Page 187 - 2021 Issue 2

P. 187

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – OLD

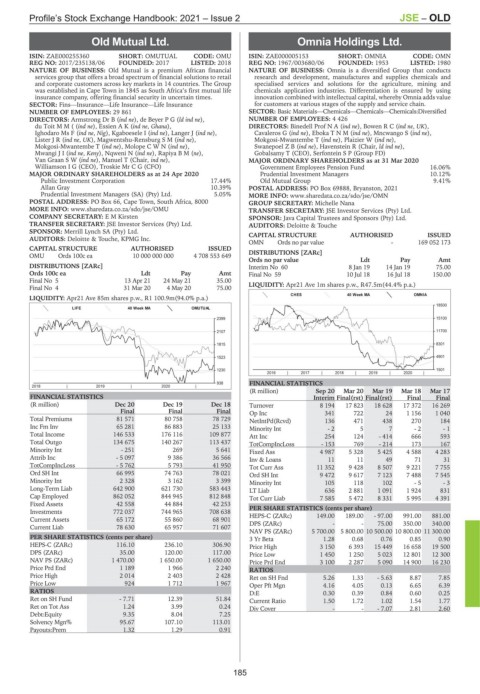

Old Mutual Ltd. Omnia Holdings Ltd.

OLD OMN

ISIN: ZAE000255360 SHORT: OMUTUAL CODE: OMU ISIN: ZAE000005153 SHORT: OMNIA CODE: OMN

REG NO: 2017/235138/06 FOUNDED: 2017 LISTED: 2018 REG NO: 1967/003680/06 FOUNDED: 1953 LISTED: 1980

NATURE OF BUSINESS: Old Mutual is a premium African financial NATURE OF BUSINESS: Omnia is a diversified Group that conducts

services group that offers a broad spectrum of financial solutions to retail research and development, manufactures and supplies chemicals and

and corporate customers across key markets in 14 countries. The Group specialised services and solutions for the agriculture, mining and

was established in Cape Town in 1845 as South Africa’s first mutual life chemicals application industries. Differentiation is ensured by using

insurance company, offering financial security in uncertain times. innovation combined with intellectual capital, whereby Omnia adds value

SECTOR: Fins—Insurance—Life Insurance—Life Insurance for customers at various stages of the supply and service chain.

NUMBER OF EMPLOYEES: 29 861 SECTOR: Basic Materials—Chemicals—Chemicals—Chemicals:Diversified

DIRECTORS: Armstrong Dr B (ind ne), de BeyerPG(ld ind ne), NUMBER OF EMPLOYEES: 4 426

du ToitMM((ind ne), EssienAK(ind ne, Ghana), DIRECTORS: Binedell ProfNA(ind ne), BowenRC(ind ne, UK),

Ighodaro Ms F (ind ne, Nig), Kgaboesele I (ind ne), Langer J (ind ne), Cavaleros G (ind ne), EbokaTNM(ind ne), Mncwango S (ind ne),

ListerJR(ind ne, UK), Magwentshu-RensburgSM(ind ne), Mokgosi-Mwantembe T (ind ne), Plaizier W (ind ne),

Mokgosi-Mwantembe T (ind ne), MolopeCWN(ind ne), SwanepoelZB(ind ne), Havenstein R (Chair, ld ind ne),

MwangiJI(ind ne, Keny), Nqweni N (ind ne), RapiyaBM(ne), Gobalsamy T (CEO), Serfontein S P (Group FD)

Van GraanSW(ind ne), Manuel T (Chair, ind ne), MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

Williamson I G (CEO), Troskie Mr C G (CFO) Government Employees Pension Fund 16.06%

MAJOR ORDINARY SHAREHOLDERS as at 24 Apr 2020 Prudential Investment Managers 10.12%

Public Investment Corporation 17.44% Old Mutual Group 9.41%

Allan Gray 10.39% POSTAL ADDRESS: PO Box 69888, Bryanston, 2021

Prudential Investment Managers (SA) (Pty) Ltd. 5.05% MORE INFO: www.sharedata.co.za/sdo/jse/OMN

POSTAL ADDRESS: PO Box 66, Cape Town, South Africa, 8000 GROUP SECRETARY: Michelle Nana

MORE INFO: www.sharedata.co.za/sdo/jse/OMU TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

COMPANY SECRETARY: E M Kirsten SPONSOR: Java Capital Trustees and Sponsors (Pty) Ltd.

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. AUDITORS: Deloitte & Touche

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: Deloitte & Touche, KPMG Inc. CAPITAL STRUCTURE AUTHORISED ISSUED

OMN Ords no par value - 169 052 173

CAPITAL STRUCTURE AUTHORISED ISSUED

OMU Ords 100c ea 10 000 000 000 4 708 553 649 DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt

DISTRIBUTIONS [ZARc] Interim No 60 8 Jan 19 14 Jan 19 75.00

Ords 100c ea Ldt Pay Amt Final No 59 10 Jul 18 16 Jul 18 150.00

Final No 5 13 Apr 21 24 May 21 35.00 LIQUIDITY: Apr21 Ave 1m shares p.w., R47.5m(44.4% p.a.)

Final No 4 31 Mar 20 4 May 20 75.00

CHES 40 Week MA OMNIA

LIQUIDITY: Apr21 Ave 85m shares p.w., R1 100.9m(94.0% p.a.)

18500

LIFE 40 Week MA OMUTUAL

2399 15100

2107 11700

1815 8301

1523 4901

1230 1501

2016 | 2017 | 2018 | 2019 | 2020 |

938 FINANCIAL STATISTICS

2018 | 2019 | 2020 |

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17

FINANCIAL STATISTICS Interim Final(rst) Final(rst) Final Final

(R million) Dec 20 Dec 19 Dec 18 Turnover 8 194 17 823 18 628 17 372 16 269

Final Final Final Op Inc 341 722 24 1 156 1 040

Total Premiums 81 571 80 758 78 729 NetIntPd(Rcvd) 136 471 438 270 184

Inc Fm Inv 65 281 86 883 25 133 Minority Int - 2 5 7 - 2 - 1

Total Income 146 533 176 116 109 877 Att Inc 254 124 - 414 666 593

Total Outgo 134 675 140 267 113 437 TotCompIncLoss - 153 769 - 214 173 167

Minority Int - 251 269 5 641 Fixed Ass 4 987 5 328 5 425 4 588 4 283

Attrib Inc - 5 097 9 386 36 566 Inv & Loans 11 11 49 71 31

TotCompIncLoss - 5 762 5 793 41 950 Tot Curr Ass 11 352 9 428 8 507 9 221 7 755

Ord SH Int 66 995 74 763 78 021 Ord SH Int 9 472 9 617 7 123 7 488 7 545

Minority Int 2 328 3 162 3 399 Minority Int 105 118 102 - 5 - 3

Long-Term Liab 642 900 621 730 583 443 LT Liab 636 2 881 1 091 1 924 831

Cap Employed 862 052 844 945 812 848 Tot Curr Liab 7 585 5 472 8 331 5 995 4 391

Fixed Assets 42 558 44 884 42 253

Investments 772 037 744 965 708 638 PER SHARE STATISTICS (cents per share) - 97.00 991.00 881.00

189.00

HEPS-C (ZARc)

149.00

Current Assets 65 172 55 860 68 901

Current Liab 78 630 65 957 71 607 DPS (ZARc) - - 75.00 350.00 340.00

NAV PS (ZARc) 5 700.00 5 800.00 10 500.00 10 800.00 11 300.00

PER SHARE STATISTICS (cents per share) 3 Yr Beta 1.28 0.68 0.76 0.85 0.90

HEPS-C (ZARc) 116.10 236.10 306.90 Price High 3 150 6 393 15 449 16 658 19 500

DPS (ZARc) 35.00 120.00 117.00 Price Low 1 450 1 250 5 023 12 801 12 300

NAV PS (ZARc) 1 470.00 1 650.00 1 650.00 Price Prd End 3 100 2 287 5 090 14 900 16 230

Price Prd End 1 189 1 966 2 240 RATIOS

Price High 2 014 2 403 2 428 Ret on SH Fnd 5.26 1.33 - 5.63 8.87 7.85

Price Low 924 1 712 1 967 Oper Pft Mgn 4.16 4.05 0.13 6.65 6.39

RATIOS D:E 0.30 0.39 0.84 0.60 0.25

Ret on SH Fund - 7.71 12.39 51.84 Current Ratio 1.50 1.72 1.02 1.54 1.77

Ret on Tot Ass 1.24 3.99 0.24 Div Cover - - - 7.07 2.81 2.60

Debt:Equity 9.35 8.04 7.25

Solvency Mgn% 95.67 107.10 113.01

Payouts:Prem 1.32 1.29 0.91

185