Page 112 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 112

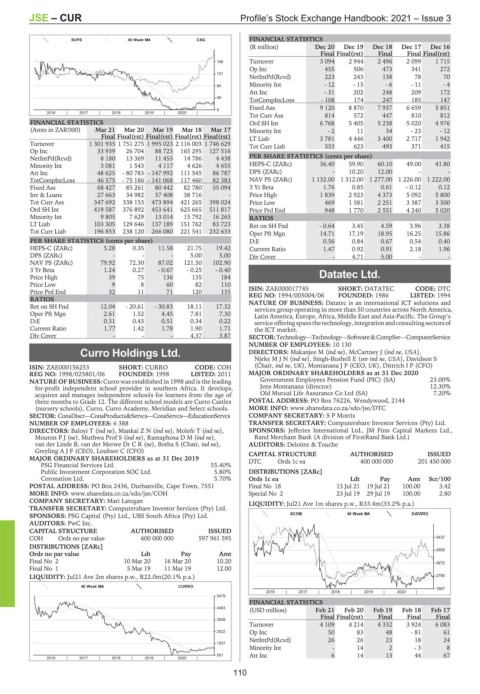

JSE – CUR Profile’s Stock Exchange Handbook: 2021 – Issue 3

SUPS 40 Week MA CSG FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

Final Final(rst) Final Final Final(rst)

Turnover 3 094 2 944 2 496 2 099 1 715

158

Op Inc 455 506 473 341 272

121

NetIntPd(Rcvd) 223 243 138 78 70

84 Minority Int - 12 - 15 - 6 - 11 - 4

Att Inc - 31 202 248 209 172

46

TotCompIncLoss - 108 174 247 185 147

Fixed Ass 9 120 8 870 7 937 6 659 5 851

9

2016 | 2017 | 2018 | 2019 | 2020 |

Tot Curr Ass 814 572 447 810 812

FINANCIAL STATISTICS Ord SH Int 6 768 5 405 5 238 5 020 4 976

(Amts in ZAR'000) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Minority Int - 2 11 34 - 23 - 12

Final Final(rst) Final(rst) Final(rst) Final(rst) LT Liab 3 781 4 446 3 400 2 717 1 942

Turnover 1 301 935 1 751 275 1 995 023 2 116 003 1 746 629 Tot Curr Liab 553 623 493 371 415

Op Inc 33 939 26 704 88 723 165 295 127 516

NetIntPd(Rcvd) 8 180 13 369 11 455 14 786 4 438 PER SHARE STATISTICS (cents per share)

Minority Int 3 081 1 543 4 117 4 626 4 655 HEPS-C (ZARc) 36.40 59.90 60.10 49.00 41.80

Att Inc 48 625 - 80 783 - 147 992 111 545 86 787 DPS (ZARc) - 10.20 12.00 - -

TotCompIncLoss 46 575 - 75 186 - 141 068 117 460 82 383 NAV PS (ZARc) 1 132.00 1 312.00 1 277.00 1 226.00 1 222.00

Fixed Ass 68 427 85 261 80 442 82 780 55 094 3 Yr Beta 1.76 0.85 0.61 - 0.12 0.12

Inv & Loans 27 663 34 982 37 408 38 716 - Price High 1 839 2 923 4 373 5 092 5 800

Tot Curr Ass 347 692 338 153 473 894 421 265 398 024 Price Low 469 1 581 2 251 3 387 3 500

Ord SH Int 419 587 376 892 453 641 625 665 511 817 Price Prd End 948 1 770 2 551 4 240 5 020

Minority Int 9 805 7 629 13 014 15 792 16 265 RATIOS

LT Liab 103 305 129 646 137 189 151 762 83 723 Ret on SH Fnd - 0.64 3.45 4.59 3.96 3.38

Tot Curr Liab 196 853 238 120 266 080 221 541 232 633 Oper Pft Mgn 14.71 17.19 18.95 16.25 15.86

PER SHARE STATISTICS (cents per share) D:E 0.56 0.84 0.67 0.54 0.40

HEPS-C (ZARc) 5.28 0.35 11.58 21.75 19.42 Current Ratio 1.47 0.92 0.91 2.18 1.96

DPS (ZARc) - - - 5.00 5.00 Div Cover - 4.71 5.00 - -

NAV PS (ZARc) 79.92 72.30 87.02 121.50 102.90

3 Yr Beta 1.24 0.27 - 0.67 - 0.25 - 0.40

Price High 39 75 136 135 184 Datatec Ltd.

Price Low 9 8 60 82 110 ISIN: ZAE000017745 SHORT: DATATEC CODE: DTC

DAT

Price Prd End 32 11 71 120 135 REG NO: 1994/005004/06 FOUNDED: 1986 LISTED: 1994

RATIOS NATURE OF BUSINESS: Datatec is an international ICT solutions and

Ret on SH Fnd 12.04 - 20.61 - 30.83 18.11 17.32 services group operating in more than 50 countries across North America,

Oper Pft Mgn 2.61 1.52 4.45 7.81 7.30 Latin America, Europe, Africa, Middle East and Asia-Pacific. The Group’s

D:E 0.31 0.43 0.51 0.34 0.22 service offering spansthe technology, integration andconsultingsectorsof

Current Ratio 1.77 1.42 1.78 1.90 1.71 the ICT market.

Div Cover - - - 4.37 3.87 SECTOR:Technology—Technology—Software&CompSer—ComputerService

NUMBER OF EMPLOYEES: 10 130

Curro Holdings Ltd. DIRECTORS: Makanjee M (ind ne), McCartney J (ind ne, USA),

NjekeMJN(ind ne), Singh-Bushell E (snr ind ne, USA), Davidson S

CUR

ISIN: ZAE000156253 SHORT: CURRO CODE: COH (Chair, ind ne, UK), Montanana J P (CEO, UK), Dittrich I P (CFO)

REG NO: 1998/025801/06 FOUNDED: 1998 LISTED: 2011 MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2020

NATURE OF BUSINESS: Curro was established in 1998 and is the leading Government Employees Pension Fund (PIC) (SA) 23.00%

for-profit independent school provider in southern Africa. It develops, Jens Montanana (director) 12.30%

acquires and manages independent schools for learners from the age of Old Mutual Life Assurance Co Ltd (SA) 7.20%

three months to Grade 12. The different school models are Curro Castles POSTAL ADDRESS: PO Box 76226, Wendywood, 2144

(nursery schools), Curro, Curro Academy, Meridian and Select schools. MORE INFO: www.sharedata.co.za/sdo/jse/DTC

SECTOR: ConsDiscr—ConsProducts&Servcs—ConsServcs—EducationServcs COMPANY SECRETARY: S P Morris

NUMBER OF EMPLOYEES: 6 388 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Baloyi T (ind ne), MankaiZN(ind ne), Molefe T (ind ne), SPONSORS: Jefferies International Ltd., JM Finn Capital Markets Ltd.,

MoutonPJ(ne), Muthwa Prof S (ind ne), RamaphosaDM(ind ne), Rand Merchant Bank (A division of FirstRand Bank Ltd.)

van der Linde B, van der Merwe DrCR(ne), Botha S (Chair, ind ne), AUDITORS: Deloitte & Touche

GreylingAJF (CEO), Loubser C (CFO) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 DTC Ords 1c ea 400 000 000 201 450 000

PSG Financial Services Ltd. 55.40%

Public Investment Corporation SOC Ltd. 5.80% DISTRIBUTIONS [ZARc]

Coronation Ltd. 5.70% Ords 1c ea Ldt Pay Amt Scr/100

POSTAL ADDRESS: PO Box 2436, Durbanville, Cape Town, 7551 Final No 18 13 Jul 21 19 Jul 21 100.00 3.42

MORE INFO: www.sharedata.co.za/sdo/jse/COH Special No 2 23 Jul 19 29 Jul 19 100.00 2.80

COMPANY SECRETARY: Mari Lategan LIQUIDITY: Jul21 Ave 1m shares p.w., R33.4m(33.2% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSORS: PSG Capital (Pty) Ltd., UBS South Africa (Pty) Ltd. SCOM 40 Week MA DATATEC

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

COH Ords no par value 600 000 000 597 961 595 5437

DISTRIBUTIONS [ZARc]

4555

Ords no par value Ldt Pay Amt

Final No 2 10 Mar 20 16 Mar 20 10.20 3672

Final No 1 5 Mar 19 11 Mar 19 12.00

LIQUIDITY: Jul21 Ave 2m shares p.w., R22.0m(20.1% p.a.) 2790

40 Week MA CURRO

1907

2016 | 2017 | 2018 | 2019 | 2020 |

5479

FINANCIAL STATISTICS

4493

(USD million) Feb 21 Feb 20 Feb 19 Feb 18 Feb 17

Final Final(rst) Final Final Final

3508

Turnover 4 109 4 214 4 332 3 924 6 083

2522 Op Inc 50 83 48 - 81 61

NetIntPd(Rcvd) 26 26 23 18 24

1537

Minority Int - 14 2 - 3 8

551 Att Inc 6 14 13 44 67

2016 | 2017 | 2018 | 2019 | 2020 |

110