Page 172 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 172

JSE – NEW Profile’s Stock Exchange Handbook: 2021 – Issue 3

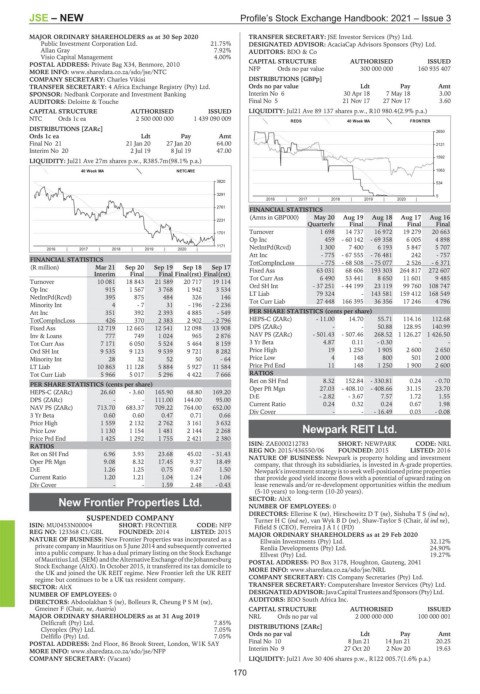

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020 TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Public Investment Corporation Ltd. 21.75% DESIGNATED ADVISOR: AcaciaCap Advisors Sponsors (Pty) Ltd.

Allan Gray 7.92% AUDITORS: BDO & Co

Visio Capital Management 4.00%

ISSUED

POSTAL ADDRESS: Private Bag X34, Benmore, 2010 CAPITAL STRUCTURE AUTHORISED 160 935 407

300 000 000

Ords no par value

NFP

MORE INFO: www.sharedata.co.za/sdo/jse/NTC

COMPANY SECRETARY: Charles Vikisi DISTRIBUTIONS [GBPp]

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: Nedbank Corporate and Investment Banking Interim No 6 30 Apr 18 7 May 18 3.00

AUDITORS: Deloitte & Touche Final No 5 21 Nov 17 27 Nov 17 3.60

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Jul21 Ave 89 137 shares p.w., R10 980.4(2.9% p.a.)

NTC Ords 1c ea 2 500 000 000 1 439 090 009

REDS 40 Week MA FRONTIER

DISTRIBUTIONS [ZARc]

2650

Ords 1c ea Ldt Pay Amt

Final No 21 21 Jan 20 27 Jan 20 64.00 2121

Interim No 20 2 Jul 19 8 Jul 19 47.00

1592

LIQUIDITY: Jul21 Ave 27m shares p.w., R385.7m(98.1% p.a.)

40 Week MA NETCARE 1063

3820 534

3291 5

2016 | 2017 | 2018 | 2019 | 2020 |

2761

FINANCIAL STATISTICS

(Amts in GBP'000) May 20 Aug 19 Aug 18 Aug 17 Aug 16

2231

Quarterly Final Final Final Final

1701 Turnover 1 698 14 737 16 972 19 279 20 663

Op Inc 459 - 60 142 - 69 358 6 005 4 898

1171 NetIntPd(Rcvd) 1 300 7 400 6 193 5 847 5 707

2016 | 2017 | 2018 | 2019 | 2020 |

Att Inc - 775 - 67 555 - 76 481 242 - 757

FINANCIAL STATISTICS TotCompIncLoss - 775 - 68 508 - 75 077 2 526 - 6 371

(R million) Mar 21 Sep 20 Sep 19 Sep 18 Sep 17

Interim Final Final Final(rst) Final(rst) Fixed Ass 63 031 68 606 193 303 264 817 272 607

Turnover 10 081 18 843 21 589 20 717 19 114 Tot Curr Ass 6 490 53 441 8 650 11 601 9 485

23 119

99 760

Op Inc 915 1 567 3 768 1 942 3 534 Ord SH Int - 37 251 - 44 199 - 143 581 159 412 108 747

LT Liab

168 549

79 324

NetIntPd(Rcvd) 395 875 484 326 146

Minority Int 4 - 7 31 - 196 - 2 236 Tot Curr Liab 27 448 166 395 36 356 17 246 4 796

Att Inc 351 392 2 393 4 885 - 549 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 426 370 2 383 2 902 - 2 796 HEPS-C (ZARc) - 11.00 14.70 55.71 114.16 112.68

Fixed Ass 12 719 12 665 12 541 12 098 13 908 DPS (ZARc) - - 50.88 128.95 140.99

Inv & Loans 777 749 1 024 965 2 876 NAV PS (ZARc) - 501.43 - 507.46 268.52 1 126.27 1 426.50

Tot Curr Ass 7 171 6 050 5 524 5 464 8 159 3 Yr Beta 4.87 0.11 - 0.30 - -

Ord SH Int 9 535 9 123 9 539 9 721 8 282 Price High 19 1 250 1 905 2 600 2 650

Minority Int 28 32 52 50 - 64 Price Low 4 148 800 501 2 000

LT Liab 10 863 11 128 5 884 5 927 11 584 Price Prd End 11 148 1 250 1 900 2 600

Tot Curr Liab 5 966 5 017 5 296 4 422 7 666 RATIOS

Ret on SH Fnd 8.32 152.84 - 330.81 0.24 - 0.70

PER SHARE STATISTICS (cents per share) Oper Pft Mgn 27.03 - 408.10 - 408.66 31.15 23.70

HEPS-C (ZARc) 26.60 - 3.60 165.90 68.80 169.20

DPS (ZARc) - - 111.00 144.00 95.00 D:E - 2.82 - 3.67 7.57 1.72 1.55

1.98

0.24

NAV PS (ZARc) 713.70 683.37 709.22 764.00 652.00 Current Ratio 0.24 - 0.32 - - 16.49 0.67 - 0.08

0.03

Div Cover

3 Yr Beta 0.60 0.60 0.47 0.71 0.66

Price High 1 559 2 132 2 762 3 161 3 632

Price Low 1 130 1 154 1 481 2 144 2 268 Newpark REIT Ltd.

Price Prd End 1 425 1 292 1 755 2 421 2 380 NEW

CODE: NRL

RATIOS ISIN: ZAE000212783 SHORT: NEWPARK LISTED: 2016

REG NO: 2015/436550/06

FOUNDED: 2015

Ret on SH Fnd 6.96 3.93 23.68 45.02 - 31.43 NATURE OF BUSINESS: Newpark is property holding and investment

Oper Pft Mgn 9.08 8.32 17.45 9.37 18.49 company, that through its subsidiaries, is invested in A-grade properties.

D:E 1.26 1.25 0.75 0.67 1.50 Newpark's investment strategy is to seek well-positioned prime properties

Current Ratio 1.20 1.21 1.04 1.24 1.06 that provide good yield income flows with a potential of upward rating on

Div Cover - - 1.59 2.48 - 0.43 lease renewals and/or re-development opportunities within the medium

(5-10 years) to long-term (10-20 years).

New Frontier Properties Ltd. SECTOR: AltX

NUMBER OF EMPLOYEES: 0

NEW DIRECTORS: Ellerine K (ne), HirschowitzDT(ne), SishubaTS(ind ne),

SUSPENDED COMPANY TurnerHC(ind ne), van WykBD(ne), Shaw-Taylor S (Chair, ld ind ne),

ISIN: MU0453N00004 SHORT: FRONTIER CODE: NFP Fifield S (CEO), FerreiraJAI( (FD)

REG NO: 123368 C1/GBL FOUNDED: 2014 LISTED: 2015 MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

NATURE OF BUSINESS: New Frontier Properties was incorporated as a Ellwain Investments (Pty) Ltd. 32.12%

private company in Mauritius on 5 June 2014 and subsequently converted Renlia Developments (Pty) Ltd. 24.90%

into a public company. It has a dual primary listing on the Stock Exchange Ellvest (Pty) Ltd. 19.27%

ofMauritius Ltd.(SEM)andthe AlternativeExchange of the Johannesburg POSTAL ADDRESS: PO Box 3178, Houghton, Gauteng, 2041

Stock Exchange (AltX). In October 2015, it transferred its tax domicile to MORE INFO: www.sharedata.co.za/sdo/jse/NRL

the UK and joined the UK REIT regime. New Frontier left the UK REIT

regime but continues to be a UK tax resident company. COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

SECTOR: AltX TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

NUMBER OF EMPLOYEES: 0 DESIGNATEDADVISOR:JavaCapitalTrusteesandSponsors(Pty)Ltd.

DIRECTORS: Abdoolakhan S (ne), Bolleurs R, CheungPSM(ne), AUDITORS: BDO South Africa Inc.

Gmeiner F (Chair, ne, Austria) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2019 NRL Ords no par val 2 000 000 000 100 000 001

Delficraft (Pty) Ltd. 7.85%

Clyroplex (Pty) Ltd. 7.05% DISTRIBUTIONS [ZARc]

Delfiflo (Pty) Ltd. 7.05% Ords no par val Ldt Pay Amt

POSTAL ADDRESS: 2nd Floor, 86 Brook Street, London, W1K 5AY Final No 10 8 Jun 21 14 Jun 21 20.25

MORE INFO: www.sharedata.co.za/sdo/jse/NFP Interim No 9 27 Oct 20 2 Nov 20 19.63

COMPANY SECRETARY: (Vacant) LIQUIDITY: Jul21 Ave 30 406 shares p.w., R122 005.7(1.6% p.a.)

170