Page 113 - SHB 2021 Issue 4

P. 113

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – DIS

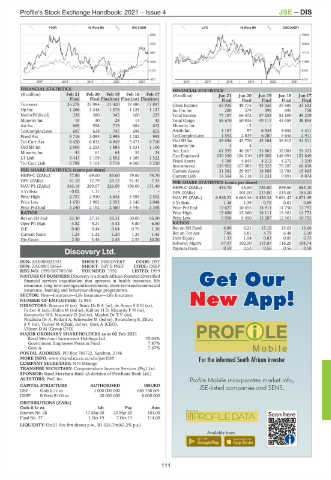

FOOR 40 Week MA DIS-CHEM LIFE 40 Week MA DISCOVERY

3800 19000

3375 16555

2951 14110

2526 11665

2102 9220

1677 6775

2017 | 2018 | 2019 | 2020 | 2021 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS FINANCIAL STATISTICS

(R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 (R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final(rst) Final(rst) Final(rst) Final Final Final Final Final

Turnover 26 278 23 984 21 420 19 480 17 897 Gross Income 55 935 49 775 43 036 36 685 33 533

Op Inc 1 266 1 248 1 376 1 125 1 127 Inc Fm Inv 280 379 398 895 758

NetIntPd(Rcvd) 328 380 345 160 225 Total Income 77 187 64 472 57 253 52 800 45 209

Minority Int 19 30 28 14 43 Total Outgo 58 670 50 935 49 117 43 059 38 894

Att Inc 669 598 719 684 612 Minority Int - - 2 - - -

TotCompIncLoss 687 628 747 698 655 Attrib Inc 3 157 97 6 533 5 652 4 411

Fixed Ass 3 716 3 095 2 995 1 182 995 TotCompIncLoss 1 592 2 839 6 280 6 656 2 911

Tot Curr Ass 8 420 6 832 6 849 5 471 4 710 Ord SH Int 45 636 43 770 42 304 36 815 31 511

Ord SH Int 2 909 2 253 1 886 1 631 1 106 Minority Int 4 4 - - -

Minority Int 43 61 64 55 24 Act. Liab 61 595 46 267 35 865 32 084 24 373

LT Liab 3 447 3 109 2 852 1 389 1 522 Cap Employed 230 330 194 210 169 002 148 091 122 849

4 643

4 188

1 210

4 272

4 212

Fixed Assets

Tot Curr Liab 6 789 5 163 5 719 4 060 3 250

Investments 139 902 107 085 92 523 79 287 66 638

PER SHARE STATISTICS (cents per share) Current Assets 31 382 29 927 18 868 18 783 15 865

HEPS-C (ZARc) 77.80 69.60 83.60 79.60 74.70 Current Liab 16 364 16 118 11 231 9 891 8 074

DPS (ZARc) 31.10 12.79 34.17 31.47 7.35 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 343.18 269.07 226.69 196.00 131.40 HEPS-C (ZARc) 454.70 45.00 789.00 899.60 683.10

3 Yr Beta - 0.02 1.11 - - - DPS (ZARc) - 101.00 215.00 215.00 186.00

Price High 2 757 2 930 3 844 3 995 2 592 NAV PS (ZARc) 6 948.23 6 666.16 6 426.34 5 691.47 4 871.49

Price Low 1 650 1 982 2 353 2 140 2 048 3 Yr Beta 1.48 1.39 0.79 0.81 0.69

Price Prd End 2 240 2 162 2 580 3 445 2 398 Price Prd End 12 627 10 455 14 911 14 750 12 792

RATIOS Price High 15 880 15 360 18 111 19 361 13 773

Ret on SH Fnd 23.30 27.15 38.31 50.00 66.90 Price Low 9 956 5 450 13 287 12 561 10 792

Oper Pft Mgn 4.82 5.21 6.42 5.80 6.50 RATIOS

D:E 0.40 0.44 0.64 0.76 1.10 Ret on SH Fund 6.80 0.21 15.16 15.03 13.66

Current Ratio 1.24 1.32 1.20 1.35 1.45 Ret on Tot Ass 7.86 6.81 4.79 6.48 5.10

Div Cover 2.50 5.44 2.45 2.53 10.20 Debt:Equity 1.33 1.04 0.83 0.85 0.75

Solvency Mgn% 97.97 102.50 115.07 116.29 108.74

Payouts:Prem 0.59 0.53 0.56 0.56 0.58

Discovery Ltd.

DIS

ISIN: ZAE000022331 SHORT: DISCOVERY CODE: DSY

ISIN: ZAE000158564 SHORT: DSY B PREF CODE: DSBP

REG NO: 1999/007789/06 FOUNDED: 1992 LISTED: 1999

NATURE OF BUSINESS: Discovery is a South African-founded diversified

financial services organisation that operates in health insurance, life

insurance,long-termsavingsandinvestments,short-termandcommercial

insurance, banking and behaviour-change programmes.

SECTOR: Fins—Insurance—Life Insurance—Life Insurance

NUMBER OF EMPLOYEES: 12 980

DIRECTORS: Bosman H (ne), Brink DrBA(ne), de BruynSEN(ne),

Farber R (ne), Hlahla M (ind ne), Kallner H D, KhanyileFN(ne),

Koopowitz N S, Macready D (ind ne), Maphai DrTV(ne),

Ntsaluba Dr A, Pollard A, Schreuder M (ind ne), Swartzberg B, Zilwa

SV(ne), Tucker M (Chair, ind ne), Gore A (CEO),

Viljoen D M (Group CFO)

MAJOR ORDINARY SHAREHOLDERS as at 02 Feb 2021

Rand Merchant Investment Holdings Ltd. 25.04%

Government Employees Pension Fund 7.87%

Gore A 7.67%

POSTAL ADDRESS: PO Box 786722, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/DSY

COMPANY SECRETARY: N N Mbongo

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

DSY Ords 0.1c ea 1 000 000 000 665 768 601

DSBP B Prefs R100 ea 20 000 000 8 000 000

DISTRIBUTIONS [ZARc]

Ords 0.1c ea Ldt Pay Amt

Interim No 28 17 Mar 20 23 Mar 20 101.00

Final No 27 1 Oct 19 7 Oct 19 114.00

LIQUIDITY: Oct21 Ave 8m shares p.w., R1 026.7m(62.2% p.a.)

111