Page 148 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 148

JSE – IMP Profile’s Stock Exchange Handbook: 2021 – Issue 1

POSTAL ADDRESS:POBox3013, Edenvale,1610

Imperial Logistics Ltd. EMAIL: Esha.Mansingh@imperiallogistics.com

WEBSITE: www.imperiallogistics.com

IMP

TELEPHONE: 011-372-6500

COMPANY SECRETARY: J Ravjee (Acting)

TRANSFER SECRETARY: Computershare

Investor Services (Pty) Ltd.

SPONSOR: Merrill Lynch SA (Pty) Ltd.

AUDITORS: Deloitte & Touche

Scan the QR code to BANKERS: First National Bank, Nedbank,

visit our website

Standard Bank

CALENDAR Expected Status

Next Interim Results 23 Feb 2021 Confirmed

Next Final Results 24 Aug 2021 Confirmed

Annual General Meeting 8 Nov 2021 Confirmed

CAPITAL STRUCTURE AUTHORISED ISSUED

ISIN: ZAE000067211 SHORT: IMPERIAL CODE: IPL

REG NO: 1946/021048/06 FOUNDED: 1946 LISTED: 1987 IPL Ords 4c ea 394 999 000 202 074 388

DISTRIBUTIONS [ZARc]

NATURE OF BUSINESS: Ords 4c ea Ldt Pay Amt

Imperial is an African and European focused provider of Interim No 60 17 Mar 20 23 Mar 20 167.00

logistics and market access solutions. Ranked among the top Final No 59 23 Sep 19 30 Sep 19 109.00

30 global logistics providers, the group is listed on the Johan- Interim No 58 18 Mar 19 25 Mar 19 135.00

nesburg Stock Exchange and employs over 25 000 people. Final No 57 25 Sep 18 1 Oct 18 387.00

Operating in more than 26 countries, we play a critical role in LIQUIDITY: Sep20 Ave 5m shares p.w., R231.3m(127.1% p.a.)

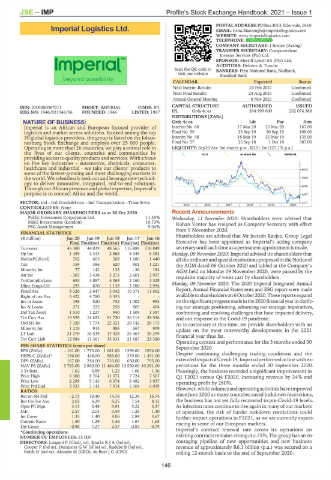

the lives of our clients, countries and communities by INDT 40 Week MA IMPERIAL

providing accesstoqualityproducts andservices. With afocus

on five key industries - automotive, chemicals, consumer,

healthcare and industrial - we take our clients’ products to 9635

some of the fastest-growing and most challenging markets in

the world. We relentlessly seek out and leverage new technol- 7846

ogy to deliver innovative, integrated, end-to-end solutions.

Through our African presence and globalexpertise, Imperial’s 6056

purpose is to connect Africa and the world. 4267

SECTOR: Ind—Ind Goods&Srvcs—Ind Transportation—Trans Srvcs 2477

2015 | 2016 | 2017 | 2018 | 2019 | 2020

CONTROLLED BY: None

MAJOR ORDINARY SHAREHOLDERS as at 30 Oct 2020 Recent Announcements

Public Investment Corporation Ltd. 11.35% Wednesday, 11 November 2020: Shareholders were advised that

M&G Investments (London) 10.73% Rohan Venter has resigned as Company Secretary with effect

PSG Asset Management 9.04%

from 9 November 2020.

FINANCIAL STATISTICS

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16 Shareholders are advised that Mr Jeetesh Ravjee, Group Legal

Final Final(rst) Final(rst) Final(rst) Final(rst) Executive has been appointed as Imperial’s acting company

Turnover 46 380 44 039 48 565 115 889 118 849 secretaryuntilsuchtimeasapermanentappointmentismade.

Op Inc 1 459 2 413 2 868 6 049 6 382 Monday, 09 November 2020: Imperial advised its shareholders that

NetIntPd(Rcvd) 762 605 569 1 680 1 440 alltheordinaryandspecialresolutionsproposed intheNoticeof

Tax 159 386 620 901 1 221 the AGM dated 06 October 2020 and tabled at the Company’s

Minority Int 77 142 135 - 36 184 AGM held on Monday 09 November 2020, were passed by the

Att Inc - 303 3 438 3 273 2 601 2 997 requisite majority of votes cast by shareholders.

TotCompIncLoss 683 3 887 4 063 2 160 3 328

Monday, 09 November 2020: The 2020 Imperial Integrated Annual

Hline Erngs-CO 295 870 1 139 2 700 2 994

Fixed Ass 3 326 2 647 3 042 10 371 11 602 Report, Annual Financial Statements and ESG report were made

Right of use Ass 5 422 4 780 5 335 - - availabletoshareholderson6October2020.Thesereportsexpand

Inv in Assoc 198 520 752 1 002 993 onthesignificantprogressmadeinthe2020financialyearinclarify-

Inv & Loans 271 225 258 805 404 ing our strategic positioning, advancing our strategic imperatives,

Def Tax Asset 1 510 1 227 940 1 509 1 387 confronting and resolving challenges that have impacted delivery,

Tot Curr Ass 19 529 14 633 51 720 36 114 38 526 and our response to the Covid-19 pandemic.

Ord SH Int 7 320 7 774 22 321 20 742 20 173 As is customary at this time, we provide shareholders with an

Minority Int 1 218 913 886 667 909 update on the most noteworthy developments in the 2021

LT Liab 21 270 16 539 17 428 26 464 26 299 financial year thus far.

Tot Curr Liab 12 984 11 361 35 331 21 687 23 320

Operating context and performance for the 3 months ended 30

PER SHARE STATISTICS (cents per share) September 2020

EPS (ZARc) - 161.00 1 773.00 1 681.00 1339.00 1554.00

HEPS-C (ZARc)* 156.00 448.00 585.00 379.00 1 451.00 Despite continuing challenging trading conditions and the

DPS (ZARc) 167.00 244.00 710.00 650.00 795.00 extendedimpactofCovid-19,Imperial performedinlinewith ex-

NAV PS (ZARc) 3 783.00 3 960.00 11 464.00 10 550.00 10 261.00 pectations for the three months ended 30 September 2020.

3 Yr Beta 1.62 0.89 1.25 1.06 1.16 Pleasingly, the business recorded a significant improvement in

Price High 6 300 8 764 11 671 7 724 7 567 Q1 F2021 versus Q4 F2020, increasing revenue by 24% and

Price Low 2 299 5 143 6 374 5 482 3 937 operating profit by 280%.

Price Prd End 3 933 5 143 7 914 6 504 6 039 However, while volumesandoperatingactivitieshaveimproved

RATIOS

Ret on SH Fnd - 2.73 10.40 14.76 12.39 15.74 since June 2020 as many countries eased lockdown restrictions,

Ret On Tot Ass 2.03 6.29 8.25 7.54 8.15 the business has not yet fully recovered to pre-Covid-19 levels.

Oper Pft Mgn 3.15 5.48 5.91 5.22 5.37 As infection rates continue to rise again in many of our markets

D:E 2.57 2.03 0.49 1.28 1.30 of operation, the risk of harder lockdown restrictions could

Int Cover 1.33 1.40 4.06 2.84 3.67 further impact operations in F2021, as we are currently experi-

Current Ratio 1.50 1.29 1.46 1.67 1.65 encing in some of our European markets.

Div Cover - 0.96 7.27 2.37 0.83 0.79

*Continuing operations Imperial’s contract renewal rate across its operations on

NUMBER OF EMPLOYEES: 25 000 existing contracts remains strong at c.75%. The group has an en-

DIRECTORS: Langeni P (Chair, ne), SparksRJA(ind ne), couraging pipeline of new opportunities and new business

Cooper P (ind ne), DempsterGW(ld ind ne), Radebe B (ind ne), revenue of approximately R6.1 billion (p.a.) was secured on a

Reich D (ind ne), Akoojee M (CEO), de Beer J G (CFO) rolling 12-month basis to the end of September 2020.

146