Page 115 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 115

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – DIS

POSTAL ADDRESS: PO Box 786722, Sandton, 2146

MORE INFO: www.sharedata.co.za/sdo/jse/DSY Distell Group Holdings Ltd.

COMPANY SECRETARY: N N Mbongo DIS

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

AUDITORS: PwC Inc.

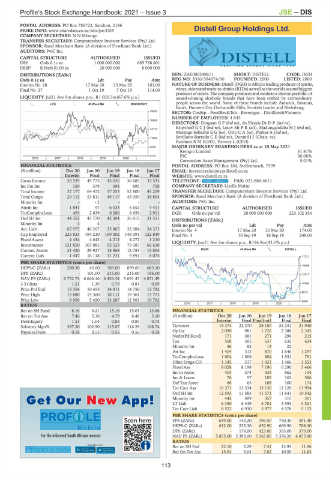

CAPITAL STRUCTURE AUTHORISED ISSUED

DSY Ords 0.1c ea 1 000 000 000 665 768 601

DSBP B Prefs R100 ea 20 000 000 8 000 000

DISTRIBUTIONS [ZARc] ISIN: ZAE000248811 SHORT: DISTELL CODE: DGH

Ords 0.1c ea Ldt Pay Amt REG NO: 2016/394974/06 FOUNDED: 2000 LISTED: 2000

Interim No 28 17 Mar 20 23 Mar 20 101.00 NATURE OF BUSINESS: Distell (DGH) is Africa's leading producer of spirits,

Final No 27 1 Oct 19 7 Oct 19 114.00 wines,cidersandready-to-drinks(RTDs)aswellastheworld'ssecondbiggest

producer of ciders. The company produces and markets a diverse portfolio of

LIQUIDITY: Jul21 Ave 9m shares p.w., R1 020.3m(67.6% p.a.) award-winning alcoholic brands that have been crafted by extraordinary

people across the world. Some of these brands include Amarula, Savanna,

LIFE 40 Week MA DISCOVERY

Bain's, Hunter's Dry, Durbanville Hills, Scottish Leader and Nederburg.

19000

SECTOR: CnsStp—FoodBev&Tob—Beverages—Distillers&Vintners

NUMBER OF EMPLOYEES: 4 845

16555

DIRECTORS: DingaanGP(ind ne), du Plessis DrDP(ind ne),

KruythoffGCJ(ind ne), Louw MrPR(alt), MadungandabaMJ(ind ne),

14110

Matenge-SebeshoEG(ne), OttoCA(ne), Parker A (ind ne),

Sevillano-BarredoCE(ind ne), Durand J J (Chair, ne),

11665

Rushton R M (CEO), Verwey L (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 10 May 2021

9220

Remgro Limited 31.41%

6775 PIC 30.08%

2016 | 2017 | 2018 | 2019 | 2020 |

Coronation Asset Management (Pty) Ltd. 5.01%

FINANCIAL STATISTICS POSTAL ADDRESS: PO Box 184, Stellenbosch, 7599

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 EMAIL: investor.relations@distell.co.za

Interim Final Final Final Final WEBSITE: www.distell.co.za

Gross Income 26 539 49 775 43 036 36 685 33 533 TELEPHONE: 021-809-7000 FAX: 021-886-4611

Inc Fm Inv 150 379 398 895 758 COMPANY SECRETARY: Lizelle Malan

Total Income 37 177 64 472 57 253 52 800 45 209 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Total Outgo 29 115 53 811 49 117 43 059 38 894 SPONSOR: Rand Merchant Bank (A division of FirstRand Bank Ltd.)

Minority Int - - 2 - - - AUDITORS: PwC Inc.

Attrib Inc 1 841 97 6 533 5 652 4 411 CAPITAL STRUCTURE AUTHORISED ISSUED

TotCompIncLoss 493 2 839 6 280 6 656 2 911 DGH Ords no par val 20 000 000 000 223 102 356

Ord SH Int 44 352 43 770 42 304 36 815 31 511 DISTRIBUTIONS [ZARc]

Minority Int 4 4 - - - Ords no par val Ldt Pay Amt

Act. Liab 67 975 46 267 35 865 32 084 24 373 Interim No 4 17 Mar 20 23 Mar 20 174.00

Cap Employed 225 833 194 210 169 002 148 091 122 849 Final No 3 10 Sep 19 16 Sep 19 249.00

Fixed Assets 4 434 4 643 4 212 4 272 1 210 LIQUIDITY: Jun21 Ave 2m shares p.w., R196.9m(42.6% p.a.)

Investments 121 850 107 085 92 523 79 287 66 638

Current Assets 31 420 29 927 18 868 18 783 15 865 BEVR 40 Week MA DISTELL

Current Liab 1 447 16 118 11 231 9 891 8 074 17221

PER SHARE STATISTICS (cents per share)

15069

HEPS-C (ZARc) 280.30 45.00 789.00 899.60 683.10

DPS (ZARc) - 101.00 215.00 215.00 186.00 12917

NAV PS (ZARc) 6 752.74 6 666.16 6 426.34 5 691.47 4 871.49

3 Yr Beta 1.51 1.39 0.79 0.81 0.69 10764

Price Prd End 15 354 10 455 14 911 14 750 12 792

8612

Price High 15 880 15 360 18 111 19 361 13 773

Price Low 9 956 5 450 13 287 12 561 10 792 6460

2016 | 2017 | 2018 | 2019 | 2020 |

RATIOS

Ret on SH Fund 8.16 0.21 15.16 15.03 13.66 FINANCIAL STATISTICS

Ret on Tot Ass 7.46 5.36 4.79 6.48 5.10 (R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Debt:Equity 1.51 1.04 0.83 0.85 0.75 Interim Final Final(rst) Final Final

Solvency Mgn% 397.30 102.50 115.07 116.29 108.74 Turnover 15 374 22 370 26 180 24 231 21 940

Payouts:Prem 0.58 0.53 0.56 0.56 0.58 Op Inc 2 090 981 1 726 2 388 2 345

NetIntPd(Rcvd) 171 381 271 296 215

Tax 568 305 637 632 624

Minority Int 36 82 13 22 -

Att Inc 1 404 312 870 1 646 1 297

TotCompIncLoss 1 004 1 008 804 1 931 761

Hline Erngs-CO 1 345 517 1 433 1 466 1 553

Fixed Ass 8 028 8 198 7 196 6 290 5 466

Inv in Assoc 403 374 433 862 134

Inv & Loans 76 57 105 162 386

Def Tax Asset 66 63 108 100 174

Tot Curr Ass 16 371 13 534 13 136 12 120 11 994

Ord SH Int 12 593 11 583 11 573 11 641 10 542

G Geett OOuurr NNeeww A Apppp!! Minority Int 6 350 6 349 5 701 5 593 4 521

301

442

315

357

409

LT Liab

Tot Curr Liab 8 522 6 930 5 977 4 578 5 122

PER SHARE STATISTICS (cents per share)

Scan here EPS (ZARc) 639.00 142.20 396.50 750.30 591.40

HEPS-C (ZARc) 612.00 235.30 652.90 669.90 708.30

DPS (ZARc) - 174.00 423.00 395.00 379.00

For the informed South African investor NAV PS (ZARc) 5 855.00 5 393.00 5 365.00 5 376.20 4 875.90

RATIOS

Available from

Powered by Ret on SH Fnd 22.10 3.29 7.41 13.95 11.96

Ret On Tot Ass 15.54 3.04 7.02 10.59 11.83

113