Page 145 - SHB 2021 Issue 4

P. 145

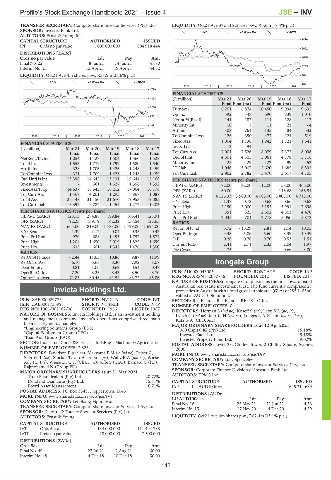

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – INV

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Oct21 Ave 372 115 shares p.w., R5.6m(17.4% p.a.)

SPONSOR: Investec Bank Ltd.

IIND 40 Week MA INVICTA

AUDITORS: Ernst & Young Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 7476

IPF Ords no par value 1 000 000 000 804 918 444

6062

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 4648

Final No 22 8 Jun 21 14 Jun 21 47.70

Interim No 21 13 Apr 21 19 Apr 21 44.52 3235

LIQUIDITY: Oct21 Ave 4m shares p.w., R34.9m(23.6% p.a.) 1821

REIV 40 Week MA INVPROP

407

2016 | 2017 | 2018 | 2019 | 2020 | 2021

1779

FINANCIAL STATISTICS

1498 (R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Final Final(rst) Final Final(rst) Final

1216

Turnover 6 251 6 874 10 450 9 994 9 632

Op Inc 592 - 348 690 839 1 010

935

NetIntPd(Rcvd) 141 182 114 128 117

654 Minority Int 10 7 11 21 - 4

Att Inc 308 - 761 135 84 533

372

2016 | 2017 | 2018 | 2019 | 2020 | 2021 TotCompIncLoss 126 - 390 477 121 519

Fixed Ass 1 004 1 738 1 942 1 721 1 641

FINANCIAL STATISTICS

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Inv & Loans 113 94 - - -

Final Final Final Final Final Tot Curr Ass 7 001 7 526 8 079 7 372 8 098

NetRent/InvInc 1 054 1 427 1 504 1 560 1 528 Ord SH Int 4 601 4 505 5 061 4 778 5 116

Total Inc 1 553 1 779 1 799 1 580 1 540 Minority Int 125 129 122 99 152

Attrib Inc - 328 1 706 1 426 1 248 1 459 LT Liab 1 046 3 007 2 620 1 685 6 892

TotCompIncLoss - 331 1 709 1 426 1 248 1 459 Tot Curr Liab 2 902 2 782 3 470 3 617 4 105

Ord UntHs Int 13 398 14 645 13 131 12 644 12 168 PER SHARE STATISTICS (cents per share)

Investments - 661 1 627 1 358 1 392 HEPS-C (ZARc) 172.00 - 82.00 112.00 58.00 466.00

FixedAss/Prop 14 637 16 643 16 212 17 004 16 176 DPS (ZARc) 60.00 - - 118.68 166.51

Tot Curr Ass 1 467 4 201 1 295 867 1 087 NAV PS (ZARc) 4 126.33 3 580.00 4 085.00 3 805.00 4 715.00

Total Ass 25 148 31 150 21 670 19 953 19 085 3 Yr Beta 1.37 0.72 - 0.68 0.66 0.68

Tot Curr Liab 3 397 6 787 1 455 1 277 1 203

Price High 2 150 3 000 5 155 5 991 7 698

PER SHARE STATISTICS (cents per share) Price Low 351 525 2 602 4 303 4 470

HEPS-C (ZARc) 128.13 284.88 199.84 106.41 123.91 Price Prd End 2 035 701 2 778 5 050 5 872

DPS (ZARc) 92.23 139.79 142.32 138.54 127.65 RATIOS

NAV PS (ZARc) 1 665.00 1 819.00 1 783.00 1 729.00 1 694.00 Ret on SH Fnd 6.72 - 16.29 2.81 2.14 10.05

3 Yr Beta 1.39 1.17 0.04 0.35 0.47 Oper Pft Mgn 9.48 - 5.06 6.60 8.39 10.49

Price Prd End 970 688 1 495 1 757 1 574 D:E 0.28 0.76 0.70 0.53 1.51

Price High 1 204 1 650 2 019 1 825 1 699

Price Low 635 601 1 342 1 476 1 350 Current Ratio 2.41 2.71 - 2.33 - 2.04 1.97

Div Cover

3.00

0.66

4.75

RATIOS

RetOnSH Funds - 2.44 11.65 10.86 9.87 11.99

RetOnTotAss 6.10 5.68 8.30 7.92 8.07 Irongate Group

Debt:Equity 0.81 1.06 0.62 0.54 0.47 IRO

OperRetOnInv 7.20 8.25 8.43 8.50 8.70 ISIN: AU0000046005 SHORT: IRONGATE CODE: IAP

OpInc:Turnover 71.83 80.46 81.54 83.72 85.86 REG NO: ARSN162067736 FOUNDED: 2012 LISTED: 2013

NATURE OF BUSINESS: Irongate Group listed as the first inward listed

Australian real estate investment trust. The fund currently comprises 27

Invicta Holdings Ltd. propertiesinAustraliawithatotalgrosslettablearea(GLA)of285 1465m²

valued at AUD1 006 million.

INV

ISIN: ZAE000029773 SHORT: INVICTA CODE: IVT SECTOR: RealEstate—RealEstate—REITS—Office

ISIN: ZAE000173399 SHORT: IVT PREF CODE: IVTP NUMBER OF EMPLOYEES: 0

REG NO: 1966/002182/06 FOUNDED: 1966 LISTED: 1987 DIRECTORS: Herman S (ind ne), Koseff S (ne), LeonSR(ne, It),

NATURE OF BUSINESS: Invicta Holdings Ltd. is an investment holding Lynch G (ind ne), Martin H (ind ne), Longes R A (Chair, ind ne, Aus),

and management company. Invicta’s operations comprise three main Katz G A (CEO, Aus)

business segments, namely: MAJOR ORDINARY SHAREHOLDERS as at 12 Apr 2021

*Engineering Solutions Group (ESG) 360 Capital IG (Pty) Ltd. 15.18%

*Capital Equipment Group (CEG) Investec Bank Ltd. 9.18%

*Kian Ann Group (KAG) Investec Property Fund Ltd. 9.02%

SECTOR:Inds—IndsGoods&Services—IndsEng—Machinery:Agricultural POSTAL ADDRESS: Level 23, Chifley Tower, 2 Chifley Square, Sydney,

NUMBER OF EMPLOYEES: 3 823 2000

DIRECTORS: Davidson F (ind ne), MakwanaPM(ld ind ne), Pelser G, MORE INFO: www.sharedata.co.za/sdo/jse/IAP

Sherrell L (ne), Sinclair T, van Heerden I (ne), WallyRA(ind ne), Wiese COMPANY SECRETARY: Lucy Spenceley

AdvJD(ne), Wiese Dr C H (Chair, ne), Joffe S (CEO), Barnard C (FD), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Rajmohamed N (Group FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 SPONSOR: Corporate Finance Division of Investec Bank Ltd.

Titan Sharedealers (Pty) Ltd. 20.72% AUDITORS: KPMG Inc.

Dorsland Diamante (Pty) Ltd. 15.81% CAPITAL STRUCTURE AUTHORISED ISSUED

Foord Asset Management 6.71% IAP LU AUD100c ea - 645 311 689

POSTAL ADDRESS: PO Box 33431, Jeppestown, 2043 DISTRIBUTIONS [AUDc]

MORE INFO: www.sharedata.co.za/sdo/jse/IVT

Pay

Ldt

COMPANY SECRETARY: Lebohang Mpumlwana LU AUD100c ea 25 May 21 11 Jun 21 Amt

4.53

Final No 16

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Interim No 15 17 Nov 20 4 Dec 20 4.39

SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

AUDITORS: Ernst & Young LIQUIDITY: Oct21 Ave 4m shares p.w., R62.4m(33.1% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

IVT Ords 5c ea 134 000 000 111 494 738

IVTP Prefs no par value 18 000 000 7 500 000

DISTRIBUTIONS [ZARc]

Ords 5c ea Ldt Pay Amt

Final No 49 27 Jul 21 2 Aug 21 60.00

Interim No 48 4 Dec 18 10 Dec 18 50.00

143