Page 124 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 124

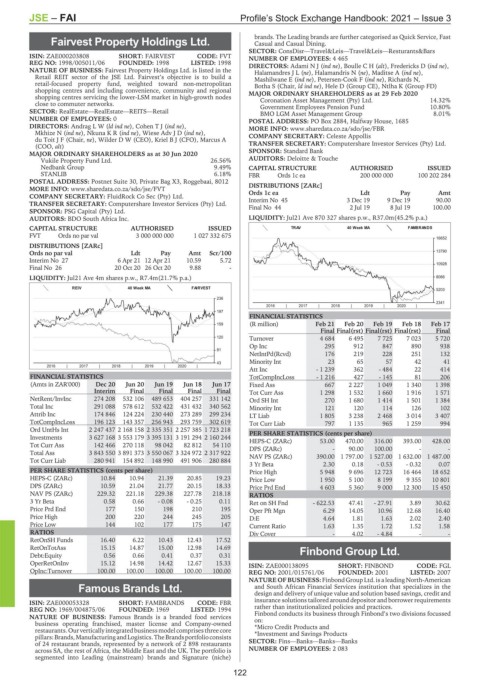

JSE – FAI Profile’s Stock Exchange Handbook: 2021 – Issue 3

brands. The Leading brands are further categorised as Quick Service, Fast

Fairvest Property Holdings Ltd. Casual and Casual Dining.

FAI SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Resturants&Bars

ISIN: ZAE000203808 SHORT: FAIRVEST CODE: FVT NUMBER OF EMPLOYEES: 4 465

REG NO: 1998/005011/06 FOUNDED: 1998 LISTED: 1998 DIRECTORS: AdamiNJ(ind ne), BoulleCH(alt), Fredericks D (ind ne),

NATURE OF BUSINESS: Fairvest Property Holdings Ltd. is listed in the HalamandresJL(ne), Halamandris N (ne), Maditse A (ind ne),

Retail REIT sector of the JSE Ltd. Fairvest’s objective is to build a Mashilwane E (ind ne), Petersen-Cook F (ind ne), Richards N,

retail-focused property fund, weighted toward non-metropolitan Botha S (Chair, ld ind ne), Hele D (Group CE), Ntlha K (Group FD)

shopping centres and including convenience, community and regional MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

shopping centres servicing the lower-LSM market in high-growth nodes Coronation Asset Management (Pty) Ltd. 14.32%

close to commuter networks. Government Employees Pension Fund 10.80%

SECTOR: RealEstate—RealEstate—REITS—Retail BMO LGM Asset Management Group 8.01%

NUMBER OF EMPLOYEES: 0 POSTAL ADDRESS: PO Box 2884, Halfway House, 1685

DIRECTORS: AndragLW(ld ind ne), CohenTJ(ind ne), MORE INFO: www.sharedata.co.za/sdo/jse/FBR

Mkhize N (ind ne), NkunaKR(ind ne), Wiese AdvJD(ind ne), COMPANY SECRETARY: Celeste Appollis

du Toit J F (Chair, ne), Wilder D W (CEO), Kriel B J (CFO), Marcus A

(COO, alt) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 SPONSOR: Standard Bank

Vukile Property Fund Ltd. 26.56% AUDITORS: Deloitte & Touche

Nedbank Group 9.49% CAPITAL STRUCTURE AUTHORISED ISSUED

STANLIB 6.18% FBR Ords 1c ea 200 000 000 100 202 284

POSTAL ADDRESS: Postnet Suite 30, Private Bag X3, Roggebaai, 8012

MORE INFO: www.sharedata.co.za/sdo/jse/FVT DISTRIBUTIONS [ZARc] Ldt Pay Amt

Ords 1c ea

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd. Interim No 45 3 Dec 19 9 Dec 19 90.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. Final No 44 2 Jul 19 8 Jul 19 100.00

AUDITORS: BDO South Africa Inc. LIQUIDITY: Jul21 Ave 870 327 shares p.w., R37.0m(45.2% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED TRAV 40 Week MA FAMBRANDS

FVT Ords no par val 3 000 000 000 1 027 332 675

16652

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt Scr/100 13790

Interim No 27 6 Apr 21 12 Apr 21 10.59 5.72

10928

Final No 26 20 Oct 20 26 Oct 20 9.88 -

LIQUIDITY: Jul21 Ave 4m shares p.w., R7.4m(21.7% p.a.) 8066

REIV 40 Week MA FAIRVEST 5203

236

2341

2016 | 2017 | 2018 | 2019 | 2020 |

197

FINANCIAL STATISTICS

159 (R million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

Final Final(rst) Final(rst) Final(rst) Final

120 Turnover 4 684 6 495 7 725 7 023 5 720

Op Inc 295 912 847 890 938

81

NetIntPd(Rcvd) 176 219 228 251 132

43 Minority Int 23 65 57 42 41

2016 | 2017 | 2018 | 2019 | 2020 |

Att Inc - 1 239 362 - 484 22 414

FINANCIAL STATISTICS TotCompIncLoss - 1 216 427 - 145 81 206

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Fixed Ass 667 2 227 1 049 1 340 1 398

Interim Final Final Final Final Tot Curr Ass 1 298 1 532 1 660 1 916 1 571

NetRent/InvInc 274 208 532 106 489 653 404 257 331 142 Ord SH Int 270 1 680 1 414 1 501 1 384

Total Inc 291 088 578 612 532 422 431 432 340 562 Minority Int 121 120 114 126 102

Attrib Inc 174 846 124 224 230 440 273 289 299 234 LT Liab 1 805 3 238 2 468 3 014 3 407

TotCompIncLoss 196 123 143 357 256 943 293 759 302 619 Tot Curr Liab 797 1 135 965 1 259 994

Ord UntHs Int 2 247 437 2 168 158 2 335 351 2 257 385 1 723 218 PER SHARE STATISTICS (cents per share)

Investments 3 627 168 3 553 179 3 395 131 3 191 294 2 160 244 HEPS-C (ZARc) 53.00 470.00 316.00 393.00 428.00

Tot Curr Ass 142 466 270 118 98 042 82 812 54 110

DPS (ZARc) - 90.00 100.00 - -

Total Ass 3 843 550 3 891 373 3 550 067 3 324 972 2 317 922 NAV PS (ZARc) 390.00 1 797.00 1 527.00 1 632.00 1 487.00

Tot Curr Liab 280 941 154 892 148 990 491 906 280 884

3 Yr Beta 2.30 0.18 - 0.53 - 0.32 0.07

PER SHARE STATISTICS (cents per share) Price High 5 948 9 696 12 723 16 464 18 652

HEPS-C (ZARc) 10.84 10.94 21.39 20.85 19.23 Price Low 1 950 5 100 8 199 9 355 10 801

DPS (ZARc) 10.59 21.04 21.77 20.15 18.33 Price Prd End 4 603 5 360 9 000 12 300 15 450

NAV PS (ZARc) 229.32 221.18 229.38 227.78 218.18 RATIOS

3 Yr Beta 0.58 0.66 - 0.08 - 0.25 0.11 Ret on SH Fnd - 622.53 47.41 - 27.91 3.89 30.62

Price Prd End 177 150 198 210 195 Oper Pft Mgn 6.29 14.05 10.96 12.68 16.40

Price High 200 220 244 245 205 D:E 4.64 1.81 1.63 2.02 2.40

Price Low 144 102 177 175 147 Current Ratio 1.63 1.35 1.72 1.52 1.58

RATIOS Div Cover - 4.02 - 4.84 - -

RetOnSH Funds 16.40 6.22 10.43 12.43 17.52

RetOnTotAss 15.15 14.87 15.00 12.98 14.69

Debt:Equity 0.56 0.66 0.41 0.37 0.31 Finbond Group Ltd.

FIN

OperRetOnInv 15.12 14.98 14.42 12.67 15.33 ISIN: ZAE000138095 SHORT: FINBOND CODE: FGL

OpInc:Turnover 100.00 100.00 100.00 100.00 100.00 REG NO: 2001/015761/06 FOUNDED: 2001 LISTED: 2007

NATURE OF BUSINESS:Finbond Group Ltd. is a leading North-American

Famous Brands Ltd. and South African Financial Services institution that specializes in the

design and delivery of unique value and solution based savings, credit and

FAM insurance solutions tailored around depositor and borrower requirements

ISIN: ZAE000053328 SHORT: FAMBRANDS CODE: FBR

REG NO: 1969/004875/06 FOUNDED: 1969 LISTED: 1994 rather than institutionalized policies and practices.

Finbond conducts its business through Finbond’s two divisions focussed

NATURE OF BUSINESS: Famous Brands is a branded food services on:

business operating franchised, master license and Company-owned *Micro Credit Products and

restaurants.Ourvertically integrated businessmodelcomprises three core *Investment and Savings Products

pillars:Brands,ManufacturingandLogistics. TheBrandsportfolioconsists

of 24 restaurant brands, represented by a network of 2 898 restaurants SECTOR: Fins—Banks—Banks—Banks

across SA, the rest of Africa, the Middle East and the UK. The portfolio is NUMBER OF EMPLOYEES: 2 083

segmented into Leading (mainstream) brands and Signature (niche)

122