Page 129 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 129

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – GOL

TELEPHONE: 011-562-9700

Gold Fields Ltd. FAX: 011-562-9829

GOL COMPANY SECRETARY: Anré Weststrate

ISIN: ZAE000018123 TRANSFER SECRETARY: Computershare

SHORT: GFIELDS Investor Services (Pty) Ltd.

CODE: GFI SPONSOR: JP Morgan Equities South Africa Ltd.

REG NO: 1968/004880/06

FOUNDED: 1998 AUDITORS: PwC Inc.

LISTED: 1998 BANKERS: Standard Bank of SA Ltd.

Scan the QR code to

NATURE OF BUSINESS: visit our website

Gold Fields Limited is a SEGMENTAL REPORTING as at 31 Dec 20 (asa%of Revenue)

globally diversified gold Australia 43.99%

producer with nine operating Ghana 37.17%

mines and one project in Australia, Chile, Ghana (including our South Africa 9.81%

Asanko Joint Venture), Peru and South Africa, with total attrib- Peru 9.03%

utable annual gold-equivalent production of 2.24Moz. It has at- CALENDAR Expected Status

tributable gold-equivalent Mineral Reserves of 52.1Moz and Next Interim Results 19 Aug 2021 Confirmed

gold Mineral Resources of 116.0Moz. Gold Fields has a primary Next Final Results Feb 2022 Unconfirmed

listing on the Johannesburg Stock Exchange (JSE) Limited, and Annual General Meeting May 2022 Unconfirmed

anadditionallistingontheNewYorkStockExchange(NYSE). CAPITAL STRUCTURE AUTHORISED ISSUED

GFI Ords 50c ea 1 000 000 000 887 717 348

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin DISTRIBUTIONS [ZARc]

MAJOR ORDINARY SHAREHOLDERS as at 28 May 2021 Ords 50c ea Ldt Pay Amt

VanEck Global (New York) 9.72% Final No 93 9 Mar 21 15 Mar 21 320.00

Public Investment Corporation (Pretoria) 8.30% Interim No 92 8 Sep 20 14 Sep 20 160.00

BlackRock Investment Mgt (London) 4.96% Final No 91 10 Mar 20 16 Mar 20 100.00

FINANCIAL STATISTICS Interim No 90 3 Sep 19 9 Sep 19 60.00

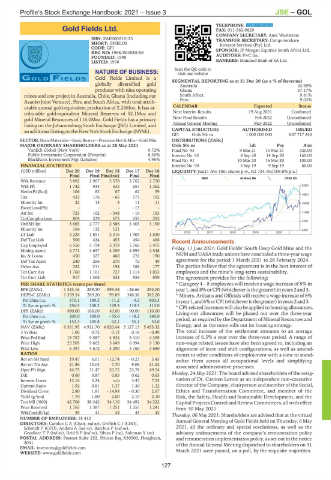

(USD million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 LIQUIDITY: Jun21 Ave 18m shares p.w., R2 724.7m(108.0% p.a.)

Final Final Final(rst) Final Final

MINI 40 Week MA GFIELDS

Wrk Revenue 3 892 2 967 2 578 2 762 2 750

Wrk Pft 1 742 934 535 657 1 362 23551

NetIntPd(Rcd) 106 82 67 62 59

19521

Tax 433 176 - 66 173 192

Minority Int 22 13 3 11 11 15492

ExordLoss(Pft) - - - - 13 -

Att Inc 723 162 - 348 - 19 163 11462

TotCompIncLoss 804 229 675 255 295

7433

Ord SH Int 3 665 2 777 2 586 3 403 3 190

Minority Int 164 132 121 - - 3403

2016 | 2017 | 2018 | 2019 | 2020 |

LT Liab 2 228 1 851 2 216 1 909 1 820

Def Tax Liab 500 434 455 454 466 Recent Announcements

Cap Employed 6 556 5 194 5 378 5 766 5 475 Friday, 11 June 2021: Gold Fields’ South Deep Gold Mine and the

Mining assets 4 771 4 657 4 259 4 893 4 548

Inv & Loans 450 327 460 276 190 NUM and UASA trade unions have concluded a three-year wage

Def Tax Asset 240 266 270 72 49 agreement for the period 1 March 2021 to 28 February 2024.

Other Ass 252 211 194 188 177 The parties believe that the agreement is in the best interest of

Tot Curr Ass 1 760 1 101 727 1 114 1 053 employees and the mine’s long-term sustainability.

Tot Curr Liab 917 1 368 532 854 859 The agreement provides for the following:

PER SHARE STATISTICS (cents per share) * Category 4 – 8 employees will receive a wage increase of 8% in

EPS (ZARc) 1 343.16 289.20 - 599.34 - 26.66 294.00 year1,and8%orCPI(whicheveristhegreater)inyears2and3.

HEPS-C (ZARc) 1 359.54 289.20 99.89 346.58 382.20 * Miners, Artisans and Officials will receive a wage increase of 6%

Pct chng p.a. 370.1 189.5 - 71.2 - 9.3 803.3 inyear1,and6%orCPI(whicheveristhegreater)inyears2and3.

Tr 5yr av grwth % 256.5 138.2 129.3 118.5 113.0 * CPI-related increases will also be applied to housing allowances.

DPS (ZARc) 480.00 160.00 40.00 90.00 110.00 Living-out allowances will be phased out over the three-year

Pct chng p.a. 200.0 300.0 - 55.6 - 18.2 340.0

Tr 5yr av grwth % 153.3 105.8 62.1 55.1 53.0 period, as required by the Department of Mineral Resources and

NAV (ZARc) 6 361.95 4 921.70 4 820.44 5 127.13 5 453.32 Energy, and as the mine rolls out its housing strategy.

3 Yr Beta 1.06 0.72 0.12 0.18 - 0.49 The total increase of the settlement amounts to an average

Price Prd End 13 757 9 587 4 934 5 410 4 359 increase of 6.5% a year over the three-year period. A range of

Price High 25 569 9 602 5 649 6 094 9 130 non-wage related issues have also been agreed to, including an

Price Low 6 397 4 672 3 290 3 760 3 680 alignment of leave and shift configurations, as well as amend-

RATIOS ments to other conditions of employment with a view to stand-

Ret on SH fund 19.47 6.01 - 12.74 - 0.23 5.45 ardise them across all occupational levels and simplifying

Ret on Tot Ass 21.86 13.03 7.70 9.06 21.62 associated administrative processes.

Oper Pft Mgn 44.75 31.47 20.75 23.78 49.54

D:E 0.60 0.87 0.85 0.62 0.63 Monday, 24 May 2021: The board advised shareholders of the resig-

Interest Cover 12.16 5.24 n/a 3.47 7.23 nation of Dr. Carmen Letton as an independent non-executive

Current Ratio 1.92 0.81 1.37 1.30 1.22 director of the Company, chairperson and member of the Social,

Dividend Cover 2.80 1.81 - 14.98 - 0.30 2.67 Ethics and Transformation Committee, and member of the

Yield (g/ton) 1.70 1.80 2.00 2.10 2.10 Risk, the Safety, Health and Sustainable Development, and the

Ton Mll (‘000) 42 706 38 342 34 110 34 492 34 222 Capital Projects Control and Review Committees, all with effect

Price Received 1 765 1 387 1 251 1 255 1 241 from 30 May 2021.

WrkCost(R/kg) 39 41 42 43 42

NUMBER OF EMPLOYEES: 18 412 Thursday, 06 May 2021: Shareholders are advised that at the virtual

Annual General Meeting of Gold Fields held on Thursday, 6 May

DIRECTORS: Carolus C A (Chair, ind ne), Griffith C I (CEO),

Schmidt P (CFO), Andani A (ind ne), Bacchus P (ind ne), 2021, all the ordinary and special resolutions, as well as the

GoodlaceTP(ind ne), ReidSP(ind ne), Sibiya P (ne), Suleman Y (ne) advisory endorsements of the company’s remuneration policy

POSTAL ADDRESS: Postnet Suite 252, Private Bag X30500, Houghton, and remuneration implementation policy, as set out in the notice

2041 of the Annual General Meeting dispatched to shareholders on 31

EMAIL: investors@goldfields.com March 2021 were passed, on a poll, by the requisite majorities.

WEBSITE: www.goldfields.com

127