Page 104 - SHB 2021 Issue 4

P. 104

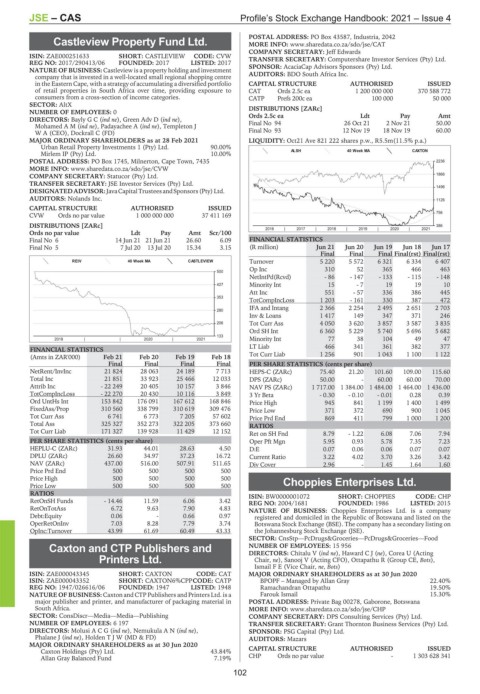

JSE – CAS Profile’s Stock Exchange Handbook: 2021 – Issue 4

POSTAL ADDRESS: PO Box 43587, Industria, 2042

Castleview Property Fund Ltd. MORE INFO: www.sharedata.co.za/sdo/jse/CAT

CAS COMPANY SECRETARY: Jeff Edwards

ISIN: ZAE000251633 SHORT: CASTLEVIEW CODE: CVW TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

REG NO: 2017/290413/06 FOUNDED: 2017 LISTED: 2017 SPONSOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

NATURE OF BUSINESS: Castleview is a property holding and investment

company that is invested in a well-located small regional shopping centre AUDITORS: BDO South Africa Inc.

in the Eastern Cape, with a strategy of accumulating a diversified portfolio CAPITAL STRUCTURE AUTHORISED ISSUED

of retail properties in South Africa over time, providing exposure to CAT Ords 2.5c ea 1 200 000 000 370 588 772

consumers from a cross-section of income categories. CATP Prefs 200c ea 100 000 50 000

SECTOR: AltX

NUMBER OF EMPLOYEES: 0 DISTRIBUTIONS [ZARc]

DIRECTORS: BaylyGC(ind ne), Green Adv D (ind ne), Ords 2.5c ea Ldt Pay Amt

MohamedAM(ind ne), Padayachee A (ind ne), Templeton J Final No 94 26 Oct 21 2 Nov 21 50.00

W A (CEO), Dockrall C (FD) Final No 93 12 Nov 19 18 Nov 19 60.00

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 LIQUIDITY: Oct21 Ave 821 222 shares p.w., R5.5m(11.5% p.a.)

Urban Retail Property Investments 1 (Pty) Ltd. 90.00%

Mirlem IP (Pty) Ltd. 10.00% ALSH 40 Week MA CAXTON

POSTAL ADDRESS: PO Box 1745, Milnerton, Cape Town, 7435 2236

MORE INFO: www.sharedata.co.za/sdo/jse/CVW

COMPANY SECRETARY: Statucor (Pty) Ltd. 1866

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

1496

DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

AUDITORS: Nolands Inc. 1126

CAPITAL STRUCTURE AUTHORISED ISSUED

CVW Ords no par value 1 000 000 000 37 411 169 756

DISTRIBUTIONS [ZARc] 386

2016 | 2017 | 2018 | 2019 | 2020 | 2021

Ords no par value Ldt Pay Amt Scr/100

Final No 6 14 Jun 21 21 Jun 21 26.60 6.09 FINANCIAL STATISTICS

Final No 5 7 Jul 20 13 Jul 20 15.34 3.15 (R million) Jun 21 Jun 20 Jun 19 Jun 18 Jun 17

Final Final Final Final(rst) Final(rst)

REIV 40 Week MA CASTLEVIEW Turnover 5 220 5 572 6 321 6 334 6 407

Op Inc 310 52 365 466 463

500

NetIntPd(Rcvd) - 86 - 147 - 133 - 115 - 148

427 Minority Int 15 - 7 19 19 10

Att Inc 551 - 57 336 386 445

353

TotCompIncLoss 1 203 - 161 330 387 472

IFA and Intang 2 366 2 254 2 495 2 651 2 703

280

Inv & Loans 1 417 149 347 371 246

206 Tot Curr Ass 4 050 3 620 3 857 3 587 3 835

Ord SH Int 6 360 5 229 5 740 5 696 5 682

133

2018 | | 2020 | 2021 Minority Int 77 38 104 49 47

LT Liab 466 341 361 382 377

FINANCIAL STATISTICS

(Amts in ZAR'000) Feb 21 Feb 20 Feb 19 Feb 18 Tot Curr Liab 1 256 901 1 043 1 100 1 122

Final Final Final Final PER SHARE STATISTICS (cents per share)

NetRent/InvInc 21 824 28 063 24 189 7 713 HEPS-C (ZARc) 75.40 21.20 101.60 109.00 115.60

Total Inc 21 851 33 923 25 466 12 033 DPS (ZARc) 50.00 - 60.00 60.00 70.00

Attrib Inc - 22 249 20 405 10 157 3 846 NAV PS (ZARc) 1 717.00 1 384.00 1 484.00 1 464.00 1 436.00

TotCompIncLoss - 22 270 20 430 10 116 3 849 3 Yr Beta - 0.30 - 0.10 - 0.01 0.28 0.39

Ord UntHs Int 153 842 176 091 167 612 168 846 Price High 945 841 1 199 1 400 1 499

FixedAss/Prop 310 560 338 799 310 619 309 476 Price Low 371 372 690 900 1 045

Tot Curr Ass 6 741 6 773 7 205 57 602 Price Prd End 869 411 799 1 000 1 200

Total Ass 325 327 352 273 322 205 373 660 RATIOS

Tot Curr Liab 171 327 139 928 11 429 12 152 Ret on SH Fnd 8.79 - 1.22 6.08 7.06 7.94

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 5.95 0.93 5.78 7.35 7.23

HEPLU-C (ZARc) 31.93 44.01 28.63 4.50 D:E 0.07 0.06 0.06 0.07 0.07

DPLU (ZARc) 26.60 34.97 37.23 16.72 Current Ratio 3.22 4.02 3.70 3.26 3.42

NAV (ZARc) 437.00 516.00 507.91 511.65 Div Cover 2.96 - 1.45 1.64 1.60

Price Prd End 500 500 500 500

Price High 500 500 500 500

Price Low 500 500 500 500 Choppies Enterprises Ltd.

CHO

RATIOS ISIN: BW0000001072 SHORT: CHOPPIES CODE: CHP

RetOnSH Funds - 14.46 11.59 6.06 3.42 REG NO: 2004/1681 FOUNDED: 1986 LISTED: 2015

RetOnTotAss 6.72 9.63 7.90 4.83 NATURE OF BUSINESS: Choppies Enterprises Ltd. is a company

Debt:Equity 0.06 - 0.66 0.97 registered and domiciled in the Republic of Botswana and listed on the

OperRetOnInv 7.03 8.28 7.79 3.74 Botswana Stock Exchange (BSE). The company has a secondary listing on

OpInc:Turnover 43.99 61.69 60.49 43.33 the Johannesburg Stock Exchange (JSE).

SECTOR: CnsStp—PcDrugs&Groceries—PcDrugs&Groceries—Food

Caxton and CTP Publishers and NUMBER OF EMPLOYEES: 15 956

DIRECTORS: Chitalu V (ind ne), HawardCJ(ne), Corea U (Acting

Printers Ltd. Chair, ne), Sanooj V (Acting CFO), Ottapathu R (Group CE, Bots),

Ismail F E (Vice Chair, ne, Bots)

CAX

ISIN: ZAE000043345 SHORT: CAXTON CODE: CAT MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

ISIN: ZAE000043352 SHORT: CAXTON6%CPPCODE: CATP BPOPF – Managed by Allan Gray 22.40%

REG NO: 1947/026616/06 FOUNDED: 1947 LISTED: 1948 Ramachandran Ottapathu 19.50%

NATURE OF BUSINESS: Caxton and CTP Publishers and Printers Ltd. is a Farouk Ismail 15.30%

major publisher and printer, and manufacturer of packaging material in POSTAL ADDRESS: Private Bag 00278, Gaborone, Botswana

South Africa. MORE INFO: www.sharedata.co.za/sdo/jse/CHP

SECTOR: ConsDiscr—Media—Media—Publishing COMPANY SECRETARY: DPS Consulting Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 6 197 TRANSFER SECRETARY: Grant Thornton Business Services (Pty) Ltd.

DIRECTORS: MolusiACG(ind ne), NemukulaAN(ind ne), SPONSOR: PSG Capital (Pty) Ltd.

Phalane J (ind ne), HoldenTJW(MD&FD) AUDITORS: Mazars

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Caxton Holdings (Pty) Ltd. 43.84% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray Balanced Fund 7.19% CHP Ords no par value - 1 303 628 341

102