Page 138 - Profile's Stock Exchange Handbook 2022 Issue 1

P. 138

JSE – HER Profile’s Stock Exchange Handbook: 2020 – Issue 4

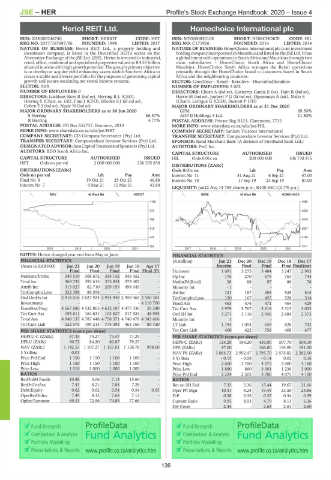

Heriot REIT Ltd. Homechoice International plc

HER HOM

ISIN: ZAE000246740 SHORT: HERIOT CODE: HET ISIN: MT0000850108 SHORT: HOMCHOICE CODE: HIL

REG NO: 2017/167697/06 FOUNDED: 1998 LISTED: 2017 REG NO: C171926 FOUNDED: 2014 LISTED: 2014

NATURE OF BUSINESS: Heriot REIT Ltd., a property holding and NATURE OF BUSINESS: HomeChoice International plc is an investment

investment company, is listed in the Diversified REITs sector on the holdingcompanyincorporatedinMauritius andlistedonthe JSELtd.Ithas

Alternative Exchange of the JSE Ltd. (JSE). Heriot is invested in industrial, a global intent with operations in South Africa and Mauritius through two

retail, office, residential and specialised properties valued at R4.59 billion main subsidiaries – HomeChoice South Africa and HomeChoice

situatedinareaswithhigh growthpotential.Thegroup’sprimary objective Mauritius. HomeChoice South Africa manages the Retail operations

is to develop or acquire yield enhancing assets within Southern Africa to primarily through the HomeChoice brand to customers based in South

create a stable and diverse portfolio for the purposes of generating capital Africa and the neighbouring countries.

growth and secure escalating net rental income streams. SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers

SECTOR: AltX NUMBER OF EMPLOYEES: 2 002

NUMBER OF EMPLOYEES: 0 DIRECTORS: Chorn A (ind ne), Gutierrez-Garcia E (ne), Hain R (ind ne),

DIRECTORS: Lockhart-Ross R (ind ne), Herring R L (CEO), Harris M (ind ne), JoubertPG(ld ind ne), Ogunsanya A (alt), Maltz S

Herring S (Chair, ne, UK), Finn J (CFO), BliedenSJ(ld ind ne), (Chair), Lartigue G (CEO), Burnett P (FD)

CohenTJ(ind ne), Ngale N (ind ne) MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 GFM 69.50%

S Herring 86.87% ADP II Holdings 3 Ltd. 21.80%

R Herring 4.77% POSTAL ADDRESS: Private Bag X123, Claremont, 7735

POSTAL ADDRESS: PO Box 652737, Benmore, 2010 MORE INFO: www.sharedata.co.za/sdo/jse/HIL

MORE INFO: www.sharedata.co.za/sdo/jse/HET COMPANY SECRETARY: Sanlam Trustees International

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd. AUDITORS: PwC Inc.

AUDITORS: BDO South Africa Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED HIL Ords 0.01c ea 200 000 000 106 730 376

HET Ords no par val 2 000 000 000 256 295 858

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc] Ords 0.01c ea Ldt Pay Amt

Ords no par val Ldt Pay Amt Interim No 11 31 Aug 21 6 Sep 21 47.00

Final No 8 19 Oct 21 25 Oct 21 46.88 Interim No 10 17 Sep 19 23 Sep 19 87.00

Interim No 7 9 Mar 21 15 Mar 21 43.84

LIQUIDITY: Jan22 Avg 14 755 shares p.w., R400 640.1(0.7% p.a.)

REIV 40 Week MA HERIOT GERE 40 Week MA HOMCHOICE

1150 4950

973 4262

795 3575

618 2887

440 2199

263 1511

2018 | 2019 | 2020 | 2021 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Heriot changed year end from May to June. FINANCIAL STATISTICS

FINANCIAL STATISTICS (R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

(Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Apr 17 Interim Final Final Final Final(rst)

Final Final Final Final Final (P) Turnover 1 691 3 275 3 484 3 247 2 993

NetRent/InvInc 349 519 368 672 354 142 345 452 - Op Inc 176 270 679 763 744

Total Inc 369 732 392 615 375 834 373 302 - NetIntPd(Rcvd) 38 88 97 86 76

Attrib Inc 313 027 82 710 209 199 498 445 - Minority Int - 1 - - - -

TotCompIncLoss 322 398 88 058 - - - Att Inc 121 167 455 528 514

Ord UntHs Int 2 918 016 2 827 924 2 954 949 2 959 465 2 550 383 TotCompIncLoss 120 167 455 528 514

Investments - - - - 4 110 700 Fixed Ass 465 476 471 464 429

FixedAss/Prop 4 667 686 4 532 865 4 612 187 4 477 336 26 240 Tot Curr Ass 3 979 3 767 3 618 3 315 3 033

Tot Curr Ass 195 611 164 631 103 627 217 924 48 995 Ord SH Int 3 271 3 116 2 946 2 684 2 373

Total Ass 4 948 137 4 787 448 4 758 371 4 740 478 4 343 666 Minority Int 1 - - - -

Tot Curr Liab 522 575 199 214 774 393 463 769 80 720 LT Liab 1 194 1 054 649 828 742

PER SHARE STATISTICS (cents per share) Tot Curr Liab 400 422 756 408 477

HEPLU-C (ZARc) 87.35 74.27 73.47 71.29 - PER SHARE STATISTICS (cents per share)

DPLU (ZARc) 90.72 84.20 80.87 79.27 - HEPS-C (ZARc) 124.20 164.20 436.00 507.70 504.10

NAV (ZARc) 1 142.55 1 107.27 1 157.01 1 158.78 998.00 DPS (ZARc) 47.00 - 166.00 194.00 191.00

3 Yr Beta - 0.01 - - - - NAV PS (ZARc) 3 064.73 2 992.47 2 795.70 2 575.82 2 282.00

Price Prd End 1 150 1 150 1 100 1 100 - 3 Yr Beta - 0.15 - 0.08 - 0.14 0.02 0.16

Price High 1 150 1 150 1 100 1 100 - Price High 2 600 3 700 4 075 5 000 4 100

Price Low 1 010 1 000 1 000 1 000 - Price Low 1 880 660 3 001 1 236 3 000

RATIOS Price Prd End 2 224 2 502 3 700 4 075 4 100

RetOnSH Funds 10.88 3.06 7.13 15.66 - RATIOS

RetOnTotAss 7.43 8.21 7.84 7.28 - Ret on SH Fnd 7.33 5.36 15.44 19.67 21.66

Debt:Equity 0.62 0.62 0.54 0.54 0.65 Oper Pft Mgn 10.41 8.24 19.49 23.50 24.86

OperRetOnInv 7.49 8.13 7.68 7.12 - D:E 0.38 0.35 0.37 0.34 0.39

OpInc:Turnover 69.33 72.56 74.85 77.66 - Current Ratio 9.95 8.93 4.79 8.13 6.36

Div Cover 2.44 - 2.63 2.61 2.60

Fund Research Fund Research

Comparison & Analysis Comparison & Analysis

Portfolio Modelling Portfolio Modelling

Presentations & Reports www.profile.co.za/analytics.htm Presentations & Reports www.profile.co.za/analytics.htm

136