Page 171 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 171

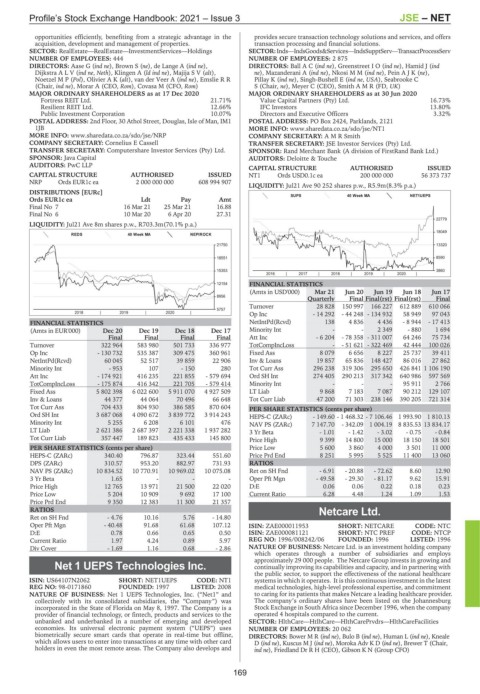

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – NET

opportunities efficiently, benefiting from a strategic advantage in the provides secure transaction technology solutions and services, and offers

acquisition, development and management of properties. transaction processing and financial solutions.

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings SECTOR:Inds—IndsGoods&Services—IndsSupptServ—TransactProcessServ

NUMBER OF EMPLOYEES: 444 NUMBER OF EMPLOYEES: 2 875

DIRECTORS: Aase G (ind ne), Brown S (ne), de Lange A (ind ne), DIRECTORS: BallAC(ind ne), GreenstreetIO(ind ne), Hamid J (ind

DijkstraALV(ind ne, Neth), Klingen A (ld ind ne), MajijaSV(alt), ne), Mazanderani A (ind ne), NkosiMM(ind ne), PeinAJK(ne),

NoetzelMP(Pol), OlivierAK(alt), van der Veer A (ind ne), Emslie R R Pillay K (ind ne), Singh-Bushell E (ind ne, USA), Seabrooke C

(Chair, ind ne), Morar A (CEO, Rom), Covasa M (CFO, Rom) S (Chair, ne), Meyer C (CEO), SmithAMR (FD, UK)

MAJOR ORDINARY SHAREHOLDERS as at 17 Dec 2020 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

Fortress REIT Ltd. 21.71% Value Capital Partners (Pty) Ltd. 16.73%

Resilient REIT Ltd. 12.66% IFC Investors 13.80%

Public Investment Corporation 10.07% Directors and Executive Officers 3.32%

POSTAL ADDRESS: 2nd Floor, 30 Athol Street, Douglas, Isle of Man, IM1 POSTAL ADDRESS: PO Box 2424, Parklands, 2121

1JB MORE INFO: www.sharedata.co.za/sdo/jse/NT1

MORE INFO: www.sharedata.co.za/sdo/jse/NRP COMPANY SECRETARY: A M R Smith

COMPANY SECRETARY: Cornelius E Cassell TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

SPONSOR: Java Capital AUDITORS: Deloitte & Touche

AUDITORS: PwC LLP

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED NT1 Ords USD0.1c ea 200 000 000 56 373 737

NRP Ords EUR1c ea 2 000 000 000 608 994 907

LIQUIDITY: Jul21 Ave 90 252 shares p.w., R5.9m(8.3% p.a.)

DISTRIBUTIONS [EURc]

SUPS 40 Week MA NET1UEPS

Ords EUR1c ea Ldt Pay Amt

Final No 7 16 Mar 21 25 Mar 21 16.88

Final No 6 10 Mar 20 6 Apr 20 27.31

22779

LIQUIDITY: Jul21 Ave 8m shares p.w., R703.3m(70.1% p.a.)

18049

REDS 40 Week MA NEPIROCK

21750 13320

18551 8590

15353 3860

2016 | 2017 | 2018 | 2019 | 2020 |

12154 FINANCIAL STATISTICS

(Amts in USD'000) Mar 21 Jun 20 Jun 19 Jun 18 Jun 17

8956

Quarterly Final Final(rst) Final(rst) Final

Turnover 28 828 150 997 166 227 612 889 610 066

5757

2018 | 2019 | 2020 | Op Inc - 14 292 - 44 248 - 134 932 58 949 97 043

FINANCIAL STATISTICS NetIntPd(Rcvd) 138 4 836 4 436 - 8 944 - 17 413

(Amts in EUR'000) Dec 20 Dec 19 Dec 18 Dec 17 Minority Int - - 2 349 - 880 1 694

Final Final Final Final Att Inc - 6 204 - 78 358 - 311 007 64 246 75 734

Turnover 322 964 583 980 501 733 336 977 TotCompIncLoss - - 51 621 - 322 469 42 444 100 026

Op Inc - 130 732 535 387 309 475 360 961 Fixed Ass 8 079 6 656 8 227 25 737 39 411

NetIntPd(Rcvd) 60 045 52 517 39 859 22 906 Inv & Loans 19 857 65 836 148 427 86 016 27 862

Minority Int - 953 107 - 150 280 Tot Curr Ass 296 238 319 306 295 650 426 841 1 106 190

Att Inc - 174 921 416 235 221 855 - 579 694 Ord SH Int 274 405 290 213 317 342 640 986 597 569

TotCompIncLoss - 175 874 416 342 221 705 - 579 414 Minority Int - - - 95 911 2 766

Fixed Ass 5 802 398 6 022 600 5 911 070 4 927 509 LT Liab 9 868 7 183 7 087 90 212 129 107

Inv & Loans 44 377 44 064 70 496 66 648 Tot Curr Liab 47 200 71 303 238 146 390 205 721 314

Tot Curr Ass 704 433 804 930 386 585 870 604 PER SHARE STATISTICS (cents per share)

Ord SH Int 3 687 068 4 090 672 3 839 772 3 914 243 HEPS-C (ZARc) - 149.60 - 1 468.32 - 7 106.46 1 993.90 1 810.13

Minority Int 5 255 6 208 6 101 476 NAV PS (ZARc) 7 147.70 - 342.09 1 004.19 8 835.53 13 834.17

LT Liab 2 621 386 2 687 397 2 221 338 1 937 282 3 Yr Beta - 1.01 - 1.42 - 3.02 - 0.75 - 0.84

Tot Curr Liab 357 447 189 823 435 433 145 800 Price High 9 399 14 800 15 000 18 150 18 501

PER SHARE STATISTICS (cents per share) Price Low 5 600 3 860 4 000 3 501 11 000

HEPS-C (ZARc) 340.40 796.87 323.44 551.60 Price Prd End 8 251 5 995 5 525 11 400 13 060

DPS (ZARc) 310.57 953.20 882.97 731.93 RATIOS

NAV PS (ZARc) 10 834.52 10 770.91 10 969.02 10 075.08 Ret on SH Fnd - 6.91 - 20.88 - 72.62 8.60 12.90

3 Yr Beta 1.65 - - - Oper Pft Mgn - 49.58 - 29.30 - 81.17 9.62 15.91

Price High 12 765 13 971 21 500 22 020 D:E 0.06 0.06 0.22 0.18 0.23

Price Low 5 204 10 909 9 692 17 100 Current Ratio 6.28 4.48 1.24 1.09 1.53

Price Prd End 9 350 12 383 11 300 21 357

RATIOS Netcare Ltd.

Ret on SH Fnd - 4.76 10.16 5.76 - 14.80

NET

Oper Pft Mgn - 40.48 91.68 61.68 107.12 ISIN: ZAE000011953 SHORT: NETCARE CODE: NTC

D:E 0.78 0.66 0.65 0.50 ISIN: ZAE000081121 SHORT: NTC PREF CODE: NTCP

Current Ratio 1.97 4.24 0.89 5.97 REG NO: 1996/008242/06 FOUNDED: 1996 LISTED: 1996

Div Cover - 1.69 1.16 0.68 - 2.86 NATURE OF BUSINESS: Netcare Ltd. is an investment holding company

which operates through a number of subsidiaries and employs

approximately 29 000 people. The Netcare Group invests in growing and

Net 1 UEPS Technologies Inc. continually improving its capabilities and capacity, and in partnering with

the public sector, to support the effectiveness of the national healthcare

NET

ISIN: US64107N2062 SHORT: NET1UEPS CODE: NT1 systems in which it operates. It is this continuous investment in the latest

REG NO: 98-0171860 FOUNDED: 1997 LISTED: 2008 medical technologies, high-level professional expertise, and commitment

NATURE OF BUSINESS: Net 1 UEPS Technologies, Inc. (“Net1” and to caring for its patients that makes Netcare a leading healthcare provider.

collectively with its consolidated subsidiaries, the “Company”) was The company’s ordinary shares have been listed on the Johannesburg

incorporated in the State of Florida on May 8, 1997. The Company is a Stock Exchange in South Africa since December 1996, when the company

provider of financial technology, or fintech, products and services to the operated 4 hospitals compared to the current.

unbanked and underbanked in a number of emerging and developed SECTOR: HlthCare—HtlhCare—HlthCarePrvdrs—HlthCareFacilities

economies. Its universal electronic payment system (“UEPS”) uses NUMBER OF EMPLOYEES: 20 062

biometrically secure smart cards that operate in real-time but offline, DIRECTORS: BowerMR(ind ne), Bulo B (ind ne), Human L (ind ne), Kneale

which allows users to enter into transactions at any time with other card D(ind ne), Kuscus M J (ind ne), Moroka Adv K D (ind ne), Brewer T (Chair,

holders in even the most remote areas. The Company also develops and ind ne), Friedland Dr R H (CEO), Gibson K N (Group CFO)

169