Page 166 - 2021 Issue 2

P. 166

JSE – MCM Profile’s Stock Exchange Handbook: 2021 – Issue 2

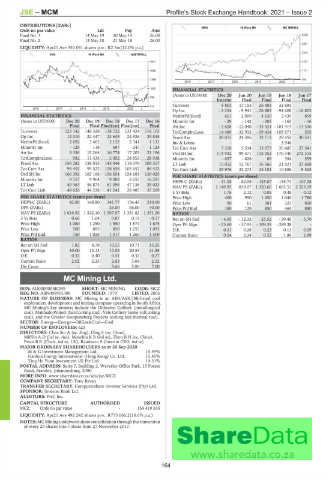

DISTRIBUTIONS [ZARc]

Ords no par value Ldt Pay Amt MINI 40 Week MA MC MINING

Final No 3 14 May 19 20 May 19 26.00 5338

Final No 2 15 May 18 21 May 18 26.00

4291

LIQUIDITY: Apr21 Ave 350 041 shares p.w., R2.5m(12.0% p.a.)

3244

IIND 40 Week MA MASTDRILL

1941 2197

1655 1151

1369 104

2016 | 2017 | 2018 | 2019 | 2020 |

1082 FINANCIAL STATISTICS

(Amts in USD'000) Dec 20 Jun 20 Jun 19 Jun 18 Jun 17

796

Interim Final Final Final Final

510 Turnover 8 803 17 155 26 403 32 693 -

2016 | 2017 | 2018 | 2019 | 2020 |

Op Inc - 2 254 - 9 941 - 28 883 - 94 608 - 16 803

FINANCIAL STATISTICS NetIntPd(Rcvd) 651 2 909 4 639 2 435 859

(Amts in USD'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 Minority Int - 29 - 142 - 305 - 165 - 16

Final Final Final(rst) Final(rst) Final Att Inc - 2 628 - 12 048 - 33 421 - 101 413 - 15 536

Turnover 123 142 148 328 138 722 121 424 118 103 TotCompIncLoss 14 489 - 32 932 - 39 434 - 103 971 505

Op Inc 12 310 22 447 23 649 24 926 25 845 Fixed Ass 28 015 24 396 32 713 29 452 30 531

NetIntPd(Rcvd) 2 692 3 462 2 122 2 341 1 131 Inv & Loans - - - 3 946 -

Minority Int - 129 118 697 247 1 124 Tot Curr Ass 7 318 5 534 13 073 20 487 27 541

Att Inc 3 336 15 264 16 774 17 203 21 196 Ord SH Int 114 932 99 571 132 052 170 340 272 315

TotCompIncLoss 982 11 434 5 492 24 853 28 938 Minority Int - 657 - 628 89 394 559

Fixed Ass 156 282 158 015 145 044 119 076 105 317 LT Liab 15 052 12 767 16 566 21 821 23 668

Tot Curr Ass 98 452 99 522 108 658 103 657 86 422 Tot Curr Liab 29 976 23 273 25 101 10 886 9 525

Ord SH Int 166 392 165 166 156 654 154 681 130 025 PER SHARE STATISTICS (cents per share)

Minority Int 9 757 9 964 9 002 8 255 16 291 HEPS-C (ZARc) - 31.08 - 82.06 - 125.07 - 155.74 - 107.38

LT Liab 40 363 56 873 61 096 47 136 29 023 NAV PS (ZARc) 1 149.95 839.07 1 320.66 1 662.51 2 523.19

Tot Curr Liab 48 626 44 228 41 241 28 485 37 269

3 Yr Beta 1.76 2.12 0.05 0.48 - 0.13

PER SHARE STATISTICS (cents per share) Price High 400 950 1 450 1 040 1 780

HEPS-C (ZARc) 42.80 148.80 141.77 154.43 210.00 Price Low 90 61 301 321 800

DPS (ZARc) - - 26.00 26.00 30.00 Price Prd End 180 129 850 465 880

NAV PS (ZARc) 1 616.92 1 542.10 1 567.97 1 331.82 1 351.20 RATIOS

3 Yr Beta 0.66 1.04 0.87 0.19 - 0.17 Ret on SH Fnd - 4.65 - 12.32 - 25.52 - 59.49 - 5.70

Price High 1 080 1 250 1 550 1 874 1 675 Oper Pft Mgn - 25.60 - 57.95 - 109.39 - 289.38 -

Price Low 500 895 850 1 255 1 093 D:E 0.31 0.28 0.23 0.13 0.09

Price Prd End 750 1 028 1 017 1 260 1 500 Current Ratio 0.24 0.24 0.52 1.88 2.89

RATIOS

Ret on SH Fnd 1.82 8.78 10.55 10.71 15.25

Oper Pft Mgn 10.00 15.13 17.05 20.53 21.88

D:E 0.32 0.40 0.41 0.32 0.27

Current Ratio 2.02 2.25 2.63 3.64 2.32

Div Cover - - 5.66 5.89 7.00

MC Mining Ltd.

MCM

ISIN: AU000000MCM9 SHORT: MC MINING CODE: MCZ

REG NO: ABN008905388 FOUNDED: 1979 LISTED: 2006

NATURE OF BUSINESS: MC Mining is an AIM/ASX/JSE-listed coal

exploration, development and mining company operating in South Africa.

MC Mining’s key projects include the Uitkomst Colliery (metallurgical

coal), Makhado Project (hard coking coal). Vele Colliery (semi-soft coking

coal), and the Greater Soutpansberg Projects (coking and thermal coal).

SECTOR: Energy—Energy—OilGas&Coal—Coal

NUMBER OF EMPLOYEES: 625

DIRECTORS: Chee Sin A (ne, Sing), Ding S (ne, China),

MifflinAD(ind ne, Aus), MosehlaKB(ind ne), ZhenBH(ne, China),

Pryor B R (Chair, ind ne, UK), Randazzo S (Interim CEO, ind ne)

MAJOR ORDINARY SHAREHOLDERS as at 30 Sep 2020

M & G Investment Management Ltd. 15.49%

Haohua Energy International (Hong Kong) Co. Ltd. 15.45%

Ying He Yuan Investment (S) Pte Ltd. 14.31%

POSTAL ADDRESS: Suite 7, Building 2, Waverley Office Park, 15 Forest

Road, Bramley, Johannesburg, 2090

MORE INFO: www.sharedata.co.za/sdo/jse/MCZ

COMPANY SECRETARY: Tony Bevan

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR: Investec Bank Ltd.

AUDITORS: PwC Inc.

CAPITAL STRUCTURE AUTHORISED ISSUED

MCZ Ords no par value - 154 419 555

LIQUIDITY: Apr21 Ave 492 242 shares p.w., R775 066.2(16.6% p.a.)

NOTES: MC Mining underwent share consolidationthrough the conversion

of every 20 shares into 1 share from 27 November 2017.

164