Page 109 - SHB 2021 Issue 4

P. 109

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – CRO

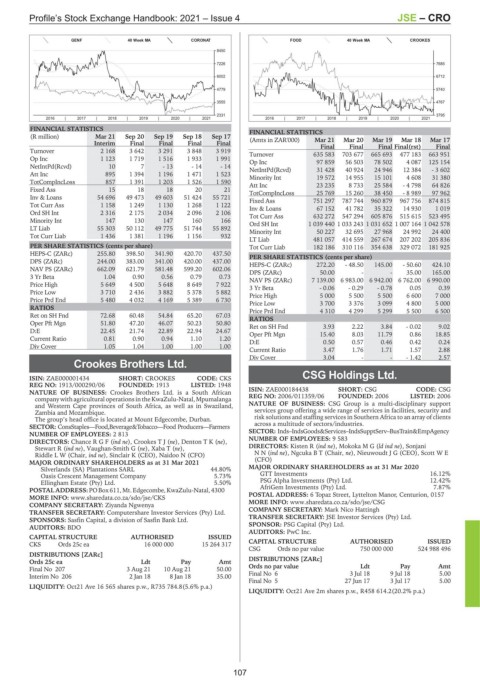

GENF 40 Week MA CORONAT FOOD 40 Week MA CROOKES

8450

7226 7685

6002 6712

4779 5740

3555 4767

2331 3795

2016 | 2017 | 2018 | 2019 | 2020 | 2021 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17 (Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final Final Final Final Final Final Final(rst) Final

Turnover 2 168 3 642 3 291 3 848 3 919 Turnover 635 583 703 677 665 693 477 183 663 951

Op Inc 1 123 1 719 1 516 1 933 1 991 Op Inc 97 859 56 503 78 502 4 087 125 154

NetIntPd(Rcvd) 10 7 - 13 - 14 - 14 NetIntPd(Rcvd) 31 428 40 924 24 946 12 384 - 3 602

Att Inc 895 1 394 1 196 1 471 1 523 Minority Int 19 572 14 955 15 101 4 608 31 380

TotCompIncLoss 857 1 391 1 203 1 526 1 590 Att Inc 23 235 8 733 25 584 - 4 798 64 826

Fixed Ass 15 18 18 20 21 TotCompIncLoss 25 769 15 260 38 450 - 8 989 97 962

Inv & Loans 54 696 49 473 49 603 51 424 55 721 Fixed Ass 751 297 787 744 960 879 967 756 874 815

Tot Curr Ass 1 158 1 249 1 130 1 268 1 122 Inv & Loans 67 152 41 782 35 322 14 930 1 019

Ord SH Int 2 316 2 175 2 034 2 096 2 106 Tot Curr Ass 632 272 547 294 605 876 515 615 523 495

Minority Int 147 130 147 160 166 Ord SH Int 1 039 440 1 033 243 1 031 652 1 007 164 1 042 578

LT Liab 55 303 50 112 49 775 51 744 55 892 Minority Int 50 227 32 695 27 968 24 992 24 400

Tot Curr Liab 1 436 1 381 1 196 1 156 932

LT Liab 481 057 414 559 267 674 207 202 205 836

PER SHARE STATISTICS (cents per share) Tot Curr Liab 182 186 310 116 354 638 329 072 181 925

HEPS-C (ZARc) 255.80 398.50 341.90 420.70 437.50

PER SHARE STATISTICS (cents per share)

DPS (ZARc) 244.00 383.00 341.00 420.00 437.00 HEPS-C (ZARc) 272.20 - 48.50 145.00 - 50.60 424.10

NAV PS (ZARc) 662.09 621.79 581.48 599.20 602.06 DPS (ZARc) 50.00 - - 35.00 165.00

3 Yr Beta 1.04 0.90 0.56 0.79 0.73 NAV PS (ZARc) 7 139.00 6 983.00 6 942.00 6 762.00 6 990.00

Price High 5 649 4 500 5 648 8 649 7 922 3 Yr Beta - 0.06 - 0.29 - 0.78 0.05 0.39

Price Low 3 710 2 436 3 882 5 378 5 882 Price High 5 000 5 500 5 500 6 600 7 000

Price Prd End 5 480 4 032 4 169 5 389 6 730 Price Low 3 700 3 376 3 099 4 800 5 000

RATIOS Price Prd End 4 310 4 299 5 299 5 500 6 500

Ret on SH Fnd 72.68 60.48 54.84 65.20 67.03 RATIOS

Oper Pft Mgn 51.80 47.20 46.07 50.23 50.80 Ret on SH Fnd 3.93 2.22 3.84 - 0.02 9.02

D:E 22.45 21.74 22.89 22.94 24.67 Oper Pft Mgn 15.40 8.03 11.79 0.86 18.85

Current Ratio 0.81 0.90 0.94 1.10 1.20 D:E 0.50 0.57 0.46 0.42 0.24

Div Cover 1.05 1.04 1.00 1.00 1.00

Current Ratio 3.47 1.76 1.71 1.57 2.88

Div Cover 3.04 - - - 1.42 2.57

Crookes Brothers Ltd.

CRO CSG Holdings Ltd.

ISIN: ZAE000001434 SHORT: CROOKES CODE: CKS

REG NO: 1913/000290/06 FOUNDED: 1913 LISTED: 1948 CSG

NATURE OF BUSINESS: Crookes Brothers Ltd. is a South African ISIN: ZAE000184438 SHORT: CSG CODE: CSG

company with agricultural operationsin the KwaZulu-Natal,Mpumalanga REG NO: 2006/011359/06 FOUNDED: 2006 LISTED: 2006

and Western Cape provinces of South Africa, as well as in Swaziland, NATURE OF BUSINESS: CSG Group is a multi-disciplinary support

Zambia and Mozambique. services group offering a wide range of services in facilities, security and

The group’s head office is located at Mount Edgecombe, Durban. risk solutions and staffing services in Southern Africa to an array of clients

SECTOR: ConsStaples—Food,Beverage&Tobacco—Food Producers—Farmers across a multitude of sectors/industries.

NUMBER OF EMPLOYEES: 2 813 SECTOR: Inds–IndsGoods&Services–IndsSupptServ–BusTrain&EmpAgency

DIRECTORS: ChanceRGF(ind ne), CrookesTJ(ne), DentonTK(ne), NUMBER OF EMPLOYEES: 9 583

Stewart R (ind ne), Vaughan-Smith G (ne), Xaba T (ne), DIRECTORS: Kisten R (ind ne), MokokaMG(ld ind ne), Sonjani

Riddle L W (Chair, ind ne), Sinclair K (CEO), Naidoo N (CFO) NN(ind ne), Ngcuka B T (Chair, ne), Nieuwoudt J G (CEO), Scott W E

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021 (CFO)

Silverlands (SA) Plantations SARL 44.80% MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Oasis Crescent Management Company 5.73% GTT Investments 16.12%

Ellingham Estate (Pty) Ltd. 5.50% PSG Alpha Investments (Pty) Ltd. 12.42%

POSTAL ADDRESS:POBox611, Mt.Edgecombe, KwaZulu-Natal,4300 AfriGem Investments (Pty) Ltd. 7.87%

MORE INFO: www.sharedata.co.za/sdo/jse/CKS POSTAL ADDRESS: 6 Topaz Street, Lyttelton Manor, Centurion, 0157

COMPANY SECRETARY: Ziyanda Ngwenya MORE INFO: www.sharedata.co.za/sdo/jse/CSG

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. COMPANY SECRETARY: Mark Nico Hattingh

SPONSORS: Sasfin Capital, a division of Sasfin Bank Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

AUDITORS: BDO SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

CKS Ords 25c ea 16 000 000 15 264 317 CAPITAL STRUCTURE AUTHORISED ISSUED

CSG Ords no par value 750 000 000 524 988 496

DISTRIBUTIONS [ZARc]

Ords 25c ea Ldt Pay Amt DISTRIBUTIONS [ZARc]

Final No 207 3 Aug 21 10 Aug 21 50.00 Ords no par value Ldt Pay Amt

Interim No 206 2 Jan 18 8 Jan 18 35.00 Final No 6 3 Jul 18 9 Jul 18 5.00

Final No 5 27 Jun 17 3 Jul 17 5.00

LIQUIDITY: Oct21 Ave 16 565 shares p.w., R735 784.8(5.6% p.a.)

LIQUIDITY: Oct21 Ave 2m shares p.w., R458 614.2(20.2% p.a.)

107