Page 107 - 2021 Issue 2

P. 107

Profile’s Stock Exchange Handbook: 2021 – Issue 2 JSE – BRI

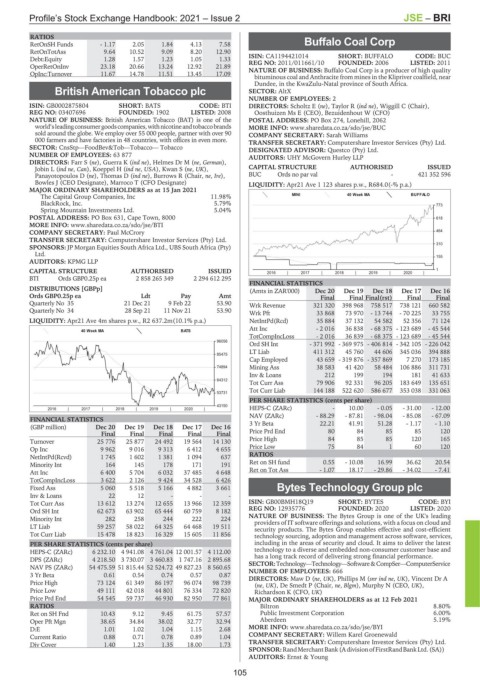

RATIOS

RetOnSH Funds - 1.17 2.05 1.84 4.13 7.58 Buffalo Coal Corp

RetOnTotAss 9.64 10.52 9.09 8.20 12.90 BUF

Debt:Equity 1.28 1.57 1.23 1.05 1.33 ISIN: CA1194421014 SHORT: BUFFALO CODE: BUC

OperRetOnInv 23.18 20.66 13.24 12.92 21.89 REG NO: 2011/011661/10 FOUNDED: 2006 LISTED: 2011

NATURE OF BUSINESS: Buffalo Coal Corp is a producer of high quality

OpInc:Turnover 11.67 14.78 11.51 13.45 17.09

bituminous coal and Anthracite from mines in the Klipriver coalfield, near

Dundee, in the KwaZulu-Natal province of South Africa.

British American Tobacco plc SECTOR: AltX

NUMBER OF EMPLOYEES: 2

BRI

ISIN: GB0002875804 SHORT: BATS CODE: BTI DIRECTORS: Scholtz E (ne), Taylor R (ind ne), Wiggill C (Chair),

REG NO: 03407696 FOUNDED: 1902 LISTED: 2008 Oosthuizen Ms E (CEO), Bezuidenhout W (CFO)

NATURE OF BUSINESS: British American Tobacco (BAT) is one of the POSTAL ADDRESS: PO Box 274, Lonehill, 2062

world’sleadingconsumergoodscompanies,withnicotineandtobaccobrands MORE INFO: www.sharedata.co.za/sdo/jse/BUC

sold around the globe. We employ over 55 000 people, partner with over 90 COMPANY SECRETARY: Sarah Williams

000 farmers and have factories in 48 countries, with offices in even more. TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SECTOR: CnsStp—FoodBev&Tob—Tobacco— Tobacco DESIGNATED ADVISOR: Questco (Pty) Ltd.

NUMBER OF EMPLOYEES: 63 877 AUDITORS: UHY McGovern Hurley LLP

DIRECTORS: Farr S (ne), Guerra K (ind ne), Helmes Dr M (ne, German),

Jobin L (ind ne, Can), Koeppel H (ind ne, USA), Kwan S (ne, UK), CAPITAL STRUCTURE AUTHORISED ISSUED

Panayotopoulos D (ne), Thomas D (ind ne), Burrows R (Chair, ne, Ire), BUC Ords no par val - 421 352 596

Bowles J (CEO Designate), Marroco T (CFO Designate) LIQUIDITY: Apr21 Ave 1 123 shares p.w., R684.0(-% p.a.)

MAJOR ORDINARY SHAREHOLDERS as at 15 Jan 2021

The Capital Group Companies, Inc 11.98% MINI 40 Week MA BUFFALO

BlackRock, Inc. 5.79% 773

Spring Mountain Investments Ltd. 5.04%

POSTAL ADDRESS: PO Box 631, Cape Town, 8000 618

MORE INFO: www.sharedata.co.za/sdo/jse/BTI

COMPANY SECRETARY: Paul McCrory 464

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

310

SPONSORS: JP Morgan Equities South Africa Ltd., UBS South Africa (Pty)

Ltd.

155

AUDITORS: KPMG LLP

CAPITAL STRUCTURE AUTHORISED ISSUED 2016 | 2017 | 2018 | 2019 | 2020 | 1

BTI Ords GBP0.25p ea 2 858 265 349 2 294 612 295

FINANCIAL STATISTICS

DISTRIBUTIONS [GBPp] (Amts in ZAR'000) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16

Ords GBP0.25p ea Ldt Pay Amt Final Final Final(rst) Final Final

Quarterly No 35 21 Dec 21 9 Feb 22 53.90 Wrk Revenue 321 320 398 968 758 517 738 121 660 582

Quarterly No 34 28 Sep 21 11 Nov 21 53.90

Wrk Pft 33 868 73 970 - 13 744 - 70 225 33 755

LIQUIDITY: Apr21 Ave 4m shares p.w., R2 637.2m(10.1% p.a.) NetIntPd(Rcd) 35 884 37 132 54 582 52 356 71 124

Att Inc - 2 016 36 838 - 68 375 - 123 689 - 45 544

40 Week MA BATS

TotCompIncLoss - 2 016 36 839 - 68 375 - 123 689 - 45 544

96056

Ord SH Int - 371 992 - 369 975 - 406 814 - 342 105 - 226 042

LT Liab 411 312 45 760 44 606 345 036 394 888

85475

Cap Employed 43 659 - 319 876 - 357 869 7 270 173 185

74894 Mining Ass 38 583 41 420 58 484 106 886 311 731

Inv & Loans 212 199 194 181 41 633

64312

Tot Curr Ass 79 906 92 331 96 205 183 649 135 651

Tot Curr Liab 144 188 522 620 586 677 353 038 331 063

53731

PER SHARE STATISTICS (cents per share)

43150 HEPS-C (ZARc) - 10.00 - 0.05 - 31.00 - 12.00

2016 | 2017 | 2018 | 2019 | 2020 |

NAV (ZARc) - 88.29 - 87.81 - 98.04 - 85.08 - 67.09

FINANCIAL STATISTICS

(GBP million) Dec 20 Dec 19 Dec 18 Dec 17 Dec 16 3 Yr Beta 22.21 41.91 51.28 - 1.17 - 1.10

Final Final Final Final Final Price Prd End 80 84 85 85 120

Turnover 25 776 25 877 24 492 19 564 14 130 Price High 84 85 85 120 165

Op Inc 9 962 9 016 9 313 6 412 4 655 Price Low 75 84 1 60 120

NetIntPd(Rcvd) 1 745 1 602 1 381 1 094 637 RATIOS

Minority Int 164 145 178 171 191 Ret on SH fund 0.55 - 10.08 16.99 36.62 20.54

Att Inc 6 400 5 704 6 032 37 485 4 648 Ret on Tot Ass - 1.07 18.17 - 29.86 - 34.02 - 7.41

TotCompIncLoss 3 622 2 126 9 424 34 528 6 426

Fixed Ass 5 060 5 518 5 166 4 882 3 661 Bytes Technology Group plc

Inv & Loans 22 12 - - - BYT

Tot Curr Ass 13 612 13 274 12 655 13 966 12 359 ISIN: GB00BMH18Q19 SHORT: BYTES CODE: BYI

Ord SH Int 62 673 63 902 65 444 60 759 8 182 REG NO: 12935776 FOUNDED: 2020 LISTED: 2020

Minority Int 282 258 244 222 224 NATURE OF BUSINESS: The Bytes Group is one of the UK's leading

providers of IT software offerings and solutions, with a focus on cloud and

LT Liab 59 257 58 022 64 325 64 468 19 511

security products. The Bytes Group enables effective and cost-efficient

Tot Curr Liab 15 478 18 823 16 329 15 605 11 856 technology sourcing, adoption and management across software, services,

PER SHARE STATISTICS (cents per share) including in the areas of security and cloud. It aims to deliver the latest

HEPS-C (ZARc) 6 232.10 4 941.08 4 761.04 12 001.57 4 112.00 technology to a diverse and embedded non-consumer customer base and

has a long track record of delivering strong financial performance.

DPS (ZARc) 4 218.50 3 730.07 3 460.83 1 747.16 2 895.68 SECTOR:Technology—Technology—Software&CompSer—ComputerService

NAV PS (ZARc) 54 475.59 51 815.44 52 524.72 49 827.23 8 560.65

3 Yr Beta 0.61 0.54 0.74 0.57 0.87 NUMBER OF EMPLOYEES: 666

DIRECTORS: MawD(ne, UK), Phillips M (snr ind ne, UK), Vincent Dr A

Price High 73 124 61 349 86 197 96 074 98 739 (ne, UK), De Smedt P (Chair, ne, Blgm), Murphy N (CEO, UK),

Price Low 49 111 42 018 44 801 76 334 72 820 Richardson K (CFO, UK)

Price Prd End 54 545 59 737 46 930 82 950 77 861 MAJOR ORDINARY SHAREHOLDERS as at 12 Feb 2021

RATIOS Biltron 8.80%

Ret on SH Fnd 10.43 9.12 9.45 61.75 57.57 Public Investment Corporation 6.00%

Oper Pft Mgn 38.65 34.84 38.02 32.77 32.94 Aberdeen 5.19%

D:E 1.01 1.02 1.04 1.15 2.68 MORE INFO: www.sharedata.co.za/sdo/jse/BYI

Current Ratio 0.88 0.71 0.78 0.89 1.04 COMPANY SECRETARY: Willem Karel Groenewald

Div Cover 1.40 1.23 1.35 18.00 1.73 TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

SPONSOR:RandMerchantBank(AdivisionofFirstRandBankLtd.(SA))

AUDITORS: Ernst & Young

105