Page 170 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 170

JSE – NED Profile’s Stock Exchange Handbook: 2021 – Issue 3

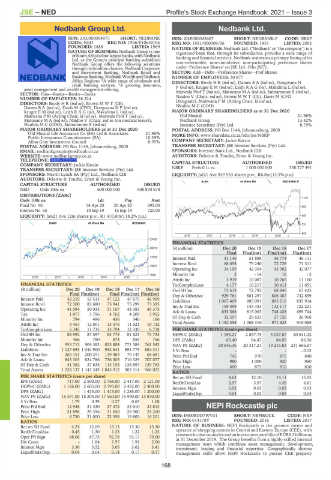

Nedbank Group Ltd. Nedbank Ltd.

NED NED

ISIN: ZAE000004875 SHORT: NEDBANK ISIN: ZAE000043667 SHORT: NEDBANK-P CODE: NBKP

CODE: NED REG NO: 1966/010630/06 REG NO: 1951/000009/06 FOUNDED: 1951 LISTED: 2002

FOUNDED: 1888 LISTED: 1969 NATURE OF BUSINESS: Nedbank Ltd. (‘Nedbank’ or ‘the company’) is a

NATURE OF BUSINESS: Nedbank Group is one registered bank that, through its subsidiaries, provides a wide range of

ofSouthAfrica'sfourlargestbanks,withNedbank banking and financial services. Nedbank maintains a primary listing of its

Ltd. as the Group's principal banking subsidiary.

Nedbank Group offers the following solutions non-redeemable, non-cumulative, non-participating preference shares

through its frontline clusters, Nedbank Corporate under ‘Preference Shares’ on JSE Ltd. (‘the JSE’).

and Investment Banking, Nedbank Retail and SECTOR: Add—Debt—Preference Shares—Pref Shares

BusinessBanking,NedbankWealthandNedbank NUMBER OF EMPLOYEES: 30 877

Africa Regions: *A wide range of wholesale and DIRECTORS: BrodyHR(ind ne), DamesBA(ind ne), Dongwana N

retail banking services. *A growing insurance,

asset management and wealth management offering. P(ind ne), KrugerEM(ind ne), LeithRAG(ne), Makalima L (ind ne),

SECTOR: Fins—Banks—Banks—Banks Marwala Prof T (ind ne), MatooaneMA(ind ne), Subramoney S (ind ne),

Naidoo V (Chair, ind ne), BrownMWT (CE), Davis M (CFO

NUMBER OF EMPLOYEES: 28 324

DIRECTORS: BrodyHR(ind ne), BrownMWT (CE), Designate), Makwana P M (Acting Chair, ld ind ne),

Nkuhlu M C (COO)

DamesBA(ind ne), Davis M (CFO), DongwanaNP(ind ne),

KrugerEM(ind ne), LeithRAG(ne), Makalima L (ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Makwana P M (Acting Chair, ld ind ne), Marwala Prof T (ind ne), Old Mutual 21.96%

MatooaneMA(ind ne), Naidoo V (Chair, ind ne (on medical leave)), Nedbank Group 13.42%

Nkuhlu M C (COO), Subramoney S (ind ne) Investec Securities (Pty) Ltd. 8.79%

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020 POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000

Old Mutual Life Assurance Co (SA) Ltd & Associates 21.96% MORE INFO: www.sharedata.co.za/sdo/jse/NBKP

Public Investment Commissioner (SA) 10.39%

Allan Gray Investment Council 8.95% COMPANY SECRETARY: Jackie Katzin

POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

EMAIL: nedbankgroupir@nedbank.co.za SPONSORS: Investec Bank Ltd., Nedbank CIB

WEBSITE: www.nedbankgroup.co.za AUDITORS: Deloitte & Touche, Ernst & Young Inc.

TELEPHONE: 011-294-4444

COMPANY SECRETARY: Jackie Katzin CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. NBKP Prefs 0.1c ea 1 000 000 000 358 277 491

SPONSORS: Merrill Lynch SA (Pty) Ltd., Nedbank CIB LIQUIDITY: Jul21 Ave 929 953 shares p.w., R6.8m(13.5% p.a.)

AUDITORS: Deloitte & Touche, Ernst & Young Inc.

ALSH 40 Week MA NEDBANK-P

CAPITAL STRUCTURE AUTHORISED ISSUED

NED Ords 100c ea 600 000 000 508 870 678

DISTRIBUTIONS [ZARc]

Ords 100c ea Ldt Pay Amt 1109

Final No 56 14 Apr 20 20 Apr 20 695.00 983

Interim No 55 10 Sep 19 16 Sep 19 720.00

LIQUIDITY: Jun21 Ave 12m shares p.w., R1 410.6m(118.2% p.a.) 857

BANK 40 Week MA NEDBANK 731

605

2016 | 2017 | 2018 | 2019 | 2020 |

27497

FINANCIAL STATISTICS

22612 (R million) Dec 20 Dec 19 Dec 18 Dec 17

Final Final(rst) Final(rst) Final(rst)

17727 Interest Paid 41 146 51 888 46 774 46 111

Interest Rcvd 68 654 79 240 72 729 71 311

12841

Operating Inc 34 109 42 304 43 302 42 077

7956 Minority Int 2 - 14 16 - 2

2016 | 2017 | 2018 | 2019 | 2020 |

Attrib Inc 3 919 10 087 10 765 11 160

FINANCIAL STATISTICS TotCompIncLoss 4 177 10 217 10 413 11 651

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Ord SH Int 73 613 72 792 68 846 67 425

Final Final(rst) Final Final(rst) Final(rst) Dep & OtherAcc 929 761 881 297 806 487 742 859

Interest Paid 42 219 53 513 47 122 47 675 46 969 Liabilities 1 067 409 985 091 895 216 835 914

Interest Rcvd 72 300 83 680 75 941 75 299 73 395 Inv & Trad Sec 159 499 143 333 132 117 122 221

Operating Inc 41 094 50 035 51 107 48 383 45 375 Adv & Loans 835 568 815 063 748 428 695 744

Tax 1 877 3 796 4 762 4 209 3 955

Minority Int 794 496 436 340 166 ST Dep & Cash 32 597 29 623 27 720 26 968

Attrib Inc 3 467 12 001 13 376 11 621 10 132 Total Assets 1 152 358 1 068 310 971 623 910 068

TotCompIncLoss 5 345 11 735 13 794 12 330 6 718 PER SHARE STATISTICS (cents per share)

Ord SH Int 88 992 87 597 83 778 81 823 75 733 HEPS-C (ZARc) 1 193.21 2 897.75 3 037.87 40 541.22

Minority Int 466 780 874 859 756 DPS (ZARc) 65.40 84.47 84.05 86.56

Dep & OtherAcc 953 715 904 382 825 804 771 584 761 542 NAV PS (ZARc) 20 546.36 20 317.21 19 215.83 241 666.67

Liabilities 1 127 693 1 044 900 952 641 894 775 884 311 3YrBeta - - - -0.12

Inv & Trad Sec 265 151 200 251 119 483 79 145 68 681 Price Prd End 745 970 875 840

Adv & Loans 843 303 824 786 736 305 710 329 707 077 Price High 980 1 000 920 960

ST Dep & Cash 41 382 37 635 114 153 128 897 129 763 Price Low 600 875 810 810

Total Assets 1 228 137 1 143 349 1 043 912 983 314 966 022

RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH Fund 4.62 12.10 14.11 15.05

EPS (ZARc) 717.00 2 500.00 2 768.00 2 417.00 2 121.00 RetOnTotalAss 2.97 3.97 4.45 4.61

HEPS-C (ZARc) 1 126.00 2 605.00 2 793.00 2 452.00 2 400.00 Interest Mgn 0.02 0.03 0.03 0.03

DPS (ZARc) - 1 415.00 1 415.00 1 285.00 1 200.00 LiquidFnds:Dep 0.04 0.03 0.03 0.04

NAV PS (ZARc) 18 391.00 18 204.00 17 560.00 16 990.00 15 830.00

3 Yr Beta 1.79 0.39 0.27 0.65 1.08

Price Prd End 12 948 21 430 27 472 25 610 23 813 NEPI Rockcastle plc

Price High 21 898 29 396 31 650 26 900 24 200 NEP

Price Low 6 730 21 000 22 358 19 800 16 201 ISIN: IM00BDD7WV31 SHORT: NEPIROCK CODE: NRP

RATIOS REG NO: 014178V FOUNDED: 2016 LISTED: 2017

Ret on SH Fund 4.24 12.69 15.13 15.30 15.30 NATURE OF BUSINESS: NEPI Rockcastle is the premier owner and

RetOnTotalAss 0.45 1.30 1.33 1.22 1.23 operator of shopping centres in Central and Eastern Europe (CEE), with

Oper Pft Mgn 68.06 87.75 92.78 93.17 79.00 presenceinninecountriesandaninvestmentportfolioofEUR6.3billionas

at 31 December 2019. The Group benefits from a highly-skilled internal

Div Cover - 1.84 1.97 1.91 2.00 management team which combines asset management, development,

Interest Mgn 3.36 3.52 3.65 3.62 3.41 investment, leasing and financial expertise. Geographically diverse

LiquidFnds:Dep 0.04 0.04 0.14 0.17 0.17 management skills allow NEPI Rockcastle to pursue CEE property

168