Page 120 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 120

JSE – EPP Profile’s Stock Exchange Handbook: 2021 – Issue 3

EPP N.V. CALENDAR Expected Status

Next Interim Results Sep 2021 Unconfirmed

EPP

Next Final Results Mar 2022 Unconfirmed

Annual General Meeting May 2022 Unconfirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

EPP Ords of EUR 0.81 ea 2 572 645 659 907 946 792

DISTRIBUTIONS [EURc]

Ords of EUR 0.81 ea Ldt Pay Amt

Interim No 6 1 Oct 19 7 Oct 19 5.80

ISIN: NL0011983374 SHORT: EPP CODE: EPP Final No 5 2 Apr 19 8 Apr 19 5.78

REG NO: 64965945 FOUNDED: 2016 LISTED: 2016 Interim No 4 2 Oct 18 8 Oct 18 5.82

Final No 3 10 Apr 18 16 Apr 18 5.68

NATURE OF BUSINESS: LIQUIDITY: Jun21 Ave 3m shares p.w., R30.0m(18.8% p.a.)

EPP is a Dutch based real estate investment company and one

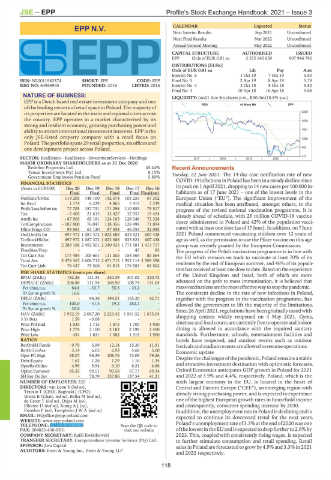

REIV 40 Week MA EPP

of the leading owners of retail space in Poland. The majority of

its properties are located in the main and regional cities across 2350

the country. EPP operates in a market characterised by its 1976

strong and resilient economy, growing purchasing power and

ability to attract international investment interests. EPP is the 1601

only JSE-listed property company with a retail focus on 1226

Poland.The portfoliospans29retailproperties, sixofficesand

one development project across Poland. 852

SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings 2017 | 2018 | 2019 | 2020 | 477

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

Redefine Properties Ltd. 45.44% Recent Announcements

Tensai Investments Pty) Ltd. 8.15% Tuesday, 22 June 2021: The 14-day case notification rate of new

Government Employees Pension Fund 5.89%

COVID-19 infections in Poland has been in a steady decline since

FINANCIAL STATISTICS

(Amts in EUR'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 its peak on 1 April 2021, dropping to 14 new cases per 100 000 in-

Final Final Final Final Final(rst) habitants as of 17 June 2021 – one of the lowest levels in the

NetRent/InvInc 114 205 148 100 142 674 103 255 67 302 European Union (“EU”). The significant improvement of the

Int Recd 1 174 6 229 4 865 7 419 7 339 medical situation has been attributed, amongst others, to the

Profit/Loss before tax 77 705 157 731 171 298 110 883 75 517 progress of the revised national vaccination programme. It is

Tax - 7 405 21 615 13 427 32 557 19 424 already ahead of schedule, with 26 million COVID-19 vaccine

Attrib Inc - 87 905 65 181 124 165 128 348 72 328

TotCompIncLoss - 187 800 76 047 118 356 128 498 71 894 doses administered in Poland and 42% of the population vacci-

Hline Erngs-CO 99 961 61 120 87 454 46 053 32 045 nated with at least one dose (as of 17 June). In addition, on 7 June

Ord UntHs Int 897 972 1 087 372 1 022 688 833 821 607 438 2021 Poland commenced vaccinating children over 12 years of

TotStockHldInt 897 972 1 087 372 1 022 688 833 821 607 438 ageaswell, as thepermission to usethe Pfizer vaccine on this age

Investments 2 288 168 2 492 501 2 340 435 1 771 581 1 413 717 group was recently granted by the European Commission.

FixedAss/Prop - - - 47 85 The progress of the Polish vaccination programme is in line with

Tot Curr Ass 177 484 105 661 111 355 154 569 85 564 the EU which remains on track to vaccinate at least 70% of its

Total Ass 2 476 367 2 606 715 2 471 715 1 952 114 1 509 398

Tot Curr Liab 76 437 75 506 61 815 176 583 83 502 residents by the end of European summer, and 46% of its popula-

tion has received at least one dose to date. Based on the experience

PER SHARE STATISTICS (cents per share) of the United Kingdom and Israel, both of which are more

EPLU (ZARc) - 182.26 121.33 240.39 301.02 320.72

HEPLU-C (ZARc) 206.88 111.94 168.90 108.74 141.64 advanced on the path to mass immunisation, it is believed that

Pct chng p.a. 84.8 - 33.7 55.3 - 23.2 - massvaccinationsarethemosteffectivewaytostopthepandemic.

Tr 5yr av grwth % 16.6 - - - - The consistent decline in the rate of new infections in Poland,

DPLU (ZARc) - 94.36 194.51 163.20 42.71 together with the progress in the vaccination programme, has

Pct chng p.a. - 100.0 - 51.5 19.2 282.1 - allowed the government to lift the majority of the limitations.

Tr 5yr av grwth % 30.0 - - - - Since 26 April 2021, regulations have been gradually eased with

NAV (ZARc) 1 952.19 2 067.20 2 223.45 1 961.52 1 675.04 shopping centres widely reopened on 4 May 2021. Gyms,

3 Yr Beta 1.59 - 0.08 - - -

Price Prd End 1 035 1 715 1 875 1 700 1 950 cinemas and food courts are currently free to operate and indoor

Price High 1 774 2 100 2 183 2 199 2 450 dining is allowed in accordance with the required sanitary

Price Low 434 1 631 1 382 1 315 1 900 standards. Furthermore, schools, entertainment facilities and

RATIOS hotels have reopened, and outdoor events such as outdoor

RetOnSH Funds - 9.79 5.99 12.14 15.39 11.91 festivalsandstadiumeventsareallowedtoresumeoperations.

RetOnTotAss 3.14 6.05 6.93 5.68 5.00 Economic update

Oper Pft Mgn 58.07 96.39 108.76 73.09 79.26 Despite the challenges of the pandemic, Poland remains a stable

Debt:Equity 1.61 1.26 1.29 1.16 1.34

OperRetOnInv 4.99 5.94 6.10 6.21 4.86 and attractive investment destination with optimistic forecasts.

OpInc:Turnover 85.35 90.51 90.58 67.73 69.34 Oxford Economics anticipates GDP growth in Poland for 2021

SH Ret On Inv - 78.79 157.86 137.54 41.21 and 2022 of 3.9% and 4.4%, respectively. Poland, which is the

NUMBER OF EMPLOYEES: 220 sixth largest economy in the EU, is located in the heart of

DIRECTORS: van Loon S (ind ne), Central and Eastern Europe (“CEE”), an emerging region with

Trzoslo T (CEO), Baginski J (CFO), already strong purchasing power, and is expected to experience

Weisz R (Chair, ind ne), Belka M (ind ne),

de Groot T (ind ne), Dyjas M (ne), one of the highest European growth rates in household income

Ellerine D (ind ne), KonigAJ(ne), and consequently, consumer spending increase by 2030.

Prinsloo P (ne), TempletonJWA(ind ne) In addition, the unemployment rate in Poland is declining and is

EMAIL: HQoffice@epp-poland.com expected to continue its downward trend for the next years.

WEBSITE: www.epp-poland.com Poland’s unemployment rate of 3.3% at the end of 2020 was one

TELEPHONE: 004822-221-7110 Scan the QR code to

FAX: 004822-430-0301 visit our website ofthelowestintheEUandisexpectedtodropfurtherto2.6%by

COMPANY SECRETARY: Rafal Kwiatkowski 2023. This, coupled with consistently rising wages, is expected

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. to further stimulate consumption and retail spending. Retail

SPONSOR: Java Capital sales in Poland are forecasted to grow by 4.9% and 3.3% in 2021

AUDITORS: Ernst & Young Inc., Ernst & Young LLP

and 2022 respectively.

118