Page 181 - 2021 Issue 2

P. 181

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – NIC

Nictus Ltd. Ninety One Ltd.

NIC NIN

ISIN: NA0009123481 ISIN: ZAE000282356 SHORT: NINETY 1L CODE: NY1

SHORT: NICTUS REG NO: 2019/526481/06 FOUNDED: 2019 LISTED: 2020

CODE: NCS NATURE OF BUSINESS: The Ninety One Group is a founder-led

REG NO: 1981/011858/06 independent global asset manager, established in South Africa in 1991

FOUNDED: 1964 with GBP119.0 billion of assets under management (“AUM”), as at 30

LISTED: 1969 September 2020. It primarily offers a range of highconviction, active

NATURE OF BUSINESS: Nictus Group is a retailer of household furniture, strategies to its sophisticated global client base.

electrical appliances and home electronics sold through the Nictus SECTOR: Fins—FinServcs—InvBnkng&BrokerServcs—AssMgrs&Custodians

Meubels brand as well as a short-term insurer through the Corporate NUMBER OF EMPLOYEES: 1 165

Guarantee brand. DIRECTORS: ArandaIFB(ind ne, Esp), CochraneVS(ind ne, UK),

SECTOR: ConsDiscr—Retail—Retailers—DiversifiedRetailers KeoghCD(snr ind ne, UK), MabuzaBA(ind ne), Titi F (ne), Penny G P

NUMBER OF EMPLOYEES: 42 H (Chair, ind ne, UK), du Toit H J (CEO), McFarland K (FD, UK)

DIRECTORS: de VryeCJ(ind ne), Martin S (ind ne), TrompNC(ne), MAJOR ORDINARY SHAREHOLDERS as at 02 Dec 2020

TrompPJdeW(ne), Willemse Prof B J (Chair, ind ne), Investec Investments Ltd. 26.87%

TrompGRdeV (Group MD), Prozesky H E (FD) Forty Two Point Two 20.00%

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 Coronation Asset Management (Pty) Ltd. 9.99%

Landswyd Beleggings (Pty) Ltd. 46.64% POSTAL ADDRESS: 36 Hans Strijdom Avenue, Foreshore, Cape Town,

Namprop (Pty) Ltd. 11.70% 8001

Trocor (Pty) Ltd. 10.66% MORE INFO: www.sharedata.co.za/sdo/jse/NY1

POSTAL ADDRESS: PO Box 2878, Randburg, 2125 COMPANY SECRETARY: Ninety One Africa (Pty) Ltd.

EMAIL: groupsec@nictus.com.na TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

WEBSITE: www.nictuslimited.co.za SPONSOR: JP Morgan Equities South Africa (Pty) Ltd.

TELEPHONE: 011-787-9019 FAX: 011-326-0863 AUDITORS: KPMG Inc.

COMPANY SECRETARY: Veritas Eksekuteurskamer (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

SPONSOR: One Capital NY1 Ords no par val. - 300 089 454

AUDITORS: PwC Inc. DISTRIBUTIONS [ZARc]

Ords no par val. Ldt Pay Amt

CAPITAL STRUCTURE AUTHORISED ISSUED

NCS Ords no par value 250 000 000 53 443 500 Interim No 1 8 Dec 20 23 Dec 20 119.00

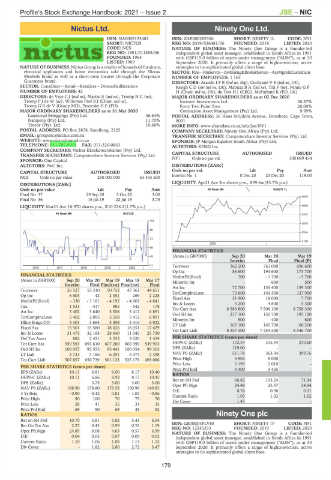

LIQUIDITY: Apr21 Ave 3m shares p.w., R99.6m(43.7% p.a.)

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt 40 Week MA NINETY 1L

Final No 37 29 Sep 20 5 Oct 20 3.00

Final No 36 16 Jul 19 22 Jul 19 3.75 4970

LIQUIDITY: Mar21 Ave 16 970 shares p.w., R10 224.2(1.7% p.a.) 4606

40 Week MA NICTUS 4242

100

3878

86

3514

72

3150

2020 |

59

FINANCIAL STATISTICS

45 (Amts in GBP'000) Sep 20 Mar 20 Mar 19

Interim Final Final (P)

31 Turnover 362 200 761 000 696 600

2016 | 2017 | 2018 | 2019 | 2020 |

Op Inc 88 600 194 600 173 700

FINANCIAL STATISTICS NetIntPd(Rcvd) 700 - 1 700 - 5 700

(Amts in ZAR'000) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Minority Int - 600 500

Interim Final Final(rst) Final(rst) Final

Turnover 26 527 53 310 50 752 47 361 44 651 Att Inc 72 700 155 400 139 300

Op Inc 6 603 42 2 351 269 2 228 TotCompIncLoss 73 600 144 500 127 900

18 000

7 700

31 900

Fixed Ass

NetIntPd(Rcvd) - 330 - 3 181 - 4 192 - 4 601 - 4 841 Inv & Loans 5 200 4 800 5 300

Tax 1 531 - 417 985 - 542 178 Tot Curr Ass 8 583 800 7 506 100 8 758 300

Att Inc 5 402 3 640 5 558 5 412 6 891 Ord SH Int 217 100 150 700 195 100

TotCompIncLoss 5 402 2 095 5 558 5 412 6 891

600

400

500

Hline Erngs-CO 5 401 3 664 5 508 5 416 6 922 Minority Int 165 100 145 700 60 200

LT Liab

Fixed Ass 15 501 15 580 18 026 18 051 17 629 Tot Curr Liab 8 357 300 7 354 500 8 546 700

Inv & Loans 31 475 32 168 28 640 11 340 25 730

Def Tax Asset 882 2 421 3 253 3 020 1 424 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 559 563 691 610 607 260 602 390 549 903 HEPS-C (ZARc) 172.54 315.34 270.60

Ord SH Int 100 957 95 555 95 441 100 054 99 303 DPS (ZARc) 119.00 - -

LT Liab 3 731 3 186 6 291 5 073 2 398 NAV PS (ZARc) 511.78 363.34 399.76

Tot Curr Liab 507 857 650 739 561 133 535 179 493 086 Price High 4 904 5 000 -

Price Low 3 199 2 010 -

PER SHARE STATISTICS (cents per share) Price Prd End 4 400 3 435 -

EPS (ZARc) 10.11 6.81 9.00 8.17 10.40 RATIOS

HEPS-C (ZARc) 10.11 6.86 8.92 8.17 10.45 Ret on SH Fnd 66.82 103.24 71.44

DPS (ZARc) - 3.75 3.00 3.00 3.00 Oper Pft Mgn 24.46 25.57 24.94

NAV PS (ZARc) 188.90 178.80 178.58 150.98 149.85 D:E 0.76 0.96 0.31

3 Yr Beta - 0.90 - 0.42 0.81 - 1.05 - 0.86 Current Ratio 1.03 1.02 1.02

Price High 90 100 70 75 70 Div Cover 1.45 - -

Price Low 28 41 35 31 35

Price Prd End 69 90 69 45 52

RATIOS Ninety One plc

Ret on SH Fnd 10.70 3.81 5.82 5.41 6.94 NIN

CODE: N91

Ret On Tot Ass 2.27 0.43 0.99 0.76 1.19 ISIN: GB00BJHPLV88 SHORT: NINETY 1P LISTED: 2020

REG NO: 12245293

FOUNDED: 2019

Oper Pft Mgn 24.89 0.08 4.63 0.57 4.99 NATURE OF BUSINESS: The Ninety One Group is a founder-led

D:E 0.04 0.03 0.07 0.05 0.02 independent global asset manager, established in South Africa in 1991

Current Ratio 1.10 1.06 1.08 1.13 1.12 with GBP119.0 billion of assets under management (“AUM”), as at 30

Div Cover - 1.82 2.80 2.72 3.47 September 2020. It primarily offers a range of highconviction, active

strategies to its sophisticated global client base.

179