Page 179 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 179

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – OCT

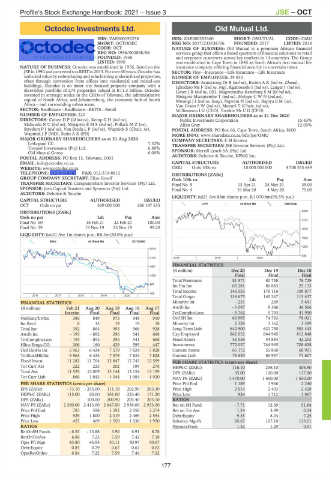

Octodec Investments Ltd. Old Mutual Ltd.

OCT OLD

ISIN: ZAE000192258 ISIN: ZAE000255360 SHORT: OMUTUAL CODE: OMU

SHORT: OCTODEC REG NO: 2017/235138/06 FOUNDED: 2017 LISTED: 2018

CODE: OCT NATURE OF BUSINESS: Old Mutual is a premium African financial

REG NO: 1956/002868/06 services group that offers a broad spectrum of financial solutions to retail

FOUNDED: 1956 and corporate customers across key markets in 14 countries. The Group

LISTED: 1990 was established in Cape Town in 1845 as South Africa’s first mutual life

NATURE OF BUSINESS: Octodec was established in 1956, listed on the insurance company, offering financial security in uncertain times.

JSEin1990 andconvertedtoaREITin2013. Forover60 years,Octodechas SECTOR: Fins—Insurance—Life Insurance—Life Insurance

unlocked value by redeveloping and refurbishing underutilised properties, NUMBER OF EMPLOYEES: 29 830

often through conversion from offices into residential and mixed-use DIRECTORS: Armstrong Dr B (ind ne), EssienAK(ind ne, Ghana),

buildings. Octodec is an inner city focused property company with a Ighodaro Ms F (ind ne, Nig), Kgaboesele I (ind ne), Langer J (ind ne),

diversified portfolio of 274 properties valued at R11.3 billion. Octodec ListerJR(ind ne, UK), Magwentshu-RensburgSM(ld ind ne),

invested in strategic nodes in the CBDs of Tshwane, the administrative Mokgosi-Mwantembe T (ind ne), MolopeCWN(ind ne),

capital of South Africa, and Johannesburg, the economic hub of South MwangiJI(ind ne, Keny), Nqweni N (ind ne), RapiyaBM(ne),

Africa – and surrounding urban areas. Van GraanSW(ind ne), Manuel T (Chair, ind ne),

SECTOR: RealEstate—RealEstate—REITS—Retail Williamson I G (CEO), Troskie Mr C G (CFO)

NUMBER OF EMPLOYEES: 220 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

DIRECTORS: CohenDP(ld ind ne), KempGH(ind ne), Public Investment Corporation 15.43%

MabundaNC(ind ne), MojapeloEMS(ind ne), PollackMZ(ne), Allan Gray 12.05%

StrydomPJ(ind ne), Van BredaLP(ind ne), Wapnick S (Chair, ne), POSTAL ADDRESS: PO Box 66, Cape Town, South Africa, 8000

Wapnick J P (MD), Stein A K (FD) MORE INFO: www.sharedata.co.za/sdo/jse/OMU

MAJOR ORDINARY SHAREHOLDERS as at 31 Aug 2020 COMPANY SECRETARY: E M Kirsten

Lefkopaul CC 7.32% TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

Tomnef Investments (Pty) Ltd. 6.89%

Old Mutual Group 6.00% SPONSOR: Merrill Lynch SA (Pty) Ltd.

POSTAL ADDRESS: PO Box 15, Tshwane, 0001 AUDITORS: Deloitte & Touche, KPMG Inc.

EMAIL: info@octodec.co.za CAPITAL STRUCTURE AUTHORISED ISSUED

WEBSITE: www.octodec.co.za OMU Ords 100c ea 10 000 000 000 4 708 553 649

TELEPHONE: 012-319-8781 FAX: 012-319-8812 DISTRIBUTIONS [ZARc]

GROUP COMPANY SECRETARY: Elize Greeff Ords 100c ea Ldt Pay Amt

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 5 13 Apr 21 24 May 21 35.00

SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd. Final No 4 31 Mar 20 4 May 20 75.00

AUDITORS: Deloitte & Touche

LIQUIDITY: Jul21 Ave 86m shares p.w., R1 070.8m(95.5% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

OCT Ords no par 500 000 000 266 197 535 LIFE 40 Week MA OMUTUAL

DISTRIBUTIONS [ZARc] 2399

Ords no par Ldt Pay Amt

2107

Final No 60 16 Feb 21 22 Feb 21 100.00

Final No 59 19 Nov 19 25 Nov 19 99.20

1815

LIQUIDITY: Jun21 Ave 1m shares p.w., R8.5m(20.8% p.a.)

1523

REIV 40 Week MA OCTODEC

1230

2515

938

2103 2018 | 2019 | 2020 |

FINANCIAL STATISTICS

1691

(R million) Dec 20 Dec 19 Dec 18

1279 Final Final Final

Total Premiums 81 571 80 758 78 729

867

Inc Fm Inv 65 281 86 883 25 133

Total Income 146 533 176 116 109 877

455

2016 | 2017 | 2018 | 2019 | 2020 | Total Outgo 134 675 140 267 113 437

FINANCIAL STATISTICS Minority Int - 251 269 5 641

(R million) Feb 21 Aug 20 Aug 19 Aug 18 Aug 17 Attrib Inc - 5 097 9 386 36 566

Interim Final Final Final Final TotCompIncLoss - 5 762 5 793 41 950

NetRent/InvInc 386 849 975 948 910 Ord SH Int 66 995 74 763 78 021

Int Recd 6 15 19 19 18 Minority Int 2 328 3 162 3 399

Total Inc 392 864 993 966 928 Long-Term Liab 642 900 621 730 583 443

Attrib Inc - 195 - 892 296 541 688 Cap Employed 862 052 844 945 812 848

TotCompIncLoss - 195 - 892 296 541 688 Fixed Assets 42 558 44 884 42 253

Hline Erngs-CO 306 160 429 595 447 Investments 772 037 744 965 708 638

Ord UntHs Int 5 963 6 424 7 579 7 824 7 828 Current Assets 65 172 55 860 68 901

TotStockHldInt 5 963 6 424 7 579 7 824 7 828 Current Liab 78 630 65 957 71 607

Fixed Invest 11 282 11 764 12 847 12 743 12 599 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 222 223 202 199 276 HEPS-C (ZARc) 116.10 236.10 306.90

Total Ass 11 529 12 009 13 144 13 154 13 129 DPS (ZARc) 35.00 120.00 117.00

Tot Curr Liab 866 1 043 1 344 1 984 1 920 NAV PS (ZARc) 1 470.00 1 650.00 1 650.00

PER SHARE STATISTICS (cents per share) Price Prd End 1 189 1 966 2 240

EPS (ZARc) - 73.10 - 335.00 111.10 202.90 263.30 Price High 2 014 2 403 2 428

HEPS-C (ZARc) 115.00 60.00 161.00 223.40 171.20 Price Low 924 1 712 1 967

DPS (ZARc) - 100.00 200.90 203.40 203.10 RATIOS

NAV PS (ZARc) 2 360.00 2 413.00 2 847.00 2 939.00 2 933.00 Ret on SH Fund - 7.71 12.39 51.84

Price Prd End 783 598 1 592 2 058 2 274 Ret on Tot Ass 1.24 3.99 0.24

Price High 929 1 800 2 319 2 469 2 554 Debt:Equity 9.35 8.04 7.25

Price Low 455 469 1 550 1 630 1 950 Solvency Mgn% 95.67 107.10 113.01

RATIOS Payouts:Prem 1.32 1.29 0.91

RetOnSH Funds - 6.53 - 13.88 3.90 6.91 8.78

RetOnTotAss 6.86 7.23 7.59 7.42 7.18

Oper Pft Mgn 43.80 45.95 50.11 50.97 50.67

Debt:Equity 0.85 0.79 0.67 0.62 0.62

OperRetOnInv 6.84 7.22 7.59 7.44 7.22

177