Page 135 - SHB 2021 Issue 4

P. 135

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – HUD

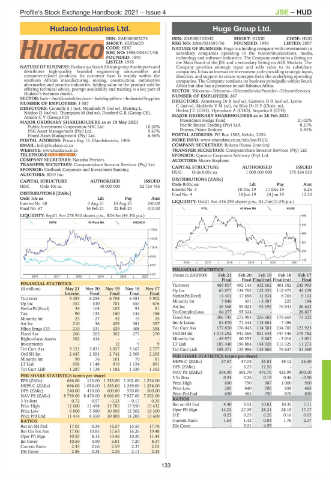

Hudaco Industries Ltd. Huge Group Ltd.

HUD HUG

ISIN: ZAE000003273 ISIN: ZAE000102042 SHORT: HUGE CODE: HUG

SHORT: HUDACO REG NO: 2006/023587/06 FOUNDED: 1993 LISTED: 2007

CODE: HDC NATURE OF BUSINESS: Huge is a holding company with investments in

REG NO: 1985/004617/06 subsidiary companies operating in the telecommunications, media,

FOUNDED: 1891 technology and software industries. The Company maintains a listing on

LISTED: 1985 the Main Board of the JSE and a secondary listing on A2X Markets. The

NATUREOF BUSINESS:HudacoisaSouthAfricangroupthatimportsand Company provides strategic input and adds value to its subsidiary

distributes high-quality branded engineering consumables and companies. It has an interactive investment style providing strategic input,

consumer-related products. Its customer base is mainly within the direction, and support to create synergies from the underlying operating

southern African manufacturing, mining, construction, automotive companies. The Company conducts its business principally within South

aftermarket and security industries. Adding value to the product sold by Africa but also has a presence in sub-Saharan Africa.

offering technical advice, prompt availability and training is a key part of SECTOR: Telecoms—Telecoms—TelecomServiceProvider—TelecomServices

Hudaco’s business model. NUMBER OF EMPLOYEES: 267

SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies

NUMBER OF EMPLOYEES: 3 587 DIRECTORS: Armstrong Dr B (ind ne), GammieDR(ind ne), Lyons

C(ind ne), MokholoVM(ne), da Silva Dr D F (Chair, ne),

DIRECTORS: ConnellySJ(ne), Mandindi N (ind ne), Meiring L, Herbst J C (CEO), Openshaw A (COO), Sequeira S (CFO)

Naidoo D (ind ne), Thompson M (ind ne), Dunford G R (Group CE),

Amoils C V (Group FD) MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

MAJOR ORDINARY SHAREHOLDERS as at 19 May 2021 Praesidium Hedge Fund 21.02%

8.21%

Pacific Breeze Trading (Pty) Ltd.

Public Investment Corporation SOC Ltd. 10.20%

PSG Asset Management (Pty) Ltd. 9.67% Peresec Prime Brokers 5.84%

Foord Asset Management (Pty) Ltd. 6.46% POSTAL ADDRESS: PO Box 1585, Kelvin, 2054

POSTAL ADDRESS: Private Bag 13, Elandsfontein, 1406 MORE INFO: www.sharedata.co.za/sdo/jse/HUG

EMAIL: info@hudaco.co.za COMPANY SECRETARY: Rokeya Hansa (interim)

WEBSITE: www.hudaco.co.za TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

TELEPHONE: 011-657-5000 SPONSOR: Questco Corporate Advisory (Pty) Ltd.

COMPANY SECRETARY: Natasha Petrides AUDITORS: Moore Stephens

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: Nedbank Corporate and Investment Banking HUG Ords 0.01c ea 1 000 000 000 175 324 030

AUDITORS: BDO Inc.

DISTRIBUTIONS [ZARc]

CAPITAL STRUCTURE AUTHORISED ISSUED

HDC Ords 10c ea 40 000 000 32 724 785 Ords 0.01c ea Ldt Pay Amt

Interim No 5 10 Dec 19 17 Dec 19 6.25

DISTRIBUTIONS [ZARc] Final No 4 18 Jun 19 24 Jun 19 12.50

Ords 10c ea Ldt Pay Amt

Interim No 68 3 Aug 21 10 Aug 21 240.00 LIQUIDITY: Oct21 Ave 346 299 shares p.w., R1.7m(10.3% p.a.)

Final No 67 16 Feb 21 22 Feb 21 410.00 FTEL 40 Week MA HUGE

LIQUIDITY: Sep21 Ave 278 930 shares p.w., R24.4m(44.3% p.a.) 995

SUPS 40 Week MA HUDACO

830

17000

666

14439

501

11879

337

9318

172

2016 | 2017 | 2018 | 2019 | 2020 | 2021

6757

FINANCIAL STATISTICS

4197 (Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Final Final Final(rst) Final(rst) Final

FINANCIAL STATISTICS Turnover 469 857 492 145 432 662 401 382 245 993

(R million) May 21 Nov 20 Nov 19 Nov 18 Nov 17 Op Inc 65 877 134 782 122 035 112 975 42 239

Interim Final Final Final Final

Turnover 3 383 6 254 6 704 6 381 5 902 NetIntPd(Rcvd) 14 401 17 856 11 834 6 704 5 103

Minority Int

3 846

301

223

184

- 3 087

Op Inc 357 510 701 655 676

NetIntPd(Rcvd) 34 104 103 91 81 Att Inc 38 568 95 023 93 592 76 841 26 623

Tax 90 133 160 144 156 TotCompIncLoss 64 277 95 324 - - 26 807

Minority Int 23 - 27 42 19 25 Fixed Ass 306 745 272 983 226 682 178 669 73 222

Att Inc 210 36 429 381 397 Inv & Loans 84 870 71 444 115 861 7 496 -

Hline Erngs-CO 210 331 429 408 398 Tot Curr Ass 177 850 176 045 114 581 134 783 121 923

Fixed Ass 266 265 302 277 270 Ord SH Int 1 014 292 941 366 831 644 747 546 379 782

Right-of-use Assets 362 414 - - - Minority Int - 49 971 60 253 5 667 - 3 016 - 3 001

Investments - - 12 9 9 LT Liab 185 440 196 884 144 928 115 325 11 273

Tot Curr Ass 3 121 3 031 3 057 3 167 2 777 Tot Curr Liab 108 371 123 996 135 865 76 637 51 360

Ord SH Int 2 647 2 593 2 742 2 509 2 295 PER SHARE STATISTICS (cents per share)

Minority Int 90 76 101 70 81 HEPS-C (ZARc) 27.67 57.03 55.81 49.12 26.30

LT Liab 958 1 148 919 1 124 891 DPS (ZARc) - 6.25 12.50 - -

Tot Curr Liab 1 287 1 138 1 182 1 339 1 353

NAV PS (ZARc) 594.90 501.70 476.76 423.99 300.10

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.24 0.26 0.19 0.46 - 0.50

EPS (ZARc) 686.00 113.00 1 355.00 1 202.00 1 254.00 Price High 690 790 987 1 000 900

HEPS-C (ZARc) 686.00 1 050.00 1 355.00 1 289.00 1 256.00

DPS (ZARc) 240.00 410.00 600.00 570.00 560.00 Price Low 285 440 700 658 485

850

485

870

790

690

Price Prd End

NAV PS (ZARc) 8 739.00 8 470.00 8 666.00 7 927.00 7 252.00

3 Yr Beta 0.72 0.57 - 0.23 - 0.17 0.35 RATIOS

Price High 12 600 11 498 15 785 17 850 15 432 Ret on SH Fnd 4.40 9.52 10.81 10.35 7.11

Price Low 6 800 5 580 10 006 12 302 10 300 Oper Pft Mgn 14.02 27.39 28.21 28.15 17.17

Price Prd End 11 414 8 550 10 808 14 200 13 600 D:E 0.25 0.25 0.26 0.16 0.05

RATIOS Current Ratio 1.64 1.42 0.84 1.76 2.37

Ret on SH Fnd 17.03 0.34 16.57 15.55 17.76 Div Cover - 9.21 4.55 - -

Ret On Tot Ass 17.06 10.85 17.63 16.26 19.48

Oper Pft Mgn 10.55 8.15 10.46 10.26 11.45

Int Cover 10.50 4.90 6.81 7.20 8.37

Current Ratio 2.43 2.66 2.59 2.37 2.05

Div Cover 2.86 0.28 2.26 2.11 2.24

133