Page 174 - 2021 Issue 2

P. 174

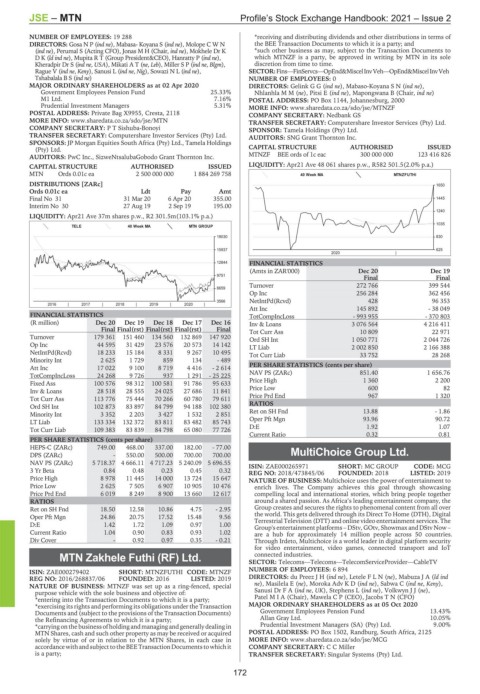

JSE – MTN Profile’s Stock Exchange Handbook: 2021 – Issue 2

NUMBER OF EMPLOYEES: 19 288 *receiving and distributing dividends and other distributions in terms of

DIRECTORS: Gosa N P (ind ne), Mabasa- Koyana S (ind ne), Molope C W N the BEE Transaction Documents to which it is a party; and

(ind ne), Perumal S (Acting CFO), Jonas M H (Chair, ind ne), Mokhele Dr K *such other business as may, subject to the Transaction Documents to

DK(ld ind ne), Mupita R T (Group President&CEO), Hanratty P (ind ne), which MTNZF is a party, be approved in writing by MTN in its sole

KheradpirDrS(ind ne, USA), Mikati A T (ne, Leb), Miller S P (ind ne, Blgm), discretion from time to time.

Rague V (ind ne, Keny), Sanusi L (ind ne, Nig), Sowazi N L (ind ne), SECTOR:Fins—FinServcs—OpEnd&MiscelInvVeh—OpEnd&MiscelInvVeh

Tshabalala B S (ind ne) NUMBER OF EMPLOYEES: 0

MAJOR ORDINARY SHAREHOLDERS as at 02 Apr 2020 DIRECTORS: GelinkGG(ind ne), Mabaso-KoyanaSN(ind ne),

Government Employees Pension Fund 25.33% NhlanhlaMM(ne), Pitsi E (ind ne), Mapongwana B (Chair, ind ne)

M1 Ltd. 7.16% POSTAL ADDRESS: PO Box 1144, Johannesburg, 2000

Prudential Investment Managers 5.31% MORE INFO: www.sharedata.co.za/sdo/jse/MTNZF

POSTAL ADDRESS: Private Bag X9955, Cresta, 2118 COMPANY SECRETARY: Nedbank GS

MORE INFO: www.sharedata.co.za/sdo/jse/MTN TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

COMPANY SECRETARY: P T Sishuba-Bonoyi SPONSOR: Tamela Holdings (Pty) Ltd.

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. AUDITORS: SNG Grant Thornton Inc.

SPONSORS: JP Morgan Equities South Africa (Pty) Ltd., Tamela Holdings

(Pty) Ltd. CAPITAL STRUCTURE AUTHORISED ISSUED

AUDITORS: PwC Inc., SizweNtsalubaGobodo Grant Thornton Inc. MTNZF BEE ords of 1c eac 300 000 000 123 416 826

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Apr21 Ave 48 061 shares p.w., R582 501.5(2.0% p.a.)

MTN Ords 0.01c ea 2 500 000 000 1 884 269 758 40 Week MA MTNZFUTHI

DISTRIBUTIONS [ZARc] 1650

Ords 0.01c ea Ldt Pay Amt

Final No 31 31 Mar 20 6 Apr 20 355.00 1445

Interim No 30 27 Aug 19 2 Sep 19 195.00

1240

LIQUIDITY: Apr21 Ave 37m shares p.w., R2 301.5m(103.1% p.a.)

1035

TELE 40 Week MA MTN GROUP

19030 830

15937 625

2020 |

12844 FINANCIAL STATISTICS

(Amts in ZAR'000) Dec 20 Dec 19

9751

Final Final

Turnover 272 766 399 544

6659

Op Inc 256 284 362 456

3566 NetIntPd(Rcvd) 428 96 353

2016 | 2017 | 2018 | 2019 | 2020 |

Att Inc 145 892 - 38 049

FINANCIAL STATISTICS TotCompIncLoss - 993 955 - 370 803

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Inv & Loans 3 076 564 4 216 411

Final Final(rst) Final(rst) Final(rst) Final Tot Curr Ass 10 809 22 971

Turnover 179 361 151 460 134 560 132 869 147 920 Ord SH Int 1 050 771 2 044 726

Op Inc 44 595 31 429 23 576 20 573 14 142 LT Liab 2 002 850 2 166 388

NetIntPd(Rcvd) 18 233 15 184 8 331 9 267 10 495 Tot Curr Liab 33 752 28 268

Minority Int 2 625 1 729 859 134 - 489

Att Inc 17 022 9 100 8 719 4 416 - 2 614 PER SHARE STATISTICS (cents per share)

TotCompIncLoss 24 268 9 726 937 1 291 - 25 225 NAV PS (ZARc) 851.40 1 656.76

Fixed Ass 100 576 98 312 100 581 91 786 95 633 Price High 1 360 2 200

Inv & Loans 28 518 28 555 24 025 27 686 11 841 Price Low 600 82

Tot Curr Ass 113 776 75 444 70 266 60 780 79 611 Price Prd End 967 1 320

Ord SH Int 102 873 83 897 84 799 94 188 102 380 RATIOS

Minority Int 3 352 2 203 3 427 1 532 2 851 Ret on SH Fnd 13.88 - 1.86

LT Liab 133 334 132 372 83 811 83 482 85 743 Oper Pft Mgn 93.96 90.72

Tot Curr Liab 109 383 83 839 84 798 65 080 77 726 D:E 1.92 1.07

Current Ratio 0.32 0.81

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 749.00 468.00 337.00 182.00 - 77.00

DPS (ZARc) - 550.00 500.00 700.00 700.00 MultiChoice Group Ltd.

NAV PS (ZARc) 5 718.37 4 666.11 4 717.23 5 240.09 5 696.55 ISIN: ZAE000265971 SHORT: MC GROUP CODE: MCG

MUL

3 Yr Beta 0.84 0.48 0.23 0.45 0.32 REG NO: 2018/473845/06 FOUNDED: 2018 LISTED: 2019

Price High 8 978 11 445 14 000 13 724 15 647 NATURE OF BUSINESS: Multichoice uses the power of entertainment to

Price Low 2 625 7 505 6 907 10 905 10 476 enrich lives. The Company achieves this goal through showcasing

Price Prd End 6 019 8 249 8 900 13 660 12 617 compelling local and international stories, which bring people together

RATIOS around a shared passion. As Africa’s leading entertainment company, the

Ret on SH Fnd 18.50 12.58 10.86 4.75 - 2.95 Group creates and secures the rights to phenomenal content from all over

Oper Pft Mgn 24.86 20.75 17.52 15.48 9.56 the world. This gets delivered through its Direct To Home (DTH), Digital

Terrestrial Television (DTT) and online video entertainment services. The

D:E 1.42 1.72 1.09 0.97 1.00 Group's entertainment platforms – DStv, GOtv, Showmax and DStv Now –

Current Ratio 1.04 0.90 0.83 0.93 1.02 are a hub for approximately 14 million people across 50 countries.

Div Cover - 0.92 0.97 0.35 - 0.21 Through Irdeto, Multichoice is a world leader in digital platform security

for video entertainment, video games, connected transport and IoT

connected industries.

MTN Zakhele Futhi (RF) Ltd. SECTOR: Telecoms—Telecoms—TelecomServiceProvider—CableTV

MTN

ISIN: ZAE000279402 SHORT: MTNZFUTHI CODE: MTNZF NUMBER OF EMPLOYEES: 6 894

REG NO: 2016/268837/06 FOUNDED: 2016 LISTED: 2019 DIRECTORS: du PreezJH(ind ne), LeteleFLN(ne), MabuzaJA(ld ind

NATURE OF BUSINESS: MTNZF was set up as a ring-fenced, special ne), Masilela E (ne), Moroka AdvKD(ind ne), Sabwa C (ind ne, Keny),

purpose vehicle with the sole business and objective of: Sanusi DrFA(ind ne, UK), Stephens L (ind ne), VolkwynJJ(ne),

*entering into the Transaction Documents to which it is a party; PatelMIA (Chair), Mawela C P (CEO), Jacobs T N (CFO)

*exercising its rights and performing its obligations under the Transaction MAJOR ORDINARY SHAREHOLDERS as at 05 Oct 2020

Documents and (subject to the provisions of the Transaction Documents) Government Employees Pension Fund 13.43%

the Refinancing Agreements to which it is a party; Allan Gray Ltd. 10.05%

*carrying on the business of holding andmanaging andgenerally dealing in Prudential Investment Managers (SA) (Pty) Ltd. 9.00%

MTN Shares, cash and such other property as may be received or acquired POSTAL ADDRESS: PO Box 1502, Randburg, South Africa, 2125

solely by virtue of or in relation to the MTN Shares, in each case in MORE INFO: www.sharedata.co.za/sdo/jse/MCG

accordancewithandsubjecttothe BEETransactionDocumentstowhich it COMPANY SECRETARY: C C Miller

is a party; TRANSFER SECRETARY: Singular Systems (Pty) Ltd.

172