Page 113 - Profile's Stock Exchange Handbook - 2021 Issue 3

P. 113

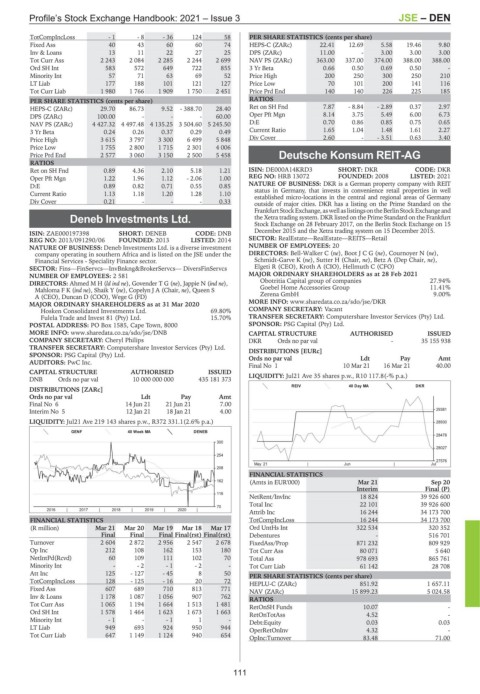

Profile’s Stock Exchange Handbook: 2021 – Issue 3 JSE – DEN

TotCompIncLoss - 1 - 8 - 36 124 58 PER SHARE STATISTICS (cents per share)

Fixed Ass 40 43 60 60 74 HEPS-C (ZARc) 22.41 12.69 5.58 19.46 9.80

Inv & Loans 13 11 22 27 25 DPS (ZARc) 11.00 - 3.00 3.00 3.00

Tot Curr Ass 2 243 2 084 2 285 2 244 2 699 NAV PS (ZARc) 363.00 337.00 374.00 388.00 388.00

Ord SH Int 583 572 649 722 855 3 Yr Beta 0.66 0.50 0.69 0.50 -

Minority Int 57 71 63 69 52 Price High 200 250 300 250 210

LT Liab 177 188 101 121 127 Price Low 70 101 200 141 116

Tot Curr Liab 1 980 1 766 1 909 1 750 2 451 Price Prd End 140 140 226 225 185

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 29.70 86.73 9.52 - 388.70 28.40 Ret on SH Fnd 7.87 - 8.84 - 2.89 0.37 2.97

DPS (ZARc) 100.00 - - - 60.00 Oper Pft Mgn 8.14 3.75 5.49 6.00 6.73

NAV PS (ZARc) 4 427.32 4 497.48 4 135.25 3 504.60 5 245.50 D:E 0.70 0.86 0.85 0.75 0.65

3 Yr Beta 0.24 0.26 0.37 0.29 0.49 Current Ratio 1.65 1.04 1.48 1.61 2.27

Price High 3 615 3 797 3 300 6 499 5 848 Div Cover 2.60 - - 3.51 0.63 3.40

Price Low 1 755 2 800 1 715 2 301 4 006

Price Prd End 2 577 3 060 3 150 2 500 5 458 Deutsche Konsum REIT-AG

RATIOS DEU

Ret on SH Fnd 0.89 4.36 2.10 5.18 1.21 ISIN: DE000A14KRD3 SHORT: DKR CODE: DKR

Oper Pft Mgn 1.22 1.96 1.12 - 2.06 1.00 REG NO: HRB 13072 FOUNDED: 2008 LISTED: 2021

D:E 0.89 0.82 0.71 0.55 0.85 NATURE OF BUSINESS: DKR is a German property company with REIT

Current Ratio 1.13 1.18 1.20 1.28 1.10 status in Germany, that invests in convenience retail properties in well

established micro-locations in the central and regional areas of Germany

Div Cover 0.21 - - - 0.33

outside of major cities. DKR has a listing on the Prime Standard on the

FrankfurtStockExchange,aswellaslistingsontheBerlinStockExchangeand

Deneb Investments Ltd. the Xetra trading system. DKR listed on the Prime Standard on the Frankfurt

Stock Exchange on 28 February 2017, on the Berlin Stock Exchange on 15

DEN

ISIN: ZAE000197398 SHORT: DENEB CODE: DNB December 2015 and the Xetra trading system on 15 December 2015.

REG NO: 2013/091290/06 FOUNDED: 2013 LISTED: 2014 SECTOR: RealEstate—RealEstate—REITS—Retail

NATURE OF BUSINESS: Deneb Investments Ltd. is a diverse investment NUMBER OF EMPLOYEES: 20

company operating in southern Africa and is listed on the JSE under the DIRECTORS: Bell-Walker C (ne), BootJCG(ne), Cournoyer N (ne),

Financial Services - Speciality Finance sector. Schmidt-Garve K (ne), Sutter H (Chair, ne), Betz A (Dep Chair, ne),

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs— DiversFinServcs Elgeti R (CEO), Kroth A (CIO), Hellmuth C (CFO)

NUMBER OF EMPLOYEES: 2 581 MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021

DIRECTORS: Ahmed M H (ld ind ne), Govender T G (ne), Jappie N (ind ne), Obotritia Capital group of companies 27.94%

Mahloma F K (ind ne), Shaik Y (ne), Copelyn J A (Chair, ne), Queen S Goebel Home Accessories Group 11.41%

A(CEO),Duncan D (COO),WegeG(FD) Zerena GmbH 9.00%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 MORE INFO: www.sharedata.co.za/sdo/jse/DKR

Hosken Consolidated Investments Ltd. 69.80% COMPANY SECRETARY: Vacant

Fulela Trade and Invest 81 (Pty) Ltd. 15.70% TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

POSTAL ADDRESS: PO Box 1585, Cape Town, 8000 SPONSOR: PSG Capital (Pty) Ltd.

MORE INFO: www.sharedata.co.za/sdo/jse/DNB CAPITAL STRUCTURE AUTHORISED ISSUED

COMPANY SECRETARY: Cheryl Philips DKR Ords no par val - 35 155 938

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: PSG Capital (Pty) Ltd. DISTRIBUTIONS [EURc] Ldt Pay Amt

Ords no par val

AUDITORS: PwC Inc.

Final No 1 10 Mar 21 16 Mar 21 40.00

CAPITAL STRUCTURE AUTHORISED ISSUED

DNB Ords no par val 10 000 000 000 435 181 373 LIQUIDITY: Jul21 Ave 35 shares p.w., R10 117.8(-% p.a.)

REIV 40 Day MA DKR

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt

Final No 6 14 Jun 21 21 Jun 21 7.00

Interim No 5 12 Jan 21 18 Jan 21 4.00 29381

LIQUIDITY: Jul21 Ave 219 143 shares p.w., R372 331.1(2.6% p.a.) 28930

GENF 40 Week MA DENEB

28478

300

28027

254

27576

May 21 | Jun | Jul

208

FINANCIAL STATISTICS

162 (Amts in EUR'000) Mar 21 Sep 20

Interim Final (P)

116

NetRent/InvInc 18 824 39 926 600

Total Inc 22 101 39 926 600

70

2016 | 2017 | 2018 | 2019 | 2020 |

Attrib Inc 16 244 34 173 700

FINANCIAL STATISTICS TotCompIncLoss 16 244 34 173 700

(R million) Mar 21 Mar 20 Mar 19 Mar 18 Mar 17 Ord UntHs Int 322 534 320 352

Final Final Final Final(rst) Final(rst) Debentures - 516 701

Turnover 2 604 2 872 2 956 2 547 2 678 FixedAss/Prop 871 232 809 929

Op Inc 212 108 162 153 180 Tot Curr Ass 80 071 5 640

NetIntPd(Rcvd) 60 109 111 102 70 Total Ass 978 693 865 761

Minority Int - - 2 - 1 - 2 - Tot Curr Liab 61 142 28 708

Att Inc 125 - 127 - 45 8 50 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 128 - 125 - 16 20 72 HEPLU-C (ZARc) 851.92 1 657.11

Fixed Ass 607 689 710 813 771 NAV (ZARc) 15 899.23 5 024.58

Inv & Loans 1 178 1 087 1 056 907 762 RATIOS

Tot Curr Ass 1 065 1 194 1 664 1 513 1 481 RetOnSH Funds 10.07 -

Ord SH Int 1 578 1 464 1 623 1 673 1 663 RetOnTotAss 4.52 -

Minority Int - 1 - - 1 1 - Debt:Equity 0.03 0.03

LT Liab 949 693 924 950 944 OperRetOnInv 4.32 -

Tot Curr Liab 647 1 149 1 124 940 654

OpInc:Turnover 83.48 71.00

111