Page 182 - 2021 Issue 2

P. 182

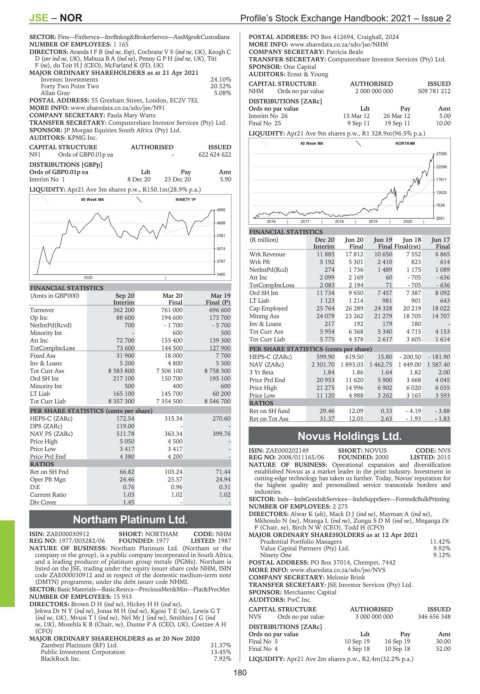

JSE – NOR Profile’s Stock Exchange Handbook: 2021 – Issue 2

SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians POSTAL ADDRESS: PO Box 412694, Craighall, 2024

NUMBER OF EMPLOYEES: 1 165 MORE INFO: www.sharedata.co.za/sdo/jse/NHM

DIRECTORS: Aranda I F B (ind ne, Esp), Cochrane V S (ind ne, UK), Keogh C COMPANY SECRETARY: Patricia Beale

D(snr ind ne, UK), Mabuza B A (ind ne), Penny G P H (ind ne, UK), Titi TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

F(ne), du Toit H J (CEO), McFarland K (FD, UK) SPONSOR: One Capital

MAJOR ORDINARY SHAREHOLDERS as at 21 Apr 2021 AUDITORS: Ernst & Young

Investec Investments 24.10%

Forty Two Point Two 20.52% CAPITAL STRUCTURE AUTHORISED ISSUED

Allan Gray 5.08% NHM Ords no par value 2 000 000 000 509 781 212

POSTAL ADDRESS: 55 Gresham Street, London, EC2V 7EL DISTRIBUTIONS [ZARc]

MORE INFO: www.sharedata.co.za/sdo/jse/N91 Ords no par value Ldt Pay Amt

COMPANY SECRETARY: Paula Mary Watts Interim No 26 15 Mar 12 26 Mar 12 5.00

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Final No 25 9 Sep 11 19 Sep 11 10.00

SPONSOR: JP Morgan Equities South Africa (Pty) Ltd. LIQUIDITY: Apr21 Ave 9m shares p.w., R1 328.9m(96.5% p.a.)

AUDITORS: KPMG Inc.

40 Week MA NORTHAM

CAPITAL STRUCTURE AUTHORISED ISSUED

N91 Ords of GBP0.01p ea - 622 624 622 27585

DISTRIBUTIONS [GBPp]

22598

Ords of GBP0.01p ea Ldt Pay Amt

Interim No 1 8 Dec 20 23 Dec 20 5.90 17611

LIQUIDITY: Apr21 Ave 3m shares p.w., R150.1m(28.9% p.a.)

12625

40 Week MA NINETY 1P

7638

4995

2651

2016 | 2017 | 2018 | 2019 | 2020 |

4688

FINANCIAL STATISTICS

4381

(R million) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final(rst) Final

4074

Wrk Revenue 11 885 17 812 10 650 7 552 6 865

3767 Wrk Pft 5 192 5 301 2 410 823 614

NetIntPd(Rcd) 274 1 736 1 489 1 175 1 089

3460

2020 | Att Inc 2 099 2 169 60 - 705 - 636

TotCompIncLoss 2 083 2 194 71 - 705 - 636

FINANCIAL STATISTICS

(Amts in GBP'000) Sep 20 Mar 20 Mar 19 Ord SH Int 11 734 9 650 7 457 7 387 8 092

Interim Final Final (P) LT Liab 1 123 1 214 981 901 643

Turnover 362 200 761 000 696 600 Cap Employed 25 764 26 289 24 328 20 219 18 022

Op Inc 88 600 194 600 173 700 Mining Ass 24 079 23 262 21 279 18 705 14 707

NetIntPd(Rcvd) 700 - 1 700 - 5 700 Inv & Loans 217 192 179 180 -

Minority Int - 600 500 Tot Curr Ass 5 954 6 368 5 340 4 715 4 153

Att Inc 72 700 155 400 139 300 Tot Curr Liab 5 775 4 378 2 617 3 605 1 614

TotCompIncLoss 73 600 144 500 127 900 PER SHARE STATISTICS (cents per share)

Fixed Ass 31 900 18 000 7 700 HEPS-C (ZARc) 599.90 619.50 15.80 - 200.50 - 181.90

Inv & Loans 5 200 4 800 5 300 NAV (ZARc) 2 301.70 1 893.03 1 462.75 1 449.00 1 587.40

Tot Curr Ass 8 583 800 7 506 100 8 758 300 3 Yr Beta 1.84 1.86 1.64 1.82 2.00

Ord SH Int 217 100 150 700 195 100 Price Prd End 20 953 11 620 5 900 3 668 4 045

Minority Int 500 400 600 Price High 21 275 14 996 6 902 6 020 6 035

LT Liab 165 100 145 700 60 200 Price Low 11 120 4 988 3 262 3 165 3 593

Tot Curr Liab 8 357 300 7 354 500 8 546 700 RATIOS

PER SHARE STATISTICS (cents per share) Ret on SH fund 29.46 12.09 0.33 - 4.19 - 3.88

HEPS-C (ZARc) 172.54 315.34 270.60 Ret on Tot Ass 31.37 12.05 2.63 - 1.93 - 1.83

DPS (ZARc) 119.00 - -

NAV PS (ZARc) 511.78 363.34 399.76 Novus Holdings Ltd.

Price High 5 050 4 500 -

NOV

Price Low 3 417 3 417 - ISIN: ZAE000202149 SHORT: NOVUS CODE: NVS

Price Prd End 4 380 4 200 - REG NO: 2008/011165/06 FOUNDED: 2000 LISTED: 2015

RATIOS NATURE OF BUSINESS: Operational expansion and diversification

Ret on SH Fnd 66.82 103.24 71.44 established Novus as a market leader in the print industry. Investment in

Oper Pft Mgn 24.46 25.57 24.94 cutting-edge technology has taken us further. Today, Novus' reputation for

D:E 0.76 0.96 0.31 the highest quality and personalised service transcends borders and

Current Ratio 1.03 1.02 1.02 industries.

Div Cover 1.45 - - SECTOR: Inds—IndsGoods&Services—IndsSupptServ—Forms&BulkPrinting

NUMBER OF EMPLOYEES: 2 275

DIRECTORS: Alwar K (alt), MackDJ(ind ne), Mayman A (ind ne),

Northam Platinum Ltd. Mkhondo N (ne), Mtanga L (ind ne), ZunguSDM(ind ne), Mnganga Dr

P (Chair, ne), Birch N W (CEO), Todd H (CFO)

NOR

ISIN: ZAE000030912 SHORT: NORTHAM CODE: NHM MAJOR ORDINARY SHAREHOLDERS as at 12 Apr 2021

REG NO: 1977/003282/06 FOUNDED: 1977 LISTED: 1987 Prudential Portfolio Managers 11.42%

NATURE OF BUSINESS: Northam Platinum Ltd. (Northam or the Value Capital Partners (Pty) Ltd. 9.92%

company or the group), is a public company incorporated in South Africa, Ninety One 9.12%

and a leading producer of platinum group metals (PGMs). Northam is POSTAL ADDRESS: PO Box 37014, Chempet, 7442

listed on the JSE, trading under the equity issuer share code NHM, ISIN MORE INFO: www.sharedata.co.za/sdo/jse/NVS

code ZAE000030912 and in respect of the domestic medium-term note COMPANY SECRETARY: Melonie Brink

(DMTN) programme, under the debt issuer code NHMI. TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd.

SECTOR:BasicMaterials—BasicResrcs—PreciousMet&Min—Plat&PrecMet SPONSOR: Merchantec Capital

NUMBER OF EMPLOYEES: 15 953 AUDITORS: PwC Inc.

DIRECTORS: BrownDH(ind ne), HickeyHH(ind ne),

Jekwa DrNY(ind ne), JonasMH(ind ne), KgosiTE(ne), Lewis G T CAPITAL STRUCTURE AUTHORISED ISSUED

(ind ne, UK), MvusiTI(ind ne), Nel Mr J (ind ne), SmithiesJG(ind NVS Ords no par value 3 000 000 000 346 656 348

ne, UK), Mosehla K B (Chair, ne), Dunne P A (CEO, UK), Coetzee A H DISTRIBUTIONS [ZARc]

(CFO) Ords no par value Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 20 Nov 2020 Final No 5 10 Sep 19 16 Sep 19 30.00

Zambezi Platinum (RF) Ltd. 31.37%

Public Investment Corporation 13.45% Final No 4 4 Sep 18 10 Sep 18 52.00

BlackRock Inc. 7.92% LIQUIDITY: Apr21 Ave 2m shares p.w., R2.4m(32.2% p.a.)

180