Page 153 - SHB 2021 Issue 4

P. 153

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – LIB

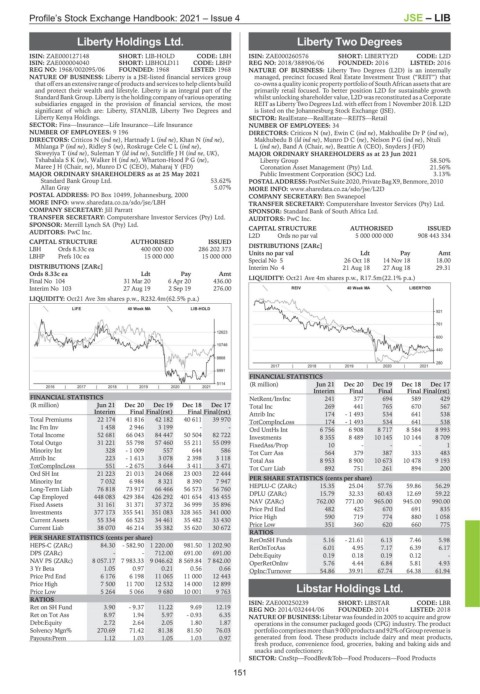

Liberty Holdings Ltd. Liberty Two Degrees

LIB LIB

ISIN: ZAE000127148 SHORT: LIB-HOLD CODE: LBH ISIN: ZAE000260576 SHORT: LIBERTY2D CODE: L2D

ISIN: ZAE000004040 SHORT: LIBHOLD11 CODE: LBHP REG NO: 2018/388906/06 FOUNDED: 2016 LISTED: 2016

REG NO: 1968/002095/06 FOUNDED: 1968 LISTED: 1968 NATURE OF BUSINESS: Liberty Two Degrees (L2D) is an internally

NATURE OF BUSINESS: Liberty is a JSE-listed financial services group managed, precinct focused Real Estate Investment Trust (“REIT”) that

that off ers an extensive range of products and services to help clients build co-owns a quality iconic property portfolio of South African assets that are

and protect their wealth and lifestyle. Liberty is an integral part of the primarily retail focused. To better position L2D for sustainable growth

Standard Bank Group. Liberty is the holding company of various operating whilst unlocking shareholder value, L2D was reconstituted as a Corporate

subsidiaries engaged in the provision of financial services, the most REIT as Liberty Two Degrees Ltd. with effect from 1 November 2018. L2D

significant of which are: Liberty, STANLIB, Liberty Two Degrees and is listed on the Johannesburg Stock Exchange (JSE).

Liberty Kenya Holdings. SECTOR: RealEstate—RealEstate—REITS—Retail

SECTOR: Fins—Insurance—Life Insurance—Life Insurance NUMBER OF EMPLOYEES: 34

NUMBER OF EMPLOYEES: 9 196 DIRECTORS: Criticos N (ne), Ewin C (ind ne), Makhoalibe Dr P (ind ne),

DIRECTORS: Criticos N (ind ne), Hartnady L (ind ne), Khan N (ind ne), Makhubedu B (ld ind ne), MunroDC(ne), NelsonPG(ind ne), Ntuli

Mhlanga P (ind ne), Ridley S (ne), Roskruge CeleCL(ind ne), L(ind ne), Band A (Chair, ne), Beattie A (CEO), Snyders J (FD)

Skweyiya T (ind ne), Suleman Y (ld ind ne), SutcliffeJH(ind ne, UK), MAJOR ORDINARY SHAREHOLDERS as at 23 Jun 2021

TshabalalaSK(ne), Walker H (ind ne), Wharton-HoodPG(ne), Liberty Group 58.50%

Maree J H (Chair, ne), Munro D C (CEO), Maharaj Y (FD) Coronation Asset Management (Pty) Ltd. 21.56%

MAJOR ORDINARY SHAREHOLDERS as at 25 May 2021 Public Investment Corporation (SOC) Ltd. 3.13%

Standard Bank Group Ltd. 53.62% POSTAL ADDRESS:PostNetSuite2020, PrivateBagX9,Benmore,2010

Allan Gray 5.07% MORE INFO: www.sharedata.co.za/sdo/jse/L2D

POSTAL ADDRESS: PO Box 10499, Johannesburg, 2000 COMPANY SECRETARY: Ben Swanepoel

MORE INFO: www.sharedata.co.za/sdo/jse/LBH TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: Jill Parratt SPONSOR: Standard Bank of South Africa Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: PwC Inc.

SPONSOR: Merrill Lynch SA (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc.

L2D Ords no par val 5 000 000 000 908 443 334

CAPITAL STRUCTURE AUTHORISED ISSUED

LBH Ords 8.33c ea 400 000 000 286 202 373 DISTRIBUTIONS [ZARc] Ldt Pay Amt

Units no par val

LBHP Prefs 10c ea 15 000 000 15 000 000

Special No 5 26 Oct 18 14 Nov 18 18.00

DISTRIBUTIONS [ZARc] Interim No 4 21 Aug 18 27 Aug 18 29.31

Ords 8.33c ea Ldt Pay Amt

Final No 104 31 Mar 20 6 Apr 20 436.00 LIQUIDITY: Oct21 Ave 4m shares p.w., R17.5m(22.1% p.a.)

Interim No 103 27 Aug 19 2 Sep 19 276.00 REIV 40 Week MA LIBERTY2D

LIQUIDITY: Oct21 Ave 3m shares p.w., R232.4m(62.5% p.a.)

LIFE 40 Week MA LIB-HOLD

921

761

12623

600

10746

440

8868

280

2017 | 2018 | 2019 | 2020 | 2021

6991

FINANCIAL STATISTICS

5114 (R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Interim Final Final Final Final(rst)

FINANCIAL STATISTICS NetRent/InvInc 241 377 694 589 429

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Total Inc 269 441 765 670 567

Interim Final Final(rst) Final Final(rst) Attrib Inc 174 - 1 493 534 641 538

Total Premiums 22 174 41 816 42 182 40 611 39 970 TotCompIncLoss 174 - 1 493 534 641 538

Inc Fm Inv 1 458 2 946 3 199 - - Ord UntHs Int 6 756 6 908 8 717 8 584 8 993

Total Income 52 681 66 043 84 447 50 504 82 722

Investments 8 355 8 489 10 145 10 144 8 709

Total Outgo 31 221 55 798 57 460 55 211 55 099 FixedAss/Prop 10 - - - 1

Minority Int 328 - 1 009 557 644 586 Tot Curr Ass 564 379 387 333 483

Attrib Inc 223 - 1 613 3 078 2 398 3 118 Total Ass 8 953 8 900 10 673 10 478 9 193

TotCompIncLoss 551 - 2 675 3 644 3 411 3 471 Tot Curr Liab 892 751 261 894 200

Ord SH Int 21 223 21 013 24 068 23 003 22 444

PER SHARE STATISTICS (cents per share)

Minority Int 7 032 6 984 8 321 8 390 7 947

Long-Term Liab 76 818 73 917 66 466 56 573 56 760 HEPLU-C (ZARc) 15.35 25.04 57.76 59.86 56.29

Cap Employed 448 083 429 384 426 292 401 654 413 455 DPLU (ZARc) 15.79 32.33 60.43 12.69 59.22

Fixed Assets 31 161 31 371 37 372 36 999 35 896 NAV (ZARc) 762.00 771.00 965.00 945.00 990.00

Investments 377 173 355 541 351 083 328 365 341 000 Price Prd End 482 425 670 691 835

Current Assets 55 334 66 523 34 461 35 482 33 430 Price High 590 719 774 880 1 058

Current Liab 38 070 46 214 35 382 35 620 30 672 Price Low 351 360 620 660 775

RATIOS

PER SHARE STATISTICS (cents per share) RetOnSH Funds 5.16 - 21.61 6.13 7.46 5.98

HEPS-C (ZARc) 84.30 - 582.90 1 220.00 981.50 1 202.90 RetOnTotAss 6.01 4.95 7.17 6.39 6.17

DPS (ZARc) - - 712.00 691.00 691.00 Debt:Equity 0.19 0.18 0.19 0.12 -

NAV PS (ZARc) 8 057.17 7 983.33 9 046.62 8 569.84 7 842.00 OperRetOnInv 5.76 4.44 6.84 5.81 4.93

3 Yr Beta 1.05 0.97 0.21 0.56 0.66 OpInc:Turnover 54.86 39.91 67.74 64.38 61.94

Price Prd End 6 176 6 198 11 065 11 000 12 443

Price High 7 500 11 700 12 532 14 000 12 899

Price Low 5 264 5 066 9 680 10 001 9 763 Libstar Holdings Ltd.

RATIOS ISIN: ZAE000250239 SHORT: LIBSTAR CODE: LBR

LIB

Ret on SH Fund 3.90 - 9.37 11.22 9.69 12.19 REG NO: 2014/032444/06 FOUNDED: 2014 LISTED: 2018

Ret on Tot Ass 8.97 1.94 5.97 - 0.93 6.35 NATURE OF BUSINESS: Libstar was founded in 2005 to acquire and grow

Debt:Equity 2.72 2.64 2.05 1.80 1.87 operations in the consumer packaged goods (CPG) industry. The product

Solvency Mgn% 270.69 71.42 81.38 81.50 76.03 portfoliocomprisesmorethan9000 productsand92% ofGrouprevenueis

Payouts:Prem 1.12 1.03 1.05 1.03 0.97 generated from food. These products include dairy and meat products,

fresh produce, convenience food, groceries, baking and baking aids and

snacks and confectionery.

SECTOR: CnsStp—FoodBev&Tob—Food Producers—Food Products

151