Page 164 - 2021 Issue 2

P. 164

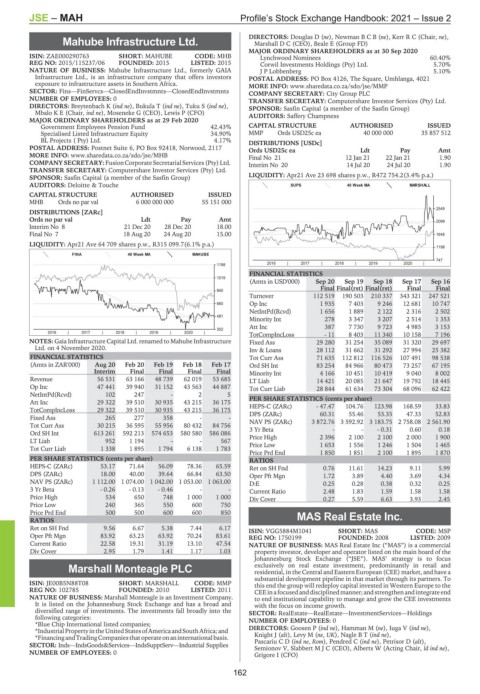

JSE – MAH Profile’s Stock Exchange Handbook: 2021 – Issue 2

DIRECTORS: Douglas D (ne), NewmanBCB(ne), Kerr R C (Chair, ne),

Mahube Infrastructure Ltd. Marshall D C (CEO), Beale E (Group FD)

MAH MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

ISIN: ZAE000290763 SHORT: MAHUBE CODE: MHB Lynchwood Nominees 60.40%

REG NO: 2015/115237/06 FOUNDED: 2015 LISTED: 2015 Corwil Investments Holdings (Pty) Ltd. 5.70%

NATURE OF BUSINESS: Mahube Infrastructure Ltd., formerly GAIA J P Lobbenberg 5.10%

Infrastructure Ltd., is an infrastructure company that offers investors POSTAL ADDRESS: PO Box 4126, The Square, Umhlanga, 4021

exposure to infrastructure assets in Southern Africa. MORE INFO: www.sharedata.co.za/sdo/jse/MMP

SECTOR: Fins—FinServcs—ClosedEndInvstmnts—ClosedEndInvstmnts COMPANY SECRETARY: City Group PLC

NUMBER OF EMPLOYEES: 0 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

DIRECTORS: Breytenbach K (ind ne), Bukula T (ind ne), Tuku S (ind ne), SPONSOR: Sasfin Capital (a member of the Sasfin Group)

Mbalo K E (Chair, ind ne), Moseneke G (CEO), Lewis P (CFO) AUDITORS: Saffery Champness

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020

Government Employees Pension Fund 42.43% CAPITAL STRUCTURE AUTHORISED ISSUED

Specialised Listed Infrastructure Equity 34.90% MMP Ords USD25c ea 40 000 000 35 857 512

BL Projects ( Pty) Ltd. 4.17% DISTRIBUTIONS [USDc]

POSTAL ADDRESS: Postnet Suite 6, PO Box 92418, Norwood, 2117 Ords USD25c ea Ldt Pay Amt

MORE INFO: www.sharedata.co.za/sdo/jse/MHB Final No 21 12 Jan 21 22 Jan 21 1.90

COMPANY SECRETARY:FusionCorporateSecretarialServices(Pty)Ltd. Interim No 20 14 Jul 20 24 Jul 20 1.90

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Sasfin Capital (a member of the Sasfin Group) LIQUIDITY: Apr21 Ave 23 698 shares p.w., R472 754.2(3.4% p.a.)

AUDITORS: Deloitte & Touche SUPS 40 Week MA MARSHALL

CAPITAL STRUCTURE AUTHORISED ISSUED

MHB Ords no par val 6 000 000 000 55 151 000

2549

DISTRIBUTIONS [ZARc]

Ords no par val Ldt Pay Amt 2099

Interim No 8 21 Dec 20 28 Dec 20 18.00

Final No 7 18 Aug 20 24 Aug 20 15.00 1648

LIQUIDITY: Apr21 Ave 64 709 shares p.w., R315 099.7(6.1% p.a.)

1198

FINA 40 Week MA MAHUBE

747

2016 | 2017 | 2018 | 2019 | 2020 |

1198

FINANCIAL STATISTICS

1019

(Amts in USD'000) Sep 20 Sep 19 Sep 18 Sep 17 Sep 16

Final Final(rst) Final(rst) Final Final

840

Turnover 112 519 190 503 210 337 343 321 247 521

660 Op Inc 1 935 7 403 9 246 12 681 10 747

NetIntPd(Rcvd) 1 656 1 889 2 122 2 316 2 502

481

Minority Int 278 3 347 3 207 2 514 1 353

Att Inc 387 7 730 9 723 4 985 3 153

302

2016 | 2017 | 2018 | 2019 | 2020 |

TotCompIncLoss - 11 8 403 11 340 10 158 7 196

NOTES: Gaia Infrastructure Capital Ltd. renamed to Mahube Infrastructure Fixed Ass 29 280 31 254 35 089 31 320 29 697

Ltd. on 4 November 2020. Inv & Loans 28 112 31 662 31 292 27 994 25 382

FINANCIAL STATISTICS Tot Curr Ass 71 635 112 812 116 526 107 491 98 538

(Amts in ZAR'000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17 Ord SH Int 83 254 84 966 80 473 73 257 67 195

Interim Final Final Final Final Minority Int 4 166 10 451 10 419 9 040 8 002

Revenue 56 531 63 166 48 739 62 019 53 685 LT Liab 14 421 20 085 21 647 19 792 18 445

Op Inc 47 441 39 940 31 152 43 563 44 887 Tot Curr Liab 28 844 61 634 73 304 68 096 62 422

NetIntPd(Rcvd) 102 247 - 2 5 PER SHARE STATISTICS (cents per share)

Att Inc 29 322 39 510 30 935 43 215 36 175

TotCompIncLoss 29 322 39 510 30 935 43 215 36 175 HEPS-C (ZARc) - 47.47 104.76 123.98 168.59 33.83

60.31

55.46

52.83

DPS (ZARc)

53.35

47.33

Fixed Ass 265 277 358 - - NAV PS (ZARc) 3 872.76 3 592.92 3 183.75 2 758.08 2 561.90

Tot Curr Ass 30 215 36 595 55 956 80 432 84 756

0.18

0.60

Ord SH Int 613 261 592 213 574 653 580 580 586 086 3 Yr Beta 2 396 - 2 100 - - 0.31 2 000 1 900

2 100

Price High

LT Liab 952 1 194 - - 567

Tot Curr Liab 1 338 1 895 1 794 6 138 1 783 Price Low 1 653 1 556 1 246 1 504 1 465

Price Prd End 1 850 1 851 2 100 1 895 1 870

PER SHARE STATISTICS (cents per share) RATIOS

HEPS-C (ZARc) 53.17 71.64 56.09 78.36 65.59 Ret on SH Fnd 0.76 11.61 14.23 9.11 5.99

DPS (ZARc) 18.00 40.00 39.64 66.84 63.50 Oper Pft Mgn 1.72 3.89 4.40 3.69 4.34

NAV PS (ZARc) 1 112.00 1 074.00 1 042.00 1 053.00 1 063.00 D:E 0.25 0.28 0.38 0.32 0.25

3 Yr Beta - 0.26 - 0.13 - 0.46 - - Current Ratio 2.48 1.83 1.59 1.58 1.58

Price High 534 650 748 1 000 1 000 Div Cover 0.27 5.59 6.63 3.93 2.45

Price Low 240 365 550 600 750

Price Prd End 500 500 600 600 850 MAS Real Estate Inc.

RATIOS

Ret on SH Fnd 9.56 6.67 5.38 7.44 6.17 ISIN: VGG5884M1041 SHORT: MAS CODE: MSP

MAS

Oper Pft Mgn 83.92 63.23 63.92 70.24 83.61 REG NO: 1750199 FOUNDED: 2008 LISTED: 2009

Current Ratio 22.58 19.31 31.19 13.10 47.54 NATURE OF BUSINESS: MAS Real Estate Inc (“MAS”) is a commercial

Div Cover 2.95 1.79 1.41 1.17 1.03 property investor, developer and operator listed on the main board of the

Johannesburg Stock Exchange (“JSE”). MAS’ strategy is to focus

Marshall Monteagle PLC exclusively on real estate investment, predominantly in retail and

residential, in the Central and Eastern European (CEE) market, and have a

MAR substantial development pipeline in that market through its partners. To

ISIN: JE00B5N88T08 SHORT: MARSHALL CODE: MMP this end the group will redeploy capital invested in Western Europe to the

REG NO: 102785 FOUNDED: 2010 LISTED: 2011 CEEinafocusedanddisciplinedmanner;andstrengthenandintegrate end

NATURE OF BUSINESS: Marshall Monteagle is an Investment Company. to end institutional capability to manage and grow the CEE investments

It is listed on the Johannesburg Stock Exchange and has a broad and with the focus on income growth.

diversified range of investments. The investments fall broadly into the SECTOR: RealEstate—RealEstate—InvestmentServices—Holdings

following categories: NUMBER OF EMPLOYEES: 0

*Blue Chip International listed companies; DIRECTORS: Goosen P (ind ne), Hamman M (ne), Iuga V (ind ne),

*IndustrialPropertyintheUnitedStatesofAmericaandSouthAfrica;and

*FinancingandTradingCompaniesthatoperateonaninternationalbasis. Knight J (alt), Levy M (ne, UK), NagleBT(ind ne),

SECTOR: Inds—IndsGoods&Services—IndsSupptServ—Industrial Supplies PascariuCD(ind ne, Rom), Pendred C (ind ne), Petrisor D (alt),

Semionov V, SlabbertMJC (CEO), Alberts W (Acting Chair, ld ind ne),

NUMBER OF EMPLOYEES: 0 Grigore I (CFO)

162