Page 167 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 167

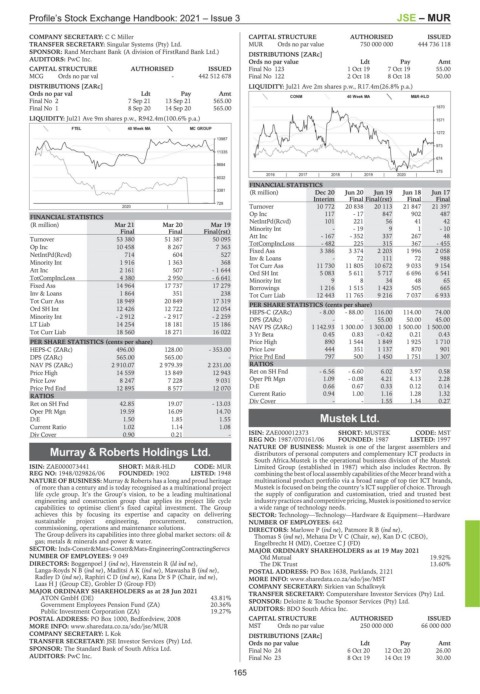

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – MUR

COMPANY SECRETARY: C C Miller CAPITAL STRUCTURE AUTHORISED ISSUED

TRANSFER SECRETARY: Singular Systems (Pty) Ltd. MUR Ords no par value 750 000 000 444 736 118

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.) DISTRIBUTIONS [ZARc]

AUDITORS: PwC Inc. Ords no par value Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED Final No 123 1 Oct 19 7 Oct 19 55.00

MCG Ords no par val - 442 512 678 Final No 122 2 Oct 18 8 Oct 18 50.00

DISTRIBUTIONS [ZARc] LIQUIDITY: Jul21 Ave 2m shares p.w., R17.4m(26.8% p.a.)

Ords no par val Ldt Pay Amt

CONM 40 Week MA M&R-HLD

Final No 2 7 Sep 21 13 Sep 21 565.00

Final No 1 8 Sep 20 14 Sep 20 565.00 1870

LIQUIDITY: Jul21 Ave 9m shares p.w., R942.4m(100.6% p.a.) 1571

FTEL 40 Week MA MC GROUP

1272

13987

973

11335

674

8684

375

2016 | 2017 | 2018 | 2019 | 2020 |

6032

FINANCIAL STATISTICS

3381 (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final(rst) Final Final

729

2020 | Turnover 10 772 20 838 20 113 21 847 21 397

Op Inc 117 - 17 847 902 487

FINANCIAL STATISTICS NetIntPd(Rcvd) 101 221 56 41 42

(R million) Mar 21 Mar 20 Mar 19

Final Final Final(rst) Minority Int - - 19 9 1 - 10

Turnover 53 380 51 387 50 095 Att Inc - 167 - 352 337 267 48

315

367

- 455

225

- 482

Op Inc 10 458 8 267 7 363 TotCompIncLoss 3 386 3 374 2 203 1 996 2 058

Fixed Ass

NetIntPd(Rcvd) 714 604 527 Inv & Loans - 72 111 72 988

Minority Int 1 916 1 363 368 Tot Curr Ass 11 730 11 805 10 672 9 033 9 154

Att Inc 2 161 507 - 1 644 Ord SH Int 5 083 5 611 5 717 6 696 6 541

TotCompIncLoss 4 380 2 950 - 6 641 Minority Int 9 8 34 48 65

Fixed Ass 14 964 17 737 17 279 Borrowings 1 216 1 515 1 423 505 665

Inv & Loans 1 864 351 238 Tot Curr Liab 12 443 11 765 9 216 7 037 6 933

Tot Curr Ass 18 949 20 849 17 319 PER SHARE STATISTICS (cents per share)

Ord SH Int 12 426 12 722 12 054 HEPS-C (ZARc) - 8.00 - 88.00 116.00 114.00 74.00

Minority Int - 2 912 - 2 917 - 2 259 DPS (ZARc) - - 55.00 50.00 45.00

LT Liab 14 254 18 181 15 186 NAV PS (ZARc) 1 142.93 1 300.00 1 300.00 1 500.00 1 500.00

Tot Curr Liab 18 560 18 271 16 022 3 Yr Beta 0.45 0.83 - 0.42 0.21 0.43

PER SHARE STATISTICS (cents per share) Price High 890 1 544 1 849 1 925 1 710

HEPS-C (ZARc) 496.00 128.00 - 353.00 Price Low 444 351 1 137 870 901

DPS (ZARc) 565.00 565.00 - Price Prd End 797 500 1 450 1 751 1 307

NAV PS (ZARc) 2 910.07 2 979.39 2 231.00 RATIOS

Price High 14 559 13 849 12 943 Ret on SH Fnd - 6.56 - 6.60 6.02 3.97 0.58

Price Low 8 247 7 228 9 031 Oper Pft Mgn 1.09 - 0.08 4.21 4.13 2.28

Price Prd End 12 895 8 577 12 070 D:E 0.66 0.67 0.33 0.12 0.14

RATIOS Current Ratio 0.94 1.00 1.16 1.28 1.32

Ret on SH Fnd 42.85 19.07 - 13.03 Div Cover - - 1.55 1.34 0.27

Oper Pft Mgn 19.59 16.09 14.70

D:E 1.50 1.85 1.55 Mustek Ltd.

Current Ratio 1.02 1.14 1.08 MUS

Div Cover 0.90 0.21 - ISIN: ZAE000012373 SHORT: MUSTEK CODE: MST

REG NO: 1987/070161/06 FOUNDED: 1987 LISTED: 1997

NATURE OF BUSINESS: Mustek is one of the largest assemblers and

Murray & Roberts Holdings Ltd. distributors of personal computers and complementary ICT products in

South Africa.Mustek is the operational business division of the Mustek

MUR

ISIN: ZAE000073441 SHORT: M&R-HLD CODE: MUR Limited Group (established in 1987) which also includes Rectron. By

REG NO: 1948/029826/06 FOUNDED: 1902 LISTED: 1948 combining the best of local assembly capabilities of the Mecer brand with a

NATURE OF BUSINESS: Murray & Roberts has a long and proud heritage multinational product portfolio via a broad range of top tier ICT brands,

of more than a century and is today recognised as a multinational project Mustek is focused on being the country’s ICT supplier of choice. Through

life cycle group. It’s the Group’s vision, to be a leading multinational the supply of configuration and customisation, tried and trusted best

engineering and construction group that applies its project life cycle industry practices and competitive pricing, Mustek is positioned to service

capabilities to optimise client’s fixed capital investment. The Group a wide range of technology needs.

achieves this by focusing its expertise and capacity on delivering SECTOR: Technology—Technology—Hardware & Equipment—Hardware

sustainable project engineering, procurement, construction, NUMBER OF EMPLOYEES: 642

commissioning, operations and maintenance solutions. DIRECTORS: Marlowe P (ind ne), PatmoreRB(ind ne),

The Group delivers its capabilities into three global market sectors: oil & Thomas S (ind ne), Mehana Dr V C (Chair, ne), Kan D C (CEO),

gas; metals & minerals and power & water. Engelbrecht H (MD), Coetzee C J (FD)

SECTOR: Inds-Constr&Mats-Constr&Mats-EngineeringContractingServcs MAJOR ORDINARY SHAREHOLDERS as at 19 May 2021

NUMBER OF EMPLOYEES: 9 049 Old Mutual 19.92%

DIRECTORS: Boggenpoel J (ind ne), Havenstein R (ld ind ne), The DK Trust 13.60%

Langa-RoydsNB(ind ne), MaditsiAK(ind ne), Mawasha B (ind ne), POSTAL ADDRESS: PO Box 1638, Parklands, 2121

Radley D (ind ne), RaphiriCD(ind ne), Kana Dr S P (Chair, ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/MST

Laas H J (Group CE), Grobler D (Group FD) COMPANY SECRETARY: Sirkien van Schalkwyk

MAJOR ORDINARY SHAREHOLDERS as at 28 Jun 2021 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ATON GmbH (DE) 43.81% SPONSOR: Deloitte & Touche Sponsor Services (Pty) Ltd.

Government Employees Pension Fund (ZA) 20.36%

Public Investment Corporation (ZA) 19.27% AUDITORS: BDO South Africa Inc.

POSTAL ADDRESS: PO Box 1000, Bedfordview, 2008 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/MUR MST Ords no par value 250 000 000 66 000 000

COMPANY SECRETARY: LKok DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Ords no par value Ldt Pay Amt

SPONSOR: The Standard Bank of South Africa Ltd. Final No 24 6 Oct 20 12 Oct 20 26.00

AUDITORS: PwC Inc. Final No 23 8 Oct 19 14 Oct 19 30.00

165