Page 140 - SHB 2021 Issue 4

P. 140

JSE – IMP Profile’s Stock Exchange Handbook: 2021 – Issue 4

POSTAL ADDRESS:POBox3013, Edenvale,1610

Imperial Logistics Ltd. EMAIL: Esha.Mansingh@imperiallogistics.com

WEBSITE: www.imperiallogistics.com

IMP

TELEPHONE: 011-372-6500

COMPANY SECRETARY: J Ravjee (Acting)

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of

FirstRand Bank Ltd. (SA))

Scan the QR code to AUDITORS: Deloitte & Touche

visit our website

BANKERS: First National Bank, Nedbank,

Standard Bank

CALENDAR Expected Status

Annual General Meeting 8 Nov 2021 Confirmed

Next Interim Results Feb 2022 Unconfirmed

ISIN: ZAE000067211 SHORT: IMPERIAL CODE: IPL

REG NO: 1946/021048/06 FOUNDED: 1946 LISTED: 1987 Next Final Results Sep 2022 Unconfirmed

NATURE OF BUSINESS: CAPITAL STRUCTURE AUTHORISED ISSUED

Imperial is an African focused provider of integrated market IPL Ords 4c ea 394 999 000 202 905 857

access and logistics solutions. With a focus on the following DISTRIBUTIONS [ZARc]

key industries - healthcare, consumer, automotive,chemicals, Ords 4c ea Ldt Pay Amt

industrial and commodities - we take our clients’ and princi- Interim No 61 16 Mar 21 23 Mar 21 83.00

pals’ products to some of the fastest growing and most chal- Interim No 60 17 Mar 20 23 Mar 20 167.00

30 Sep 19

23 Sep 19

lenging markets in the world. Ranked among the top tier Final No 59 18 Mar 19 25 Mar 19 109.00

Interim No 58

135.00

global logistics providers and listed on the JSE in South Africa,

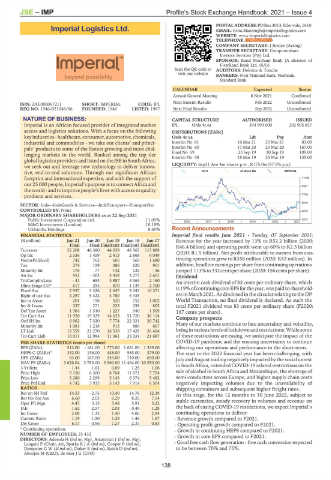

we seek out and leverage new technology to deliver innova- LIQUIDITY: Sep21 Ave 4m shares p.w., R175.0m(97.5% p.a.)

tive, end-to-end solutions. Through our significant African INDT 40 Week MA IMPERIAL

footprint and international expertise, and with the support of 11425

our 25 000 people, Imperial’s purpose is to connect Africa and 9587

the world - and to improve people’s lives with access to quality

products and services. 7748

5910

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer

CONTROLLED BY: None 4072

MAJOR ORDINARY SHAREHOLDERS as at 22 Sep 2021

Public Investment Corporation Ltd. 11.05% 2016 | 2017 | 2018 | 2019 | 2020 | 2021 2233

M&G Investments (London) 10.19%

Ukhamba Holdings 8.65% Recent Announcements

FINANCIAL STATISTICS Imperial final results June 2021 - Tuesday, 07 September 2021:

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 Revenue for the year increased by 13% to R52.2 billion (2020:

Final Final Final(rst) Final(rst) Final(rst) R46.4 billion) and operating profit went up 60% to R2.3 billion

Turnover 52 208 46 380 44 039 48 565 115 889

Op Inc 2 336 1 459 2 413 2 868 6 049 (2020: R1.5 billion). Net profit attributable to owners from con-

NetIntPd(Rcvd) 742 762 605 569 1 680 tinuing operations grew to R358 million (2020: R42 million). In

Tax 274 159 386 620 901 addition, headlineearningsper sharefromcontinuingoperations

Minority Int 176 77 142 135 - 36 jumped 113%to332centspershare(2020:156centspershare).

Att Inc 951 - 303 3 438 3 273 2 601 Dividend

TotCompIncLoss - 41 683 3 887 4 063 2 160 An interim cash dividend of 83 cents per ordinary share, which

Hline Erngs-CO* 617 295 870 1 139 2 700

Fixed Ass 2 937 3 326 2 647 3 042 10 371 is 19%ofcontinuingcoreEPSforthe year, was paid tosharehold-

Right of use Ass 4 297 5 422 4 780 5 335 - ers in March 2021. As disclosed in the circular relating to the DP

Inv in Assoc 201 198 520 752 1 002 World Transaction, no final dividend is declared. As such the

Inv & Loans 337 271 225 258 805 total F2021 dividend was 83 cents per ordinary share (F2020:

Def Tax Asset 1 384 1 510 1 227 940 1 509 167 cents per share).

Tot Curr Ass 11 920 19 529 14 633 51 720 36 114 Company prospects

Ord SH Int 6 962 7 320 7 774 22 321 20 742 Many of our markets continue to face uncertainty and volatility,

Minority Int 1 081 1 218 913 886 667

LT Liab 12 559 21 270 16 539 17 428 26 464 beinginvariouslevelsoflockdownandrestrictions. Whilesome

Tot Curr Liab 10 011 12 984 11 361 35 331 21 687 of these restrictions are easing, we anticipate the impact of the

PER SHARE STATISTICS (cents per share) COVID-19 pandemic and the ensuing uncertainty to continue

EPS (ZARc) 512.00 - 161.00 1 773.00 1 681.00 1 339.00 affecting our operations and performance in the short-term.

HEPS-C (ZARc)* 332.00 156.00 448.00 585.00 379.00 The start to the 2022 financial year has been challenging, with

DPS (ZARc) 83.00 167.00 244.00 710.00 650.00 July and August trading negativelyimpacted by the social unrest

NAV PS (ZARc) 3 626.04 3 783.00 3 960.00 11 464.00 10 550.00 in South Africa, extended COVID-19 related restrictions on the

3 Yr Beta 1.44 1.62 0.89 1.25 1.06

Price High 5 150 6 300 8 764 11 671 7 724 sale of alcohol in South Africa and Mozambique, the shortage of

Price Low 3 280 2 299 5 143 6 374 5 482 semi-conductors across Europe, and higher supply chain costs

Price Prd End 4 742 3 933 5 143 7 914 6 504 negatively impacting volumes due to the unavailability of

RATIOS shipping containers and subsequent higher freight rates.

Ret on SH Fnd 14.53 - 2.73 10.40 14.76 12.39 At this stage, for the 12 months to 30 June 2022, subject to

Ret On Tot Ass 6.60 2.03 6.29 8.25 7.54

Oper Pft Mgn 4.47 3.15 5.48 5.91 5.22 stable currencies, steady recovery in volumes and revenue on

D:E 1.62 2.57 2.03 0.49 1.28 the back of easing COVID-19 restrictions, we expect Imperial’s

Int Cover 2.08 1.33 1.40 4.06 2.84 continuing operations to deliver:

Current Ratio 1.19 1.50 1.29 1.46 1.67 - Revenue growth compared to F2021.

Div Cover 6.17 - 0.96 7.27 2.37 0.83 - Operating profit growth compared to F2021.

* Continuing operations - Growth in continuing HEPS compared to F2021.

NUMBER OF EMPLOYEES: 25 432 - Growth in core EPS compared to F2021.

DIRECTORS: Adesola H (ind ne, Nig), Anammah J (ind ne, Nig),

Langeni P (Chair, ne), SparksRJA(ind ne), Cooper P (ind ne), - Good free cash flow generation - free cash conversion expected

DempsterGW(ld ind ne), Duker B (ind ne), Reich D (ind ne), to be between 70% and 75%.

Akoojee M (CEO), de Beer J G (CFO)

138