Page 168 - 2021 Issue 2

P. 168

JSE – MER Profile’s Stock Exchange Handbook: 2021 – Issue 2

components. Metair was formed in 1948, becoming a supplier of

Merafe Resources Ltd. automotive components to a single OEM in South Africa in 1964. As

Metair has grown, our strategy has evolved to meet the challenges of

MER

ISIN: ZAE000060000 SHORT: MERAFE CODE: MRF competing in the global automotive industry.

REG NO: 1987/003452/06 FOUNDED: 1987 LISTED: 1988 SECTOR: Consumer Discretionary—Auto&Parts—Auto&Parts—Auto

NATURE OF BUSINESS: Merafe is listed on the JSE Ltd. in the General NUMBER OF EMPLOYEES: 9 287

Mining sector under the share code MRF. Currently, the main focus of DIRECTORS: Douwenga S (CEO & FD), Matthews B (ind ne),

Merafe's business is on the 20.5% participation of its wholly owned Mawasha B (ind ne), MgodusoTN(ld ind ne), Mkhondo N (ind ne),

subsidiary, Merafe Ferrochrome and Mining (Pty) Ltd., in the earnings before Molefe P (ind ne), MuellMH(ind ne), SithebeAK(ind ne),

interest,taxdepreciationandamortisation(EBITDA)oftheGlencore-Merafe Sithole S (ind ne), FlemmingCMD (Chair, ind ne),

Chrome Venture (the Venture), in which Glencore has a 79.5% participation. Pretorius S G (Chair, ind ne)

Merafe and Glencore South Africa operations (Glencore) formed the Venture MAJOR ORDINARY SHAREHOLDERS as at 11 Nov 2020

inJuly2004whenthecompaniespooledtheirchromeoperationstocreatethe Value Capital Partners (Pty) Ltd. 11.99%

largest ferrochrome producer in the world. Foord Asset Management (Pty) Ltd. 11.47%

SECTOR:BasicMaterials—BasicResrcs—IndMet&Min—GeneralMining Kagiso Asset Management (Pty) Ltd. 10.58%

NUMBER OF EMPLOYEES: 7 368 POSTAL ADDRESS: PO Box 2077, Saxonwold, 2132

DIRECTORS: Blankfield S (ne), Majova B (ind ne), McClaughlan MORE INFO: www.sharedata.co.za/sdo/jse/MTA

J(ind ne), MosweuMT(ne), Tlale K (ind ne), VusoMJ(ind ne), COMPANY SECRETARY: S M Vermaak

Mngomezulu A (Chair, ind ne), Matlala Z (CEO), Chocho D (FD)

MAJOR ORDINARY SHAREHOLDERS as at 05 Aug 2020 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

Glencore BV 28.68% SPONSOR: One Capital

Industrial Development Corporation of SA Ltd. 21.78% AUDITORS: PwC Inc.

PSG Konsult 6.64% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 652157, Benmore, 2010 MTA Ords no par value 400 000 000 198 985 886

MORE INFO: www.sharedata.co.za/sdo/jse/MRF DISTRIBUTIONS [ZARc]

COMPANY SECRETARY: CorpStat Governance Services Ords no par value Ldt Pay Amt

TRANSFER SECRETARY: JSE Investor Services (Pty) Ltd. Final No 69 13 Apr 21 19 Apr 21 75.00

SPONSOR: One Capital Sponsor Services (Pty) Ltd. Final No 68 15 Apr 19 23 Apr 19 100.00

AUDITORS: Deloitte & Touche

LIQUIDITY: Apr21 Ave 1m shares p.w., R24.2m(33.9% p.a.)

CAPITAL STRUCTURE AUTHORISED ISSUED

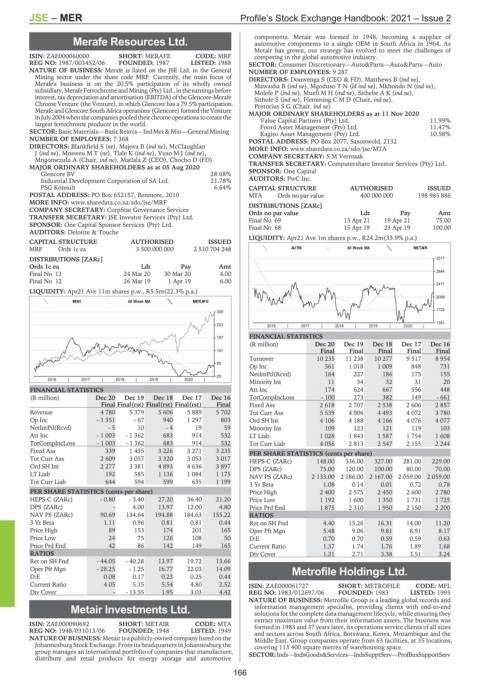

MRF Ords 1c ea 3 500 000 000 2 510 704 248 AUTM 40 Week MA METAIR

DISTRIBUTIONS [ZARc] 3217

Ords 1c ea Ldt Pay Amt

2844

Final No 13 24 Mar 20 30 Mar 20 4.00

Final No 12 26 Mar 19 1 Apr 19 6.00

2471

LIQUIDITY: Apr21 Ave 11m shares p.w., R5.5m(22.3% p.a.)

2098

MINI 40 Week MA MERAFE

1724

309

1351

253 2016 | 2017 | 2018 | 2019 | 2020 |

197 FINANCIAL STATISTICS

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

141 Final Final Final Final Final

Turnover 10 235 11 238 10 277 9 517 8 954

85

Op Inc 561 1 018 1 009 848 731

NetIntPd(Rcvd) 164 227 186 175 155

29

2016 | 2017 | 2018 | 2019 | 2020 |

Minority Int 11 34 32 31 20

FINANCIAL STATISTICS Att Inc 174 624 667 556 448

(R million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 TotCompIncLoss - 100 273 382 149 - 661

Final Final(rst) Final(rst) Final(rst) Final Fixed Ass 2 618 2 707 2 538 2 606 2 857

Revenue 4 780 5 379 5 606 5 889 5 702 Tot Curr Ass 5 539 4 906 4 493 4 072 3 780

Op Inc - 1 351 - 67 940 1 297 803 Ord SH Int 4 106 4 188 4 166 4 076 4 077

NetIntPd(Rcvd) - 5 10 - 4 19 59 Minority Int 109 123 121 119 103

Att Inc - 1 003 - 1 362 683 914 532 LT Liab 1 028 1 843 1 587 1 754 1 608

TotCompIncLoss - 1 003 - 1 362 683 914 532 Tot Curr Liab 4 056 2 813 2 547 2 155 2 244

Fixed Ass 339 1 435 3 226 3 271 3 235 PER SHARE STATISTICS (cents per share)

Tot Curr Ass 2 609 3 057 3 320 3 053 3 017 HEPS-C (ZARc) 148.00 336.00 327.00 281.00 229.00

Ord SH Int 2 277 3 381 4 893 4 636 3 897 DPS (ZARc) 75.00 120.00 100.00 80.00 70.00

LT Liab 192 585 1 136 1 084 1 175 NAV PS (ZARc) 2 133.00 2 186.00 2 167.00 2 059.00 2 059.00

Tot Curr Liab 644 594 599 635 1 199

3 Yr Beta 1.08 0.14 0.01 0.72 0.78

PER SHARE STATISTICS (cents per share) Price High 2 400 2 575 2 450 2 600 2 780

HEPS-C (ZARc) - 0.80 - 3.40 27.20 36.40 21.20 Price Low 1 192 1 600 1 350 1 731 1 725

DPS (ZARc) - 4.00 13.97 12.00 4.80 Price Prd End 1 875 2 310 1 950 2 150 2 200

NAV PS (ZARc) 90.69 134.64 194.88 184.63 155.22 RATIOS

3 Yr Beta 1.11 0.96 0.81 0.81 0.44 Ret on SH Fnd 4.40 15.26 16.31 14.00 11.20

Price High 89 153 174 201 165 Oper Pft Mgn 5.48 9.06 9.81 8.91 8.17

Price Low 24 75 126 108 50 D:E 0.70 0.70 0.59 0.59 0.63

Price Prd End 42 86 142 149 165 Current Ratio 1.37 1.74 1.76 1.89 1.68

RATIOS Div Cover 1.21 2.71 3.38 3.51 3.24

Ret on SH Fnd - 44.05 - 40.28 13.97 19.72 13.66

Oper Pft Mgn - 28.25 - 1.25 16.77 22.03 14.09 Metrofile Holdings Ltd.

D:E 0.08 0.17 0.23 0.25 0.44

MET

Current Ratio 4.05 5.15 5.54 4.80 2.52 ISIN: ZAE000061727 SHORT: METROFILE CODE: MFL

Div Cover - - 13.55 1.95 3.03 4.42 REG NO: 1983/012697/06 FOUNDED: 1983 LISTED: 1995

NATURE OF BUSINESS: Metrofile Group is a leading global records and

Metair Investments Ltd. information management specialist, providing clients with end-to-end

solutions for the complete data management lifecycle, while ensuring they

MET extract maximum value from their information assets. The business was

ISIN: ZAE000090692 SHORT: METAIR CODE: MTA formed in 1983 and 37 years later, its operations service clients of all sizes

REG NO: 1948/031013/06 FOUNDED: 1948 LISTED: 1949 and sectors across South Africa, Botswana, Kenya, Mozambique and the

NATURE OF BUSINESS:Metair is a publicly-owned company listed on the Middle East. Group companies operate from 63 facilities, at 35 locations,

Johannesburg Stock Exchange. From its headquarters in Johannesburg the covering 113 400 square metres of warehousing space.

group manages an international portfolio of companies that manufacture, SECTOR:Inds—IndsGoods&Services—IndsSupptServ—ProfBusSupportServ

distribute and retail products for energy storage and automotive

166