Page 123 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 123

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – EXX

Status

Exxaro Resources Ltd. CALENDAR Expected Unconfirmed

Aug 2021

Next Interim Results

EXX

Next Final Results Mar 2022 Unconfirmed

Annual General Meeting May 2022 Unconfirmed

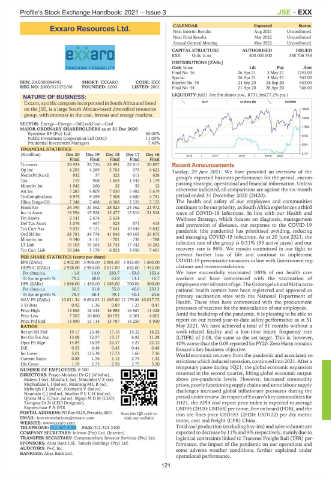

CAPITAL STRUCTURE AUTHORISED ISSUED

EXX Ords 1c ea 500 000 000 358 706 754

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

Final No 36 26 Apr 21 3 May 21 1243.00

Special 26 Apr 21 3 May 21 543.00

ISIN: ZAE000084992 SHORT: EXXARO CODE: EXX Interim No 35 21 Sep 20 28 Sep 20 643.00

REG NO: 2000/011076/06 FOUNDED: 2000 LISTED: 2001 Final No 34 21 Apr 20 28 Apr 20 566.00

NATURE OF BUSINESS: LIQUIDITY: Jul21 Ave 5m shares p.w., R731.3m(77.2% p.a.)

Exxaro,apubliccompanyincorporatedinSouthAfricaandlisted OILP 40 Week MA EXXARO

on the JSE, is a large South African-based diversified resources 18030

group, with interests in the coal, ferrous and energy markets.

14846

SECTOR: Energy—Energy—OilGas&Coal—Coal

11662

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Eyesizwe RF (Pty) Ltd. 30.00%

Public Investment Corporation Ltd (SOC) 11.00% 8478

Prudential Investment Managers 7.40% 5294

FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 2016 | 2017 | 2018 | 2019 | 2020 | 2110

Final Final Final Final Final

Turnover 28 924 25 726 25 491 22 813 20 897 Recent Announcements

Op Inc 4 293 4 269 5 703 975 4 623 Tuesday, 29 June 2021: We have provided an overview of the

NetIntPd(Rcvd) 832 37 322 611 628 group’s expected business performance for the period, encom-

Tax 719 968 1 653 1 542 1 179 passing strategic, operational and financial information. Unless

Minority Int 1 943 260 32 50 12

otherwise indicated, all comparisons are against the six-month

Att Inc 7 283 9 809 7 030 5 982 5 679

TotCompIncLoss 8 975 9 359 7 308 4 680 4 741 period ended 31 December 2020 (2H20).

Hline Erngs-CO 7 348 7 488 6 568 2 120 5 155 The health and safety of our employees and communities

Fixed Ass 38 395 33 562 28 825 24 362 21 972 continues to be our priority, as South Africa experiences a third

Inv in Assoc 18 594 15 928 15 477 15 810 21 518 wave of COVID-19 infections. In line with our Health and

Fin Assets 2 141 2 674 2 634 - - Wellness Strategy, which focuses on diagnosis, management

Def Tax Asset 1 076 467 523 571 415 and prevention of diseases, our response to the COVID-19

Tot Curr Ass 9 033 9 121 7 641 10 844 9 842 pandemic (the pandemic) has prioritised avoiding, reducing

Ord SH Int 38 781 34 776 41 846 40 103 35 875 and managing COVID-19 infections. As at 20 June 2021, the

Minority Int 9 340 8 111 - 701 - 738 - 788

LT Liab 19 103 19 364 15 745 17 442 16 282 infection rate of the group is 0.51% (93 active cases) and our

Tot Curr Liab 10 244 5 179 6 823 3 956 7 461 recovery rate is 96%. We remain committed in our fight to

prevent further loss of life and continue to implement

PER SHARE STATISTICS (cents per share)

EPS (ZARc) 2 902.00 3 908.00 2 801.00 1 923.00 1 600.00 COVID-19 preventative measures in line with Government reg-

HEPS-C (ZARc) 2 928.00 2 983.00 2 617.00 682.00 1 452.00 ulations and recommendations.

Pct chng p.a. - 1.8 14.0 283.7 - 53.0 153.4 We have successfully vaccinated 100% of our health care

Tr 5yr av grwth % 79.2 68.0 63.8 13.1 16.7 workers and have commenced with the vaccination of

DPS (ZARc) 1 886.00 1 430.00 1 085.00 700.00 500.00 employees over 60 years ofage. The Grootegelukand Matlaoccu-

Pct chng p.a. 30.5 31.8 55.0 40.0 233.3 pational health centers have been registered and approved as

Tr 5yr av grwth % 78.4 58.4 49.1 40.1 24.6 primary vaccination sites with the National Department of

NAV PS (ZARc) 10 811.34 9 694.83 11 665.80 11 179.88 10 017.72 Health. These sites have commenced with the procurement

3 Yr Beta 0.92 1.36 0.89 1.23 0.41 processes of vaccines for the innoculation of our employees.

Price High 14 865 18 345 16 988 16 567 11 428

Price Low 7 507 10 860 10 192 8 301 4 002 Amid the backdrop of the pandemic, it is pleasing to be able to

Price Prd End 13 890 13 114 13 787 16 250 8 950 report on our record year-to-date safety performance as at 31

RATIOS May 2021. We have achieved a total of 51 months without a

Ret on SH Fnd 19.17 23.48 17.16 15.32 16.22 work-related fatality and a lost-time injury frequency rate

Ret On Tot Ass 13.08 12.97 13.17 6.92 11.28 (LTIFR) of 0.08, the same as the set target. This is, however,

Oper Pft Mgn 14.84 16.59 22.37 4.27 22.12 40% worse than the 0.05 reported for FY20. Zero Harm remains

D:E 0.53 0.48 0.43 0.44 0.48 Exxaro’s key business objective.

Int Cover 5.01 115.38 17.73 1.60 7.36 World economic recovery from the pandemic and associated re-

Current Ratio 0.88 1.76 1.12 2.74 1.32 strictions which induced recession, continuedinto2021. Aftera

Div Cover 1.19 2.73 2.58 2.75 3.20

temporary pause during 1Q21, the global economic expansion

NUMBER OF EMPLOYEES: 8 500

DIRECTORS: Fraser-Moleketi Dr G J (ld ind ne), resumed in the second quarter, lifting global economic output

Malevu I (ne), Mbatha L (ne), Mntambo V Z (ne), above pre-pandemic levels. However, increased commodity

Mophatlane L I (ind ne), Msimang M LB(ne), prices, poorlyfunctioningsupply chainsandsomelaboursupply

Myburgh E J (ind ne), NkonyeniV(ind ne), challenges increased global inflationary pressures during the

Nxumalo C J (ind ne), Snyders P CCH (ind ne),

Qhena M G (Chair, ind ne), Mgojo M D M (CEO), period under review. In respect of Exxaro’s key commodities for

Tsengwa Dr N (CEO Designate), 1H21, the API4 coal export price index is expected to average

Koppeschaar P A (FD) USD95 (2H20: USD64) per tonne, free on board (FOB), and the

POSTAL ADDRESS:POBox9229, Pretoria,0001 Scan the QR code to iron ore fines price USD183 (2H20: USD122) per dry metric

EMAIL: investorrelations@exxaro.com visit our website tonne, cost and freight (CFR) China.

WEBSITE: www.exxaro.com

TELEPHONE: 012-307-5000 FAX: 012-323-3400 Total coal production (excluding buy-ins) and sales volumes are

COMPANY SECRETARY: Inlexso (Pty) Ltd. (Interim) expected to decrease by 11% and 9% respectively, mainly due to

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. logistical constraints linked to Transnet Freight Rail (TFR) per-

SPONSORS: Absa Bank Ltd., Tamela Holdings (Pty) Ltd. formance, the impact of the pandemic on our operations and

AUDITORS: PwC Inc. some adverse weather conditions, further explained under

BANKERS: Absa Bank Ltd.

operational performance.

121