Page 142 - SHB 2021 Issue 4

P. 142

JSE – IND Profile’s Stock Exchange Handbook: 2021 – Issue 4

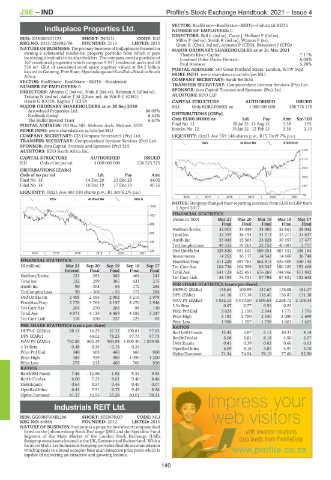

SECTOR: RealEstate—RealEstate—REITs—Industrial REITs

Indluplace Properties Ltd. NUMBER OF EMPLOYEES: 0

IND DIRECTORS: Bell L (ind ne), Carey J, Holland P (ind ne),

ISIN: ZAE000201125 SHORT: INDLU CODE: ILU Miller P (ind ne), Smith R (ind ne), Watson P (ne),

REG NO: 2013/226082/06 FOUNDED: 2013 LISTED: 2015 Grant R (Chair, ind ne), Arenson P (CEO), Beaumont J (CFO)

NATURE OF BUSINESS: The primary business of Indluplace is focused on MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

owning a substantial residential property portfolio from which it pays Thames River Capital 7.11%

increasing dividends to its shareholders. The company owns a portfolio of Lombard Odier Darier Hentsch 6.00%

167 residential properties which comprise 9 917 residential units and 20 Paul Arenson 5.28%

538 m 2 GLA of associated retail space together valued at R4.2 billion POSTAL ADDRESS: 180 Great Portland Street, London, W1W 5QZ

located in Gauteng, Free State, Mpumalanga and KwaZulu-Natal in South

Africa. MORE INFO: www.sharedata.co.za/sdo/jse/MLI

SECTOR: RealEstate—RealEstate—REITS—Residential COMPANY SECRETARY: Sarah Bellilchi

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Abrams C (ind ne), Noik S (ind ne), Rehman A (ld ind ne), SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

Tetyana N (ind ne), Adler T M (Chair, ne), de Wit P C (CEO), AUDITORS: BDO LLP

Harris G (COO), Kaplan T (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 MLI Ords EUR0.000001 ea 1 000 000 000 298 775 175

Arrowhead Properties Ltd. 56.05%

Nedbank Group 8.44% DISTRIBUTIONS [GBPp]

The Buffet Bewind Trust 6.57% Ords EUR0.000001 ea Ldt Pay Amt Scr/100

POSTAL ADDRESS: PO Box 685, Melrose Arch, Melrose, 2076 Final No 13 20 Jul 21 13 Aug 21 3.38 1.91

MORE INFO: www.sharedata.co.za/sdo/jse/ILU Interim No 12 19 Jan 21 12 Feb 21 3.38 2.10

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. LIQUIDITY: Oct21 Ave 559 148 shares p.w., R15.7m(9.7% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. REIV 40 Week MA STENPROP

AUDITORS: BDO South Africa Inc. 3700

CAPITAL STRUCTURE AUTHORISED ISSUED 3112

ILU Ords of no par val 3 000 000 000 336 523 275

2523

DISTRIBUTIONS [ZARc]

Ords of no par val Ldt Pay Amt

1935

Final No 15 14 Dec 20 21 Dec 20 44.02

Final No 14 10 Dec 19 17 Dec 19 40.76 1347

LIQUIDITY: Oct21 Ave 400 010 shares p.w., R1.3m(6.2% p.a.)

758

2016 | 2017 | 2018 | 2019 | 2020 | 2021

REIV 40 Week MA INDLU

NOTES: Stenprop changed their reporting currency from EUR to GBP from

1216 1 April 2017.

FINANCIAL STATISTICS

1021

(Amts in ‘000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

826 Final Final Final Final Final

NetRent/InvInc 32 003 33 049 33 905 32 861 28 042

630

Total Inc 32 359 36 154 41 713 33 217 31 837

Attrib Inc 53 045 15 565 23 828 39 357 17 477

435

TotCompIncLoss 49 352 19 263 22 752 40 081 2 717

240 Ord UntHs Int 425 820 391 241 389 251 387 331 426 164

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Investments 14 262 16 117 14 542 14 660 36 748

FINANCIAL STATISTICS FixedAss/Prop 511 220 387 761 562 815 535 509 550 145

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17 Tot Curr Ass 104 736 204 559 85 547 180 165 192 466

Interim Final Final Final Final Total Ass 641 124 622 451 676 269 744 966 813 842

NetRent/InvInc 121 283 362 404 243 Tot Curr Liab 38 193 74 721 57 794 87 921 122 608

Total Inc 122 299 385 431 275 PER SHARE STATISTICS (cents per share)

Attrib Inc 90 - 308 - 56 172 284

TotCompIncLoss 90 - 308 - 56 172 284 HEPS-C (ZARc) 155.64 109.99 137.67 176.06 181.07

Ord UntHs Int 2 405 2 455 2 902 3 216 2 979 DPS (ZARc) 141.18 135.38 118.46 136.87 131.38

FixedAss/Prop 3 778 3 765 4 157 4 270 2 946 NAV PS (ZARc) 3 032.15 3 070.50 2 609.64 2 268.72 2 108.34

Tot Curr Ass 204 270 203 98 110 3 Yr Beta 0.67 0.77 0.56 0.23 -

Price Prd End 3 024 2 150 2 044 1 775 1 795

Total Ass 4 071 4 123 4 469 4 582 3 247

Tot Curr Liab 118 270 227 229 65 Price High 3 192 2 700 2 330 2 080 2 699

Price Low 1 906 1 357 1 738 1 601 1 625

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 28.11 16.25 37.32 100.81 97.65 RetOnSH Funds 12.45 3.87 6.13 10.31 4.14

DPS (ZARc) - 44.02 78.25 97.75 97.75

RetOnTotAss 5.06 5.81 6.18 4.50 2.97

NAV PS (ZARc) 782.88 803.19 903.04 1 009.30 1 029.98 Debt:Equity 0.41 0.39 0.62 0.66 0.63

3 Yr Beta 0.48 0.35 - 0.15 - 0.24 - OperRetOnInv 6.09 8.18 5.87 5.97 4.78

Price Prd End 340 303 460 860 960 OpInc:Turnover 71.34 74.94 76.19 77.60 92.50

Price High 385 459 900 1 090 1 200

Price Low 275 215 400 700 910

RATIOS

RetOnSH Funds 7.46 - 12.56 - 1.92 5.34 9.54

RetOnTotAss 6.00 7.25 8.61 9.40 8.46

Debt:Equity 0.64 0.57 0.46 0.40 0.07

OperRetOnInv 6.43 7.51 8.72 9.45 8.26

OpInc:Turnover 41.27 43.95 55.28 60.01 59.33

Impress your

Industrials REIT Ltd.

IND

ISIN: GG00BFWMR296 SHORT: STENPROP CODE: MLI web visitors

REG NO: 64865 FOUNDED: 2012 LISTED: 2013

NATURE OF BUSINESS: Stenprop is a property investment company dual

listed on the Johannesburg Stock Exchange (JSE) and the Specialist Fund with investor relations

Segment of the Main Market of the London Stock Exchange (LSE).

Stenprop ownsassets located in the UK, Germany and Switzerland. With a data feeds from ProfileData

focus on Multi-Let Industrials Stenprop provides flexible accommodation

which appeals to a broad occupier base at an attractive price point which is www.profile.co.za

capable of delivering an attractive and growing income.

140