Page 148 - SHB 2021 Issue 4

P. 148

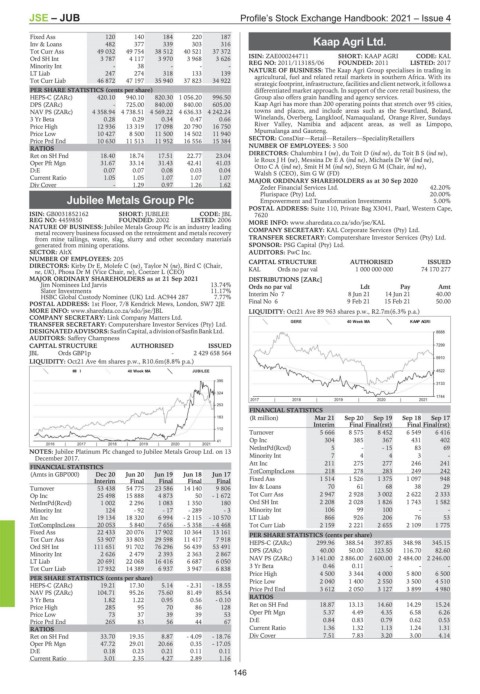

JSE – JUB Profile’s Stock Exchange Handbook: 2021 – Issue 4

Fixed Ass 120 140 184 220 187

Inv & Loans 482 377 339 303 316 Kaap Agri Ltd.

Tot Curr Ass 49 032 49 754 38 512 40 521 37 372 KAA

Ord SH Int 3 787 4 117 3 970 3 968 3 626 ISIN: ZAE000244711 SHORT: KAAP AGRI CODE: KAL

Minority Int - 38 - - - REG NO: 2011/113185/06 FOUNDED: 2011 LISTED: 2017

LT Liab 247 274 318 133 139 NATURE OF BUSINESS: The Kaap Agri Group specialises in trading in

Tot Curr Liab 46 872 47 197 35 940 37 823 34 922 agricultural, fuel and related retail markets in southern Africa. With its

strategic footprint, infrastructure, facilities and client network, it follows a

PER SHARE STATISTICS (cents per share) differentiated market approach. In support of the core retail business, the

HEPS-C (ZARc) 420.10 940.10 820.30 1 056.20 996.50 Group also offers grain handling and agency services.

DPS (ZARc) - 725.00 840.00 840.00 605.00 Kaap Agri has more than 200 operating points that stretch over 95 cities,

NAV PS (ZARc) 4 358.94 4 738.51 4 569.22 4 636.33 4 242.24 towns and places, and include areas such as the Swartland, Boland,

3 Yr Beta 0.28 0.29 0.34 0.47 0.66 Winelands, Overberg, Langkloof, Namaqualand, Orange River, Sundays

Price High 12 936 13 319 17 098 20 790 16 750 River Valley, Namibia and adjacent areas, as well as Limpopo,

Price Low 10 427 8 500 11 500 14 502 11 940 Mpumalanga and Gauteng.

Price Prd End 10 630 11 513 11 952 16 556 15 384 SECTOR: ConsDisr—Retail—Retailers—SpecialityRetaillers

RATIOS NUMBER OF EMPLOYEES: 3 500

Ret on SH Fnd 18.40 18.74 17.51 22.77 23.04 DIRECTORS: Chalumbira I (ne), du Toit D (ind ne),duToitBS(ind ne),

Oper Pft Mgn 31.67 33.14 31.43 42.41 41.03 leRouxJH(ne), Messina DrEA(ind ne), Michaels Dr W (ind ne),

D:E 0.07 0.07 0.08 0.03 0.04 OttoCA(ind ne),SmitHM(ind ne), Steyn G M (Chair, ind ne),

Walsh S (CEO), Sim G W (FD)

Current Ratio 1.05 1.05 1.07 1.07 1.07 MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

Div Cover - 1.29 0.97 1.26 1.62

Zeder Financial Services Ltd. 42.20%

Plurispace (Pty) Ltd. 20.00%

Jubilee Metals Group Plc Empowerment and Transformation Investments 5.00%

POSTAL ADDRESS: Suite 110, Private Bag X3041, Paarl, Western Cape,

JUB

ISIN: GB0031852162 SHORT: JUBILEE CODE: JBL 7620

REG NO: 4459850 FOUNDED: 2002 LISTED: 2006 MORE INFO: www.sharedata.co.za/sdo/jse/KAL

NATURE OF BUSINESS: Jubilee Metals Group Plc is an industry leading COMPANY SECRETARY: KAL Corporate Services (Pty) Ltd.

metal recovery business focussed on the retreatment and metals recovery

from mine tailings, waste, slag, slurry and other secondary materials TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

generated from mining operations. SPONSOR: PSG Capital (Pty) Ltd.

SECTOR: AltX AUDITORS: PwC Inc.

NUMBER OF EMPLOYEES: 205 CAPITAL STRUCTURE AUTHORISED ISSUED

DIRECTORS: Kirby Dr E, Molefe C (ne), Taylor N (ne), Bird C (Chair, KAL Ords no par val 1 000 000 000 74 170 277

ne, UK), Phosa Dr M (Vice Chair, ne), Coetzer L (CEO)

MAJOR ORDINARY SHAREHOLDERS as at 21 Sep 2021 DISTRIBUTIONS [ZARc]

Jim Nominees Ltd Jarvis 13.74% Ords no par val Ldt Pay Amt

Slater Investments 11.17% Interim No 7 8 Jun 21 14 Jun 21 40.00

HSBC Global Custody Nominee (UK) Ltd. AC944 287 7.77%

POSTAL ADDRESS: 1st Floor, 7/8 Kendrick Mews, London, SW7 2JE Final No 6 9 Feb 21 15 Feb 21 50.00

MORE INFO: www.sharedata.co.za/sdo/jse/JBL LIQUIDITY: Oct21 Ave 89 963 shares p.w., R2.7m(6.3% p.a.)

COMPANY SECRETARY: Link Company Matters Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. GERE 40 Week MA KAAP AGRI

DESIGNATEDADVISORS:SasfinCapital,adivisionofSasfinBankLtd. 8688

AUDITORS: Saffery Champness

CAPITAL STRUCTURE AUTHORISED ISSUED 7299

JBL Ords GBP1p - 2 429 658 564

5910

LIQUIDITY: Oct21 Ave 4m shares p.w., R10.6m(8.8% p.a.)

MI I 40 Week MA JUBILEE 4522

395

3133

324

1744

2017 | 2018 | 2019 | 2020 | 2021

253

FINANCIAL STATISTICS

183 (R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final(rst) Final Final(rst)

112

Turnover 5 666 8 575 8 452 6 549 6 416

41 Op Inc 304 385 367 431 402

2016 | 2017 | 2018 | 2019 | 2020 | 2021

NOTES: Jubilee Platinum Plc changed to Jubilee Metals Group Ltd. on 13 NetIntPd(Rcvd) 5 - - 15 83 69

December 2017. Minority Int 7 4 4 3 -

Att Inc 211 275 277 246 241

FINANCIAL STATISTICS TotCompIncLoss 218 278 283 249 242

(Amts in GBP'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final Final Fixed Ass 1 514 1 526 1 375 1 097 948

Turnover 53 438 54 775 23 586 14 140 9 806 Inv & Loans 70 61 68 38 29

Op Inc 25 498 15 888 4 873 50 - 1 672 Tot Curr Ass 2 947 2 928 3 002 2 622 2 333

NetIntPd(Rcvd) 1 002 2 296 1 083 1 350 180 Ord SH Int 2 208 2 028 1 826 1 743 1 582

Minority Int 124 - 92 - 17 - 289 - 3 Minority Int 106 99 100 - -

Att Inc 19 134 18 320 6 994 - 2 115 - 10 570 LT Liab 866 926 206 76 53

TotCompIncLoss 20 053 5 840 7 656 - 5 358 - 4 468 Tot Curr Liab 2 159 2 221 2 655 2 109 1 775

Fixed Ass 22 433 20 076 17 902 10 364 13 161 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 53 907 33 803 29 598 11 417 7 918 HEPS-C (ZARc) 299.96 388.54 397.85 348.98 345.15

Ord SH Int 111 651 91 702 76 296 56 439 53 491 DPS (ZARc) 40.00 50.00 123.50 116.70 82.60

Minority Int 2 626 2 479 2 393 2 363 2 867

LT Liab 20 691 22 068 16 416 6 687 6 050 NAV PS (ZARc) 3 141.00 2 886.00 2 600.00 2 484.00 2 246.00

Tot Curr Liab 17 932 14 389 6 937 3 947 6 838 3 Yr Beta 0.46 0.11 - - -

Price High 4 500 3 344 4 000 5 800 6 500

PER SHARE STATISTICS (cents per share) Price Low 2 040 1 400 2 550 3 500 4 510

HEPS-C (ZARc) 19.21 17.30 5.14 - 2.31 - 18.55 Price Prd End 3 612 2 050 3 127 3 899 4 980

NAV PS (ZARc) 104.71 95.26 75.60 81.49 85.54

3 Yr Beta 1.82 1.22 0.95 0.56 - 0.10 RATIOS

Price High 285 95 70 86 128 Ret on SH Fnd 18.87 13.13 14.60 14.29 15.24

Price Low 73 37 39 39 53 Oper Pft Mgn 5.37 4.49 4.35 6.58 6.26

Price Prd End 265 83 56 44 67 D:E 0.84 0.83 0.79 0.62 0.53

RATIOS Current Ratio 1.36 1.32 1.13 1.24 1.31

Ret on SH Fnd 33.70 19.35 8.87 - 4.09 - 18.76 Div Cover 7.51 7.83 3.20 3.00 4.14

Oper Pft Mgn 47.72 29.01 20.66 0.35 - 17.05

D:E 0.18 0.23 0.21 0.11 0.11

Current Ratio 3.01 2.35 4.27 2.89 1.16

146