Page 189 - 2021 Issue 2

P. 189

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – PBT

DIRECTORS: HickeyHH(ind ne), MosololiTF(ind ne),

NeedhamCDS(ind ne), Themba Y (ind ne), Spencer K C

(Chair, ind ne), Loots C (CEO), Louw D (FD)

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2021

Allan Gray Investment Management 23.65%

PAR Gold (Pty) Ltd. 13.71%

Ruffer LLP 5.22%

POSTAL ADDRESS: PO Box 2768, Pinegowrie, 2123

MORE INFO: www.sharedata.co.za/sdo/jse/PAN

COMPANY SECRETARY: St James's Corporate Services

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Questco (Pty) Ltd.

AUDITORS: PwC LLP

CAPITAL STRUCTURE AUTHORISED ISSUED Looking for

PAN Ords GBP1p ea - 2 234 687 537

DISTRIBUTIONS [GBPp]

Ords GBP1p ea Ldt Pay Amt

Final No 10 1 Dec 20 15 Dec 20 0.69

Final No 9 10 Dec 19 30 Dec 19 0.12 great

LIQUIDITY: Apr21 Ave 20m shares p.w., R79.8m(46.7% p.a.) good

ALSH 40 Week MA PAN-AF

605

marketing

506

407

308

opportunities?

209

110

2016 | 2017 | 2018 | 2019 | 2020 |

NOTES: Pan-Af'spresentationcurrency changed for the financialyear ended

30 June 2019 to United States dollars ("USD") from pounds sterling

("GBP").

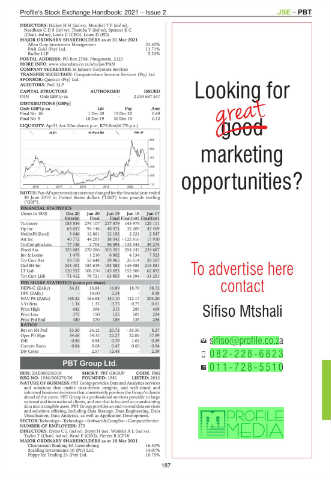

FINANCIAL STATISTICS

(Amts in ‘000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

Interim Final Final Final(rst) Final(rst)

Turnover 183 534 274 107 217 679 145 975 125 111

Op Inc 63 657 94 146 48 471 32 209 47 409

NetIntPd(Rcvd) 3 646 12 881 12 192 2 221 2 547

Att Inc 40 772 44 293 38 042 - 122 816 17 910

TotCompIncLoss 77 136 2 704 36 594 - 132 344 39 274

Fixed Ass 325 685 270 286 305 355 254 247 224 687

Inv & Loans 1 479 1 216 6 802 4 134 7 523

Tot Curr Ass 59 718 53 648 29 965 26 514 29 307

Ord SH Int 243 401 183 619 183 582 146 988 216 581

LT Liab 120 557 106 276 145 693 152 906 62 892 To advertise here

Tot Curr Liab 71 412 78 721 63 855 44 394 31 251

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 34.31 35.88 16.89 18.76 38.72 contact

DPS (ZARc) - 14.00 2.24 - 8.28

NAV PS (ZARc) 185.22 164.98 134.10 112.17 204.20

3 Yr Beta 1.34 1.33 0.75 0.75 0.61

Price High 642 398 215 285 469 Sifiso Mtshali

Price Low 375 150 125 105 224

Price Prd End 480 370 186 135 236

RATIOS

Ret on SH Fnd 33.50 24.12 20.72 - 83.56 8.27

Oper Pft Mgn 34.68 34.35 22.27 22.06 37.89

D:E 0.50 0.58 0.79 1.04 0.29 sifiso@profile.co.za

Current Ratio 0.84 0.68 0.47 0.60 0.94

Div Cover - 2.57 12.48 - 2.39

082-228-6823

PBT Group Ltd.

PBT 011-728-5510

ISIN: ZAE000256319 SHORT: PBT GROUP CODE: PBG

REG NO: 1936/008278/06 FOUNDED: 1981 LISTED: 2012

NATURE OF BUSINESS: PBT Group provides Data and Analytics services

and solutions that enable data-driven insights, and well-timed and

informed business decisions that consistently position the Group’s clients

ahead of the curve. PBT Group is a professional services provider to large

national and international clients, and one that is focused on transforming

data into a tangible asset. PBT Group provides an end-to-end data services

and solutions offering, including Data Strategy, Data Engineering, Data

Visualisation, Data Analytics, as well as Application Development.

SECTOR:Technology—Technology—Software&CompSer—ComputerService

NUMBER OF EMPLOYEES: 375

DIRECTORS: DyersCL(ind ne), Steyn H (ne), WinklerAL(ind ne),

Taylor T (Chair, ind ne), Read E (CEO), Pieters B (CFO)

MAJOR ORDINARY SHAREHOLDERS as at 10 Mar 2021

Clearstream Banking SA Luxembourg 16.33%

Spalding Investments 10 (Pty) Ltd. 14.07%

Poppy Ice Trading 23 (Pty) Ltd. 10.75%

187