Page 149 - SHB 2021 Issue 4

P. 149

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – KAP

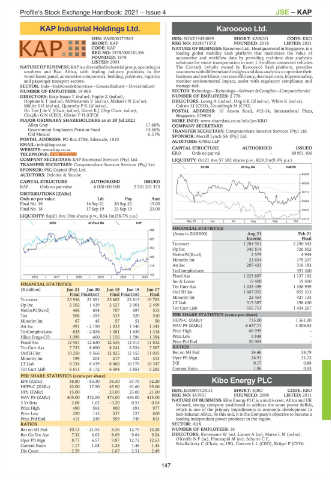

KAP Industrial Holdings Ltd. Karooooo Ltd.

KAP KAR

ISIN: ZAE000171963 ISIN: SGXZ19450089 SHORT: KAROO CODE: KRO

SHORT: KAP REG NO: 201817157Z FOUNDED: 2018 LISTED: 2021

CODE: KAP NATURE OF BUSINESS: Karooooo Ltd., Headquartered in Singapore, is a

REG NO: 1978/000181/06 leading global mobility SaaS platform that maximizes the value of

FOUNDED: 1978 automotive and workflow data by providing real-time data analytics

LISTED: 2004 solutions for smart transportation to over 1.3 million connected vehicles.

NATUREOF BUSINESS:KAPisadiversifiedindustrialgroup, operatingin The Cartrack (wholly owned by Karooooo) SaaS platform, provides

southern and East Africa, with leading industry positions in the customers with differentiated insights and data analytics to optimize their

wood-based panel, automotive components, bedding, polymers, logistics business and workforce, increase efficiency, decrease costs, improve safety,

and passenger transport sectors. monitor environmental impact, assist with regulatory compliance and

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—DiversIndustr manage risk.

NUMBER OF EMPLOYEES: 19 063 SECTOR:Technology—Technology—Software&CompSer—ComputerService

DIRECTORS: Esau-Isaacs T (ind ne), Fuphe Z (ind ne), NUMBER OF EMPLOYEES: 2 776

HopkinsKT(ind ne), McMenamin V (ind ne), MkhariIN(ind ne), DIRECTORS: Leong A (ind ne), OngSK(ld ind ne), White K (ind ne),

MüllerSH(ind ne), QuarmbyPK(ld ind ne), Calisto I J (CEO), Grundlingh M (CFO)

Du Toit J de V (Chair, ind ne), Grové K J (Dep Chair, ind ne), POSTAL ADDRESS: 10 Anson Road, #12-14, International Plaza,

Chaplin G N (CEO), Olivier F H (CFO) Singapore, 079903

MAJOR ORDINARY SHAREHOLDERS as at 30 Jul 2021 MORE INFO: www.sharedata.co.za/sdo/jse/KRO

Allan Gray 17.68% COMPANY SECRETARY:

Government Employees Pension Fund 14.56% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Old Mutual 6.51% SPONSOR: Merrill Lynch SA (Pty) Ltd.

POSTAL ADDRESS: PO Box 2766, Edenvale, 1610 AUDITORS: KPMG LLP

EMAIL: info@kap.co.za

WEBSITE: www.kap.co.za CAPITAL STRUCTURE AUTHORISED ISSUED

TELEPHONE: 021-808-0900 KRO Ords no par val - 30 951 106

COMPANY SECRETARY: KAP Secretarial Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 57 382 shares p.w., R29.3m(9.6% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SCOM 80 Day MA KAROO

SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Deloitte & Touche 62000

CAPITAL STRUCTURE AUTHORISED ISSUED

56355

KAP Ords no par value 6 000 000 000 2 531 201 473

DISTRIBUTIONS [ZARc] 50710

Ords no par value Ldt Pay Amt

Final No 19 14 Sep 21 20 Sep 21 15.00 45065

Final No 18 17 Sep 19 23 Sep 19 23.00 39420

LIQUIDITY: Sep21 Ave 19m shares p.w., R64.1m(38.7% p.a.)

33775

May 21 | Jun | Jul | Aug | Sep | Oct

GENI 40 Week MA KAP

FINANCIAL STATISTICS

988

(Amts in ZAR'000) Aug 21 Feb 21

821 Interim Final

Turnover 1 284 961 2 290 543

653 Op Inc 345 814 726 562

NetIntPd(Rcvd) 2 579 4 944

485

Minority Int 23 654 179 237

318 Att Inc 207 423 318 183

TotCompIncLoss - 497 420

150 Fixed Ass 1 223 897 1 137 192

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Inv & Loans 19 400 19 400

FINANCIAL STATISTICS Tot Curr Ass 1 035 499 1 326 939

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Ord SH Int 1 867 055 855 313

Final Final(rst) Final Final(rst) Final

Turnover 23 956 21 591 25 602 22 813 19 783 Minority Int 22 464 427 133

Op Inc 2 102 1 419 2 527 2 901 2 499 LT Liab 315 387 198 430

NetIntPd(Rcvd) 466 654 707 697 515 Tot Curr Liab 555 713 1 434 267

Tax 506 - 395 533 520 510 PER SHARE STATISTICS (cents per share)

Minority Int 67 45 57 51 50 HEPS-C (ZARc) 735.00 1 561.00

Att Inc 991 - 2 190 1 033 1 540 1 343 NAV PS (ZARc) 6 637.71 4 206.53

TotCompIncLoss 825 - 2 026 1 081 1 630 1 318 Price High 68 999 -

Hline Erngs-CO 1 099 460 1 156 1 596 1 394 Price Low 5 848 -

Fixed Ass 12 957 12 630 12 536 12 513 11 832 Price Prd End 50 004 -

Tot Curr Ass 7 733 6 690 8 241 8 524 7 587 RATIOS

Ord SH Int 10 250 9 566 12 825 12 155 11 035 Ret on SH Fnd 24.46 38.79

Minority Int 199 204 217 322 313 Oper Pft Mgn 26.91 31.72

LT Liab 8 334 8 419 8 468 10 176 10 347 D:E 0.17 0.88

Tot Curr Liab 6 611 6 172 6 594 5 851 5 283 Current Ratio 1.86 0.93

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 38.80 - 83.30 38.30 57.70 52.20 Kibo Energy PLC

HEPS-C (ZARc) 43.00 17.50 45.90 61.60 55.60 KIB

CODE: KBO

DPS (ZARc) 15.00 - 23.00 23.00 21.00 ISIN: IE00B97C0C31 SHORT: KIBO LISTED: 2011

REG NO: 451931

FOUNDED: 2008

NAV PS (ZARc) 405.00 372.00 474.00 454.00 415.00

3 Yr Beta 2.08 1.62 - 0.20 0.53 0.64 NATURE OF BUSINESS: Kibo Energy PLC is a multi-asset, Africa and UK

focused, energy company positioned to address the acute power deficit,

Price High 490 593 900 991 977

which is one of the primary impediments to economic development in

Price Low 220 115 537 727 600 Sub-Saharan Africa. To this end, it is the Company's objective to become a

Price Prd End 413 249 559 749 813 leading independent power producer in the region.

RATIOS SECTOR: AltX

Ret on SH Fnd 10.13 - 21.95 8.36 12.75 12.28 NUMBER OF EMPLOYEES: 16

Ret On Tot Ass 7.32 3.63 8.09 9.64 9.24 DIRECTORS: Kerremans W (ne), Lianos A (ne), MareeLM(ind ne),

Oper Pft Mgn 8.77 6.57 9.87 12.72 12.63 O'KeeffeNF(ne), Phumaphi M (ne), Schutte C E,

Current Ratio 1.17 1.08 1.25 1.46 1.44 Schaffalitzky C (Chair, ne, UK), Coetzee L L (CEO), Krügel P (CFO)

Div Cover 2.59 - 1.67 2.51 2.49

147