Page 174 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 174

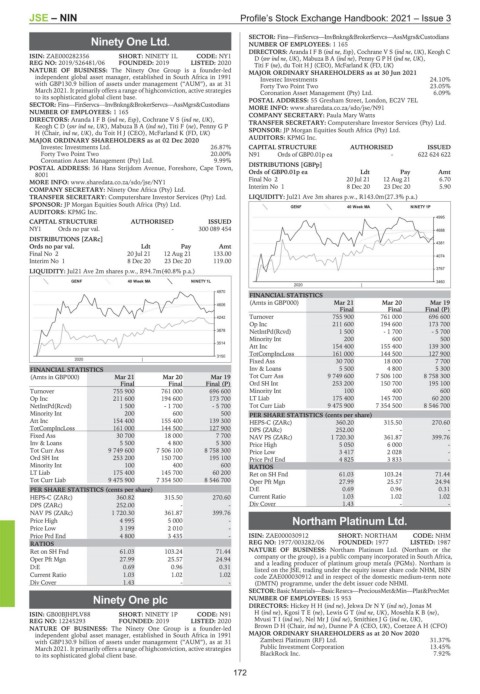

JSE – NIN Profile’s Stock Exchange Handbook: 2021 – Issue 3

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

Ninety One Ltd. NUMBER OF EMPLOYEES: 1 165

NIN DIRECTORS: Aranda I F B (ind ne, Esp), Cochrane V S (ind ne, UK), Keogh C

ISIN: ZAE000282356 SHORT: NINETY 1L CODE: NY1 D(snr ind ne, UK), Mabuza B A (ind ne), Penny G P H (ind ne, UK),

REG NO: 2019/526481/06 FOUNDED: 2019 LISTED: 2020 Titi F (ne), du Toit H J (CEO), McFarland K (FD, UK)

NATURE OF BUSINESS: The Ninety One Group is a founder-led MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2021

independent global asset manager, established in South Africa in 1991 Investec Investments 24.10%

with GBP130.9 billion of assets under management (“AUM”), as at 31 Forty Two Point Two 23.05%

March 2021. It primarily offers a range of highconviction, active strategies Coronation Asset Management (Pty) Ltd. 6.09%

to its sophisticated global client base. POSTAL ADDRESS: 55 Gresham Street, London, EC2V 7EL

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians MORE INFO: www.sharedata.co.za/sdo/jse/N91

NUMBER OF EMPLOYEES: 1 165 COMPANY SECRETARY: Paula Mary Watts

DIRECTORS: ArandaIFB(ind ne, Esp), CochraneVS(ind ne, UK), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

KeoghCD(snr ind ne, UK), MabuzaBA(ind ne), Titi F (ne), Penny G P

H (Chair, ind ne, UK), du Toit H J (CEO), McFarland K (FD, UK) SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 02 Dec 2020 AUDITORS: KPMG Inc.

Investec Investments Ltd. 26.87% CAPITAL STRUCTURE AUTHORISED ISSUED

Forty Two Point Two 20.00% N91 Ords of GBP0.01p ea - 622 624 622

Coronation Asset Management (Pty) Ltd. 9.99%

POSTAL ADDRESS: 36 Hans Strijdom Avenue, Foreshore, Cape Town, DISTRIBUTIONS [GBPp]

8001 Ords of GBP0.01p ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/NY1 Final No 2 20 Jul 21 12 Aug 21 6.70

COMPANY SECRETARY: Ninety One Africa (Pty) Ltd. Interim No 1 8 Dec 20 23 Dec 20 5.90

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. LIQUIDITY: Jul21 Ave 3m shares p.w., R143.0m(27.3% p.a.)

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

GENF 40 Week MA NINETY 1P

AUDITORS: KPMG Inc.

4995

CAPITAL STRUCTURE AUTHORISED ISSUED

NY1 Ords no par val. - 300 089 454 4688

DISTRIBUTIONS [ZARc]

4381

Ords no par val. Ldt Pay Amt

Final No 2 20 Jul 21 12 Aug 21 133.00 4074

Interim No 1 8 Dec 20 23 Dec 20 119.00

LIQUIDITY: Jul21 Ave 2m shares p.w., R94.7m(40.8% p.a.) 3767

GENF 40 Week MA NINETY 1L 3460

2020 |

4970

FINANCIAL STATISTICS

(Amts in GBP'000) Mar 21 Mar 20 Mar 19

4606

Final Final Final (P)

4242 Turnover 755 900 761 000 696 600

Op Inc 211 600 194 600 173 700

3878 NetIntPd(Rcvd) 1 500 - 1 700 - 5 700

Minority Int 200 600 500

3514

Att Inc 154 400 155 400 139 300

TotCompIncLoss 161 000 144 500 127 900

3150

2020 | Fixed Ass 30 700 18 000 7 700

FINANCIAL STATISTICS Inv & Loans 5 500 4 800 5 300

(Amts in GBP'000) Mar 21 Mar 20 Mar 19 Tot Curr Ass 9 749 600 7 506 100 8 758 300

Final Final Final (P) Ord SH Int 253 200 150 700 195 100

Turnover 755 900 761 000 696 600 Minority Int 100 400 600

Op Inc 211 600 194 600 173 700 LT Liab 175 400 145 700 60 200

NetIntPd(Rcvd) 1 500 - 1 700 - 5 700 Tot Curr Liab 9 475 900 7 354 500 8 546 700

Minority Int 200 600 500 PER SHARE STATISTICS (cents per share)

Att Inc 154 400 155 400 139 300 HEPS-C (ZARc) 360.20 315.50 270.60

TotCompIncLoss 161 000 144 500 127 900 DPS (ZARc) 252.00 - -

Fixed Ass 30 700 18 000 7 700 NAV PS (ZARc) 1 720.30 361.87 399.76

Inv & Loans 5 500 4 800 5 300 Price High 5 050 6 000 -

Tot Curr Ass 9 749 600 7 506 100 8 758 300 Price Low 3 417 2 028 -

Ord SH Int 253 200 150 700 195 100 Price Prd End 4 825 3 833 -

Minority Int 100 400 600 RATIOS

LT Liab 175 400 145 700 60 200 Ret on SH Fnd 61.03 103.24 71.44

Tot Curr Liab 9 475 900 7 354 500 8 546 700 Oper Pft Mgn 27.99 25.57 24.94

PER SHARE STATISTICS (cents per share) D:E 0.69 0.96 0.31

HEPS-C (ZARc) 360.82 315.50 270.60 Current Ratio 1.03 1.02 1.02

DPS (ZARc) 252.00 - - Div Cover 1.43 - -

NAV PS (ZARc) 1 720.30 361.87 399.76

Price High 4 995 5 000 - Northam Platinum Ltd.

Price Low 3 199 2 010 -

NOR

Price Prd End 4 800 3 435 - ISIN: ZAE000030912 SHORT: NORTHAM CODE: NHM

RATIOS REG NO: 1977/003282/06 FOUNDED: 1977 LISTED: 1987

Ret on SH Fnd 61.03 103.24 71.44 NATURE OF BUSINESS: Northam Platinum Ltd. (Northam or the

Oper Pft Mgn 27.99 25.57 24.94 company or the group), is a public company incorporated in South Africa,

and a leading producer of platinum group metals (PGMs). Northam is

D:E 0.69 0.96 0.31 listed on the JSE, trading under the equity issuer share code NHM, ISIN

Current Ratio 1.03 1.02 1.02 code ZAE000030912 and in respect of the domestic medium-term note

Div Cover 1.43 - - (DMTN) programme, under the debt issuer code NHMI.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet

Ninety One plc NUMBER OF EMPLOYEES: 15 953

DIRECTORS: HickeyHH(ind ne), Jekwa DrNY(ind ne), Jonas M

NIN

ISIN: GB00BJHPLV88 SHORT: NINETY 1P CODE: N91 H(ind ne), KgosiTE(ne), LewisGT(ind ne, UK), MosehlaKB(ne),

REG NO: 12245293 FOUNDED: 2019 LISTED: 2020 MvusiTI(ind ne), Nel Mr J (ind ne), SmithiesJG(ind ne, UK),

NATURE OF BUSINESS: The Ninety One Group is a founder-led Brown D H (Chair, ind ne), Dunne P A (CEO, UK), Coetzee A H (CFO)

independent global asset manager, established in South Africa in 1991 MAJOR ORDINARY SHAREHOLDERS as at 20 Nov 2020

with GBP130.9 billion of assets under management (“AUM”), as at 31 Zambezi Platinum (RF) Ltd. 31.37%

March 2021. It primarily offers a range of highconviction, active strategies Public Investment Corporation 13.45%

to its sophisticated global client base. BlackRock Inc. 7.92%

172