Page 94 - 2021 Issue 2

P. 94

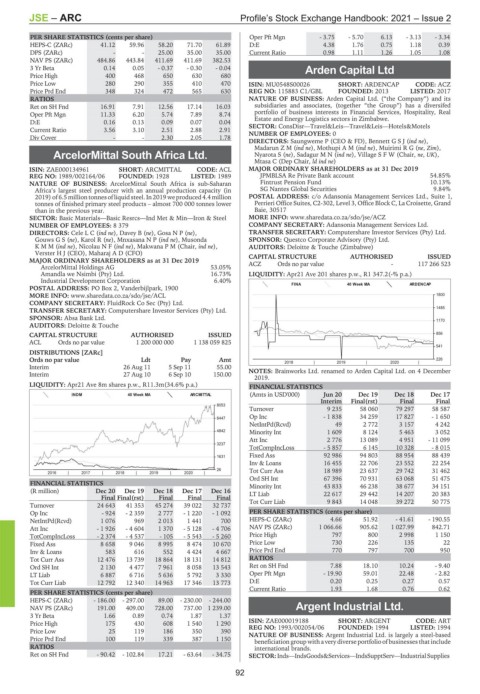

JSE – ARC Profile’s Stock Exchange Handbook: 2021 – Issue 2

PER SHARE STATISTICS (cents per share) Oper Pft Mgn - 3.75 - 5.70 6.13 - 3.13 - 3.34

HEPS-C (ZARc) 41.12 59.96 58.20 71.70 61.89 D:E 4.38 1.76 0.75 1.18 0.39

DPS (ZARc) - - 25.00 35.00 35.00 Current Ratio 0.98 1.11 1.26 1.05 1.08

NAV PS (ZARc) 484.86 443.84 411.69 411.69 382.53

3 Yr Beta 0.14 0.05 - 0.37 - 0.30 - 0.04 Arden Capital Ltd

Price High 400 468 650 630 680

ARD

Price Low 280 290 355 410 470 ISIN: MU0548S00026 SHORT: ARDENCAP CODE: ACZ

Price Prd End 348 324 472 565 630 REG NO: 115883 C1/GBL FOUNDED: 2013 LISTED: 2017

RATIOS NATURE OF BUSINESS: Arden Capital Ltd. (“the Company”) and its

Ret on SH Fnd 16.91 7.91 12.56 17.14 16.03 subsidiaries and associates, (together “the Group”) has a diversifed

Oper Pft Mgn 11.33 6.20 5.74 7.89 8.74 portfolio of business interests in Financial Services, Hospitality, Real

Estate and Energy Logistics sectors in Zimbabwe.

D:E 0.16 0.13 0.09 0.07 0.04 SECTOR: ConsDisr—Travel&Leis—Travel&Leis—Hotels&Motels

Current Ratio 3.56 3.10 2.51 2.88 2.91 NUMBER OF EMPLOYEES: 0

Div Cover - - 2.30 2.05 1.78

DIRECTORS: Saungweme P (CEO & FD), BennettGSJ(ind ne),

MadarunZM(ind ne), MothupiAM(ind ne), MuirimiRG(ne, Zim),

ArcelorMittal South Africa Ltd. Nyarota S (ne), SadagurMN(ind ne), VillageSFW (Chair, ne, UK),

Mtasa C (Dep Chair, ld ind ne)

ARC

ISIN: ZAE000134961 SHORT: ARCMITTAL CODE: ACL MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019

REG NO: 1989/002164/06 FOUNDED: 1928 LISTED: 1989 JPMBLSA Re Private Bank account 54.85%

NATURE OF BUSINESS: ArcelorMittal South Africa is sub-Saharan Fintrust Pension Fund 10.13%

Africa’s largest steel producer with an annual production capacity (in SG Nantes Global Securities 9.84%

2019) of 6.5 million tonnesof liquid steel. In 2019 we produced 4.4 million POSTAL ADDRESS: c/o Adansonia Management Services Ltd., Suite 1,

tonnes of finished primary steel products – almost 700 000 tonnes lower Perrieri Office Suites, C2-302, Level 3, Office Block C, La Croisette, Grand

than in the previous year. Baie, 30517

SECTOR: Basic Materials—Basic Resrcs—Ind Met & Min—Iron & Steel MORE INFO: www.sharedata.co.za/sdo/jse/ACZ

NUMBER OF EMPLOYEES: 8 379 COMPANY SECRETARY: Adansonia Management Services Ltd.

DIRECTORS: CeleLC(ind ne), Davey B (ne), GosaNP(ne), TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

GouwsGS(ne), Karol R (ne), MnxasanaNP(ind ne), Musonda SPONSOR: Questco Corporate Advisory (Pty) Ltd.

KMM(ind ne), NicolauNF(ind ne), Makwana P M (Chair, ind ne), AUDITORS: Deloitte & Touche (Zimbabwe)

Verster H J (CEO), Maharaj A D (CFO)

ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 CAPITAL STRUCTURE AUTHORISED - 117 266 523

Ords no par value

ACZ

ArcelorMittal Holdings AG 53.05%

Amandla we Nsimbi (Pty) Ltd. 16.73% LIQUIDITY: Apr21 Ave 201 shares p.w., R1 347.2(-% p.a.)

Industrial Development Corporation 6.40%

FINA 40 Week MA ARDENCAP

POSTAL ADDRESS: PO Box 2, Vanderbijlpark, 1900

MORE INFO: www.sharedata.co.za/sdo/jse/ACL 1800

COMPANY SECRETARY: FluidRock Co Sec (Pty) Ltd.

1485

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Absa Bank Ltd. 1170

AUDITORS: Deloitte & Touche

CAPITAL STRUCTURE AUTHORISED ISSUED 856

ACL Ords no par value 1 200 000 000 1 138 059 825

541

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 2018 | 2019 | 2020 | 226

Interim 26 Aug 11 5 Sep 11 55.00 NOTES: Brainworks Ltd. renamed to Arden Capital Ltd. on 4 December

Interim 27 Aug 10 6 Sep 10 150.00

2019.

LIQUIDITY: Apr21 Ave 8m shares p.w., R11.3m(34.6% p.a.) FINANCIAL STATISTICS

INDM 40 Week MA ARCMITTAL (Amts in USD'000) Jun 20 Dec 19 Dec 18 Dec 17

Interim Final(rst) Final Final

8053

Turnover 9 235 58 060 79 297 58 587

6447 Op Inc - 1 838 34 259 17 827 - 1 650

NetIntPd(Rcvd) 49 2 772 3 157 4 242

4842 Minority Int 1 609 8 124 5 463 3 052

Att Inc 2 776 13 089 4 951 - 11 099

3237

TotCompIncLoss - 5 857 6 145 10 328 - 8 015

1631 Fixed Ass 92 986 94 803 88 954 88 439

Inv & Loans 16 455 22 706 23 552 22 254

26 Tot Curr Ass 18 989 23 637 29 742 31 462

2016 | 2017 | 2018 | 2019 | 2020 |

Ord SH Int 67 396 70 931 63 068 51 475

FINANCIAL STATISTICS Minority Int 43 833 46 238 38 677 34 151

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 LT Liab 22 617 29 442 14 207 20 383

Final Final(rst) Final Final Final

Turnover 24 643 41 353 45 274 39 022 32 737 Tot Curr Liab 9 843 14 048 39 272 50 775

Op Inc - 924 - 2 359 2 777 - 1 220 - 1 092 PER SHARE STATISTICS (cents per share)

NetIntPd(Rcvd) 1 076 969 2 013 1 441 700 HEPS-C (ZARc) 4.66 51.92 - 41.61 - 190.55

Att Inc - 1 926 - 4 604 1 370 - 5 128 - 4 706 NAV PS (ZARc) 1 066.66 905.62 1 027.99 842.71

TotCompIncLoss - 2 374 - 4 537 - 105 - 5 543 - 5 260 Price High 797 800 2 998 1 150

Fixed Ass 8 658 9 046 8 995 8 474 10 670 Price Low 730 226 135 22

Inv & Loans 583 616 552 4 424 4 667 Price Prd End 770 797 700 950

Tot Curr Ass 12 476 13 739 18 864 18 131 14 812 RATIOS

Ord SH Int 2 130 4 477 7 961 8 058 13 543 Ret on SH Fnd 7.88 18.10 10.24 - 9.40

LT Liab 6 887 6 716 5 636 5 792 3 330 Oper Pft Mgn - 19.90 59.01 22.48 - 2.82

Tot Curr Liab 12 792 12 340 14 963 17 346 13 773 D:E 0.20 0.25 0.27 0.57

Current Ratio 1.93 1.68 0.76 0.62

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 186.00 - 297.00 89.00 - 230.00 - 244.00

NAV PS (ZARc) 191.00 409.00 728.00 737.00 1 239.00 Argent Industrial Ltd.

3 Yr Beta 1.66 0.89 0.74 1.87 1.37 ARG

CODE: ART

Price High 175 430 608 1 540 1 290 ISIN: ZAE000019188 SHORT: ARGENT LISTED: 1994

FOUNDED: 1994

REG NO: 1993/002054/06

Price Low 25 119 186 350 390 NATURE OF BUSINESS: Argent Industrial Ltd. is largely a steel-based

Price Prd End 100 119 339 387 1 150 beneficiation group with a very diverse portfolio of businesses that include

RATIOS international brands.

Ret on SH Fnd - 90.42 - 102.84 17.21 - 63.64 - 34.75 SECTOR:Inds—IndsGoods&Services—IndsSupptServ—IndustrialSupplies

92