Page 144 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 144

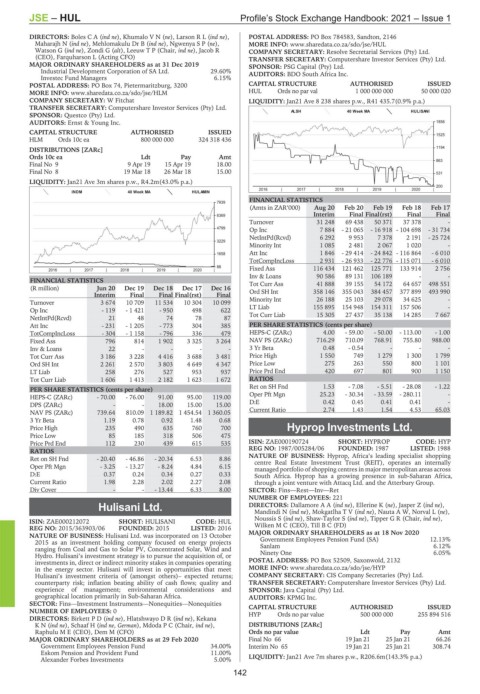

JSE – HUL Profile’s Stock Exchange Handbook: 2021 – Issue 1

DIRECTORS: BolesCA(ind ne), KhumaloVN(ne), LarsonRL(ind ne), POSTAL ADDRESS: PO Box 784583, Sandton, 2146

Maharajh N (ind ne), Mehlomakulu Dr B (ind ne), NgwenyaSP(ne), MORE INFO: www.sharedata.co.za/sdo/jse/HUL

Watson G (ind ne), Zondi G (alt), Leeuw T P (Chair, ind ne), Jacob R COMPANY SECRETARY: Resolve Secretarial Services (Pty) Ltd.

(CEO), Farquharson L (Acting CFO) TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 31 Dec 2019 SPONSOR: PSG Capital (Pty) Ltd.

Industrial Development Corporation of SA Ltd. 29.60% AUDITORS: BDO South Africa Inc.

Investec Fund Managers 6.15%

POSTAL ADDRESS: PO Box 74, Pietermaritzburg, 3200 CAPITAL STRUCTURE AUTHORISED ISSUED

MORE INFO: www.sharedata.co.za/sdo/jse/HLM HUL Ords no par val 1 000 000 000 50 000 020

COMPANY SECRETARY: W Fitchat LIQUIDITY: Jan21 Ave 8 238 shares p.w., R41 435.7(0.9% p.a.)

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ALSH 40 Week MA HULISANI

SPONSOR: Questco (Pty) Ltd.

AUDITORS: Ernst & Young Inc. 1856

CAPITAL STRUCTURE AUTHORISED ISSUED

1525

HLM Ords 10c ea 800 000 000 324 318 436

DISTRIBUTIONS [ZARc] 1194

Ords 10c ea Ldt Pay Amt

Final No 9 9 Apr 19 15 Apr 19 18.00 863

Final No 8 19 Mar 18 26 Mar 18 15.00 531

LIQUIDITY: Jan21 Ave 3m shares p.w., R4.2m(43.0% p.a.)

200

2016 | 2017 | 2018 | 2019 | 2020 |

INDM 40 Week MA HULAMIN

FINANCIAL STATISTICS

7939

(Amts in ZAR’000) Aug 20 Feb 20 Feb 19 Feb 18 Feb 17

6369 Interim Final Final(rst) Final Final

Turnover 31 248 69 438 50 371 37 378 -

4799 Op Inc 7 884 - 21 065 - 16 918 - 104 698 - 31 734

NetIntPd(Rcvd) 6 292 9 953 7 378 2 191 - 25 724

3229

Minority Int 1 085 2 481 2 067 1 020 -

1658 Att Inc 1 846 - 29 414 - 24 842 - 116 864 - 6 010

TotCompIncLoss 2 931 - 26 933 - 22 776 - 115 071 - 6 010

88 Fixed Ass 116 434 121 462 125 771 133 914 2 756

2016 | 2017 | 2018 | 2019 | 2020 |

Inv & Loans 90 586 89 131 106 189 - -

FINANCIAL STATISTICS Tot Curr Ass 41 888 39 155 54 172 64 657 498 551

(R million) Jun 20 Dec 19 Dec 18 Dec 17 Dec 16 Ord SH Int 358 146 355 043 384 457 377 899 493 990

Interim Final Final Final(rst) Final

Turnover 3 674 10 709 11 534 10 304 10 099 Minority Int 26 188 25 103 29 078 34 625 -

Op Inc - 119 - 1 421 - 950 498 622 LT Liab 155 895 154 948 154 311 157 506 -

NetIntPd(Rcvd) 21 48 74 78 87 Tot Curr Liab 15 305 27 437 35 138 14 285 7 667

Att Inc - 231 - 1 205 - 773 304 385 PER SHARE STATISTICS (cents per share)

TotCompIncLoss - 304 - 1 158 - 796 336 479 HEPS-C (ZARc) 4.00 - 59.00 - 50.00 - 113.00 - 1.00

Fixed Ass 796 814 1 902 3 325 3 264 NAV PS (ZARc) 716.29 710.09 768.91 755.80 988.00

Inv & Loans 22 - - - - 3 Yr Beta 0.48 - 0.54 - - -

Tot Curr Ass 3 186 3 228 4 416 3 688 3 481 Price High 1 550 749 1 279 1 300 1 799

Ord SH Int 2 261 2 570 3 803 4 649 4 347 Price Low 275 263 550 800 1 101

LT Liab 258 276 527 953 937 Price Prd End 420 697 801 900 1 150

Tot Curr Liab 1 606 1 413 2 182 1 623 1 672 RATIOS

Ret on SH Fnd 1.53 - 7.08 - 5.51 - 28.08 - 1.22

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) - 70.00 - 76.00 91.00 95.00 119.00 Oper Pft Mgn 25.23 - 30.34 - 33.59 - 280.11 -

DPS (ZARc) - - 18.00 15.00 15.00 D:E 0.42 0.45 0.41 0.41 -

NAV PS (ZARc) 739.64 810.09 1 189.82 1 454.54 1 360.05 Current Ratio 2.74 1.43 1.54 4.53 65.03

3 Yr Beta 1.19 0.78 0.92 1.48 0.68

Price High 235 490 635 760 700 Hyprop Investments Ltd.

Price Low 85 185 318 506 475 HYP

Price Prd End 112 230 439 615 535 ISIN: ZAE000190724 SHORT: HYPROP CODE: HYP

RATIOS REG NO: 1987/005284/06 FOUNDED: 1987 LISTED: 1988

Ret on SH Fnd - 20.40 - 46.86 - 20.34 6.53 8.86 NATURE OF BUSINESS: Hyprop, Africa’s leading specialist shopping

centre Real Estate Investment Trust (REIT), operates an internally

Oper Pft Mgn - 3.25 - 13.27 - 8.24 4.84 6.15

managed portfolio of shopping centres in major metropolitan areas across

D:E 0.37 0.24 0.34 0.27 0.33 South Africa. Hyprop has a growing presence in sub-Saharan Africa,

Current Ratio 1.98 2.28 2.02 2.27 2.08 through a joint venture with Attacq Ltd. and the Atterbury Group.

Div Cover - - - 13.44 6.33 8.00 SECTOR: Fins—Rest—Inv—Ret

NUMBER OF EMPLOYEES: 221

Hulisani Ltd. DIRECTORS: DallamoreAA(ind ne), Ellerine K (ne), Jasper Z (ind ne),

Mandindi N (ind ne), MokgatlhaTV(ind ne), Nauta A W, Norval L (ne),

HUL Noussis S (ind ne), Shaw-Taylor S (ind ne), Tipper G R (Chair, ind ne),

ISIN: ZAE000212072 SHORT: HULISANI CODE: HUL Wilken M C (CEO), Till B C (FD)

REG NO: 2015/363903/06 FOUNDED: 2015 LISTED: 2016

NATURE OF BUSINESS: Hulisani Ltd. was incorporated on 13 October MAJOR ORDINARY SHAREHOLDERS as at 18 Nov 2020 12.13%

Government Employees Pension Fund (SA)

2015 as an investment holding company focused on energy projects

ranging from Coal and Gas to Solar PV, Concentrated Solar, Wind and Sanlam 6.12%

Hydro. Hulisani’s investment strategy is to pursue the acquisition of, or Ninety One 6.05%

investments in, direct or indirect minority stakes in companies operating POSTAL ADDRESS: PO Box 52509, Saxonwold, 2132

in the energy sector. Hulisani will invest in opportunities that meet MORE INFO: www.sharedata.co.za/sdo/jse/HYP

Hulisani’s investment criteria of (amongst others)– expected returns; COMPANY SECRETARY: CIS Company Secretaries (Pty) Ltd.

counterparty risk; inflation beating ability of cash flows; quality and TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

experience of management; environmental considerations and SPONSOR: Java Capital (Pty) Ltd.

geographical location primarily in Sub-Saharan Africa. AUDITORS: KPMG Inc.

SECTOR: Fins—Investment Instruments—Nonequities—Nonequities CAPITAL STRUCTURE AUTHORISED ISSUED

NUMBER OF EMPLOYEES: 0 HYP Ords no par value 500 000 000 255 894 516

DIRECTORS: BirkettPD(ind ne), HlatshwayoDR(ind ne), Kekana

KN(ind ne), Schaaf H (ind ne, German), Mdoda P C (Chair, ind ne), DISTRIBUTIONS [ZARc]

Raphulu M E (CEO), Dem M (CFO) Ords no par value Ldt Pay Amt

MAJOR ORDINARY SHAREHOLDERS as at 29 Feb 2020 Final No 66 19 Jan 21 25 Jan 21 66.26

Government Employees Pension Fund 34.00% Interim No 65 19 Jan 21 25 Jan 21 308.74

Eskom Pension and Provident Fund 11.00%

Alexander Forbes Investments 5.00% LIQUIDITY: Jan21 Ave 7m shares p.w., R206.6m(143.3% p.a.)

142