Page 130 - SHB 2021 Issue 4

P. 130

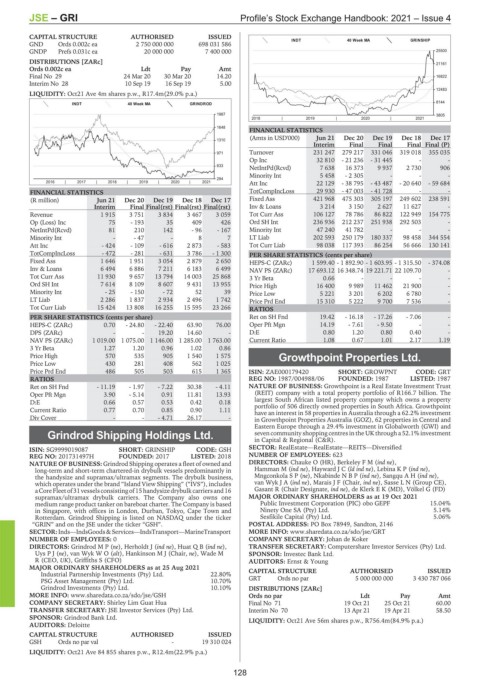

JSE – GRI Profile’s Stock Exchange Handbook: 2021 – Issue 4

CAPITAL STRUCTURE AUTHORISED ISSUED

GND Ords 0.002c ea 2 750 000 000 698 031 586 INDT 40 Week MA GRINSHIP

GNDP Prefs 0.031c ea 20 000 000 7 400 000 25500

DISTRIBUTIONS [ZARc] 21161

Ords 0.002c ea Ldt Pay Amt

Final No 29 24 Mar 20 30 Mar 20 14.20 16822

Interim No 28 10 Sep 19 16 Sep 19 5.00

12483

LIQUIDITY: Oct21 Ave 4m shares p.w., R17.4m(29.0% p.a.)

8144

INDT 40 Week MA GRINDROD

1987 3805

2018 | 2019 | 2020 | 2021

1648

FINANCIAL STATISTICS

(Amts in USD'000) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17

1310

Interim Final Final Final Final (P)

971 Turnover 231 247 279 217 331 046 319 018 355 035

Op Inc 32 810 - 21 236 - 31 445 - -

633

NetIntPd(Rcvd) 7 638 16 373 9 937 2 730 906

Minority Int 5 458 - 2 305 - - -

294

2016 | 2017 | 2018 | 2019 | 2020 | 2021 Att Inc 22 129 - 38 795 - 43 487 - 20 640 - 59 684

FINANCIAL STATISTICS TotCompIncLoss 29 930 - 47 003 - 41 728 - -

(R million) Jun 21 Dec 20 Dec 19 Dec 18 Dec 17 Fixed Ass 421 968 475 303 305 197 249 602 238 591

Interim Final Final(rst) Final(rst) Final(rst) Inv & Loans 3 214 3 150 2 627 11 627 -

Revenue 1 915 3 751 3 834 3 467 3 059 Tot Curr Ass 106 127 78 786 86 822 122 949 154 775

Op (Loss) Inc 75 - 193 35 409 426 Ord SH Int 236 936 212 237 251 938 292 503 -

NetIntPd(Rcvd) 81 210 142 - 96 - 167 Minority Int 47 240 41 782 - - -

Minority Int - - 47 - 8 7 LT Liab 202 593 250 179 180 337 98 458 344 554

Att Inc - 424 - 109 - 616 2 873 - 583 Tot Curr Liab 98 038 117 393 86 254 56 666 130 141

TotCompIncLoss - 472 - 281 - 631 3 786 - 1 300 PER SHARE STATISTICS (cents per share)

Fixed Ass 1 646 1 951 3 054 2 879 2 650 HEPS-C (ZARc) 1 599.40 - 1 892.90 - 1 603.95 - 1 315.50 - 374.08

Inv & Loans 6 494 6 886 7 211 6 183 6 499 NAV PS (ZARc) 17 693.12 16 348.74 19 221.71 22 109.70 -

Tot Curr Ass 11 930 9 657 13 794 14 003 25 868 3 Yr Beta 0.66 - - - -

Ord SH Int 7 614 8 109 8 607 9 431 13 955 Price High 16 400 9 989 11 462 21 900 -

Minority Int - 25 - 150 - 72 52 39 Price Low 5 221 3 201 6 202 6 780 -

LT Liab 2 286 1 837 2 934 2 496 1 742 Price Prd End 15 310 5 222 9 700 7 536 -

Tot Curr Liab 15 424 13 808 16 255 15 595 23 266 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fnd 19.42 - 16.18 - 17.26 - 7.06 -

HEPS-C (ZARc) 0.70 - 24.80 - 22.40 63.90 76.00 Oper Pft Mgn 14.19 - 7.61 - 9.50 - -

DPS (ZARc) - - 19.20 14.60 - D:E 0.80 1.20 0.80 0.40 -

NAV PS (ZARc) 1 019.00 1 075.00 1 146.00 1 285.00 1 763.00 Current Ratio 1.08 0.67 1.01 2.17 1.19

3 Yr Beta 1.27 1.20 0.96 1.02 0.86

Price High 570 535 905 1 540 1 575 Growthpoint Properties Ltd.

Price Low 430 281 408 562 1 025

GRO

Price Prd End 486 505 503 615 1 365 ISIN: ZAE000179420 SHORT: GROWPNT CODE: GRT

RATIOS REG NO: 1987/004988/06 FOUNDED: 1987 LISTED: 1987

Ret on SH Fnd - 11.19 - 1.97 - 7.22 30.38 - 4.11 NATURE OF BUSINESS: Growthpoint is a Real Estate Investment Trust

Oper Pft Mgn 3.90 - 5.14 0.91 11.81 13.93 (REIT) company with a total property portfolio of R166.7 billion. The

D:E 0.66 0.57 0.53 0.42 0.18 largest South African listed property company which owns a property

Current Ratio 0.77 0.70 0.85 0.90 1.11 portfolio of 506 directly owned properties in South Africa. Growthpoint

have an interest in 58 properties in Australia through a 62.2% investment

Div Cover - - - 4.71 26.17 - in Growthpoint Properties Australia (GOZ), 62 properties in Central and

Eastern Europe through a 29.4% investment in Globalworth (GWI) and

Grindrod Shipping Holdings Ltd. seven community shopping centres in the UK through a 52.1% investment

in Capital & Regional (C&R).

GRI

ISIN: SG9999019087 SHORT: GRINSHIP CODE: GSH SECTOR: RealEstate—RealEstate—REITS—Diversified

REG NO: 201731497H FOUNDED: 2017 LISTED: 2018 NUMBER OF EMPLOYEES: 623

NATURE OF BUSINESS: Grindrod Shipping operates a fleet of owned and DIRECTORS: Chauke O (HR), BerkeleyFM(ind ne),

long-term and short-term chartered-in drybulk vessels predominantly in Hamman M (ind ne), HaywardJC(ld ind ne), LebinaKP(ind ne),

the handysize and supramax/ultramax segments. The drybulk business, MngconkolaSP(ne), NkabindeNBP(ind ne), SangquAH(ind ne),

which operates under the brand “Island View Shipping” (“IVS”), includes van WykJA(ind ne), Marais J F (Chair, ind ne), Sasse L N (Group CE),

aCoreFleetof31vesselsconsistingof15handysizedrybulk carriersand16 Gasant R (Chair Designate, ind ne), de Klerk E K (MD), Völkel G (FD)

supramax/ultramax drybulk carriers. The Company also owns one MAJOR ORDINARY SHAREHOLDERS as at 19 Oct 2021

medium range product tanker on bareboat charter. The Company is based Public Investment Corporation (PIC) obo GEPF 15.04%

in Singapore, with offices in London, Durban, Tokyo, Cape Town and Ninety One SA (Pty) Ltd. 5.14%

Rotterdam. Grindrod Shipping is listed on NASDAQ under the ticker Sesfikile Capital (Pty) Ltd. 5.06%

“GRIN” and on the JSE under the ticker “GSH”. POSTAL ADDRESS: PO Box 78949, Sandton, 2146

SECTOR:Inds—IndsGoods&Services—IndsTransport—MarineTransport MORE INFO: www.sharedata.co.za/sdo/jse/GRT

NUMBER OF EMPLOYEES: 0 COMPANY SECRETARY: Johan de Koker

DIRECTORS: GrindrodMP(ne), Herholdt J (ind ne), HuatQB(ind ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

UysPJ(ne), van WykWO(alt), Hankinson M J (Chair, ne), Wade M SPONSOR: Investec Bank Ltd.

R (CEO, UK), Griffiths S (CFO) AUDITORS: Ernst & Young

MAJOR ORDINARY SHAREHOLDERS as at 25 Aug 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Industrial Partnership Investments (Pty) Ltd. 22.80%

PSG Asset Management (Pty) Ltd. 10.70% GRT Ords no par 5 000 000 000 3 430 787 066

Grindrod Investments (Pty) Ltd. 10.10% DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/GSH Ords no par Ldt Pay Amt

COMPANY SECRETARY: Shirley Lim Guat Hua Final No 71 19 Oct 21 25 Oct 21 60.00

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Interim No 70 13 Apr 21 19 Apr 21 58.50

SPONSOR: Grindrod Bank Ltd. LIQUIDITY: Oct21 Ave 56m shares p.w., R756.4m(84.9% p.a.)

AUDITORS: Deloitte

CAPITAL STRUCTURE AUTHORISED ISSUED

GSH Ords no par val - 19 310 024

LIQUIDITY: Oct21 Ave 84 855 shares p.w., R12.4m(22.9% p.a.)

128