Page 162 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 162

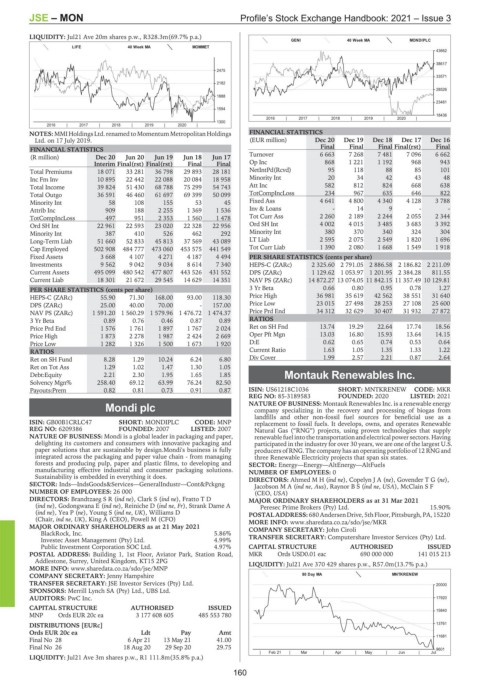

JSE – MON Profile’s Stock Exchange Handbook: 2021 – Issue 3

LIQUIDITY: Jul21 Ave 20m shares p.w., R328.3m(69.7% p.a.)

GENI 40 Week MA MONDIPLC

LIFE 40 Week MA MOMMET

43662

38617

2475

33571

2182

28526

1888

23481

1594

18436

2016 | 2017 | 2018 | 2019 | 2020 |

1300

2016 | 2017 | 2018 | 2019 | 2020 |

NOTES: MMI Holdings Ltd. renamed to Momentum Metropolitan Holdings FINANCIAL STATISTICS

Ltd. on 17 July 2019. (EUR million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

Final Final Final Final(rst) Final

FINANCIAL STATISTICS

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Turnover 6 663 7 268 7 481 7 096 6 662

Interim Final(rst) Final(rst) Final Final Op Inc 868 1 221 1 192 968 943

Total Premiums 18 071 33 281 36 798 29 893 28 181 NetIntPd(Rcvd) 95 118 88 85 101

Inc Fm Inv 10 895 22 442 22 088 20 084 18 958 Minority Int 20 34 42 43 48

Total Income 39 824 51 430 68 788 75 299 54 743 Att Inc 582 812 824 668 638

Total Outgo 36 591 46 460 61 697 69 399 50 099 TotCompIncLoss 234 967 635 646 822

Minority Int 58 108 155 53 45 Fixed Ass 4 641 4 800 4 340 4 128 3 788

Attrib Inc 909 188 2 255 1 369 1 536 Inv & Loans - 14 9 - -

TotCompIncLoss 497 951 2 353 1 560 1 478 Tot Curr Ass 2 260 2 189 2 244 2 055 2 344

Ord SH Int 22 961 22 593 23 020 22 328 22 956 Ord SH Int 4 002 4 015 3 485 3 683 3 392

Minority Int 387 410 526 462 292 Minority Int 380 370 340 324 304

Long-Term Liab 51 660 52 833 45 813 37 569 43 089 LT Liab 2 595 2 075 2 549 1 820 1 696

Cap Employed 502 908 484 777 473 060 453 575 441 549 Tot Curr Liab 1 390 2 080 1 668 1 549 1 918

Fixed Assets 3 668 4 107 4 271 4 187 4 494 PER SHARE STATISTICS (cents per share)

Investments 9 562 9 042 9 034 8 614 7 340 HEPS-C (ZARc) 2 325.60 2 791.05 2 886.58 2 186.82 2 211.09

Current Assets 495 099 480 542 477 807 443 526 431 552 DPS (ZARc) 1 129.62 1 053.97 1 201.95 2 384.28 811.55

Current Liab 18 301 21 672 29 545 14 629 14 351 NAV PS (ZARc) 14 872.27 13 074.05 11 842.15 11 357.49 10 129.81

PER SHARE STATISTICS (cents per share) 3 Yr Beta 0.66 0.80 0.95 0.78 1.27

HEPS-C (ZARc) 55.90 71.30 168.00 93.00 118.30 Price High 36 981 35 619 42 562 38 551 31 640

DPS (ZARc) 25.00 40.00 70.00 - 157.00 Price Low 23 015 27 498 28 253 27 108 25 600

NAV PS (ZARc) 1 591.20 1 560.29 1 579.96 1 476.72 1 474.37 Price Prd End 34 312 32 629 30 407 31 932 27 872

3 Yr Beta 0.89 0.76 0.46 0.87 0.89 RATIOS

Price Prd End 1 576 1 761 1 897 1 767 2 024 Ret on SH Fnd 13.74 19.29 22.64 17.74 18.56

Price High 1 873 2 278 1 987 2 424 2 669 Oper Pft Mgn 13.03 16.80 15.93 13.64 14.15

Price Low 1 282 1 326 1 500 1 673 1 920 D:E 0.62 0.65 0.74 0.53 0.64

RATIOS Current Ratio 1.63 1.05 1.35 1.33 1.22

Ret on SH Fund 8.28 1.29 10.24 6.24 6.80 Div Cover 1.99 2.57 2.21 0.87 2.64

Ret on Tot Ass 1.29 1.02 1.47 1.30 1.05

Debt:Equity 2.21 2.30 1.95 1.65 1.85 Montauk Renewables Inc.

Solvency Mgn% 258.40 69.12 63.99 76.24 82.50 MON

Payouts:Prem 0.82 0.81 0.73 0.91 0.87 ISIN: US61218C1036 SHORT: MNTKRENEW CODE: MKR

REG NO: 85-3189583 FOUNDED: 2020 LISTED: 2021

NATURE OF BUSINESS: Montauk Renewables Inc. is a renewable energy

Mondi plc company specializing in the recovery and processing of biogas from

landfills and other non-fossil fuel sources for beneficial use as a

MON

ISIN: GB00B1CRLC47 SHORT: MONDIPLC CODE: MNP replacement to fossil fuels. It develops, owns, and operates Renewable

REG NO: 6209386 FOUNDED: 2007 LISTED: 2007 Natural Gas (“RNG”) projects, using proven technologies that supply

NATURE OF BUSINESS: Mondi is a global leader in packaging and paper, renewablefuel intothe transportationandelectrical powersectors. Having

delighting its customers and consumers with innovative packaging and participated in the industry for over 30 years, we are one of the largest U.S.

paper solutions that are sustainable by design.Mondi's business is fully producers of RNG. The company has an operating portfolio of 12 RNG and

integrated across the packaging and paper value chain - from managing three Renewable Electricity projects that span six states.

forests and producing pulp, paper and plastic films, to developing and SECTOR: Energy—Energy—AltEnergy—AltFuels

manufacturing effective industrial and consumer packaging solutions. NUMBER OF EMPLOYEES: 0

Sustainability is embedded in everything it does. DIRECTORS: AhmedMH(ind ne), CopelynJA(ne), GovenderTG(ne),

SECTOR: Inds—IndsGoods&Services—GeneralIndustr—Cont&Pckgng JacobsonMA(ind ne, Aus), RaynorBS(ind ne, USA), McClain S F

NUMBER OF EMPLOYEES: 26 000 (CEO, USA)

DIRECTORS: BrandtzaegSR(ind ne), Clark S (ind ne), Fratto T D MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

(ind ne), Godongwana E (ind ne), Reiniche D (ind ne, Fr), Strank Dame A Peresec Prime Brokers (Pty) Ltd. 15.90%

(ind ne), Yea P (ne), Young S (ind ne, UK), Williams D POSTAL ADDRESS:680 AndersenDrive,5thFloor,Pittsburgh, PA,15220

(Chair, ind ne, UK), King A (CEO), Powell M (CFO) MORE INFO: www.sharedata.co.za/sdo/jse/MKR

MAJOR ORDINARY SHAREHOLDERS as at 21 May 2021 COMPANY SECRETARY: John Ciroli

BlackRock, Inc. 5.86% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Investec Asset Management (Pty) Ltd. 4.99%

Public Investment Corporation SOC Ltd. 4.97% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: Building 1, 1st Floor, Aviator Park, Station Road, MKR Ords USD0.01 eac 690 000 000 141 015 213

Addlestone, Surrey, United Kingdom, KT15 2PG LIQUIDITY: Jul21 Ave 370 429 shares p.w., R57.0m(13.7% p.a.)

MORE INFO: www.sharedata.co.za/sdo/jse/MNP

COMPANY SECRETARY: Jenny Hampshire 80 Day MA MNTKRENEW

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. 20000

SPONSORS: Merrill Lynch SA (Pty) Ltd., UBS Ltd.

AUDITORS: PwC Inc. 17920

CAPITAL STRUCTURE AUTHORISED ISSUED

15840

MNP Ords EUR 20c ea 3 177 608 605 485 553 780

DISTRIBUTIONS [EURc] 13761

Ords EUR 20c ea Ldt Pay Amt

11681

Final No 28 6 Apr 21 13 May 21 41.00

Final No 26 18 Aug 20 29 Sep 20 29.75 9601

| Feb 21 | Mar | Apr | May | Jun | Jul

LIQUIDITY: Jul21 Ave 3m shares p.w., R1 111.8m(35.8% p.a.)

160