Page 238 - Profile's Stock Exchange Handbook 2020 Issue 4

P. 238

JSE – TRU Profile’s Stock Exchange Handbook: 2020 – Issue 4

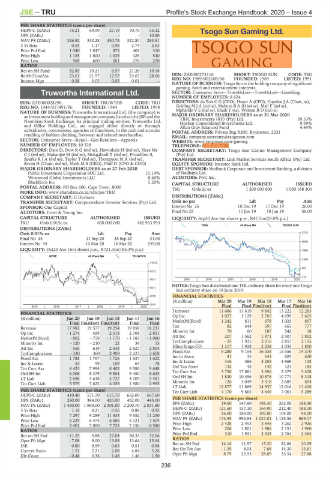

PER SHARE STATISTICS (cents per share)

HEPS-C (ZARc) 75.21 69.99 27.19 70.75 55.32 Tsogo Sun Gaming Ltd.

DPS (ZARc) - - - - 10.80

TSO

NAV PS (ZARc) 326.92 332.28 450.74 322.80 283.51

3 Yr Beta 0.59 1.17 0.98 2.74 2.63

Price Prd End 1 040 1 047 875 404 310

Price High 1 135 1 600 1 035 425 540

Price Low 568 600 261 276 270

RATIOS

Ret on SH Fund 32.85 19.21 6.57 21.26 19.18

RetOnTotalAss 23.61 21.97 12.57 23.67 28.66 ISIN: ZAE000273116 SHORT: TSOGO SUN CODE: TSG

Interest Mgn 0.28 0.05 0.05 0.01 - REG NO: 1989/002108/06 FOUNDED: 1989 LISTED: 1991

NATURE OF BUSINESS: Tsogo Sun is the holding company of significant

gaming, hotel and entertainment interests.

Truworths International Ltd. SECTOR: Consumer Srvcs—Travel&Leis—Travel&Leis—Gambling

NUMBER OF EMPLOYEES: 8 624

TRU

ISIN: ZAE000028296 SHORT: TRUWTHS CODE: TRU DIRECTORS: du Toit C G (CEO), Hoyer A (CFO), Copelyn J A (Chair, ne),

REG NO: 1944/017491/06 FOUNDED: 1944 LISTED: 1998 Golding M J A (ind ne), Mabuza B A (ld ind ne), Mall F (ind ne),

NATURE OF BUSINESS: Truworths International Ltd. (the company) is Mphande V E (ind ne), Shaik Y (ne), Watson R D (ind ne)

an investment holding and management company listed on the JSE and the MAJOR ORDINARY SHAREHOLDERS as at 31 Mar 2020 39.53%

TIHC Investments (RF) (Pty) Ltd.

Namibian Stock Exchange. Its principal trading entities, Truworths Ltd. Hosken Consolidated Investments Ltd. 9.99%

and Office Holdings Ltd., are engaged either directly or through Allan Gray Balanced Fund 4.44%

subsidiaries, concessions, agencies or franchises, in the cash and account POSTAL ADDRESS: Private Bag X200, Bryanston, 2021

retailing of fashion clothing, footwear and related merchandise. EMAIL: company.secretary@tsogosun.com

SECTOR: Consumer Srvcs—Retail—Gen Retailers—Apparels WEBSITE: www.tsogosun.com/gaming

NUMBER OF EMPLOYEES: 10 328 TELEPHONE: 011-510-7700

DIRECTORS: Dare D, DowRG(ind ne), Hawinkels H (ind ne), Hess Ms COMPANY SECRETARY: Tsogo Sun Casino Management Company

CJ(ind ne), Makanjee M (ind ne), Mokgabudi T (ind ne), Proudfoot S, (Pty) Ltd.

SparksRJA(ind ne), Taylor T (ind ne), ThompsonMA(ind ne), TRANSFER SECRETARY: Link Market Services South Africa (Pty) Ltd.

Saven H (Chair, ind ne), Mark M S (CEO), Pfaff D (CFO & COO) EQUITY SPONSOR: Investec Bank Ltd.

MAJOR ORDINARY SHAREHOLDERS as at 27 Feb 2020 DEBT SPONSOR: Nedbank Corporate and Investment Banking, a division

Public Investment Corporation SOC Ltd. 15.14% of Nedbank Ltd.

Westwood Global Investments LLC 8.60% AUDITORS: PwC Inc.

BlackRock Inc 5.20% CAPITAL STRUCTURE AUTHORISED ISSUED

POSTAL ADDRESS: PO Box 600, Cape Town, 8000 TSG Ords 2c ea 1 200 000 000 1 050 188 300

MORE INFO: www.sharedata.co.za/sdo/jse/TRU

COMPANY SECRETARY: C Durham DISTRIBUTIONS [ZARc]

TRANSFER SECRETARY: Computershare Investor Services (Pty) Ltd. Ords no par Ldt Pay Amt

SPONSOR: One Capital Interim No 26 10 Dec 19 17 Dec 19 26.00

AUDITORS: Ernst & Young Inc. Final No 25 11 Jun 19 18 Jun 19 56.00

CAPITAL STRUCTURE AUTHORISED ISSUED LIQUIDITY: Sep20 Ave 6m shares p.w., R47.5m(29.8% p.a.)

TRU Ords 0.015c ea 650 000 000 442 963 993

TRAV 40 Week MA TSOGO SUN

DISTRIBUTIONS [ZARc]

Ords 0.015c ea Ldt Pay Amt 3215

Final No 45 21 Sep 20 28 Sep 20 31.00

2606

Interim No 44 10 Mar 20 16 Mar 20 249.00

LIQUIDITY: Oct20 Ave 16m shares p.w., R721.3m(185.3% p.a.) 1998

GERE 40 Week MA TRUWTHS

1389

11012

781

9312

172

7611 2015 | 2016 | 2017 | 2018 | 2019 | 2020

NOTES: Tsogo Sun distributed one THL ordinary share for every one Tsogo

5911

Sun ordinary share on 18 June 2019.

4210 FINANCIAL STATISTICS

(R million) Mar 20 Mar 19 Mar 18 Mar 17 Mar 16

2510 Final Final Final(rst) Final Final(rst)

2015 | 2016 | 2017 | 2018 | 2019 | 2020

Turnover 11 686 11 619 9 842 13 222 12 283

FINANCIAL STATISTICS Op Inc 1 027 3 129 2 765 4 699 3 425

(R million) Jun 20 Jun 19 Jun 18 Jun 17 Jun 16

Final Final(rst) Final(rst) Final Final NetIntPd(Rcvd) 1 242 811 678 1 023 857

Revenue 17 982 19 577 19 254 19 858 18 231 Tax 82 644 597 665 777

Op Inc - 1 274 459 2 518 2 708 2 851 Minority Int 70 60 187 542 18

NetIntPd(Rcvd) - 802 - 759 - 1 170 - 1 183 - 1 080 Att Inc 207 1 562 1 971 2 507 1 802

Minority Int - 120 - 210 22 39 13 TotCompIncLoss - 35 1 935 2 016 2 857 2 155

Att Inc - 556 619 2 643 2 827 2 804 Hline Erngs-CO 1 317 1 928 2 238 2 033 1 800

TotCompIncLoss - 330 360 2 909 2 223 2 608 Fixed Ass 9 280 9 154 16 038 15 556 14 370

Fixed Ass 1 788 1 767 1 726 1 637 1 622 Inv in Assoc 41 35 641 609 620

Inv & Loans 53 99 109 64 78 Inv & Loans 416 486 5 255 4 969 108

Tot Curr Ass 8 425 7 994 8 402 9 580 9 648 Def Tax Asset 132 43 142 121 185

Ord SH Int 6 008 8 379 9 854 9 450 8 625 Tot Curr Ass 3 750 17 881 3 856 3 379 3 408

LT Liab 2 698 4 638 5 727 4 709 5 481 Ord SH Int 1 830 10 496 10 876 10 771 8 318

Tot Curr Liab 5 575 3 622 4 039 1 980 2 955 Minority Int 126 3 049 3 318 2 685 654

LT Liab 12 877 11 869 14 937 12 016 11 406

PER SHARE STATISTICS (cents per share) Tot Curr Liab 4 170 9 663 4 649 7 061 5 289

HEPS-C (ZARc) 410.40 571.70 615.70 662.00 667.60

DPS (ZARc) 280.00 384.00 420.00 452.00 445.00 PER SHARE STATISTICS (cents per share)

NAV PS (ZARc) 1 450.00 1 969.00 2 301.00 2 200.70 2 031.80 EPS (ZARc) 19.60 147.60 198.30 262.00 188.30

3 Yr Beta 1.18 0.21 0.56 0.88 0.92 HEPS-C (ZARc) 121.60 157.10 164.90 212.40 188.10

Price High 7 297 9 289 11 433 9 552 11 250 DPS (ZARc) 26.00 188.00 102.00 104.00 98.00

Price Low 2 229 6 474 6 686 6 121 7 504 NAV PS (ZARc) 174.95 993.94 1 027.01 1 125.50 869.17

Price Prd End 3 401 7 000 7 725 7 150 8 580 Price High 2 428 2 453 2 848 3 262 2 926

RATIOS Price Low 206 1 801 1 986 2 151 1 960

Ret on SH Fnd - 11.25 4.88 27.04 30.33 32.66 Price Prd End 310 1 931 2 333 2 764 2 364

Oper Pft Mgn - 7.08 9.00 13.08 13.64 15.64 RATIOS

D:E 0.80 0.59 0.65 0.51 0.68 Ret on SH Fnd 14.16 11.97 15.20 22.66 20.29

Current Ratio 1.51 2.21 2.08 4.84 3.26 Ret On Tot Ass - 1.39 8.04 7.68 14.30 13.61

Div Cover - 0.48 0.38 1.46 1.46 1.50 Oper Pft Mgn 8.79 26.93 28.09 35.54 27.88

236