Page 141 - Profile's Stock Exchange Handbook - 2021 issue 1

P. 141

Profile’s Stock Exchange Handbook: 2021 – Issue 1 JSE – HOS

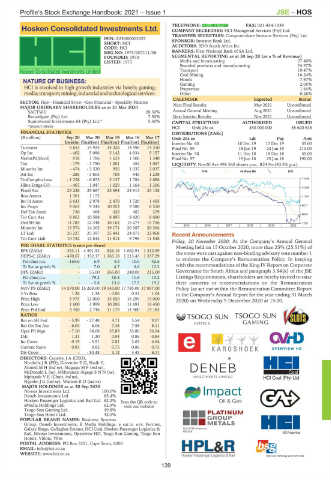

TELEPHONE: 021-481-7560 FAX: 021-434-1539

Hosken Consolidated Investments Ltd. COMPANY SECRETARY: HCI Managerial Services (Pty) Ltd.

HOS TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd.

ISIN: ZAE000003257 SPONSOR: Investec Bank Ltd.

SHORT: HCI AUDITORS: BDO South Africa Inc.

CODE: HCI

REG NO: 1973/007111/06 BANKERS: First National Bank of SA Ltd.

FOUNDED: 1973 SEGMENTAL REPORTING as at 30 Sep 20 (asa%of Revenue)

LISTED: 1973 Media and broadcasting 27.40%

Branded products and manufacturing 24.97%

Transport 19.47%

Coal Mining 16.24%

NATURE OF BUSINESS: Hotels 7.97%

Gaming

2.05%

HCI is involved in high growth industries via hotels; gaming; Properties 1.64%

media;transport;mining;industrialandtechnologicalservices. Other 0.26%

CALENDAR Expected Status

SECTOR: Fins—Financial Srvcs—Gen Financial—Specialty Finance Next Final Results May 2021 Unconfirmed

MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020

SACTWU 28.50% Annual General Meeting Aug 2021 Unconfirmed

Ronaldgate (Pty) Ltd. 7.50% Next Interim Results Nov 2021 Unconfirmed

Squirewood Investments 64 (Pty) Ltd.* 5.30% CAPITAL STRUCTURE AUTHORISED ISSUED

*treasury shares

HCI Ords 25c ea 450 000 000 85 620 648

FINANCIAL STATISTICS DISTRIBUTIONS [ZARc]

(R million) Sep 20 Mar 20 Mar 19 Mar 18 Mar 17 Ords 25c ea Ldt Pay Amt

Interim Final(rst) Final(rst) Final(rst) Final(rst) Interim No 60 10 Dec 19 17 Dec 19 55.00

Turnover 5 653 14 924 14 326 14 596 14 310 Final No 59 18 Jun 19 24 Jun 19 210.00

Op Inc - 402 5 086 5 142 4 934 5 157 Interim No 58 11 Dec 18 18 Dec 18 55.00

NetIntPd(Rcvd) 918 1 786 1 633 1 506 1 340 Final No 57 19 Jun 18 25 Jun 18 190.00

Tax - 179 - 1 750 1 001 454 1 067 LIQUIDITY: Nov20 Ave 498 560 shares p.w., R24.9m(30.3% p.a.)

Minority Int - 474 - 3 520 956 1 037 2 037

FINI 40 Week MA HCI

Att Inc - 286 - 3 805 708 940 1 238

TotCompIncLoss - 1 258 - 6 853 2 137 1 784 2 688 17449

Hline Erngs-CO - 407 1 047 1 029 1 164 1 306

14305

Fixed Ass 25 258 25 687 25 694 24 913 25 128

Rou Assets 1 361 1 172 - - - 11161

Inv in Assoc 2 633 2 978 2 470 1 720 1 455

Inv Props 9 063 9 345 10 053 9 588 8 510 8017

Def Tax Asset 730 468 429 487 379

4874

Tot Curr Ass 8 863 10 588 8 895 8 420 8 690

Ord SH Int 11 783 12 348 16 162 15 274 15 756 1730

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Minority Int 13 574 14 303 19 171 20 387 20 364

LT Liab 26 227 25 397 25 441 24 873 22 868 Recent Announcements

Tot Curr Liab 10 732 12 844 11 812 9 796 11 548

Friday, 20 November 2020: At the Company’s Annual General

PER SHARE STATISTICS (cents per share) Meeting held on 15 October 2020, more than 25% (25.51%) of

EPS (ZARc) - 353.11 - 4 591.53 826.16 1 062.91 1 312.99 the votes were cast against non-binding advisory vote number 1

HEPS-C (ZARc) - 470.67 1 352.17 1 265.18 1 213.43 1 357.29

Pct chng p.a. - 169.6 6.9 4.3 - 10.6 42.6 to endorse the Company’s Remuneration Policy. In keeping

Tr 5yr av grwth % - 7.0 4.7 6.6 12.2 with the recommendations of the King IV Report on Corporate

DPS (ZARc) - 55.00 265.00 240.00 215.00 Governance for South Africa and paragraph 3.84(k) of the JSE

Pct chng p.a. - - 79.2 10.4 11.6 13.2 Listings Requirements, shareholders are hereby invited to raise

Tr 5yr av grwth % - - 5.8 13.6 17.5 19.2 their concerns or recommendations on the Remuneration

NAV PS (ZARc) 14 570.00 15 269.00 19 043.00 17 785.00 17 897.00 Policy (as set out within the Remuneration Committee Report

3 Yr Beta 1.26 1.34 - 0.06 0.51 1.04 in the Company’s Annual Report for the year ending 31 March

Price High 3 975 12 000 15 650 16 299 15 000 2020) on Wednesday 9 December 2020 at 15:00.

Price Low 1 600 1 999 10 206 11 691 10 450

Price Prd End 3 450 2 746 11 179 14 400 14 185

RATIOS

Ret on SH Fnd - 5.99 - 27.48 4.71 5.54 9.07

Ret On Tot Ass - 6.04 6.06 7.48 7.58 8.11

Oper Pft Mgn - 7.10 34.08 35.89 33.80 36.04

D:E 1.31 1.30 0.94 0.86 0.84

Int Cover 0.19 - 3.91 2.81 2.63 4.64

Current Ratio 0.83 0.82 0.75 0.86 0.75

Div Cover - - 83.48 3.12 4.43 6.11

DIRECTORS: Copelyn J A (CEO),

Nicolella J R (FD), Govender T G, Shaik Y,

AhmedMH(ind ne), MaguguMF(ind ne),

McDonald L (ne), Mkhwanazi-SigegeSNN(ne),

Mphande V E (Chair, ind ne),

NgcoboJG(ind ne), WatsonRD(ind ne)

MAJOR HOLDINGS as at 30 Sep 2020

Niveus Investments Ltd. 100.0%

Deneb Investments Ltd. 85.4%

Hosken Passenger Logistics and Rail Ltd. 82.2% Scan the QR code to

eMedia Holdings Ltd. 62.9% visit our website

Tsogo Sun Gaming Ltd. 49.8%

Tsogo Sun Hotels Ltd. 42.5%

POPULAR BRAND NAMES: Business Systems

Group, Deneb Investments, E Media Holdings, e sat.tv, e.tv, Formex,

Galaxy Bingo, Gallagher Estates, HCI Coal, Hosken Passenger Logistics &

Rail, Niveus Investments, Openview HD, Tsogo Sun Gaming, Tsogo Sun

Hotels, VSlots, YFm

POSTAL ADDRESS: PO Box 5251, Cape Town, 8000

EMAIL: info@hci.co.za

WEBSITE: www.hci.co.za

139