Page 152 - SHB 2021 Issue 4

P. 152

JSE – LEW Profile’s Stock Exchange Handbook: 2021 – Issue 4

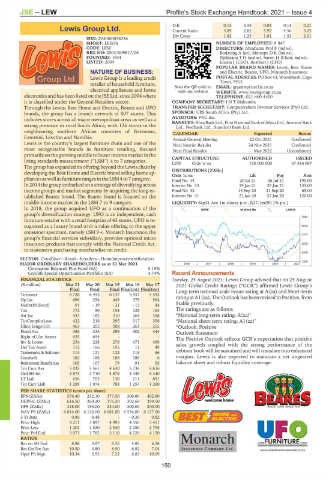

D:E 0.13 0.35 0.03 0.14 0.21

Lewis Group Ltd. Current Ratio 3.89 2.82 5.92 4.56 5.25

LEW Div Cover 1.82 1.25 1.61 1.53 2.01

ISIN: ZAE000058236

SHORT: LEWIS NUMBER OF EMPLOYEES: 8 847

CODE: LEW DIRECTORS: Abrahams Prof F (ind ne),

REG NO: 2004/009817/06 Bodasing A (ne), MotsepeDR(ind ne),

FOUNDED: 1934 NjikizanaTH(ind ne), Saven H (Chair, ind ne),

LISTED: 2004 Enslin J (CEO), Bestbier J (CFO)

POPULAR BRAND NAMES: Lewis, Best Home

NATURE OF BUSINESS: and Electric, Beares, UFO, Monarch Insurance

Lewis Group is a leading credit POSTAL ADDRESS: PO Box 43, Woodstock, Cape

retailer of household furniture, Scan the QR code to Town, 7915

electrical appliances and home visit our website EMAIL: graeme@tier1ir.co.za

WEBSITE: www.lewisgroup.co.za

electronicsandhasbeenlisted ontheJSELtd. since2004where TELEPHONE: 021-460-4400

it is classified under the General Retailers sector. COMPANY SECRETARY: I N T Makomba

Through the Lewis, Best Home and Electric, Beares and UFO TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

brands, the group has a branch network of 807 stores. This SPONSOR: UBS South Africa (Pty) Ltd.

includes stores across all major metropolitan areas as well as a AUDITORS: PwC Inc.

BANKERS:AbsaBankLtd.,FirstNationalBankofAfricaLtd.,InvestecBank

strong presence in rural South Africa, with 126 stores in the Ltd., Nedbank Ltd., Standard Bank Ltd.

neighbouring southern African countries of Botswana,

CALENDAR Expected Status

Eswatini, Lesotho and Namibia. Annual General Meeting 22 Oct 2021 Confirmed

Lewisisthe country’slargest furniturechain andone of the Next Interim Results 24 Nov 2021 Confirmed

most recognisable brands in furniture retailing, focused Next Final Results May 2022 Unconfirmed

primarily on the growing middle to lower income market in the

living standards measurement (“LSM”) 4 to 7 categories. CAPITAL STRUCTURE AUTHORISED ISSUED

LEW Ords 1c ea 150 000 000 67 514 697

The group has expanded its offering beyond the Lewis chain by

developing the Best Home and Electric brand selling home ap- DISTRIBUTIONS [ZARc] Ldt Pay Amt

Ords 1c ea

pliancesaswellasfurniturerangesintheLSM4to7category. Final No 34 20 Jul 21 26 Jul 21 195.00

In 2014 the group embarked on a strategy of diversifying across Interim No 33 19 Jan 21 25 Jan 21 133.00

income groups and market segments by acquiring the long-es- Final No 32 15 Sep 20 21 Sep 20 65.00

tablished Beares brand. The Beares brand is focused on the Interim No 31 21 Jan 20 27 Jan 20 120.00

middle-income market in the LSM 7 to 9 category. LIQUIDITY: Sep21 Ave 1m shares p.w., R27.1m(90.1% p.a.)

In 2018, the group acquired UFO as a continuation of the GERE 40 Week MA LEWIS

group’s diversification strategy. UFO is an independent, cash

7084

furniture retailer with a retail footprint of 43 stores. UFO is re-

cognised as a luxury brand with a value offering to the upper 5915

consumer spectrum, namely LSM 9+. Monarch Insurance, the

4747

group’s financial services subsidiary, provides optional micro

insurance products that comply with the National Credit Act, 3578

to customers purchasing merchandise on credit.

2409

SECTOR: ConsDiscr—Retail—Retailers—HomeImprovementRetailers

1240

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 2016 | 2017 | 2018 | 2019 | 2020 | 2021

Coronation Balanced Plus Fund (SA) 5.15%

Corolife Special Opportunities Portfolio (SA) 4.74% Recent Announcements

FINANCIAL STATISTICS Tuesday, 24 August 2021: Lewis Group advised that on 24 August

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 2021 Global Credit Ratings (“GCR”) affirmed Lewis Group’s

Final Final Final Final(rst) Final(rst) Long-term national scale Issuer rating at A(za) and Short-term

Turnover 6 726 6 453 6 137 5 557 5 592

Op Inc 696 254 443 379 564 rating at A1(za). The Outlook has been revised to Positive, from

NetIntPd(Rcvd) 91 - 19 - 21 - 13 44 Stable previously.

Tax 172 90 154 128 163 The ratings are as follows:

Att Inc 433 182 310 264 358 *National long-term rating: A(za)’

TotCompIncLoss 422 216 295 317 356 *National short-term rating: A1(za)’

Hline Erngs-CO 463 205 308 261 355 *Outlook: Positive

Fixed Ass 386 324 299 302 344 Outlook Statement

Right of Use Assets 635 694 - - - The Positive Outlook reflects GCR’s expectation that positive

Inv & Loans 254 228 276 471 456 sales growth coupled with the strong performance of the

Def Tax Asset 112 166 195 11 49

Trademarks&Software 114 121 122 118 66 debtors book will be sustained and will translate into enhanced

Goodwill 182 188 188 188 6 margins. Lewis is also expected to maintain a net ungeared

Retirement Benefit Ass 105 107 79 91 55 balance sheet and robust liquidity coverage.

Tot Curr Ass 5 035 5 561 4 630 5 736 6 616

Ord SH Int 4 873 4 710 4 876 5 449 5 440

LT Liab 656 705 130 211 891

Tot Curr Liab 1 295 1 974 783 1 257 1 260

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 576.40 232.10 377.50 306.80 402.90

HEPS-C (ZARc) 616.50 260.20 376.20 302.60 399.50

DPS (ZARc) 328.00 185.00 234.00 200.00 200.00

NAV PS (ZARc) 6 814.00 6 126.00 6 081.00 6 534.00 6 127.00

3 Yr Beta 0.86 0.48 - - 0.30 0.82

Price High 3 211 3 897 4 995 4 550 5 411

Price Low 1 201 1 520 2 540 2 250 2 795

Price Prd End 3 071 1 782 3 110 4 220 4 150

RATIOS

Ret on SH Fnd 8.88 3.87 6.35 4.85 6.58

Ret On Tot Ass 10.50 4.80 8.50 6.92 7.04

Oper Pft Mgn 10.34 3.93 7.22 6.83 10.09

150