Page 111 - SHB 2021 Issue 4

P. 111

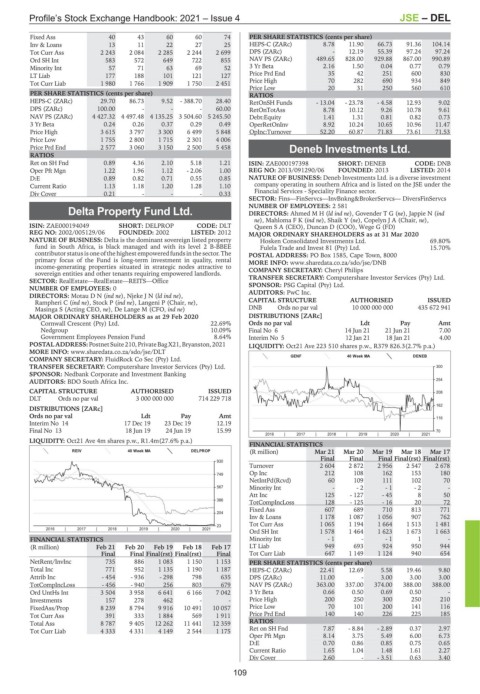

Profile’s Stock Exchange Handbook: 2021 – Issue 4 JSE – DEL

Fixed Ass 40 43 60 60 74 PER SHARE STATISTICS (cents per share)

Inv & Loans 13 11 22 27 25 HEPS-C (ZARc) 8.78 11.90 66.73 91.36 104.14

Tot Curr Ass 2 243 2 084 2 285 2 244 2 699 DPS (ZARc) - 12.19 55.39 97.24 97.24

Ord SH Int 583 572 649 722 855 NAV PS (ZARc) 489.65 828.00 929.88 867.00 990.89

Minority Int 57 71 63 69 52 3 Yr Beta 2.16 1.50 0.04 0.77 0.79

LT Liab 177 188 101 121 127 Price Prd End 35 42 251 600 830

Tot Curr Liab 1 980 1 766 1 909 1 750 2 451 Price High 70 282 690 934 849

Price Low 20 31 250 560 610

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 29.70 86.73 9.52 - 388.70 28.40 RetOnSH Funds - 13.04 - 23.78 - 4.58 12.93 9.02

DPS (ZARc) 100.00 - - - 60.00 RetOnTotAss 8.78 10.12 9.26 10.78 9.61

NAV PS (ZARc) 4 427.32 4 497.48 4 135.25 3 504.60 5 245.50 Debt:Equity 1.41 1.31 0.81 0.82 0.73

3 Yr Beta 0.24 0.26 0.37 0.29 0.49 OperRetOnInv 8.92 10.24 10.65 10.96 11.47

Price High 3 615 3 797 3 300 6 499 5 848 OpInc:Turnover 52.20 60.87 71.83 73.61 71.53

Price Low 1 755 2 800 1 715 2 301 4 006

Price Prd End 2 577 3 060 3 150 2 500 5 458 Deneb Investments Ltd.

RATIOS

DEN

Ret on SH Fnd 0.89 4.36 2.10 5.18 1.21 ISIN: ZAE000197398 SHORT: DENEB CODE: DNB

Oper Pft Mgn 1.22 1.96 1.12 - 2.06 1.00 REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014

D:E 0.89 0.82 0.71 0.55 0.85 NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment

Current Ratio 1.13 1.18 1.20 1.28 1.10 company operating in southern Africa and is listed on the JSE under the

Div Cover 0.21 - - - 0.33 Financial Services - Speciality Finance sector.

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs

NUMBER OF EMPLOYEES: 2 581

Delta Property Fund Ltd. DIRECTORS: AhmedMH(ld ind ne), GovenderTG(ne), Jappie N (ind

ne), MahlomaFK(ind ne), Shaik Y (ne), Copelyn J A (Chair, ne),

DEL

ISIN: ZAE000194049 SHORT: DELPROP CODE: DLT Queen S A (CEO), Duncan D (COO), Wege G (FD)

REG NO: 2002/005129/06 FOUNDED: 2002 LISTED: 2012 MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

NATURE OF BUSINESS: Delta is the dominant sovereign listed property Hosken Consolidated Investments Ltd. 69.80%

fund in South Africa, is black managed and with its level 2 B-BBEE Fulela Trade and Invest 81 (Pty) Ltd. 15.70%

contributor statusis one of the highest empowered fundsin the sector. The POSTAL ADDRESS: PO Box 1585, Cape Town, 8000

primary focus of the Fund is long-term investment in quality, rental MORE INFO: www.sharedata.co.za/sdo/jse/DNB

income-generating properties situated in strategic nodes attractive to COMPANY SECRETARY: Cheryl Philips

sovereign entities and other tenants requiring empowered landlords.

SECTOR: RealEstate—RealEstate—REITS—Office TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 SPONSOR: PSG Capital (Pty) Ltd.

DIRECTORS: MotauDN(ind ne), NjekeJN(ld ind ne), AUDITORS: PwC Inc.

Rampheri C (ind ne), Stock P (ind ne), Langeni P (Chair, ne), CAPITAL STRUCTURE AUTHORISED ISSUED

Masinga S (Acting CEO, ne), De Lange M (CFO, ind ne) DNB Ords no par val 10 000 000 000 435 672 941

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 DISTRIBUTIONS [ZARc]

Cornwall Crescent (Pty) Ltd. 22.69% Ords no par val Ldt Pay Amt

Nedgroup 10.09% Final No 6 14 Jun 21 21 Jun 21 7.00

Government Employees Pension Fund 8.64% Interim No 5 12 Jan 21 18 Jan 21 4.00

POSTAL ADDRESS:PostnetSuite210, PrivateBagX21,Bryanston,2021 LIQUIDITY: Oct21 Ave 223 510 shares p.w., R379 826.3(2.7% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/DLT

GENF 40 Week MA DENEB

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. 300

SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: BDO South Africa Inc. 254

CAPITAL STRUCTURE AUTHORISED ISSUED 208

DLT Ords no par val 3 000 000 000 714 229 718

162

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt 116

Interim No 14 17 Dec 19 23 Dec 19 12.19

Final No 13 18 Jun 19 24 Jun 19 15.99 70

2016 | 2017 | 2018 | 2019 | 2020 | 2021

LIQUIDITY: Oct21 Ave 4m shares p.w., R1.4m(27.6% p.a.)

FINANCIAL STATISTICS

REIV 40 Week MA DELPROP (R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17

Final Final Final Final(rst) Final(rst)

930

Turnover 2 604 2 872 2 956 2 547 2 678

Op Inc 212 108 162 153 180

749

NetIntPd(Rcvd) 60 109 111 102 70

567 Minority Int - - 2 - 1 - 2 -

Att Inc 125 - 127 - 45 8 50

386

TotCompIncLoss 128 - 125 - 16 20 72

Fixed Ass 607 689 710 813 771

204

Inv & Loans 1 178 1 087 1 056 907 762

23 Tot Curr Ass 1 065 1 194 1 664 1 513 1 481

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Ord SH Int 1 578 1 464 1 623 1 673 1 663

FINANCIAL STATISTICS Minority Int - 1 - - 1 1 -

(R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17 LT Liab 949 693 924 950 944

Final Final Final(rst) Final(rst) Final Tot Curr Liab 647 1 149 1 124 940 654

NetRent/InvInc 735 886 1 083 1 150 1 153 PER SHARE STATISTICS (cents per share)

Total Inc 771 952 1 135 1 190 1 187 HEPS-C (ZARc) 22.41 12.69 5.58 19.46 9.80

Attrib Inc - 454 - 936 - 298 798 635 DPS (ZARc) 11.00 - 3.00 3.00 3.00

TotCompIncLoss - 456 - 940 256 803 679 NAV PS (ZARc) 363.00 337.00 374.00 388.00 388.00

Ord UntHs Int 3 504 3 958 6 641 6 166 7 042 3 Yr Beta 0.66 0.50 0.69 0.50 -

Investments 157 278 462 - - Price High 200 250 300 250 210

FixedAss/Prop 8 239 8 794 9 916 10 491 10 057 Price Low 70 101 200 141 116

Tot Curr Ass 391 333 1 884 569 1 911 Price Prd End 140 140 226 225 185

Total Ass 8 787 9 405 12 262 11 441 12 359 RATIOS

Tot Curr Liab 4 333 4 331 4 149 2 544 1 175 Ret on SH Fnd 7.87 - 8.84 - 2.89 0.37 2.97

Oper Pft Mgn 8.14 3.75 5.49 6.00 6.73

D:E 0.70 0.86 0.85 0.75 0.65

Current Ratio 1.65 1.04 1.48 1.61 2.27

Div Cover 2.60 - - 3.51 0.63 3.40

109