Page 156 - SHB 2021 Issue 4

P. 156

JSE – LUX Profile’s Stock Exchange Handbook: 2021 – Issue 4

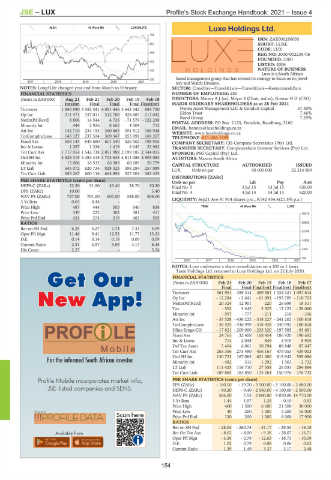

Luxe Holdings Ltd.

ALSH 40 Week MA LONG4LIFE

759 LUX

ISIN: ZAE000286035

657 SHORT: LUXE

CODE: LUX

555

REG NO: 2000/002239/06

FOUNDED: 2000

453

LISTED: 2006

NATURE OF BUSINESS:

352

Luxe is a South African

based management group that has revised its strategy to focus on its Jewel-

250

2017 | 2018 | 2019 | 2020 | 2021

lery and Watch Division.

NOTES: Long4Life changed year end from March to February. SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Resturants&Bars

FINANCIAL STATISTICS NUMBER OF EMPLOYEES: 280

(Amts in ZAR'000) Aug 21 Feb 21 Feb 20 Feb 19 Feb 18 DIRECTORS: Maizey AJ(ne), Meyer S (Chair, ind ne), Grewar H D (CEO)

Interim Final Final Final Final(rst) MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

Turnover 1 845 990 3 582 541 4 091 446 3 642 342 884 750 Protea Asset Management LLC & Conduit Capital 57.40%

Op Inc 211 471 337 011 512 700 428 685 117 042 Eldon Trust 7.46%

Rand Group 7.29%

NetIntPd(Rcvd) 8 806 14 544 4 726 - 71 579 - 122 298 POSTAL ADDRESS: PO Box 1125, Ferndale, Randburg, 2160

Minority Int 444 2 926 8 662 4 504 712 EMAIL: hannes@luxeholdings.co.za

Att Inc 144 710 234 155 360 665 351 512 168 948 WEBSITE: www.luxeholdings.co.za

TotCompIncLoss 145 127 237 324 369 347 355 991 169 267 TELEPHONE: 011-608-1999

Fixed Ass 658 144 645 680 601 540 526 502 198 955 COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

Inv & Loans 1 297 1 338 1 419 6 045 22 982 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Tot Curr Ass 1 717 054 1 542 738 2 051 988 2 199 185 2 344 015 SPONSOR: PSG Capital (Pty) Ltd.

Ord SH Int 4 626 319 4 484 415 4 703 645 4 811 086 4 503 084 AUDITORS: Mazars South Africa

Minority Int 15 006 16 532 66 389 60 289 20 779 CAPITAL STRUCTURE AUTHORISED ISSUED

LT Liab 645 072 620 734 828 323 398 284 257 089 LUX Ords no par 40 000 000 22 214 989

Tot Curr Liab 683 267 600 116 664 896 527 004 363 425

DISTRIBUTIONS [ZARc]

PER SHARE STATISTICS (cents per share) Ords no par Ldt Pay Amt

HEPS-C (ZARc) 22.50 31.90 43.40 38.70 30.20 Final No 5 3 Jul 15 13 Jul 15 650.00

DPS (ZARc) 10.00 - - - 5.40 Final No 4 4 Jul 14 14 Jul 14 620.00

NAV PS (ZARc) 727.00 701.00 607.00 548.00 506.00

3 Yr Beta 0.65 0.44 - - - LIQUIDITY: Sep21 Ave 91 914 shares p.w., R142 434.4(21.5% p.a.)

Price High 487 444 505 640 838 TRAV 40 Week MA LUXE

Price Low 339 222 302 381 411 36915

Price Prd End 424 374 319 463 555

RATIOS 29552

Ret on SH Fnd 6.25 5.27 7.74 7.31 4.09

22189

Oper Pft Mgn 11.46 9.41 12.53 11.77 13.23

D:E 0.14 0.14 0.18 0.09 0.09 14826

Current Ratio 2.51 2.57 3.09 4.17 6.45

Div Cover 2.27 - - - 5.56 7463

100

2016 | 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Luxe underwent a share consolidation on a 100 to 1 basis.

Taste Holdings Ltd. renamed to Luxe Holdings Ltd. on 22 July 2020.

FINANCIAL STATISTICS

(Amts in ZAR’000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

Final Final Final(rst) Final(rst) Final(rst)

Turnover 361 951 459 414 489 981 1 034 321 1 097 614

Op Inc - 12 284 - 3 641 - 61 891 - 193 709 - 110 703

NetIntPd(Rcvd) 20 324 12 901 220 26 698 18 511

Tax - 552 3 443 2 325 - 12 122 - 28 060

Minority Int - 997 - 777 - 211 210 - 336

Att Inc - 35 528 - 436 222 - 318 227 - 241 202 - 100 818

TotCompIncLoss - 36 525 - 436 999 - 318 438 - 240 992 - 100 818

Hline Erngs-CO - 17 821 - 209 000 - 233 320 - 197 585 - 93 881

Fixed Ass 24 765 32 408 168 454 186 920 190 692

Inv & Loans 714 2 038 849 4 919 8 905

Def Tax Asset 5 464 6 061 30 294 88 848 87 647

Tot Curr Ass 263 356 273 490 456 167 479 053 439 003

Ord SH Int 130 723 167 085 621 000 813 942 559 086

Minority Int - 482 515 1 292 1 503 - 2 732

LT Liab 111 425 116 710 27 358 26 031 284 884

Tot Curr Liab 189 885 183 850 135 264 150 976 176 732

PER SHARE STATISTICS (cents per share)

EPS (ZARc) - 160.10 - 19.70 - 3 500.00 - 5 100.00 - 2 680.00

HEPS-C (ZARc) - 60.20 - 9.40 - 2 560.00 - 4 180.00 - 2 500.00

NAV PS (ZARc) 586.00 7.53 2 800.00 9 070.00 14 770.00

3 Yr Beta 1.44 1.97 1.29 - 0.10 0.53

Price High 400 1 500 6 600 21 500 30 000

Price Low 40 200 1 000 5 200 16 000

Price Prd End 120 200 1 200 6 000 17 900

RATIOS

Ret on SH Fnd - 28.04 - 260.74 - 51.17 - 29.55 - 18.18

Ret On Tot Ass - 8.62 - 4.00 - 9.38 - 28.07 - 16.71

Oper Pft Mgn - 3.39 - 0.79 - 12.63 - 18.73 - 10.09

D:E 1.02 0.79 0.08 0.06 0.62

Current Ratio 1.39 1.49 3.37 3.17 2.48

154