Page 219 - 2021 Issue 2

P. 219

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – SIL

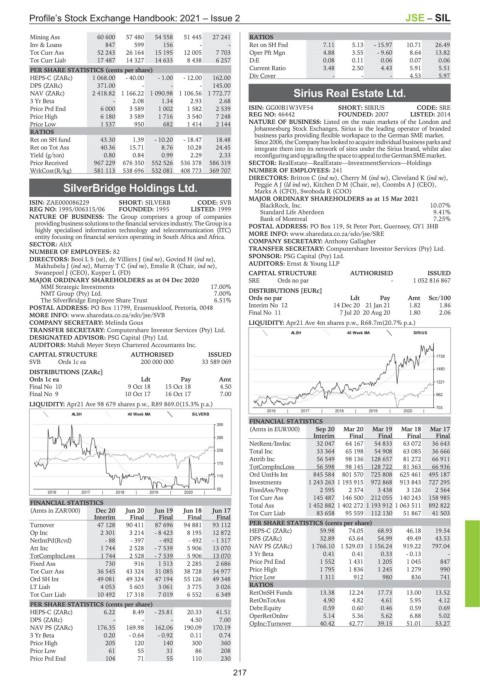

Mining Ass 60 600 57 480 54 558 51 445 27 241 RATIOS

Inv & Loans 847 599 156 - - Ret on SH Fnd 7.11 5.13 - 15.97 10.71 26.49

Tot Curr Ass 52 243 26 164 15 195 12 005 7 703 Oper Pft Mgn 4.88 3.55 - 9.60 8.64 13.82

Tot Curr Liab 17 487 14 327 14 633 8 438 6 257 D:E 0.08 0.11 0.06 0.07 0.06

PER SHARE STATISTICS (cents per share) Current Ratio 3.48 2.50 4.43 5.91 5.51

HEPS-C (ZARc) 1 068.00 - 40.00 - 1.00 - 12.00 162.00 Div Cover - - - 4.53 5.97

DPS (ZARc) 371.00 - - - 145.00

NAV (ZARc) 2 418.82 1 166.22 1 090.98 1 106.56 1 772.77 Sirius Real Estate Ltd.

3 Yr Beta - 2.08 1.34 2.93 2.68 SIR

Price Prd End 6 000 3 589 1 002 1 582 2 539 ISIN: GG00B1W3VF54 SHORT: SIRIUS CODE: SRE

Price High 6 180 3 589 1 716 3 540 7 248 REG NO: 46442 FOUNDED: 2007 LISTED: 2014

Price Low 1 537 950 682 1 414 2 144 NATURE OF BUSINESS: Listed on the main markets of the London and

Johannesburg Stock Exchanges, Sirius is the leading operator of branded

RATIOS business parks providing flexible workspace to the German SME market.

Ret on SH fund 43.30 1.39 - 10.20 - 18.47 18.48 Since 2006, the Company haslookedtoacquire individualbusinessparksand

Ret on Tot Ass 40.36 15.71 8.76 10.28 24.45 integrate them into its network of sites under the Sirius brand, whilst also

Yield (g/ton) 0.80 0.84 0.99 2.29 2.33 reconfiguringandupgradingthespacetoappealtotheGermanSMEmarket.

Price Received 967 229 676 350 552 526 536 378 586 319 SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

WrkCost(R/kg) 581 113 538 696 532 081 408 773 369 707 NUMBER OF EMPLOYEES: 241

DIRECTORS: Britton C (ind ne), Cherry M (ind ne), Cleveland K (ind ne),

SilverBridge Holdings Ltd. PeggieAJ(ld ind ne), Kitchen D M (Chair, ne), Coombs A J (CEO),

Marks A (CFO), Swoboda R (COO)

SIL MAJOR ORDINARY SHAREHOLDERS as at 15 Mar 2021

ISIN: ZAE000086229 SHORT: SILVERB CODE: SVB BlackRock, Inc. 10.07%

REG NO: 1995/006315/06 FOUNDED: 1995 LISTED: 1999 Standard Life Aberdeen 9.41%

NATURE OF BUSINESS: The Group comprises a group of companies Bank of Montreal 7.25%

providing business solutions to the financial services industry. The Group is a POSTAL ADDRESS: PO Box 119, St Peter Port, Guernsey, GY1 3HB

highly specialised information technology and telecommunication (ITC) MORE INFO: www.sharedata.co.za/sdo/jse/SRE

entity focusing on financial services operating in South Africa and Africa.

SECTOR: AltX COMPANY SECRETARY: Anthony Gallagher

NUMBER OF EMPLOYEES: 82 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: BooiLS(ne), de Villiers J (ind ne), Govind H (ind ne), SPONSOR: PSG Capital (Pty) Ltd.

Makhubela J (ind ne), MurrayTC(ind ne), Emslie R (Chair, ind ne), AUDITORS: Ernst & Young LLP

Swanepoel J (CEO), Kuyper L (FD) CAPITAL STRUCTURE AUTHORISED ISSUED

MAJOR ORDINARY SHAREHOLDERS as at 04 Dec 2020 SRE Ords no par - 1 052 816 867

MMI Strategic Investments 17.00% DISTRIBUTIONS [EURc]

NMT Group (Pty) Ltd. 7.00%

The SilverBridge Employee Share Trust 6.51% Ords no par Ldt Pay Amt Scr/100

POSTAL ADDRESS: PO Box 11799, Erasmuskloof, Pretoria, 0048 Interim No 12 14 Dec 20 21 Jan 21 1.82 1.86

MORE INFO: www.sharedata.co.za/sdo/jse/SVB Final No 11 7 Jul 20 20 Aug 20 1.80 2.06

COMPANY SECRETARY: Melinda Gous LIQUIDITY: Apr21 Ave 4m shares p.w., R68.7m(20.7% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ALSH 40 Week MA SIRIUS

DESIGNATED ADVISOR: PSG Capital (Pty) Ltd.

AUDITORS: Mahdi Meyer Steyn Chartered Accountants Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED 1739

SVB Ords 1c ea 200 000 000 33 589 069

1480

DISTRIBUTIONS [ZARc]

Ords 1c ea Ldt Pay Amt

1221

Final No 10 9 Oct 18 15 Oct 18 4.50

Final No 9 10 Oct 17 16 Oct 17 7.00 962

LIQUIDITY: Apr21 Ave 98 679 shares p.w., R89 869.0(15.3% p.a.)

703

2016 | 2017 | 2018 | 2019 | 2020 |

ALSH 40 Week MA SILVERB

FINANCIAL STATISTICS

355

(Amts in EUR'000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

Interim Final Final Final Final

295

NetRent/InvInc 32 047 64 167 54 833 63 072 36 643

235 Total Inc 33 364 65 198 54 908 63 085 36 666

Attrib Inc 56 549 98 136 128 657 81 272 66 911

175

TotCompIncLoss 56 598 98 145 128 722 81 363 66 936

115 Ord UntHs Int 845 584 801 570 725 808 625 461 495 187

Investments 1 243 263 1 193 915 972 868 913 843 727 295

55 FixedAss/Prop 2 595 2 374 3 438 3 126 2 564

2016 | 2017 | 2018 | 2019 | 2020 |

Tot Curr Ass 145 487 146 500 212 055 140 243 158 985

FINANCIAL STATISTICS Total Ass 1 452 882 1 402 272 1 193 912 1 063 511 892 822

(Amts in ZAR'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17 Tot Curr Liab 83 658 95 559 112 130 51 867 41 503

Interim Final Final Final Final

Turnover 47 128 90 411 87 696 94 881 93 112 PER SHARE STATISTICS (cents per share)

Op Inc 2 301 3 214 - 8 423 8 195 12 872 HEPS-C (ZARc) 59.98 74.05 68.93 46.18 19.54

NetIntPd(Rcvd) - 88 - 397 - 492 - 492 - 1 317 DPS (ZARc) 32.89 63.64 54.99 49.49 43.53

Att Inc 1 744 2 528 - 7 539 5 906 13 070 NAV PS (ZARc) 1 766.10 1 529.03 1 156.24 919.22 797.04

TotCompIncLoss 1 744 2 528 - 7 539 5 906 13 070 3 Yr Beta 0.41 0.41 0.33 - 0.13 -

Fixed Ass 730 916 1 513 2 285 2 686 Price Prd End 1 552 1 431 1 205 1 045 847

Tot Curr Ass 36 545 43 324 31 085 38 728 34 977 Price High 1 795 1 836 1 245 1 279 990

Ord SH Int 49 081 49 324 47 194 55 126 49 348 Price Low 1 311 912 980 836 741

LT Liab 4 053 5 603 3 061 3 775 3 026 RATIOS

Tot Curr Liab 10 492 17 318 7 019 6 552 6 349 RetOnSH Funds 13.38 12.24 17.73 13.00 13.52

RetOnTotAss 4.90 4.82 4.61 5.95 4.12

PER SHARE STATISTICS (cents per share) Debt:Equity 0.59 0.60 0.46 0.59 0.69

HEPS-C (ZARc) 6.22 8.49 - 25.81 20.33 41.51 OperRetOnInv 5.14 5.36 5.62 6.88 5.02

DPS (ZARc) - - - 4.50 7.00 OpInc:Turnover 40.42 42.77 39.15 51.01 53.27

NAV PS (ZARc) 176.35 169.98 162.06 190.09 170.19

3 Yr Beta 0.20 - 0.64 - 0.92 0.11 0.74

Price High 205 120 140 300 360

Price Low 61 55 31 86 208

Price Prd End 104 71 55 110 230

217