 146 159 146 907 154 948 154 311 157 506

DPS (ZARc) - - - 18.00 15.00 Tot Curr Liab 14 064 21 293 27 437 35 138 14 285

NAV PS (ZARc) 802.53 767.77 810.09 1 189.82 1 454.54

3 Yr Beta 1.56 1.48 0.78 0.92 1.48 PER SHARE STATISTICS (cents per share)

Price High 287 231 490 635 760 HEPS-C (ZARc) 49.00 - 6.00 - 59.00 - 50.00 - 113.00

Price Low 178 85 185 318 506 DPS (ZARc) - 6.00 - - -

Price Prd End 203 225 230 439 615 NAV PS (ZARc) 778.00 735.57 710.09 768.91 755.80

RATIOS 3 Yr Beta 0.10 0.09 - 0.54 - -

Ret on SH Fnd 7.16 - 9.73 - 46.86 - 20.34 6.53 Price High 420 1 550 749 1 279 1 300

Oper Pft Mgn 1.43 - 0.85 - 13.27 - 8.24 4.84 Price Low 100 120 263 550 800

D:E 0.41 0.44 0.24 0.34 0.27 Price Prd End 420 189 697 801 900

Current Ratio 1.74 1.82 2.28 2.02 2.27 RATIOS

Div Cover - - - - 13.44 6.33 Ret on SH Fnd 12.51 3.43 - 7.08 - 5.51 - 28.08

Oper Pft Mgn 91.41 38.67 - 30.34 - 33.59 - 280.11

D:E 0.37 0.41 0.45 0.41 0.41

Current Ratio 2.55 1.78 1.43 1.54 4.53

Div Cover - 3.83 - - -

139