Page 131 - SHB 2021 Issue 4

P. 131

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – HAM

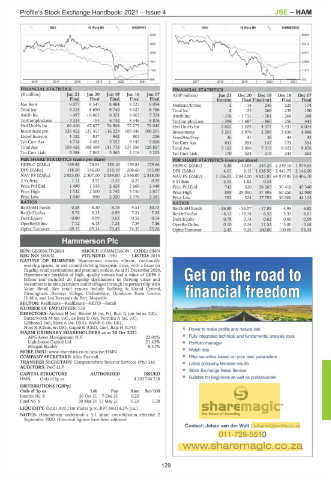

REIV 40 Week MA GROWPNT REIV 40 Week MA HAMMERSON

3090 56504

2594 45272

2098 34041

1601 22809

1105 11577

609 345

2016 | 2017 | 2018 | 2019 | 2020 | 2021 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17 (GBP million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

Final Final Final Final Final Interim Final Final(rst) Final Final

Net Rent 9 077 8 547 8 484 8 123 8 094 NetRent/InvInc 2 14 246 225 174

Total Inc 9 215 8 650 9 740 9 027 8 786 Total Inc 8 23 268 239 190

Attrib Inc - 497 - 6 865 6 321 6 663 7 524 Attrib Inc - 376 - 1 735 - 781 - 268 388

TotCompIncLoss - 3 314 194 6 742 8 146 6 876 TotCompIncLoss - 396 - 1 687 - 860 - 256 445

Ord UntHs Int 66 410 67 877 74 908 75 273 72 045 Ord UntHs Int 2 802 3 209 4 377 5 433 6 024

Investment pro 126 452 137 457 116 229 109 046 108 201 Investments 3 201 3 976 2 099 3 830 4 686

Listed Investm 1 122 837 942 801 226 FixedAss/Prop 36 41 38 44 42

Tot Curr Ass 4 718 4 482 5 552 9 145 5 068 Tot Curr Ass 631 553 147 173 354

Total Ass 154 455 168 499 141 778 137 356 126 857 Total Ass 5 162 5 906 7 315 8 922 9 876

Tot Curr Liab 5 388 7 862 3 363 3 118 3 203 Tot Curr Liab 170 324 219 244 263

PER SHARE STATISTICS (cents per share) PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 169.98 79.93 158.10 159.84 179.66 HEPS-C (ZARc) 5.26 12.65 245.25 2 249.10 1 979.65

DPS (ZARc) 118.50 146.00 218.10 208.60 195.80 DPS (ZARc) 4.01 8.12 1 038.50 2 441.75 2 146.20

NAV PS (ZARc) 2 023.00 2 307.00 2 539.00 2 556.00 2 518.00 NAV PS (ZARc) 1 136.03 2 843.20 4 825.87 64 979.85 63 406.70

3 Yr Beta 1.11 0.92 0.35 0.25 0.35 3 Yr Beta 2.04 1.82 0.34 - -

Price Prd End 1 490 1 335 2 428 2 669 2 448 Price Prd End 742 520 28 265 30 410 45 340

Price High 1 532 2 500 2 742 3 150 2 817 Price High 899 29 090 37 495 50 250 52 980

Price Low 1 040 950 2 220 2 376 2 361 Price Low 392 324 17 795 30 000 44 105

RATIOS RATIOS

RetOnSH Funds 0.58 - 8.30 8.78 9.51 10.73 RetOnSH Funds - 26.80 - 54.07 - 17.85 - 4.94 6.82

RetOnTotAss 5.72 5.15 6.99 7.21 7.35 RetOnTotAss - 6.13 - 18.78 6.52 3.33 6.01

Debt:Equity 0.80 0.89 0.62 0.58 0.54 Debt:Equity 0.78 0.78 0.62 0.60 0.59

OperRetOnInv 7.12 6.18 7.24 7.39 7.46 OperRetOnInv 0.10 0.34 11.53 5.80 3.68

OpInc:Turnover 69.15 69.14 73.43 74.35 75.26 OpInc:Turnover 2.45 9.26 100.00 100.00 54.34

Hammerson Plc

HAM

ISIN: GB00BK7YQK64 SHORT: HAMMERSON CODE: HMN

REG NO: 360632 FOUNDED: 1940 LISTED: 2016

NATURE OF BUSINESS: Hammerson creates vibrant, continually

evolving spaces, in and around thriving European cities, with a focus on

flagship retail destinations and premium outlets. As at 31 December 2020,

Hammerson's portfolio of high- quality venues had a value of GBP6.3

billion and included 20 flagship destinations in thriving cities and

investments in nine premium outlet villages through its partnership with

Value Retail. Key retail venues include Bullring & Grand Central,

Birmingham, Bicester Village, Oxfordshire, Dundrum Town Centre,

Dublin, and Les Terrasses du Port, Marseille.

SECTOR: RealEstate—RealEstate—REITS—Retail

NUMBER OF EMPLOYEES: 538

DIRECTORS: Annous H (ne), Brunel M (ne, Fr), Burr G (snr ind ne, UK),

Butterworth M (ne, UK), de Beer D (ne), Formica A (ne, UK),

Gibbons J (ne), Metz A (ne, USA), Welch C (ne, UK),

Noel R (Chair, ne, UK), Gagné R (CEO, Can), Raja H (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 20 Oct 2021

APG Asset Management N.V. 22.00%

Lighthouse Capital Ltd. 21.43%

Morgan Stanley 8.41%

MORE INFO: www.sharedata.co.za/sdo/jse/HMN

COMPANY SECRETARY: Alice Darwall

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

AUDITORS: PwC LLP

CAPITAL STRUCTURE AUTHORISED ISSUED

HMN Ords of 5p ea - 4 203 744 238

DISTRIBUTIONS [GBPp]

Ords of 5p ea Ldt Pay Amt Scr/100

Interim No 9 26 Oct 21 7 Dec 21 0.20 -

Final No 8 30 Mar 21 13 May 21 0.20 5.28

LIQUIDITY: Oct21 Ave 11m shares p.w., R97.8m(14.2% p.a.)

NOTES: Hammerson undertook a 5:1 share consolidation effective 2

September 2020. Historical figures have been adjusted.

129