Page 188 - 2021 Issue 2

P. 188

JSE – ONE Profile’s Stock Exchange Handbook: 2021 – Issue 2

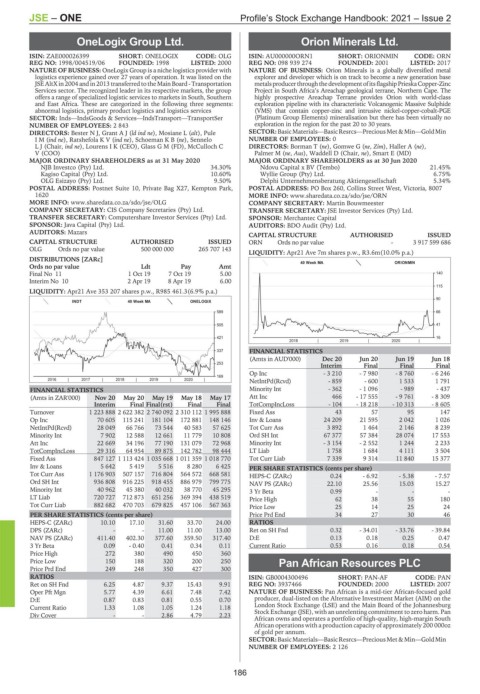

OneLogix Group Ltd. Orion Minerals Ltd.

ONE ORI

ISIN: ZAE000026399 SHORT: ONELOGIX CODE: OLG ISIN: AU000000ORN1 SHORT: ORIONMIN CODE: ORN

REG NO: 1998/004519/06 FOUNDED: 1998 LISTED: 2000 REG NO: 098 939 274 FOUNDED: 2001 LISTED: 2017

NATURE OF BUSINESS: OneLogix Group is a niche logistics provider with NATURE OF BUSINESS: Orion Minerals is a globally diversified metal

logistics experience gained over 27 years of operation. It was listed on the explorer and developer which is on track to become a new generation base

JSE AltX in 2004 and in 2013 transferred to the Main Board - Transportation metalsproducerthroughthedevelopmentofitsflagshipPrieskaCopper-Zinc

Services sector. The recognized leader in its respective markets, the group Project in South Africa’s Areachap geological terrane, Northern Cape. The

offers a range of specialized logistic services to markets in South, Southern highly prospective Areachap Terrane provides Orion with world-class

and East Africa. These are categorized in the following three segments: exploration pipeline with its characteristic Volcanogenic Massive Sulphide

abnormal logistics, primary product logistics and logistics services (VMS) that contain copper-zinc and intrusive nickel-copper-cobalt-PGE

SECTOR: Inds—IndsGoods & Services—IndsTransport—TransportSer (Platinum Group Elements) mineralisation but there has been virtually no

NUMBER OF EMPLOYEES: 2 843 exploration in the region for the past 20 to 30 years.

DIRECTORS: Bester N J, GrantAJ(ld ind ne), Mosiane L (alt), Pule SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

IM(ind ne), RatshefolaKV(ind ne), SchoemanKB(ne), Sennelo NUMBER OF EMPLOYEES: 0

L J (Chair, ind ne), Lourens I K (CEO), Glass G M (FD), McCulloch C DIRECTORS: Borman T (ne), Gomwe G (ne, Zim), Haller A (ne),

V (COO) Palmer M (ne, Aus), Waddell D (Chair, ne), Smart E (MD)

MAJOR ORDINARY SHAREHOLDERS as at 31 May 2020 MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020

NJB Investco (Pty) Ltd. 34.30% Ndovu Capital x BV (Tembo) 21.45%

Kagiso Capital (Pty) Ltd. 10.60% Wyllie Group (Pty) Ltd. 6.75%

OLG Esizayo (Pty) Ltd. 9.50% Delphi Unternehmensberatung Aktiengesellschaft 5.34%

POSTAL ADDRESS: Postnet Suite 10, Private Bag X27, Kempton Park, POSTAL ADDRESS: PO Box 260, Collins Street West, Victoria, 8007

1620 MORE INFO: www.sharedata.co.za/sdo/jse/ORN

MORE INFO: www.sharedata.co.za/sdo/jse/OLG COMPANY SECRETARY: Martin Bouwmeester

COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. SPONSOR: Merchantec Capital

SPONSOR: Java Capital (Pty) Ltd. AUDITORS: BDO Audit (Pty) Ltd.

AUDITORS: Mazars

CAPITAL STRUCTURE AUTHORISED ISSUED

CAPITAL STRUCTURE AUTHORISED ISSUED ORN Ords no par value - 3 917 599 686

OLG Ords no par value 500 000 000 265 707 143

LIQUIDITY: Apr21 Ave 7m shares p.w., R3.6m(10.0% p.a.)

DISTRIBUTIONS [ZARc]

40 Week MA ORIONMIN

Ords no par value Ldt Pay Amt

Final No 11 1 Oct 19 7 Oct 19 5.00 140

Interim No 10 2 Apr 19 8 Apr 19 6.00

115

LIQUIDITY: Apr21 Ave 353 207 shares p.w., R985 461.3(6.9% p.a.)

90

INDT 40 Week MA ONELOGIX

589 66

505 41

421 16

2018 | 2019 | 2020 |

337 FINANCIAL STATISTICS

(Amts in AUD'000) Dec 20 Jun 20 Jun 19 Jun 18

253

Interim Final Final Final

Op Inc - 3 210 - 7 980 - 8 760 - 6 246

169

2016 | 2017 | 2018 | 2019 | 2020 |

NetIntPd(Rcvd) - 859 - 600 1 533 1 791

FINANCIAL STATISTICS Minority Int - 362 - 1 096 - 989 - 437

(Amts in ZAR'000) Nov 20 May 20 May 19 May 18 May 17 Att Inc 466 - 17 555 - 9 761 - 8 309

Interim Final Final(rst) Final Final TotCompIncLoss - 104 - 18 218 - 10 313 - 8 605

Turnover 1 223 888 2 622 382 2 740 092 2 310 112 1 995 888 Fixed Ass 43 57 95 147

Op Inc 70 605 115 241 181 104 172 881 148 146 Inv & Loans 24 209 21 595 2 042 1 026

NetIntPd(Rcvd) 28 049 66 766 73 544 40 583 57 625 Tot Curr Ass 3 892 1 464 2 146 8 239

Minority Int 7 902 12 588 12 661 11 779 10 808 Ord SH Int 67 377 57 384 28 074 17 553

Att Inc 22 669 34 196 77 190 131 079 72 968 Minority Int - 3 154 - 2 552 1 244 2 233

TotCompIncLoss 29 316 64 954 89 875 142 782 98 444 LT Liab 1 758 1 684 4 111 3 504

Fixed Ass 847 127 1 113 424 1 035 668 1 011 359 1 018 770 Tot Curr Liab 7 339 9 314 11 840 15 377

Inv & Loans 5 642 5 419 5 516 8 280 6 425 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 1 176 903 507 157 716 804 564 572 668 581 HEPS-C (ZARc) 0.24 - 6.92 - 5.38 - 7.57

Ord SH Int 936 808 916 225 918 455 886 979 799 775 NAV PS (ZARc) 22.10 25.56 15.03 15.27

Minority Int 40 962 45 380 40 032 38 770 45 295 3 Yr Beta 0.99 - - -

LT Liab 720 727 712 873 651 256 369 394 438 519 Price High 62 38 55 180

Tot Curr Liab 882 682 470 703 679 825 457 106 567 363 Price Low 25 14 25 24

PER SHARE STATISTICS (cents per share) Price Prd End 34 27 30 46

HEPS-C (ZARc) 10.10 17.10 31.60 33.70 24.00 RATIOS

DPS (ZARc) - - 11.00 11.00 13.00 Ret on SH Fnd 0.32 - 34.01 - 33.76 - 39.84

NAV PS (ZARc) 411.40 402.30 377.60 359.50 317.40 D:E 0.13 0.18 0.25 0.47

3 Yr Beta 0.09 - 0.40 0.41 0.34 0.11 Current Ratio 0.53 0.16 0.18 0.54

Price High 272 380 490 450 360

Price Low 150 188 320 200 250 Pan African Resources PLC

Price Prd End 249 248 350 427 300

PAN

RATIOS ISIN: GB0004300496 SHORT: PAN-AF CODE: PAN

Ret on SH Fnd 6.25 4.87 9.37 15.43 9.91 REG NO: 3937466 FOUNDED: 2000 LISTED: 2007

Oper Pft Mgn 5.77 4.39 6.61 7.48 7.42 NATURE OF BUSINESS: Pan African is a mid-tier African-focused gold

D:E 0.87 0.83 0.81 0.55 0.70 producer, dual-listed on the Alternative Investment Market (AIM) on the

Current Ratio 1.33 1.08 1.05 1.24 1.18 London Stock Exchange (LSE) and the Main Board of the Johannesburg

Stock Exchange (JSE), with an unrelenting commitment to zero harm. Pan

Div Cover - - 2.86 4.79 2.23

African owns and operates a portfolio of high-quality, high-margin South

African operations with a production capacity of approximately 200 000oz

of gold per annum.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—GoldMin

NUMBER OF EMPLOYEES: 2 126

186