Page 108 - SHB 2021 Issue 4

P. 108

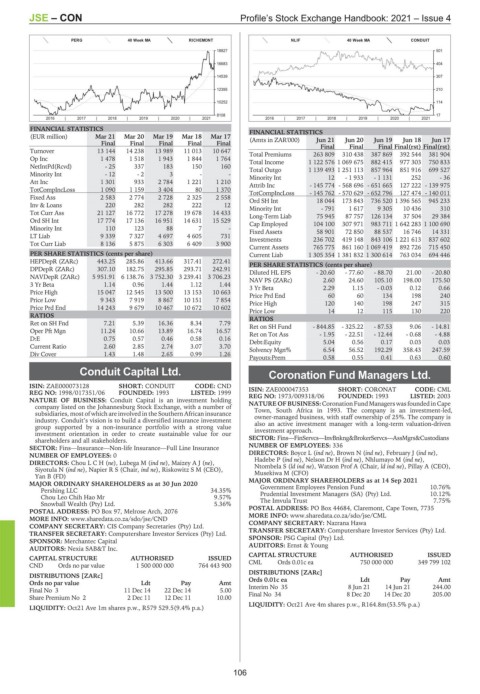

JSE – CON Profile’s Stock Exchange Handbook: 2021 – Issue 4

PERG 40 Week MA RICHEMONT NLIF 40 Week MA CONDUIT

18827 501

16683 404

14539 307

12395 210

10252 114

8108 17

2016 | 2017 | 2018 | 2019 | 2020 | 2021 2016 | 2017 | 2018 | 2019 | 2020 | 2021

FINANCIAL STATISTICS FINANCIAL STATISTICS

(EUR million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 (Amts in ZAR'000) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final Final Final Final Final Final(rst) Final(rst)

Turnover 13 144 14 238 13 989 11 013 10 647 Total Premiums 263 809 310 438 387 869 392 544 381 904

Op Inc 1 478 1 518 1 943 1 844 1 764 Total Income 1 122 576 1 069 675 882 415 977 303 750 833

NetIntPd(Rcvd) - 25 337 183 150 160 Total Outgo 1 139 493 1 251 113 857 964 851 916 699 527

Minority Int - 12 - 2 3 - - Minority Int 12 - 1 933 - 1 131 252 - 36

Att Inc 1 301 933 2 784 1 221 1 210 Attrib Inc - 145 774 - 568 696 - 651 665 127 222 - 139 975

TotCompIncLoss 1 090 1 159 3 404 80 1 370 TotCompIncLoss - 145 762 - 570 629 - 652 796 127 474 - 140 011

Fixed Ass 2 583 2 774 2 728 2 325 2 558 Ord SH Int 18 044 173 843 736 520 1 396 565 945 233

Inv & Loans 220 282 282 222 12 Minority Int - 791 1 617 9 305 10 436 310

Tot Curr Ass 21 127 16 772 17 278 19 678 14 433 Long-Term Liab 75 945 87 757 126 134 37 504 29 384

Ord SH Int 17 774 17 136 16 951 14 631 15 529 Cap Employed 104 100 307 971 983 711 1 642 283 1 100 690

Minority Int 110 123 88 7 - Fixed Assets 58 901 72 850 88 537 16 746 14 331

LT Liab 9 339 7 327 4 697 4 605 731 Investments 236 702 419 148 843 106 1 221 613 837 602

Tot Curr Liab 8 136 5 875 6 303 6 409 3 900

Current Assets 765 775 861 160 1 069 419 892 726 715 450

PER SHARE STATISTICS (cents per share) Current Liab 1 305 354 1 381 832 1 300 614 763 034 694 446

HEPDepR (ZARc) 443.25 285.86 413.66 317.41 272.41 PER SHARE STATISTICS (cents per share)

DPDepR (ZARc) 307.10 182.75 295.85 293.71 242.91 Diluted HL EPS - 20.60 - 77.60 - 88.70 21.00 - 20.80

NAVDepR (ZARc) 5 951.91 6 138.76 3 752.30 3 239.41 3 706.23 NAV PS (ZARc) 2.60 24.60 105.10 198.00 175.50

3 Yr Beta 1.14 0.96 1.44 1.12 1.44 3 Yr Beta 2.29 1.15 - 0.03 0.12 0.66

Price High 15 047 12 545 13 500 13 153 10 663 Price Prd End 60 60 134 198 240

Price Low 9 343 7 919 8 867 10 151 7 854 Price High 120 140 198 247 315

Price Prd End 14 243 9 679 10 467 10 672 10 602 Price Low 14 12 115 130 220

RATIOS RATIOS

Ret on SH Fnd 7.21 5.39 16.36 8.34 7.79 Ret on SH Fund - 844.85 - 325.22 - 87.53 9.06 - 14.81

Oper Pft Mgn 11.24 10.66 13.89 16.74 16.57 Ret on Tot Ass - 1.95 - 22.51 - 12.44 - 0.68 - 4.88

D:E 0.75 0.57 0.46 0.58 0.16 Debt:Equity 5.04 0.56 0.17 0.03 0.03

Current Ratio 2.60 2.85 2.74 3.07 3.70 Solvency Mgn% 6.54 56.52 192.29 358.43 247.59

Div Cover 1.43 1.48 2.65 0.99 1.26

Payouts:Prem 0.58 0.55 0.41 0.63 0.60

Conduit Capital Ltd. Coronation Fund Managers Ltd.

CON

ISIN: ZAE000073128 SHORT: CONDUIT CODE: CND ISIN: ZAE000047353 SHORT: CORONAT CODE: CML

COR

REG NO: 1998/017351/06 FOUNDED: 1993 LISTED: 1999 REG NO: 1973/009318/06 FOUNDED: 1993 LISTED: 2003

NATURE OF BUSINESS: Conduit Capital is an investment holding NATURE OF BUSINESS:Coronation FundManagers wasfounded in Cape

company listed on the Johannesburg Stock Exchange, with a number of

subsidiaries, most of which are involved in the Southern African insurance Town, South Africa in 1993. The company is an investment-led,

owner-managed business, with staff ownership of 25%. The company is

industry. Conduit’s vision is to build a diversified insurance investment also an active investment manager with a long-term valuation-driven

group supported by a non-insurance portfolio with a strong value

investment orientation in order to create sustainable value for our investment approach.

shareholders and all stakeholders. SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

SECTOR: Fins—Insurance—Non-life Insurance—Full Line Insurance NUMBER OF EMPLOYEES: 336

NUMBER OF EMPLOYEES: 0 DIRECTORS: Boyce L (ind ne), Brown N (ind ne), February J (ind ne),

DIRECTORS: ChouLCH(ne), Lubega M (ind ne), MaizeyAJ(ne), Hadebe P (ind ne), Nelson Dr H (ind ne), Nhlumayo M (ind ne),

Siyotula N (ind ne), Napier R S (Chair, ind ne), Riskowitz S M (CEO), Ntombela S (ld ind ne), Watson Prof A (Chair, ld ind ne), Pillay A (CEO),

Musekiwa M (CFO)

Yan B (FD)

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 MAJOR ORDINARY SHAREHOLDERS as at 14 Sep 2021 10.76%

Government Employees Pension Fund

Pershing LLC 34.35%

Chou Leo Chih Hao Mr 9.57% Prudential Investment Managers (SA) (Pty) Ltd. 10.12%

7.75%

The Imvula Trust

Snowball Wealth (Pty) Ltd. 5.36%

POSTAL ADDRESS: PO Box 97, Melrose Arch, 2076 POSTAL ADDRESS: PO Box 44684, Claremont, Cape Town, 7735

MORE INFO: www.sharedata.co.za/sdo/jse/CND MORE INFO: www.sharedata.co.za/sdo/jse/CML

COMPANY SECRETARY: Nazrana Hawa

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Merchantec Capital SPONSOR: PSG Capital (Pty) Ltd.

AUDITORS: Nexia SAB&T Inc. AUDITORS: Ernst & Young

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED

CND Ords no par value 1 500 000 000 764 443 900 CML Ords 0.01c ea 750 000 000 349 799 102

DISTRIBUTIONS [ZARc]

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt Ords 0.01c ea Ldt Pay Amt

14 Jun 21

8 Jun 21

Final No 3 11 Dec 14 22 Dec 14 5.00 Interim No 35 8 Dec 20 14 Dec 20 244.00

Final No 34

205.00

Share Premium No 2 2 Dec 11 12 Dec 11 10.00

LIQUIDITY: Oct21 Ave 4m shares p.w., R164.8m(53.5% p.a.)

LIQUIDITY: Oct21 Ave 1m shares p.w., R579 529.5(9.4% p.a.)

106