Page 89 - 2021 Issue 2

P. 89

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – ALL

DIRECTORS: Leeming M J (Chair, ind ne),

Allied Electronics Corporation Ltd. Nyati M (CE), Miller C (CFO), BallAC(ne),

DawsonBW(ne), FrancisBJ(ind ne),

ALL

GelinkGG(ind ne), Mnganga Dr P (ind ne),

Sithole S (ne), Van GraanSW(ind ne),

VenterRE(ne)

POPULAR BRAND NAMES: Altron Security,

Altron TMT, Altron Nexus, Altron Nexus

Solutions, Altron Nexus Distributors, Altron

Scan the QR code to Nexus @Connect, Altron Systems Integration,

visit our Investor Altron Karabina, Netstar, Altron Document

ISIN: ZAE000191342 SHORT: ALTRON CODE: AEL Centre Solutions, Altron Managed Solutions, Altron

REG NO: 1947/024583/06 FOUNDED: 1965 LISTED: 1979 People Solutions, Altron Arrow, Altron

Healthcare, Altron Fintech

NATURE OF BUSINESS: POSTAL ADDRESS: PO Box 981, Houghton, 2041

Allied Electronics Corporation Ltd. (Altron) is domiciled in EMAIL: info@altron.com

South Africa and listed on the Johannesburg Stock Exchange WEBSITE: www.altron.com

(JSE). Altron is invested in the information and communica- TELEPHONE: 011-645-3600

tions technology sector (ICT). Altron’s solutions and services COMPANY SECRETARY: Nicole Morgan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

are clustered into the four segments of its ICT capabilities, SPONSOR: Investec Ltd.

namely Digital Transformation, Managed Services, regions AUDITORS: PwC Inc.

and own platforms. Altron creates value by providing innova- BANKERS: Absa Bank Ltd., Investec Bank Ltd., Nedbank Ltd., a division of

tive and end-to-end technology solutions to business, govern- Nedcor Bank Ltd., Rand Merchant Bank, a division of FirstRand Bank Ltd.,

ment and consumers. Altron has a direct presence in twelve The Standard Bank of South Africa Ltd.

SEGMENTAL REPORTING as at 31 Aug 20 (asa%of Revenue)

African countries (including the United Arab Emirates), Digital Transformation 78.56%

Australia and the United Kingdom. Altron has four regions Smart IoT 9.15%

beingSouthAfrica,AltronRestofAfrica,UnitedKingdomand Managed Services 8.26%

6.56%

Australia. The Altron head office is located in Johannesburg, Healthtech/Fintech -2.53%

Other

South Africa. Altron’s strategic partnerships with leading in-

ternational technology companies offers the group an indirect CALENDAR Expected Status

presence in several countries across Africa and the Middle Next Final Results May 2021 Confirmed

East. The Altron Group employs approximately 7 711 Annual General Meeting Jul 2021 Confirmed

employees globally. Next Interim Results Oct 2021 Confirmed

SECTOR:Technology—Technology—Software&CompSer—ComputerService

MAJOR ORDINARY SHAREHOLDERS as at 28 Feb 2021 CAPITAL STRUCTURE AUTHORISED ISSUED

Coronation Asset Management 25.14% AEL A ords no par value 500 000 000 401 883 022

Value Capital Partners 19.10% DISTRIBUTIONS [ZARc]

Biltron 13.98% A ords no par value Ldt Pay Amt

NOTES: Altron delisted the N ordinary shares from the JSE as of 4 April Special 11 May 21 17 May 21 96.00

2017.

Interim No 72 10 Nov 20 16 Nov 20 33.00

FINANCIAL STATISTICS Final No 71 2 Jun 20 8 Jun 20 26.00

(R million) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Interim No 70 12 Nov 19 18 Nov 19 29.00

Interim Final(rst) Final Final(rst) Final(rst)

Turnover 8 354 14 381 15 723 14 743 13 892 LIQUIDITY: Apr21 Ave 2m shares p.w., R44.5m(31.0% p.a.)

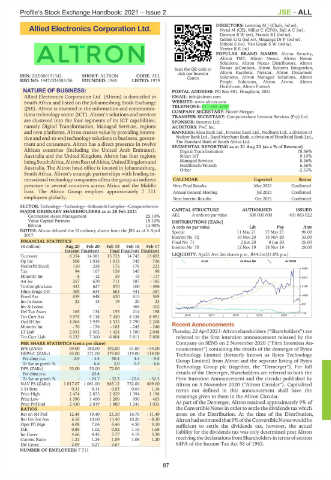

Op Inc 508 1 016 1 015 745 736 ELEE 40 Week MA ALTRON

NetIntPd(Rcvd) 110 228 176 178 223

3460

Tax 94 167 158 145 98

Minority Int - 8 - 12 39 - 19 - 117 2803

Att Inc 257 670 711 187 - 185

TotCompIncLoss 431 627 870 100 - 496 2146

Hline Erngs-CO 309 634 663 441 387

Fixed Ass 659 648 620 615 569 1489

Inv in Assoc 22 15 19 20 23

831

Inv & Loans - - - 468 302

Def Tax Asset 165 134 155 214 198 174

Tot Curr Ass 9 975 9 118 7 430 6 138 6 991 2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 4 064 3 939 3 535 2 790 2 268

Minority Int - 76 - 176 - 162 - 245 - 240 Recent Announcements

LT Liab 2 051 2 502 1 424 1 580 2 048 Thursday, 22 April 2021: Altron shareholders (“Shareholders”) are

Tot Curr Liab 8 233 7 360 6 804 5 811 5 808 referred to the firm intention announcement released by the

PER SHARE STATISTICS (cents per share) Company on SENS on 2 November 2020 (“Firm Intention An-

EPS (ZARc) 69.00 180.00 192.00 51.00 - 54.00 nouncement”) containing the details of the demerger of Bytes

HEPS-C (ZARc) 83.00 171.00 179.00 119.00 114.00 Technology Limited (formerly known as Bytes Technology

Pct chng p.a. - 2.9 - 4.5 50.4 4.4 - 9.5 Group Limited) from Altron and the separate listing of Bytes

Tr 5yr av grwth % - 6.6 2.0 0.4 - 6.6

DPS (ZARc) 33.00 55.00 72.00 - - Technology Group plc (together, the “Demerger”). For full

Pct chng p.a. - - 23.6 - - - details of the Demerger, Shareholders are referred to both the

Tr 5yr av grwth % - - 24.7 - 32.3 - 25.6 - 32.5 Firm Intention Announcement and the circular published by

NAV PS (ZARc) 1 017.07 1 061.00 885.12 752.00 669.00 Altron on 3 November 2020 (“Altron Circular”). Capitalised

3 Yr Beta 0.31 0.14 - 0.03 0.64 1.16 terms not defined in this announcement shall have the

Price High 2 474 2 875 2 029 1 394 1 198 meanings given to them in the Altron Circular.

Price Low 1 390 1 400 1 200 950 463

Price Prd End 2 430 2 019 1 880 1 245 1 035 As part of the Demerger, Altron retained approximately 9% of

RATIOS the Convertible Notes in order to settle the dividends tax which

Ret on SH Fnd 12.49 19.40 21.30 16.70 - 11.40 arose on the Distribution. At the time of the Distribution,

Ret On Tot Ass 6.58 10.60 13.40 10.20 - 8.30 Altronhad estimatedthat9%ofthe ConvertibleNoteswouldbe

Oper Pft Mgn 6.08 7.06 6.46 4.50 3.10 sufficient to settle the dividends tax, however, the actual

D:E 0.88 1.02 0.92 1.16 1.68

Int Cover 4.66 4.45 5.77 4.19 3.30 liability for the dividends tax was only determined post Altron

Current Ratio 1.21 1.24 1.09 1.06 1.20 receiving the declarations from Shareholders in terms of section

Div Cover 2.09 3.27 2.67 - - 64FA of the Income Tax Act 58 of 1962.

NUMBER OF EMPLOYEES: 7 711

87