Page 146 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 146

JSE – IMB Profile’s Stock Exchange Handbook: 2021 – Issue 1

Imbalie Beauty Ltd. Impala Platinum Holdings Ltd.

IMB IMP

ISIN: ZAE000165239 SHORT: IMBALIE CODE: ILE ISIN: ZAE000083648

REG NO: 2003/025374/06 FOUNDED: 2003 LISTED: 2007 SHORT: IMPLATS

NATURE OF BUSINESS: Imbalie Beauty has its own and franchise salon CODE: IMP

footprint through the following franchise salon chains: Placecol Skin Care ISIN: ZAE000247458

Clinics, Perfect 10 and Dream Nails Beauty Salons. The Group’s skin care SHORT: IMPL CB22

brands are available to consumers in its own salon footprint, large retail CODE: IMCB22

groups, pharmacies, various independent salon outlets and on various REG NO: 1957/001979/06

on-line platforms. Imbalie Beauty is a leading beauty and wellness FOUNDED: 1957

solutions group, with its focus primarily on the development and LISTED: 1973

transformation of people working in our franchise salon footprint (“salon NATURE OF BUSINESS: Impala Platinum Holdings Ltd. is principally in

footprint”) through ongoing education and the development, growth and the businessofproducing andsupplying platinumgroup metals(PGMs)to

innovation of our own skin care product brands, being Placecol and industrial economies.

Skinderm. The Placecol skin care brand turns forty in January 2020. SECTOR: Basic Materials—Basic Resrcs—Mining—Plat&Prcs Metals

SECTOR: AltX NUMBER OF EMPLOYEES: 51 338

NUMBER OF EMPLOYEES: 50 DIRECTORS: Davey P W (ind ne), Earp D (ind ne), Koshane B T (ne),

DIRECTORS: HarlowGD(ne), SchoemanTJ(ld ind ne), Macfarlane A S (ind ne), Mufamadi Dr F S (ind ne), Ngonyama B (ld ind ne),

van der MerweWP(ne), Colyn E (CEO), de Jager C W (FD) Nkeli M E K (ind ne), Samuel L, Speckmann P (ind ne),

Swanepoel B Z (ind ne), Orleyn Adv N D B (Chair, ind ne),

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 Muller N J (CEO), Kerber M (CFO)

Holistic Remedies (Pty) Ltd. 32.53%

SA Madiba Investments (Pty) Ltd. 21.95% MAJOR ORDINARY SHAREHOLDERS as at 30 Jun 2020 13.87%

PIC

Unihold Group (Pty) Ltd. 10.46% BlackRock Inc 7.52%

POSTAL ADDRESS: PO Box 8833, Centurion, 0046 Coronation Asset Management 6.23%

MORE INFO: www.sharedata.co.za/sdo/jse/ILE POSTAL ADDRESS: Private Bag X18, Northlands, 2116

COMPANY SECRETARY: Paige Atkins EMAIL: investor@implats.co.za

TRANSFER SECRETARY: 4 Africa Exchange Registry (Pty) Ltd. WEBSITE: www.implats.co.za

DESIGNATED ADVISOR: Exchange Sponsors (Pty) Ltd. TELEPHONE: 011-731-9000 FAX: 011-731-9276

AUDITORS: Nexia SAB&T Inc. COMPANY SECRETARY: Tebogo Llale

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

CAPITAL STRUCTURE AUTHORISED ISSUED

ILE Ords no par val 2 000 000 000 1 384 039 225 SPONSOR: Nedbank Corporate and Investment Banking

AUDITORS: Deloitte

LIQUIDITY: Jan21 Ave 3m shares p.w., R73 305.6(12.7% p.a.) CAPITAL STRUCTURE AUTHORISED ISSUED

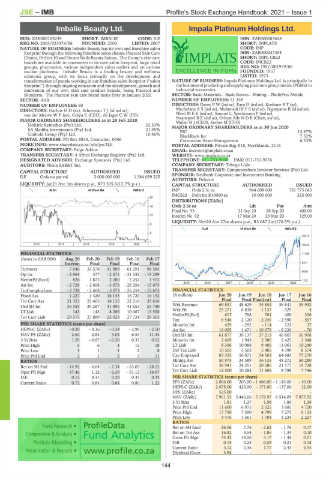

ALSH 40 Week MA IMBALIE IMP Ords 2.5c ea 944 008 000 781 775 045

IMCB22 Debt Int R10000 ea 10 000 000 325 000

20

DISTRIBUTIONS [ZARc]

16 Ords 2.5c ea Ldt Pay Amt

Final No 93 21 Sep 20 28 Sep 20 400.00

12 Interim No 92 17 Mar 20 23 Mar 20 125.00

LIQUIDITY: Nov20 Ave 27m shares p.w., R3 087.2m(176.5% p.a.)

9

PLAT 40 Week MA IMPLATS

5

18374

1

2016 | 2017 | 2018 | 2019 | 2020 |

15040

FINANCIAL STATISTICS 11705

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

Interim Final Final Final Final 8371

Turnover 7 646 33 578 41 809 61 291 96 584

5036

Op Inc - 2 864 377 - 2 671 - 31 332 - 19 289

NetIntPd(Rcvd) 826 1 873 2 280 2 252 1 472 1702

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Att Inc - 2 728 - 2 608 - 3 073 - 26 254 - 15 675

TotCompIncLoss - 2 728 - 2 608 - 3 073 - 26 254 - 15 675 FINANCIAL STATISTICS

Fixed Ass 1 227 1 420 16 143 16 720 16 192 (R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Tot Curr Ass 21 323 23 405 14 135 22 216 35 616 Final Final Final(rst) Final Final

Ord SH Int 36 559 39 287 41 895 41 653 55 740 Wrk Revenue 69 851 48 629 35 854 36 841 35 932

LT Liab 143 143 8 286 10 067 13 558 Wrk Pft 23 271 6 838 1 137 - 529 4

Tot Curr Liab 29 575 27 889 22 023 27 724 29 303 NetIntPd(Rcd) 617 768 701 400 336

Tax 6 546 2 120 - 2 249 - 2 590 - 557

PER SHARE STATISTICS (cents per share) Minority Int 429 - 292 - 114 122 27

HEPS-C (ZARc) - 0.20 - 0.16 - 0.24 - 2.98 - 2.50 Att Inc 16 055 1 471 - 10 679 - 8 220 - 70

NAV PS (ZARc) 2.64 2.84 3.03 6.54 11.34 Ord SH Int 61 877 39 137 37 213 46 807 55 908

3 Yr Beta 1.29 - 0.87 - 0.20 0.37 0.62 Minority Int 2 669 1 943 2 380 2 425 2 548

Price High 5 6 4 15 18 LT Liab 8 306 10 088 9 485 11 061 10 240

Price Low 1 1 1 2 8 Def Tax Liab 10 503 5 503 5 485 4 390 8 574

Price Prd End 2 3 2 3 11 Cap Employed 83 355 56 671 54 563 64 683 77 270

RATIOS Mining Ass 50 975 34 589 36 135 48 272 50 280

Ret on SH Fnd - 14.92 - 6.64 - 7.34 - 63.03 - 28.12 Tot Curr Ass 38 941 24 251 20 586 21 177 19 728

Oper Pft Mgn - 37.46 1.12 - 6.39 - 51.12 - 19.97 Tot Curr Liab 12 500 10 283 11 605 8 798 7 746

D:E 0.12 0.11 0.29 0.37 0.32 PER SHARE STATISTICS (cents per share)

Current Ratio 0.72 0.84 0.64 0.80 1.22 EPS (ZARc) 2 066.00 205.00 - 1 486.00 - 1 145.00 - 10.00

HEPS-C (ZARc) 2 075.00 423.00 - 171.00 - 137.00 12.00

DPS (ZARc) 525.00 - - - -

NAV (ZARc) 7 961.53 5 446.66 5 178.97 6 514.09 7 877.92

3 Yr Beta 1.81 1.27 1.98 1.80 1.36

Price Prd End 11 600 6 975 2 025 3 685 4 720

Price High 17 750 7 300 4 799 7 275 6 125

Price Low 4 476 1 561 1 784 3 234 2 227

RATIOS

Ret on SH fund 26.06 7.76 - 2.62 - 1.76 0.17

Ret on Tot Ass 16.82 4.54 - 1.86 - 1.34 0.10

Gross Pft Mgn 33.32 14.06 3.17 - 1.44 0.01

D:E 0.15 0.23 0.29 0.21 0.18

Current Ratio 3.12 2.36 1.77 2.41 2.55

Dividend Cover 3.94 - - - -

144